John D

discard calculation(NASDAQ: RGTI) has surged 172.43% (year-over-year) to almost breach the $2 mark and is currently trading 42.27% below its 52-week high of $3.43 (at the time of writing).The increase comes months after media reports It said the company had “filed a prospectus” in an attempt to raise $250 million through a hybrid offering. It has been two years since RGTI went public through a SPAC merger (after its establishment in 2013) and has been innovating different quantum computing components. This includes related chips and integrated software, where the quantum processing unit (QPU) can be accessed in the cloud.Quantum computing is part of four major industries, according to a report McKinsey The article stated, “By 2035, the value may be as high as $1.3 trillion.”

paper

I believe Rigetti computing has high growth potential and quantum computing is expected to dominate Responsible for improving various technical areas such as cryptography and machine learning (ML). RGTI is also committed to improving the dynamics of high-performance computing (HPC) to reduce modern computing challenges such as resource over-utilization and industrial operating costs. Additionally, Rigetti has multiple intellectual property rights/patents, and its valuation may soon boost the stock price. Over the long term, I think the promise of advanced quantum computing will continue to push this small-cap stock to new records above its 52-week high.

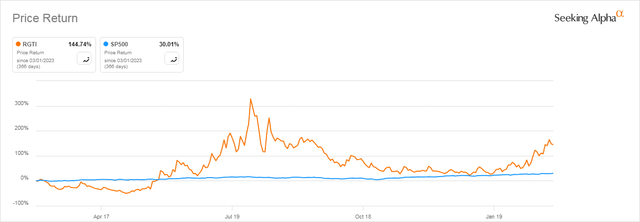

Driven by positive markets in 2024, RGTI outperformed the S&P 500 (year-over-year) by more than 100%.

Seeking Alpha

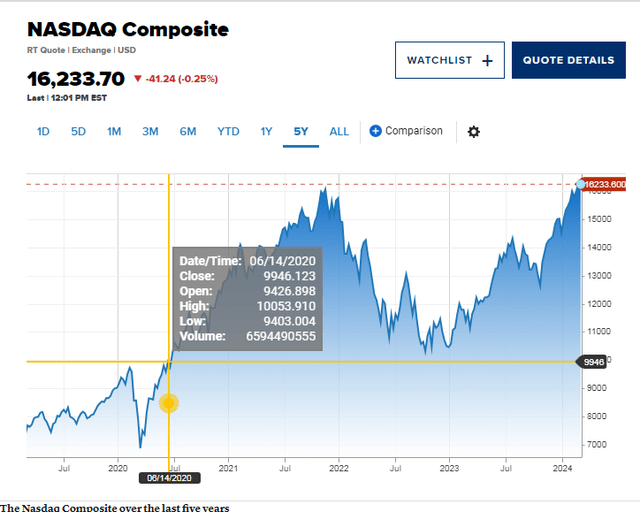

RGTI is expected to report strong fourth-quarter 2023 earnings on March 14, 2024, after its third-quarter 2023 revenue increased 10.7% annually. Against this backdrop, the Nasdaq opened in March 2024 at $16,302.24, a record high.

CNBC

In tech stocks, Nasdaq rises on bullish news Performance The growth of artificial intelligence-related stocks such as Nvidia and Meta has slowed inflation and raised expectations that the Federal Reserve will cut interest rates later this year.

High performance computing

throw away declare A project partnership with the U.S. Department of Energy’s Oak Ridge National Laboratory (ORNL) will demonstrate future applications of quantum computers. The project will also seek the services of Riverlane, a company known for its “quantum error correction technology,” with results expected to demonstrate how high-performance computing (HPC) structures can be integrated with quantum devices.

First, the successful integration of these two components (HPC and QC – more of a hybrid quantum system) will help Rigetti secure relevant government contracts, as it is already working with governments to realize these contracts. Second, we are studying the evolution of quantum simulators, which have been limited by memory requirements in the past. Enhanced simulators make it easier to study algorithms and help debug generated code. The use of HPC will help develop super quantum computers that can break through the limitations of memory. Furthermore, by replacing binary bits (used in classical computers) with qubits (used in quantum computing), Rigetti will amplify the power of superposition. This feature is suitable for cryptography and machine learning dynamics such as computer vision, natural language processing (NLP), etc.

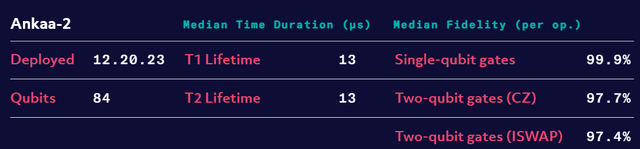

For example, Rigetti recently roll out Its 84-qubit Ankaa-2 quantum computer offers a 2.5x performance increase in its description.

give up calculation

Making the announcement, Rigetti CEO Subodh Kulkarni point out,

“Rigetti’s focus on improving our median 2-qubit fidelity is an important part of our mission to build the world’s most powerful computer. A useful quantum computer requires not only a large number of qubits; High-quality qubits. The Ankaa-2 system’s 98% fidelity is the result of years of innovation and commitment from our teams across the technology stack. I look forward to the Ankaa-2 system now being available to all of our customers and partners Focused on accelerating the continued progress of this transformative technology.”

This advancement puts Google in the spotlight demonstration As early as 2019, through the “Quantum Supremacy” article in 2019, it calculated the “amplitude of each bit string” through simulation. At the time, this method used an algorithmic approach called Schrödinger-Feynman, and one challenge it encountered was its high computational cost. As the number of patch gates increases, the circuit depth continues to increase.I believe this problem will be solved by Rigetti soon quantum systems because they have a universal gate processing infrastructure based on tunable superconducting qubits.

property

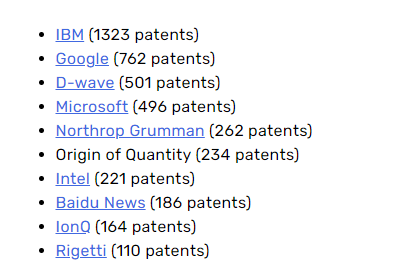

In my opinion, Rigetti has a better chance of increasing its valuation through its intellectual property (IP).Company instant recharge Record It is shown that it holds at least 152 patents spread across its quantum chips, cloud-based quantum services and related software. Rigetti’s founder/former CEO, Dr. Chad Rigetti, has invented approximately 38 patents that have been issued by the U.S. government (as of 2022).In the field of quantum computing, IBM has about 1,323 patent (The number of patents worldwide is 122,110), while Google owns 762. Rigetti ranks in the top ten, just below IonQ, with 164 patents.

Quantum Zeitgeist

Currently, RGTI has a market capitalization of $337.18 million and an enterprise value of $260.51 million. In the case of mergers and acquisitions (M&A), one of the factors to be considered when determining the overall valuation is intellectual property rights. I believe the intellectual property rights in quantum computing are a key asset and will make the company more attractive, especially since it ranks in the top ten in this field.What’s more, we’ll soon have a hybrid of quantum computing and artificial intelligence (AI) Research Emphasize a strong intellectual property portfolio.

in another articleIt is worth noting that in 2023, companies such as “IBM, Microsoft, Origin Quantum Computing, Google and Baidu” applied for more than 600 new patents (cryptography), showing the highest progress.

new progress

throw away declare In December 2023, its 9-qubit Novera processing unit (QPU) was commercially launched/launched. The system is based on its 4th The new generation of Ankaa-level infrastructure “features tunable couplers for fast 2-qubit operations and 5-qubit wafers for testing single-qubit operations.” The new QPU is expected to be priced at $900,000. Reports indicate that the company has sold QPU to Fermilab in 2023.

Recently, D-wave Quantum Inc. (QBTS) declare Launched a novel Go-to-Market (GTM) program designed to fast track the “deployment of commercial quantum technologies.” Through this strategy, D-wave’s industry verticals will focus on increasing sales and marketing by redesigning their manufacturing/product development and logistics planning. The company also plans to increase cooperation with governments in 2024, and Rigetti is already working with the Department of Energy.

Quantinuum’s majority shareholder is Honeywell, which recently declare Developing a “digital bus-based” system that connects quantum computer qubits rather than “using direct connections” has no scalability. It is worth noting that qubits in quantum computers currently use a limited scalability from 1 to 20 control signals, which also encounter wiring challenges. With its patented design, Quantinuum aims to solve wiring challenges while expanding the grid to capture and control more qubits. This gave way to more digital connections than analog systems.

risk

low income

Rigetti has yet to generate significant revenue from its quantum computing business, with revenue of $2.6 million in the quarter ended September 2023. Total revenue for the year ended December 31, 2022 was $13.1 million and net loss was $71.5 million. However, this revenue was up from $8.2 million in 2021, while the net loss was $38.5 million. When the fiscal 2023 report is released, it will be important to understand the amount of capital expenditures for 2023, as 2022 expenditures will be $22.7 million.

Qubit decoherence characteristics

Like other quantum computing companies, Rigetti needs to find a way to reduce the number of qubits decoherence, which occurs “when a qubit interacts with its surroundings and loses its coherent characteristics.” According to the study, the advantages of quantum computing diminish when “qubits decohere to conventional bits.” Furthermore, it is known that quantum computers operate at cryogenic temperatures. Any changes in temperature or electromagnetic fields can destroy the accuracy of the information stored in these computers. More research is needed to develop quantum-resistant computing devices that can withstand such problems.

Valuation

Rigetti’s forward P/B ratio is 2.77, compared to the industry average of 4.40. This represents a difference of -37.06%, showing that the stock is slightly undervalued and that we may see gains in the second half of 2024. Additionally, Rigetti has a relatively strong cash balance of $110 million, compared with a total debt portfolio of $33.6 million. The company’s total debt/capital ratio (MRQ) is 22.94%, indicating that it has enough cash to repay its current debt position.

bottom line

I believe Rigetti is a buy with strong profit potential over the next 12 months. The company is continually improving its quantum computing technology and has patents that will increase its valuation in the long run. In addition, quantum computing is an emerging technology field with high growth potential. Although revenue is lower due to technology-related fluctuations, the company has announced that its 9-qubit QPU is commercially available, a move that will drive revenue growth across the company.

Editor’s note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks.