FatCamera/E+ via Getty Images

introduce

RCM technology (RCMT) Fiscal year 2023 results will be announced on March 13th after listing (under SA), so I’d like to check in with the company again to see how it’s progressing throughout the year, as well What will happen in season 4? The company’s financial position is relatively strong, with margins deteriorating slightly in the short term and revenue slowing significantly. However, management is excited about the future and I believe the worst is behind us. I reiterate my Strong Buy rating and update my PT.

Since my first article in late August, the company’s stock has gained about 37% relative to the S&P 500 (spy) 14%, let’s see how the company fared last year.

Financial Brief

As of 3Q23, the company has approximately $654,000 in cash and equivalents and long-term debt of $6.6 million.I I don’t think this debt is a particularly big problem for RCMT. The company generates very healthy operating profits that easily cover its annual interest payments on its debt. The company’s interest coverage ratio is about 16x, well above my minimum target of 5x. Therefore, the company is still not at risk of bankruptcy.

However, the company’s current ratio has declined significantly since last reported, ending Q3 at around 1.08, down from around 1.5 at the end of FY22, due to a significant increase in transportation receivables. Still, the ratio is above 1, which means the company does not have any liquidity issues. I’d like to see management address this issue, but I don’t think it’s a big issue. Let’s take a look at how the company’s margins grew last year.

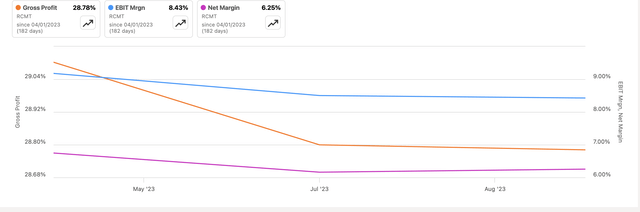

We can see a slight decrease in overall profitability, but I don’t think it’s huge, so margins are pretty stable, which is a good sign even in a tough micro environment like 2023.

margin (exist)

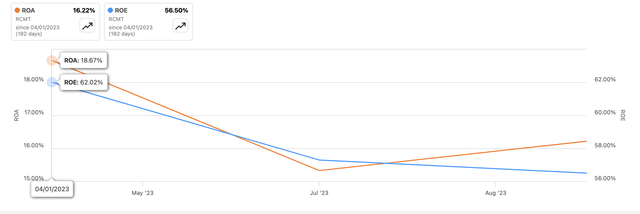

With net profit down slightly, it’s no surprise that the company’s ROA and ROE have also declined. Despite the decline, these are still pretty good and we could see a slight rebound from Q2, at least in terms of return on assets. Still, the company is very efficient at using its assets and shareholder capital, which should create value.

Return on assets and return on equity (exist)

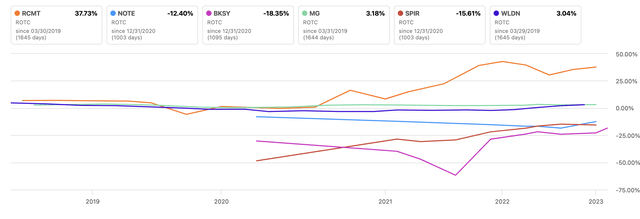

In terms of competition, the company hasn’t mentioned anyone in their 10K being direct competition, so I’ll have to use SA’s default selections to see how the company fares. The company’s ROTC compared to default-selected SA is much higher than other companies, which tells me that the company is enjoying some kind of competitive advantage and has a decent moat. Even without looking at its peers, the company’s high ROTC is very admirable, well above the 10% I look for in any investment, and a number like that demands a premium in my opinion.

ROTC vs. Peers (exist)

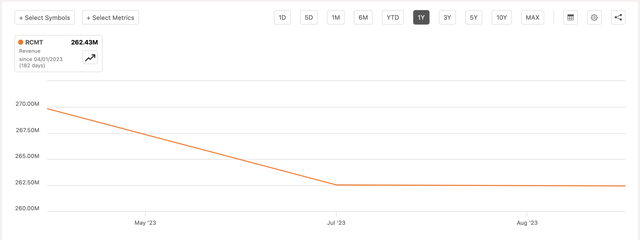

In terms of revenue, we could see a slight slowdown in revenue in 2023, which is understandable given the tough macro environment of high interest rates and sticky inflation that makes many businesses nervous. However, the revenue decline appears to have bottomed out in the second quarter, however, we’ll have to see what kind of numbers the company will report this month, which I’ll cover in more detail in a later section.

income (exist)

Overall, the company has seen better days, but the decline in 2023 isn’t as severe as I’ve seen with many other companies, so I think the company will return to its growth potential once the uncertainty resolves and An upward trend will be seen. The company’s financial position remains relatively strong, and its efficiency and profitability indicators remain excellent.

Fourth quarter expectations

Analysts expected adjusted earnings per share and GAAP of $0.62 and $0.63, respectively, on revenue of $72.29 million. This shows good sequential and year-over-year growth of approximately 37% and 31% respectively. This tells me that margins will improve significantly across the board, while revenue will see modest year-over-year growth of around 3%.

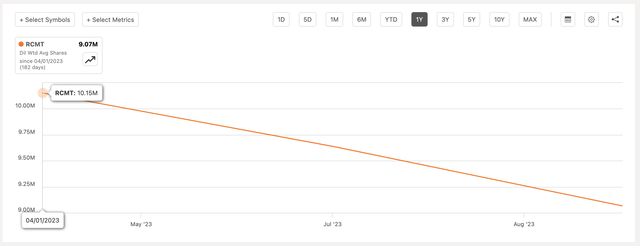

What I believe has helped improve this number is that the company has repurchased quite a bit of stock over the last year, and I’d like to see that continue.

outstanding shares (exist)

Over the past 11 quarters, the company has topped EPS estimates 10 times and revenue beat estimates 8 times.

beats and misses (exist)

Companies often don’t provide guidance. However, we can see that this time around, the company expects revenue to be between $70 million and $74 million, with a midpoint of $72 million, in line with analysts, while margins will be in line with Q3, which is also Yes, as long as they don’t see the deterioration, I’m happy.

Overall, management is very optimistic about the year ahead, with revenue growth and further deterioration in margins supporting the view that the bottom is set and we should see a return to growth going forward.

Outlook’s comments

I’d like to see the company add more schools to its portfolio, bringing in over 300,000 in revenue. As I mentioned in my last article, the company owns about 60 schools, about 15 of which have revenue in excess of $300,000. When asked how many schools the company currently owns, management said there were about 70. They don’t mention how many other schools are making over $300,000, but I’m assuming little has changed on that front. I want administration to tell us what kind of growth they are seeing in this revenue area and how well they are doing in transforming lower revenue schools. Also, in the first article, I mentioned that the company expects this market to grow 10x in the next 3 to 4 years, so I wonder if they still do, because I think it will be difficult to achieve. Specialty Healthcare remains the largest revenue contributor, so I expect to see revenue growth in this segment recover in the future as this segment saw the largest decline in 2023 while other segments held up somewhat of stability.

In terms of other segments, which account for about half of the company’s profits, I would like to see these remain stable or grow, as I believe the biggest difference in the company’s valuation will come from a resurgence in the healthcare revenue segment. The engineering and life sciences sectors are performing extremely well even in such a tough macro environment, which leads me to believe that once the economic uncertainty subsides, these fields will continue to perform as well or even better than they have in the past.

risk

The company was unable to increase the number of schools in its portfolio or convert more schools, which would have brought in more than $300,000 a year. This will certainly continue to put pressure on the company’s largest revenue contributor and impact the company’s stock price in the near term until we see material improvement.

As I mentioned in my previous article, the same risk remains that the company is not well known and the daily trading volume is not very high, so expect volatility in both directions.

Further deterioration in margins is not out of the question, which would impact the company’s valuation. However, I believe that when things start to improve, we will soon see them return to their highs.

Valuation

It’s been a while since I’ve run a valuation model on this company, so I’ve gone ahead and updated some of the assumptions and inputs that have changed over time.

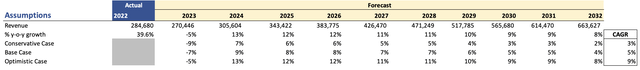

For revenue growth, I’m keeping growth fairly modest, which will serve as a margin of safety. The company grew at an astonishing rate. However, the recent economic slowdown doesn’t give me hope at the moment, so for my base case, I see ~5% CAGR over the next decade. To cover my bases, I also simulated a more conservative case and a more optimistic case. Below are these estimates and their respective compound annual growth rates.

Revenue Assumptions (author)

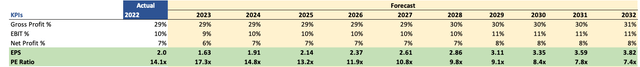

In terms of margins and EPS, I forecast some deterioration for the company in fiscal 2023, with things gradually improving over time, but not drastically, as I want to stay conservative. This will provide further margin of error for my estimate. Below are estimates compared to fiscal 2022.

Margin and EPS Assumptions (author)

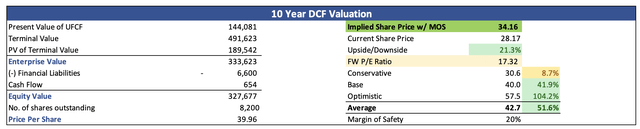

For the DCF model, I decided to use 10% as the discount rate instead of the company’s 7.5% WACC, which would give me more error/safety margin in terms of the company’s intrinsic value. Additionally, I set a terminal growth rate of 2.5% and discounted it a further 20% from the company’s intrinsic value, just to be absolutely certain that I wasn’t overpaying to own the company. That being said, the company’s conservative intrinsic value is about $34 per share, which means the company is still trading at a sizable discount to its fair value.

Intrinsic Value (author)

Conclusion

So it seems the company is still trading at a pretty hefty discount after my model was updated. Additionally, I raised my fair value target to around $34 from around $29.50 last August, and I maintain a strong buy recommendation as I believe the company has yet to reach its full potential.

I believe the company’s margins will continue to improve and revenue growth should re-accelerate. Maybe not at the growth rates we’ve seen in previous years, but still an improvement. My model projects lower revenue growth going forward, so I think the negative impact of this scenario is very small. Additionally, I’m more concerned about margin improvement than revenue growth, but if the company can do both, it’s undervalued so far and has plenty of room to grow.

I’m looking forward to seeing the company’s full-year results this month and hearing management’s thoughts on the future.