Stock colors

Introduction and thesis

Reynolds Consumer Products Company (NASDAQ: Wren) is a leading consumer products company known for its innovative and sustainable solutions.Known for its iconic brands such as Reynolds Wrap and Hefty, the company offers a wide range of products Includes food storage, aluminum foil and disposable cutlery.

REYN has leading commercial positions in multiple segments of the U.S. market, allowing it to generate sustained demand and maintain its position through retail relationships.

Our concern is the execution of its recovery strategy, as management seeks to maintain growth while improving margins. Competition will make this difficult, as will its resilient nature, as recent demand has demonstrated.

We recommend investors remain patient and wait for further improvements before considering REYN.

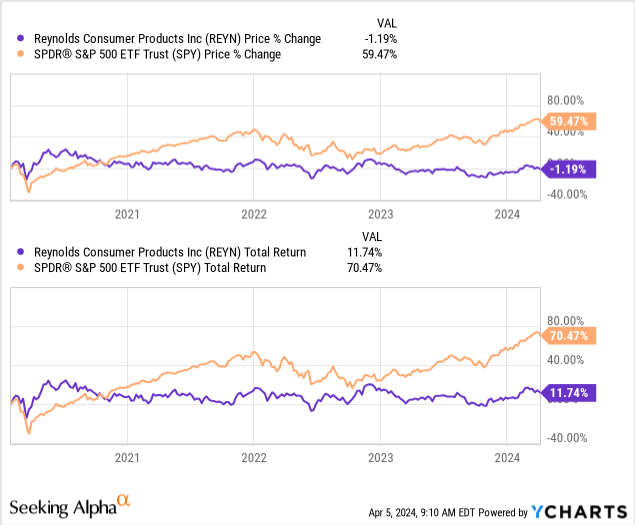

share price

REYN share price performance has been lackluster since the business was founded The listing comes despite awareness that it has been impacted by the pandemic, the subsequent recovery, and the current weak macroeconomic environment.

financial analysis

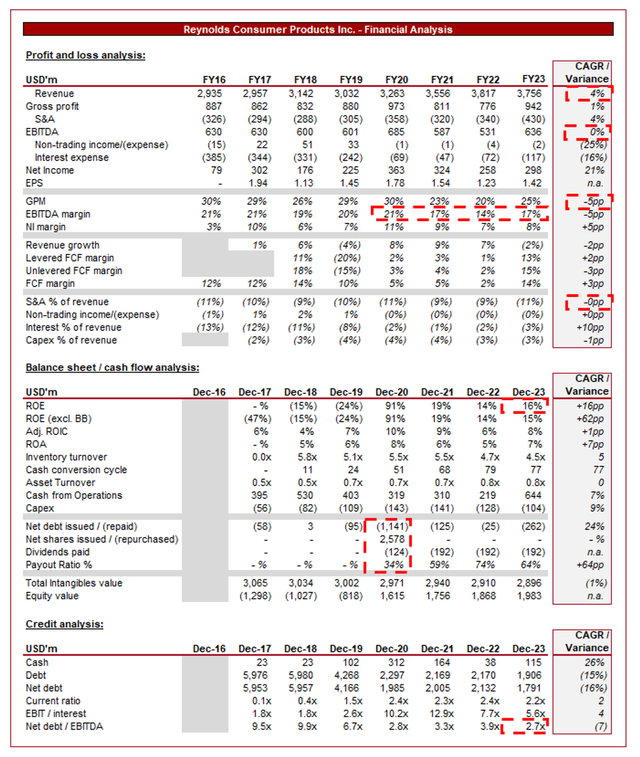

Capital IQ

The above describes the financial performance of REYN.

business model

REYN has a variety of products including aluminum foil, plastic wrap, parchment paper and disposable plates. The company operates a range of well-known brands such as Reynolds Wrap, Hefty and Pan Lining Paper.

A staggering 95% of U.S. households own at least one REYN product, and the company ranks No. 1 or No. 2 in most of its product categories (Source: Management).

Its strong brand is developed through a combination of:

- distribute: REYN has an unrivaled presence across various distribution channels including supermarkets, online retailers and hypermarkets. For many consumers who are not necessarily overly picky, REYN is top of mind. This does have its drawbacks, however, as during times of inflation (such as currently) consumers may become more picky and not see enough value in REYN.

- Innovation and Research: REYN invests heavily in research and development to drive ongoing product development to stay ahead of the curve.

This high brand recall has a positive compounding impact as consumers can rely on its products, retailers offer preferential treatment and maximum inventory, and launching new products becomes easier.

competitive positioning

Despite its strong competitive position, REYN has struggled to achieve outstanding growth, which is attributed to overall factors in its industry:

- product simplicity: Many of REYN’s products are relatively simple in nature, which limits the degree of differentiation and therefore pricing power. This creates sensitivity to pricing.

- Saturated market dynamics: The development of new entrants and production leads to saturation, again limiting the scope for differentiation and aggressive pricing.

- Economic sensitivity: Sales of home furnishings and the premium nature of simple merchandise make the company vulnerable to economic conditions.

- Marketing strategy: A lack of innovative marketing limits the ability to disrupt markets and positively change the status quo.

finance

REYN’s recent financial performance has been mixed. Its revenue growth has been lackluster, with growth rates of +3.4%, +2.5%, (3.3)% and (7.4)% in the past four quarters respectively. At the same time, profit margins also improved.

We believe that, operationally, management has been poor over the past few years. The recent improvement in margins can be primarily attributed to easing inflationary pressures and some positive pricing, which, oddly enough, was partially offset negatively by the business due to lower pricing in its cooking and baking divisions.

Broader market conditions have had a negative impact on the company, particularly the impact of rising interest rates on the housing market as consumers seek to cut costs. This is the main reason why it’s hard to stay positive while growing up.

Looking ahead, we expect growth to remain subdued until expansionary government policies return, with profit margins in turn rising.

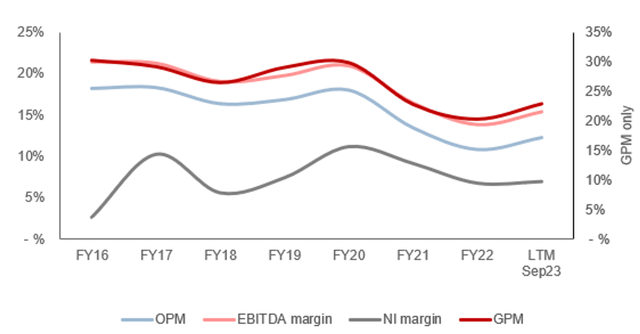

Capital IQ

REYN’s margin development has been disappointing since the company’s IPO, with EBITDA-M falling from 21% in fiscal 2016 to 17% in fiscal 2023. This is mainly due to the impact of inflation, with gross margin declining by 5 percentage points since FY20.

REYN has been struggling with rapidly rising material costs and has been unable to raise prices sufficiently to offset the impact. Compounding the problem are negative changes in volumes, particularly in fiscal 2021 and heading into fiscal 2022. This is very disappointing for FMCG companies and shows that their brand power and value proposition are not enough to offset cyclicality.

REYN is likely to experience a natural improvement as inflationary pressures continue to subside, although we are hesitant about whether this will be enough to fully return to pre-pandemic levels. The company was also negatively affected by rising wages, which affected cost of sales and operating costs.

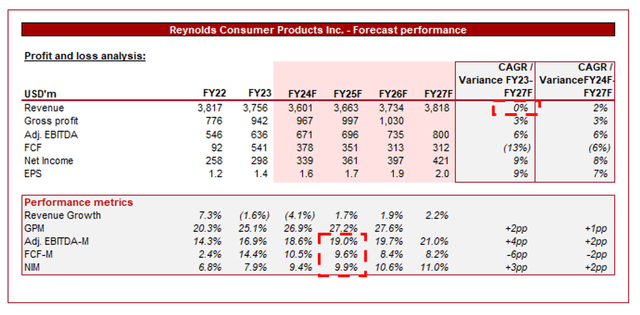

Capital IQ

The above is Wall Street’s consensus for the next few years.

Analysts predict mediocre growth over the next few years, with a CAGR of 0% through fiscal 2027. At the same time, profit margins are expected to gradually increase to approximately 20% of EBITDA-M.

The growth forecast is disappointing and below our expectations, indicating that negative conditions in the housing market are expected to continue in the near term. Furthermore, this situation may be partly related to brand weakness and the slow recovery in the cooking and baking segment.

Furthermore, we think the forecast for margin improvement is very optimistic. Given the limited results to date, we are less convinced. We expect EBITDA-M to normalize to closer to 18%.

Balance Sheet and Cash Flow

After a period of restructuring, REYN’s financing position is reasonable, with an ND/EBITDA ratio of 3.1x and interest accounting for 3% of revenue. This puts the business in a good position to maintain and expand its distribution, especially as its free cash flow margins are quite good. Additionally, this gives REYN the option of pursuing mergers and acquisitions to improve its growth trajectory.

Capital IQ

Industry analysis

Seeking Alpha

Above is how REYN’s growth and profitability compare to its industry average, as defined by Seeking Alpha (12 companies).

REYN’s performance leaves a lot to be desired compared to its peers. The company’s profit margins are slightly lower than those of its peers, but the gap widens on both FCF and ROTC basis. This is due to macroeconomic conditions having a greater-than-average negative impact on it.

However, the company is doing better from a growth perspective, so if it can improve its margins sufficiently, REYN could soon become the leader in the industry.

Valuation

Capital IQ

REYN currently trades at 12x LTM EBITDA and 12x NTM EBITDA. This is a discount to the historical average.

We believe a discount to its historical average is warranted due to execution risks associated with margin improvement, as well as weaknesses identified following the recent decline in financial performance.

In addition, REYN’s trading price is at a discount of approximately 30% to its peers based on LTM EBITDA and approximately 25% based on price-to-earnings ratio. We think the current discounts are broadly reasonable, but we’d recommend closer to 20%. This will fully reflect its current weaknesses while taking into account potential improvements.

Based on this, we generally believe REYN is adequately valued, although we suspect improved execution will quickly lead to the stock being undervalued. Investors with a higher risk appetite may consider this a good entry point.

Key Risks of Our Paper

The risks of our current paper are:

- (Upside) The e-commerce market is performing strongly.

- (Advantages) Expand overseas through retail relationships.

- (Disadvantages) The cost of raw materials has further increased.

- (Disadvantages) Inability to adapt to changing consumer preferences, leading to brand erosion.

final thoughts

REYN is a strong FMCG business with leading brands, unparalleled market reach and scale. Still, its cyclical and broader weaknesses in recent years have left a lot to be desired. We do expect its performance to improve over the next few years, although we’d like to see further evidence before considering buying the stock.