The Commerce Department reported Thursday that consumer spending fell sharply in January, a potential early red flag for the economy.

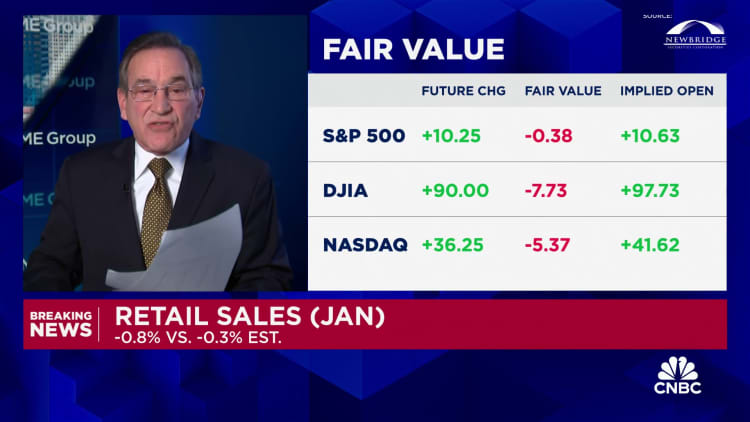

Drive retail sales According to the Census Bureau, the number fell 0.8% this month after rising 0.4% in December. The decline was expected: Economists polled by Dow Jones expected a 0.3% drop, in part to compensate for seasonal distortions that may have pushed up December’s data.

However, the pullback was much larger than expected. Even excluding cars, sales fell 0.6%, well below expectations for 0.2% growth.

The sales report is adjusted for seasonality but not inflation, so it shows spending lags behind price increases. Compared with the same period last year, sales increased by only 0.6%.

The U.S. Labor Department reported on Tuesday that overall inflation rose 0.3% in January, and if food and energy prices were excluded, it rose 0.4%. Compared with the same period last year, these two readings were 3.1% and 3.9% respectively.

Sales at building materials and gardening stores were particularly weak, down 4.1%. Sales at miscellaneous stores fell 3% and sales at auto parts and retailers fell 1.7%. Gas station sales also fell 1.7% as prices dropped at the pump this month. On the bright side, restaurant and bar sales rose 0.7%.

Control group retail sales, which exclude items such as food services, automobiles, natural gas and building materials, fell 0.4%. This number feeds directly into the Commerce Department’s gross domestic product calculations.

Consumer strength has been at the heart of U.S. growth prospects, which are proving to be much more durable than most policymakers and economists expected. Spending accelerated to 2.8% in the fourth quarter of 2023, and gross domestic product (GDP) grew by 2.5% despite widespread forecasts of a recession.

However, concerns remain that persistently high inflation could take a toll and jeopardize future prospects.

“This is a weak report, but there is no fundamental shift in consumer spending,” said Robert Frick, corporate economist at Navy Federal Credit Union. “Spending was higher in December due to holiday shopping, compared with January. There have been declines in these spending categories, coupled with colder weather and adverse seasonal adjustments. Consumer spending may not be huge this year, but as real wages grow and employment increases, it should be a lot to help keep the economy expanding. “

Another economic report on Thursday showed continued strength in the labor market, another key cornerstone of the economic outlook.

Initial jobless claims totaled 212,000 in the week ended February 10, down 8,000 from the previous week’s upwardly revised total and below the estimate of 220,000. Labor Department the report said.

Continuing claims, which trailed one week, totaled just under 1.9 million, up 30,000 for the week and above expectations of 1.88 million.

There was also some good news on the manufacturing front, with regional Fed surveys for the Philadelphia and New York areas both better than expected in February.

Philadelphia’s poll came in at 5.2, up 16 points and better than the -8 forecast, while New York state’s poll came in at -2.4. While the New York survey still showed contraction, the reading was much better than January’s -43.7 and -15 expectations. The survey measures the proportion of companies reporting growth, so a positive reading indicates expansion.

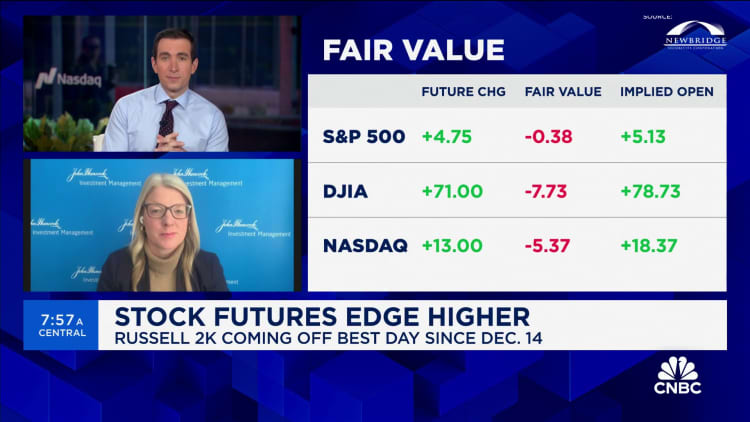

The market largely took the reports in stride, with stock futures pointing to a higher open on Wall Street.

Investors are watching the data closely for clues on where the Fed will go with regard to monetary policy and interest rates.

Fed officials said they were comfortable enough with the prospects for falling inflation and stable growth to believe the rate-raising cycle that began in March 2022 may be over. But they are watching the data closely, with most saying they need more evidence that inflation is returning sustainably to the central bank’s 2% target before starting to cut rates.

Futures market pricing shows that the first rate cut will occur in June, and by the end of 2024, the Fed will cut interest rates a total of four times, or one percentage point.

Don’t miss these stories from CNBC PRO: