59 yuan

Xu Mandi

Weekly Market Commentary: March 18, 2024

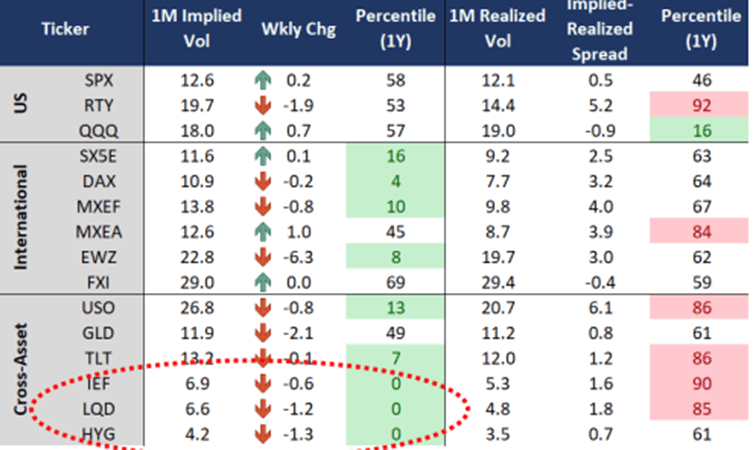

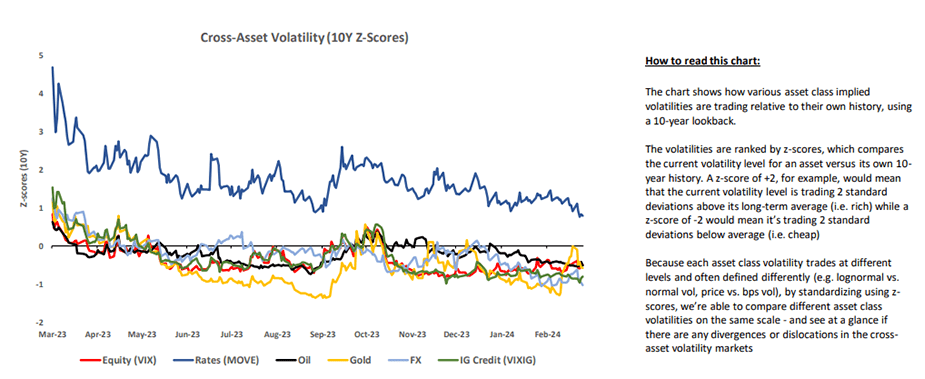

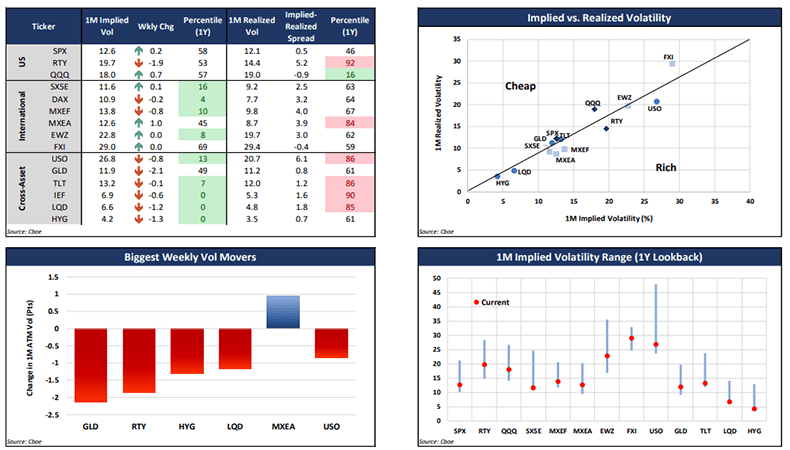

Cross-asset volatility: Implied volatility fell across most asset classes last week as stronger-than-expected consumer price index inflation reinforced the Fed’s cautious stance. Possibility of rate cut in June Down from 65% to 51%, the market is now expecting fewer than 3 rate cuts this year (2.8 to be exact, down from 6 at the beginning of the year). Interest rate volatility led the decline, with the MOVE index falling 3 knots to close to a one-year low of 97 basis points. It is worth noting that HYG’s implied trading volume (HYG) and LQD (Linear QDs) hit a one-year low last week (see Chart 1). Gold volatility normalized significantly, with GLD 1M ATM transaction volume falling more than 2 percentage points to 11.9%.FX swings were wide-ranging, led by USD/JPY moves It’s worth noting that expectations for a rate hike are growing ahead of tomorrow’s key Bank of Japan meeting.

Figure 1: Corporate bond volatility hits one-year low

Source: CBOE

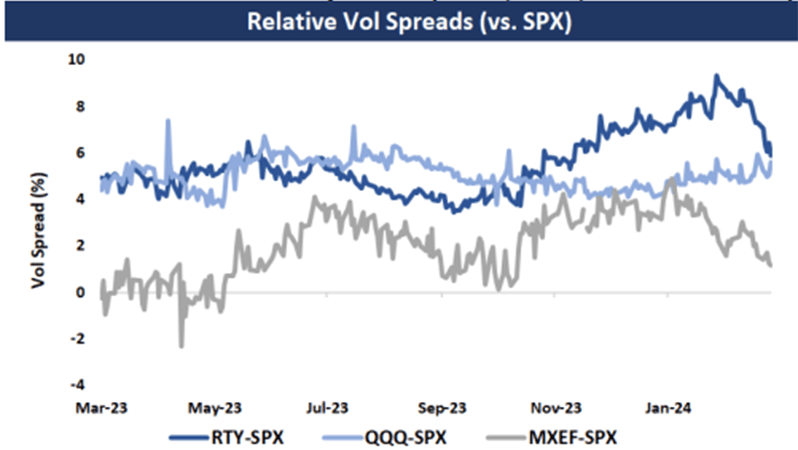

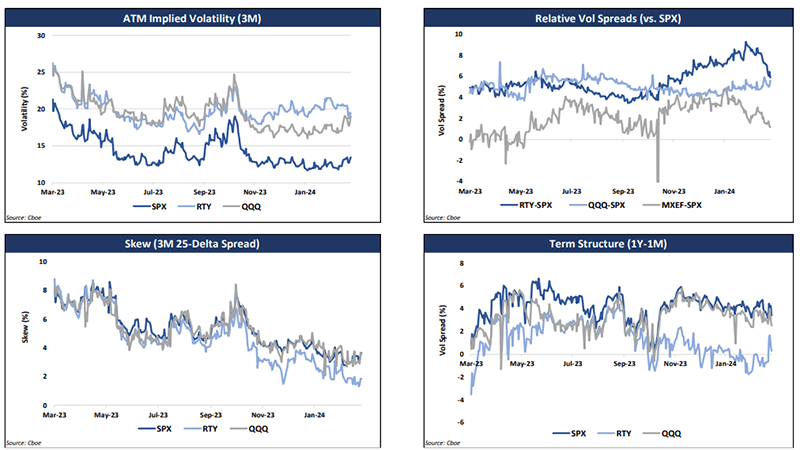

stock volatility: Index volatility saw mild buying last week as stocks struggled amid rising interest rates. Not surprisingly, QQQ (QQQ) led the gains, with 1M ATM transaction volume increasing 0.7 percentage points to 18.0% (57th percentile). In comparison, RTY volumes fell even as small caps sold off, with RTY 1M ATM volume falling nearly 2 percentage points to 19.7% (53rd percentile). As shown in Chart 2, the RTY-SPX® implied volatility spread has normalized significantly over the past month, with the 3M spread narrowing from 9.3% to 5.9%, while the QQQ-SPX spread has remained stable. As China stabilizes from its lows and emerging market risks subside, the MXEF-SPX volatility spread has declined from a high of 4.9% to currently 1.1%.

Chart 2: Relative volatility spreads (QQQ, RTY, MXEF and SPX)

Source: CBOE

tilt: SPX (SPX) skewness was essentially unchanged at the front end of the curve, but steepened slightly further, with 3M skewness (25-delta spread) widening from 3.4% to 3.7%, still in the 12th percentile low.

term structure: Last week, the SPX term structure further flattened, with the 1Y-1M volatility spread narrowing from 3.7% to 3.4% (20th percentile high), driven by the front end of the curve.

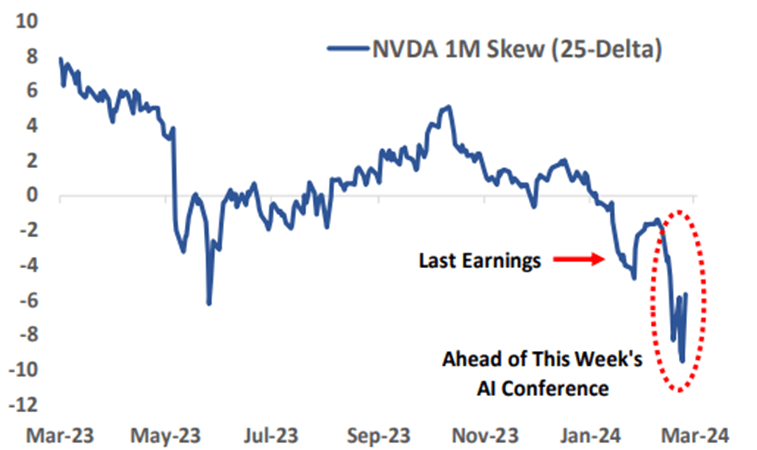

Correlation and dispersion: Despite the Fed meeting, all eyes are on NVDA (NVDA) ahead of its artificial intelligence conference this week. NVDA 1M implied volatility is back to pre-earnings highs, while bias is even wider (NVDA 1M 25-Delta bias hit a 16-year low of -9.5% last week). The mania for NVDA options has had clear spillover effects to other stocks, as we highlight Last week, this caused the average volatility of individual stocks to rise significantly relative to the index. This makes the SPX implied dispersion extremely high, as seen in the DSPXSM index, which jumped to near a 1-year high last week (especially noteworthy since we have yet to report earnings) before falling back to 28.6% on Friday ( Still at the 83rd percentile) higher than last year).

Chart 3: Before the AI incident, NVDA skewness was at a 16-year low

Source: CBOE

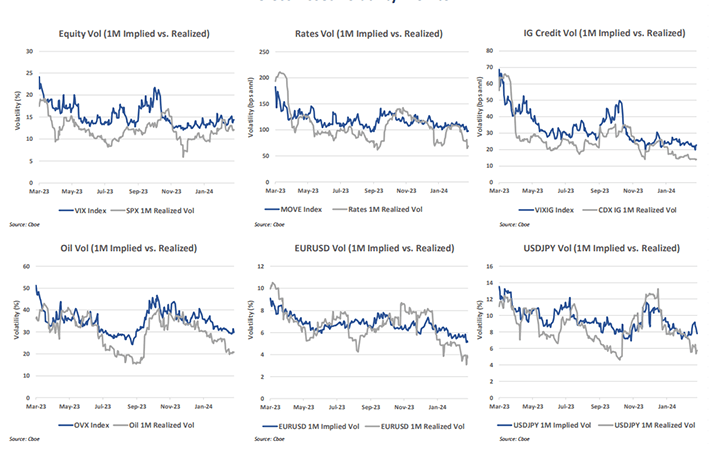

Cross-asset volatility monitoring

Source: CBOE

Cross-asset volatility snapshot (10 years back)

Source: CBOE

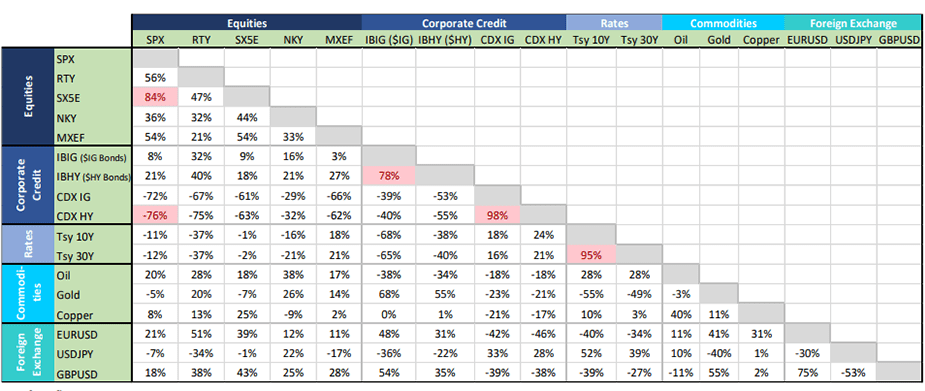

Cross-asset correlation matrix (1M)

Source: CBOE

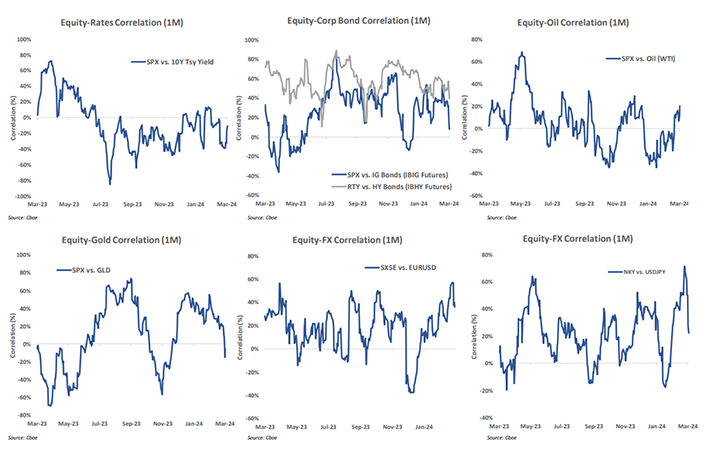

Cross-asset correlation analysis

Source: CBOE

Macro stock market fluctuations

Source: CBOE

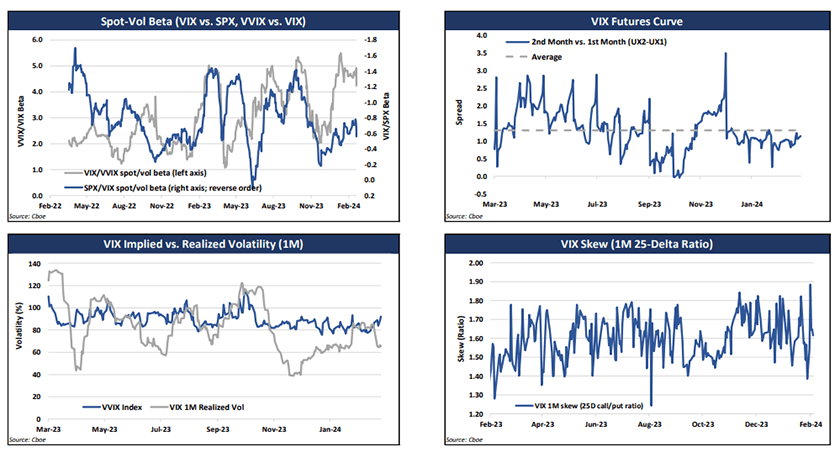

VIX Index Volatility

Source: CBOE

US Index Volatility

Source: CBOE Source: CBOE

Disclaimer:

The information provided is for general educational and informational purposes only. Any statements provided should not be construed as a recommendation to buy or sell securities, futures, financial instruments, investment funds or other investment products (collectively, “Financial Products”), or the provision of investment advice.

In particular, the inclusion of a security or other instrument in an Index is not a recommendation to buy, sell or hold that security or any other instrument, nor should it be considered investment advice.

Past performance of an index or financial product is not indicative of future results.

The views expressed in this article are those of the author and do not necessarily reflect the views of Cboe Global Markets, Inc. or any of its affiliates.

There are important risks associated with trading in any CBOE products or any digital assets discussed herein. Before engaging in any transaction in these products or digital assets, market participants must carefully review the disclosures and disclaimers contained in: Disclosures and Disclaimers Related to Chicago Options Exchange Options and Futures Products and Digital Assets

These products and digital assets are complex and only suitable for mature market participants. In certain jurisdictions, including the UK, Cboe Digital products are only available to investment professionals, accredited sophisticated investors or high net worth companies and associations.

These products involve risk of loss, which may be substantial and, depending on the product type, may exceed the amount of funds deposited when establishing the position.

Market participants should only put at risk money that they can afford to lose without affecting their lifestyle.

© 2024 Cboe Exchange, Inc. All rights reserved.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.