Bruce Bennett/Getty Images News

Turning around an investment is hard. But when an economic turnaround may finally occur, I like to buy stocks whose investor base is exhausted.exist ValueInvestorsClub.comthere are already many Regis companies (NASDAQ:RGS) Recommendations over the past ten years:

Value Investors Club

Adjusted for reverse splits, RGS was trading at around $350/share when it was first launched in 2010, compared to over $20/share when it was first launched in 2010. Last Recommended in 2023. In other words, everyone involved here for any length of time is in trouble investing. However, I’m not sure if the recent pitches are seizing on the wrong opportunity, but they certainly come too soon.

company

St. Regis brand (St. Regis website)

Regis is a franchisor of barber salons, primarily Supercuts and Smart Style (in Walmart ( WMT ) stores), and owns brands including Roosters, Cost Cutters, Borics and First Choice.Company owned had been rapidly transitioning from previously owning the salon itself to a franchise model, but when COVID-19 hit in the middle of the transition, they ran into predictable problems. Many lower-margin stores have closed over the past few years, leaving fewer than 100 company-owned stores. Most remaining company-owned locations will close in June (every second quarter call).

With the transition to a full franchise model almost complete, Regis is betting that the new business model will be rewarded by a market that has been skeptical of their every move.

activist

Regis activist (LinkedIn)

Two radical groups have recently appeared in Regis, Bruce Galloway Galloway Capital Partners and Gary Wizner, Stephen Salvador, Aurora Salvador, Barbara Salvador, and William Charters (13D Archive). Every activist has one core concern: dilution. With a current market capitalization of $23 million and debt of approximately $190 million, the equity transaction will dilute common shareholders with relatively little cash. That would heighten the risk of harming the company’s approximately $646 million in federal NOLs, which must avoid a change in control to protect tax benefits.To this end, the company has recently taken tax benefit retention plan. I think management is very aware of these factors and will do the right thing for shareholders. I’m also glad there’s external pressure to ensure shareholder alignment.

To be absolutely clear: I do not coordinate with any activists or act as a group.

question

Despite the introduction of new CEO Dr. Matt In order to successfully complete the final refinancing and complete the transformation, Regis has been working hard to improve profitability while closing its own stores and becoming a pure franchise operator. As activists have highlighted, Regis earns less than $300,000 per salon and has struggled to delay the launch of its new CRM system, Zenoti.The company sold Zenoti to help boost leverage and has received about $2 million in payments since the end of last quarter, with another $10 million in remaining payments likely to come The salon-to-system migration is expected to be completed this summer:

Currently, there are approximately 1,600 salons on the Zenoti platform, with another 900 expected to be migrated by March 31 and the remainder by June 30 this year.

Zenotti Software (Zenotti)

Since Regis posted $13.5 million in adjusted EBITDA in the first half of the fiscal year, its debt to EBITDA ratio is about 7:1. Investors had hoped to see EBITDA grow faster than it actually did. I think until the market gets some kind of “all clear” from Regis that common shareholders won’t be diluted into oblivion, equity will remain capped.recent tax benefit retention plan It seems clear that Regis is looking to protect an ownership change that would be hampered by significant dilution. The good news is that the Q2 2024 conference call (Oct < Nov < Dec) highlighted solid sales trends, and I expect more time to unlock significant growth if store counts can stabilize and EBITDA can grow. value. Management has worked hard on change management and should soon be able to focus more on operations.The company has gone bankrupt 800 locations in 18 months, and this trend has slowed but has not yet stabilized.One potential bright spot here is that the company’s existing franchisees have signed up Develop at least 100 units in India next 5 years. So unit growth may be about to return.

solution

Reading between the lines, I think Regis will normalize around 4,500 locations and generate $75 million in annual franchise revenue with running rate SG&A of $40-45 million. EBITDA of $30-35 million and a leverage ratio of 5:1 should provide more favorable refinancing terms than the current ratio of 7:1. Due to large NOLs and an asset-light business model, interest payments should be the only impediment to a substantial free cash flow conversion.

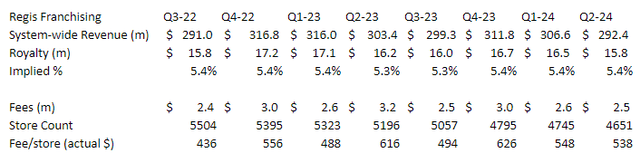

As support for these assumptions, consider recent company performance:

St. Regis Historical Performance (Public documents and author calculations)

I expect average sales at 4,500 stores to reach $270,000 per store by 2024, which works out to $14,600 per store at an annual royalty rate of 5.4%. With an additional $21 million in franchise fees per store, the franchise fee would be $16,700 per location, or $75 million per year.

In this case, a convertible makes sense, as noted recently in J.Jill (JILL), Superior (SUP) and comScore (SCOR). The $150 million note has a term of 5 years and is convertible at approximately 1.5-2x the current share price, with a PIK option, which will allow more time to adjust the store count and grow on a better basis. Again, it would be best if the equity stakes didn’t take such a severe hit due to dilution concerns.

To this end — in November 2023, the company announced Explore strategic alternatives and hired Jefferies as a financial advisor. The company is starting this process very cautiously now as their current debt is due to mature in a year and a half – August 2025. Interestingly, Jefferies hired in 2022 Help them pay off their final debts as they come due. The company seems to have plenty of time and good consultants to help them find a solution.

Valuation

ValueInvestorsClub’s latest offer was $4.60-$18.20 per share, which is even better if you remember that was before the 20:1 reverse split. The last two articles on Seeking Alpha argue $40-$50and $100 after split, and essentially the same investment case remains. If the company can survive without significant dilution, a solid store base and stable cash flow should attract a higher multiple than what Regis currently enjoys.

risk

St. Regis is highly leveraged and its store count has dropped significantly. There’s no guarantee they can turn things around before falling into bankruptcy.

I don’t know how to fully explain the competitive threats facing the traditional salon model. The pandemic has led more people to cut their hair at home and buy hair care products online. If these trends are not reversed, salon revenues may permanently remain below pre-COVID levels.

With multiple activists present, there is a risk that the company will spend time and money fighting for control rather than repairing the business. This could further weaken their ability to survive.

Rolling out the new CRM to the remaining stores should help standardize the business and increase sales, but may encounter some resistance if it doesn’t go well. The hope is that the standard operating model will allow Regis to start accelerating sales.

in conclusion

I think Regis is at an interesting inflection point, and I expect the end of their efforts to address debt maturities will send a clear signal to the market to hold on to equity. Investors can then refocus on management’s efforts to stabilize the business and steer Regis toward a profitable future. Otherwise, investors may lose part or all of their investment. An investment in Regis comes with significant risks and potential rewards.

Editor’s note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks.