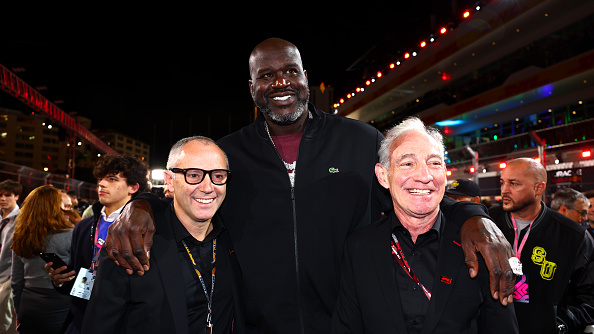

Dan Istitene – Formula 1/Formula 1 via Getty Images

Qurate Retail (NASDAQ: QRTEA) closed above $1 on Thursday, a huge milestone for the stock. Could this be a turning point for battered stocks? We think so.

sad history

Quirat It has been plagued by many unfavorable factors in recent years.

Some are the result of poor management:

- Qurate acquired Zulily in 2015 and eventually sold the company in 2023 for next to nothing. Zulily is nothing more than a money-burning fire pit.

- Qurate paid a special dividend in 2020-2021 amid the post-COVID recovery boom, when they were supposed to be paying down debt. Even if they expected the recovery to last forever, it’s hard to imagine that paying dividends should take precedence over high-coupon (in a near-zero interest rate environment) debt at that time.

Some are the result of unfortunate exogenous shocks:

- A fire in 2022 destroyed their largest fulfillment facility. The fire caused many problems for their operations and ultimately resulted in significant losses to customers due to delayed shipments and unfulfilled orders.

Some are simply the product of long-term business decline:

- The classic argument against Qurate has always been that “their customer base is aging and dying.”

But, the million dollar question…

Qurate’s focus over the past few years has been whether or how they can address their massive debt load amid shrinking revenue and profitability. You might ask how a company with EBITDA of $700-800 million has a market capitalization of only about $400 million. That’s because language in QVC’s debt prevents funds from flowing upstream to the parent company that issued the equity unless it meets the leverage test. So in order for shareholders to see value, you can’t simply take an EBITDA multiple, you have to first analyze the binary outcome of whether they can pass this leverage test.

Based on recent guidance, we can start to make some predictions. Our forecast expects leverage to continue until 2025, after they pay their 2025 maturity date. The left column is based on company guidance, assuming stable revenue, and taking everything else they say (about cost savings, etc.) at face value. The right column assumes a continued long-term decline.

| Estimate | ||

| Advanced | low level | |

| QVC ends debt | 3784 | 4039 |

| Adjusted OIBDA | Chapter 1279 | 1024 |

| Combined Leverage Ratio (QVC) | 3.0 times | 3.9 times |

| QRI End Debt | 6655 | 6910 |

| Adjusted OIBDA | 1319 | 1064 |

| Total Leverage (QRI) | 5.0 times | 6.5 times |

Now that does tell us a lot. If we take their word for it, by the end of Q1 2025, our QVC leverage should be 3.0 and the true leverage for the entire entity should be 5.0 (including parent-level debt). If this happens then we will get the following result:

- Under RP leverage, they will be able to funnel more cash upstream from the QVC entities to the parent company

- At 5x true total leverage, they will be able to refinance remaining debt at reasonable rates.

In this case, we estimate that QRTEA’s share price will be between $3-8, representing a forward EV/EBITDA ratio of approximately 6-7x.

In this case, we estimate QRTEP to trade at $85-90, and at 5x total leverage, we believe a yield of approximately 12-14% is still very attractive.

Now let us consider alternative paths. If the decline slows, Qurate may still have considerable room to grow. They can also try restructuring to deal with debt. Without any immediate filings, we think the stock will only hover around $1, and we also set a $40 price target on the preferred stock, as the parent still has $25 per share in cash and has distributed some ongoing possibility. Recovery and the possibility of restructuring.

The third path is severe decline and imminent application. In this case, the common stock is worth zero and the preferred stock is probably worth about $20 (based on the remaining cash discounted to its present value).

Given our current trajectory, the odds of this last path have steadily declined. While this may have been the base case assumption last May, it is probably <5% currently. We think the probability of a middle path is about 30%, and with the company performing close to management guidance, we assign a 65% probability. Based on these odds, we arrive at a mixed forecast of approximately $3.50 for common shares and approximately $70 for preferred shares, which we assign as our price targets.

risk

There’s no doubt that Qurate is a high-risk investment.

- Continued long-term decline, in other words, the realization of the “aging and dying customers” theory may lead to continued decline in revenue. The result would be indefinite leverage chasing and eventual default.

- Creditors and debt capital markets are taking a tough stance – they need significant assistance to refinance or otherwise extend debt maturities.

- Competition is increasing, not only from Amazon and other existing e-commerce players, but also from social media platforms entering the space.

- With another external impact, they are already in danger. Another accident may cause the ship to sink.

Some final notes

The bottom line in investing is not to find the best company. That’s easy. Apple is an amazing company, and Walmart is an amazing company.But investing isn’t about finding great companies, it’s about buying the ones that are trading less than their actual value. Of course, Apple is amazing, but everyone knows it, so its price is relatively high and there is no advantage.

Qurate is objectively a poorly managed company. They made a lot of mistakes, from the Zulilli disaster to an ill-timed special dividend. But this is indeed a low standard. As long as they avoid another land mine, QVC is a $1 billion EBITDA gift that will keep giving.

Finally, if you’re concerned about inflation, keep in mind that inflation may help Qurate, as their ultra-high leverage will actually be offset by inflation. Economics 101: Your debt won’t expand, but your income will.