gear

Living on passive income from dividends can be truly life-changing because once your passive income exceeds your living expenses, you no longer need to work to support yourself. ETFs can be a particularly powerful tool for achieving this goal, given the following factors: They provide investors with immediate access to a diversified portfolio managed by professional managers and/or passive algorithms, allowing them to engage in hands-off investing.

Additionally, if you invest in a high-yield fund that pays monthly dividends, regular passive income checks can help you easily budget your living expenses in line with your income, thereby maintaining your long-term perspective and sticking to your strategy during your investing period .A period of severe market volatility. Best of all, high-yield monthly dividend ETFs have the potential to allow you to retire early because they generate more passive income than low-yielding stocks and even some bonds.

In this article, we’ll look at five diversified funds that pay monthly dividends and yield between 7-12% annualized that may be suitable for your retirement income portfolio needs.

#1. Virtus InfraCap U.S. Preferred Stock ETF (PFFA)

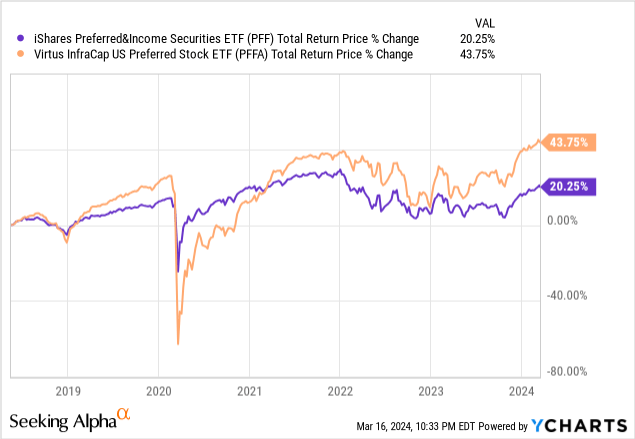

PFFA is a broadly diversified ETF that combines an actively managed portfolio of 188 preferred stocks with reasonable leverage levels (typically in the 20-30% range) to deliver very attractive current income and relative Target preferred equity sectors at scale for broader long-term total returns. The management team has succeeded in achieving this goal, as the fund currently offers a 9.6% full dividend yield with monthly payments (which is actually up 1.5% this year) and has doubled the total return of iShares Preferred and Income Since its inception, the Multi-Security ETF (PFF) has:

Therefore, investors looking for a relatively defensive and lucrative yield without giving up too much total return may find PFFA quite attractive. This may be especially true given that interest rates appear to be falling over the next few years, which should cause preferred stocks to move higher. For more information about the fund, you can read our recent in-depth analysis here.

#2. Cohen & Steers Quality Income Real Estate Fund (RQI)

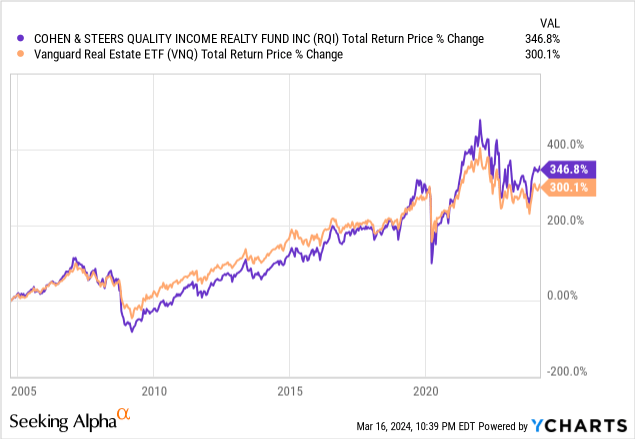

RQI is a diversified REIT CEF with a diversified portfolio of 203 stocks. It holds mostly equity REITs but also some fixed income. It also uses reasonable leverage to boost yields and total returns without exposing the fund to excessive risk during an economic downturn.

Currently paying a monthly yield of 8.25% and not taking a cut during the COVID-19 lockdown, coupled with skilled active management (which has outperformed the broader REIT profile since inception), the Vanguard Real Estate Index Fund ETF (VNQ) Industry), RQI appears to be an attractive investment in the real estate space at a time when REITs are severely undervalued and leading institutional investors like The Blackstone Group (BX) are buying heavily.

For more information about the fund, you can read our recent in-depth analysis here.

#3. JPMorgan Equity Premium Income ETF (JEPI)

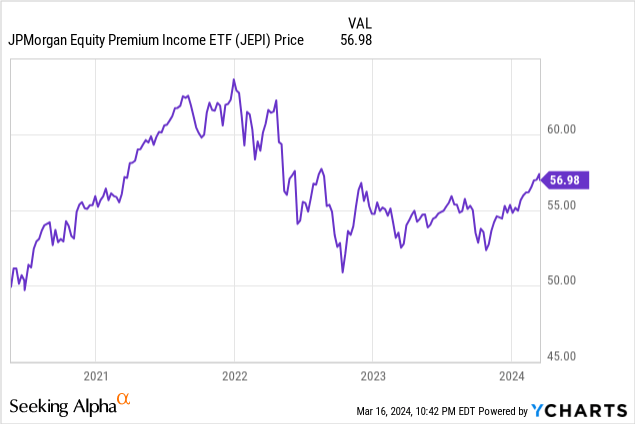

JEPI is a very diversified ETF that combines the power of leading mega- and large-cap companies with strong monthly dividend payments. As such, it offers investors a rare opportunity to gain exposure to stocks of companies like Microsoft (MSFT) and Amazon (AMZN) while earning high returns.

JEPI’s trailing 12-month dividend yield is approximately 8%, and monthly payouts are quite stable. Thanks to the option premium of its notional covered call strategy, JEPI has provided investors with attractive current dividends since its inception. income while retaining shareholder capital very well, making it a useful regular monthly income machine for longs.

For more information about the fund, you can read our recent in-depth analysis here.

#4. Neos S&P 500(R) High Income ETF (SPYI) .

SPYI is somewhat similar to JEPI in that it pays a very attractive monthly dividend through an option selling strategy while maintaining diversified underlying investments in mega- and large-cap stocks. Although its expense ratio is higher than JEPI, its dividend yield is also higher, close to 12%. It also has greater exposure to large-cap tech stocks, so along with JEPI it could be a great choice for those who want higher yields and greater exposure to large-cap tech stocks in exchange for higher management fees. Good balanced funds. For more information about the fund, you can read our recent in-depth analysis here.

#5. Cohen & Steers Infrastructure Fund (UTF)

Last but not least, UTF offers investors an actively managed infrastructure fund yielding 8.4%, with monthly payments and no dividend cuts during the COVID-19 lockdown. Due to the strong defensive nature of the underlying assets and key macro drivers such as demographics, development, digitalization, deglobalization and decarbonization, tens of trillions of dollars of investment are expected to enter the industry over the next few decades. UTF looks like a good approach for income-focused investors. Ride this wave. For more information about these trends and how funds can benefit from them, you can read our recent in-depth analysis here.

Important points for investors

For investors looking to build a portfolio of high-yielding, monthly dividend-paying funds, these five funds can give you a good start on a comprehensive and diversified portfolio that can help you get on the road to financial independence.

While we prefer to actively pick our own stocks and manage our own portfolios according to value investing principles because by doing so we are able to significantly outperform the funds discussed in this article, for investors who value passivity over maximizing total returns Generally speaking, these funds are good choices.