Gopisa

Finding stable and substantial income investments in the market has become more challenging. As interest rates rise, leveraged funds perform worse, prices rise, and many people need more income to cover monthly expenses, many dividend investors are struggling.

An increasingly common investment for income and dividend investors in this more challenging environment is the covered call strategy.Another well-known ETF that focuses on selling covered calls is Global X Nasdaq 100 Covered Call ETF (NASDAQ: QYLD).

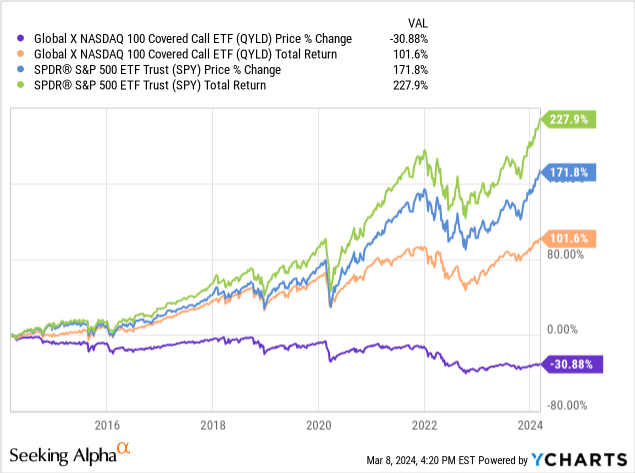

QYLD has provided investors with a total return of 102.94% over the past decade, while the S&P 500 Index (SPY) has provided investors with a total return of 180% during the same period.Nonetheless, QYLD is an income fund focused on providing investors with stable and consistent income, and this ETF is not built on maximizing total income. return.

The last time I wrote about QYLD was last August.I rate this fund a Hold because I correctly believe that lower levels of overall market volatility will result in lower income expenditure. I’m upgrading this investment to Buy today for a few reasons. First, volatility levels should be rising for a number of reasons, and the VIX is at the lower end of the range where this measure typically trades. Second, growth expectations for this year remain tepid, and the market is likely to remain range-bound for some time. Finally, the fund’s strong focus on large-cap technology stocks should prevent the ETF from excessive volatility, even if economic and market conditions deteriorate further.

QYLD has an expense ratio of 0.61%, assets under management of $8.8 billion, and a trailing return of 11.50%. The ETF holds 51.58% of the technology sector, 15.49% of the communications sector, 12.74% of the cyclical consumer goods sector, 6.48% of the consumer defense sector, 6.46% of the healthcare sector, 4.84% of the industrial sector, 1.22% of the utility sector, and 0.47% of the energy industry. %, the financial industry accounts for 0.46%, and the real estate industry accounts for 0.26%. QYLD’s largest holdings are Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA) and Amazon (AMZN). These four positions account for 28% of the fund’s total holdings.

The fund is paid monthly. QYLD employs a strategy of selling at-the-money monthly call options on the Nasdaq 100 index, which the fund owns. The ETF then distributes the monthly payout to investors as income. The fund uses the same strategy every month regardless of market conditions.The income from selling the option is taxable 60% is capital gains and 40% is short-term gains.

QYLD performs best in markets with higher levels of volatility, so the volatility premiums on options sold by the fund are higher, but the market is not so volatile that the fund may lose outsized losses. This ETF uses a strategy that limits upside potential, so in very volatile markets, the fund may face unlimited loss potential with limited upside from the investment.

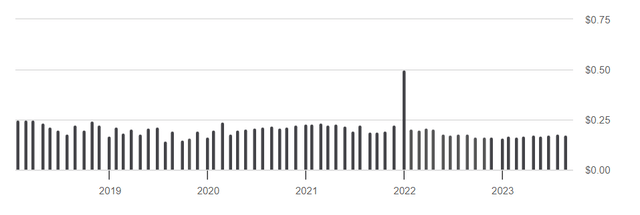

QYLD Spend Chart (Seeking Alpha)

QYLD has been paying steady income since the fund’s inception in 2014. The fund still paid $2.06, or 11.50%, last year, although payments are down slightly in 2023, largely due to lower volatility levels in the second half of the year.

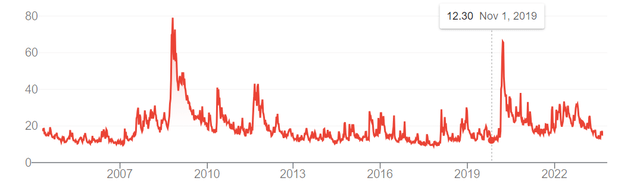

VIX Chart (Chicago Options Commission)

The primary factor affecting QYLD’s monthly distribution is the volatility premium of the monthly options sold by the fund relative to its core holdings. Although the VIX is currently at the lower end of the index’s 10-year range, there are several reasons to think volatility levels will be higher this year.

In 2024, markets are likely to face both political and economic uncertainty, with global tensions continuing to rise as a result of wars in the Middle East and between Russia and Ukraine. Economists also predict that 2024 will be a year of slow growth.Economists still predict 2024 will be a period of slow growth. The Fed may also not want to be seen as interfering in the election, as prices remain high even though inflation has fallen to nearly 3%. With earnings and growth expectations so conservative, the market is likely to remain range-bound this year, and volatility levels should rise from their current lower ranges.

All investing involves risk, and this fund does limit upside potential but does not limit potential downside losses.Nonetheless, the beta version of QYLD yes Quite conservative. The fund has a beta of 0.63 relative to the S&P 500 Index and 0.53 relative to the Nasdaq 100 Index, which the ETF holds. QYLD provides investors with more stable income than other covered call funds like the J.P. Morgan Premium Income ETF (JEPI) because the ETF uses the same strategy of selling at-the-money monthly calls every month, while funds like JEPI use a different The method of selling option months is at the sole discretion of the fund manager. The fund also limits upside more than alternative investments that sell out-of-the-money call options, but also generates more income from the options sold.

Covered call funds perform best when volatility levels are high but downside risk is not too great, and these are market conditions the market is likely to see next year. QYLD is also uniquely positioned to outperform the broader index if the market moves range-bound, as this investment generates income from monthly options. While the ETF uses a strategy that limits upside potential, QYLD’s strategy of selling at-the-money monthly call options each month will also appeal to income investors looking for stable payouts.