Yassin Sona 1

By Stephen H. Dover, CFA, Chief Market Strategist, President, Franklin Templeton Institute | Rick Polsinello, CIMA, Senior Market Strategist, Franklin Templeton Institute

Originally published by Stephen Dover LinkedIn Communications Global market prospects.

As widely expected, the Federal Reserve (Fed) decided The federal funds rate was kept unchanged at the Federal Open Market Committee (FOMC) meeting on March 20. Members voted unanimously to maintain the target interest rate range at 5.25% to 5.50%.

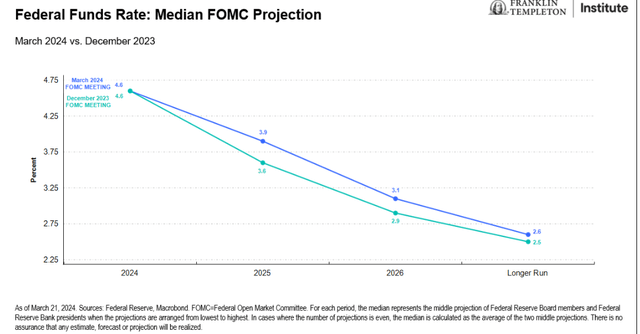

Although the meeting did not bring huge surprises, Fed Chairman Powell’s subsequent statement and press conference were still interesting and may hint at how the FOMC is considering future changes in monetary policy. This is also the FOMC’s quarterly meeting, so the Fed has released an updated “dot plot” (formally known as the Summary of Economic Projections, or SEP).

although Gross domestic product (GDP) growth is expected to rise from 1.4% to 2.1% in 2024. The unemployment rate remains close to a 50-year historical low. Some recent data points indicate that inflation may be slightly higher than expected. The Fed still believes that overall The case for easing monetary policy through interest rate cuts remains intact. In fact, the midpoint still shows the central bank cutting interest rates three times before the end of the year, each by at least 25 basis points.

Also as expected, the Fed’s message to the market was that voting members had begun discussing when it might be appropriate to slow down the pace of the $95 billion in monthly balance sheet reductions, most of which are long-term U.S. Treasuries. However, in response to the problems caused by the COVID-19 pandemic, the size of the Fed’s balance sheet has almost doubled to $9 trillion, but it is still more than $7.5 trillion.

Federal Reserve Chairman Powell also reiterated that “the Committee does not expect to reduce the target range until it has increased confidence that inflation will continue to move towards the 2% goal.” The Federal Open Market Committee also continued to state that the dual mission of achieving price stability and maximizing employment is necessary. The risks faced have been “achieving a better balance”.

Finally, Fed policymakers emphasized that their monetary policy decisions will continue to rely heavily on data, economic activity continues to expand steadily, inflation has eased but remains high, and employment growth remains strong.

All in all, the market responded well, with most major domestic stock indexes ending the day up about 1%, while U.S. Treasury rates showed no meaningful moves.

Powell and the Fed are certainly following their recent mantra of “patience and predictability” in their efforts.

What are the risks?

All investments involve risks, including possible loss of principal.

equity securities Subject to price fluctuations and possible loss of principal.

Fixed income securities Involves interest rate, credit, inflation and reinvestment risks, as well as possible loss of principal. As interest rates rise, the value of fixed income securities declines. Low-rated high-yield bonds Exposed to greater price volatility, illiquidity, and the possibility of default.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.