Temijurek

Analysis of iron ore miner Rio Tinto (NYSE:RIO) is now a great example of how much things can change in just one quarter, changing the way people think about it.when i write about it The last time it happened, in December 2023, there were clear signs that its price was about to correct, prompting me to change its rating from Buy to Hold. In fact, a correction has already occurred, with its price falling by 9% since then.

But the price decline is also accompanied by changes in its fundamentals. Here I review them in some detail and see what they mean for their ratings.

review

To better understand where it’s at now, first, let’s take a quick look back at where it was a quarter ago.More specifically, the reason I went Hold rating:

- Due to falling profits, the company cut its dividend by 34% when it released first-half results (H1 2023). Weak commodity prices, especially iron ore prices, contributed approximately 84% to the company’s underlying EBITDA in 2023, resulting in a 43% year-on-year decline in attributable net profit.

- While iron ore prices are set to rise in the second half of 2023 on possible improvement in Chinese demand and possible reductions in BHP’s (BHP) sales due to the possibility of strikes, the reasons are not enough to suggest continued price increases. China’s economy still faces risks of weakness, as evidenced by the government’s fiscal stimulus measures.In addition, BHP Billiton recently reach agreement and unions.

- The stock’s trailing 12-month (TTM) and forward price-to-earnings (P/E) ratios are both above averages over the past few years, suggesting a correction is likely amid uncertain fundamentals.

Since then, there have been a number of positive developments that have had an impact on the stock and may have an impact in the future as well. Here, I assess how Rio Tinto might play its balancing role in the future.

Full year results improved

Rising iron ore prices served the company well in the second half of 2023, with net sales revenue rising 6.2% year over year during the period following a 10.4% contraction in the first half of 2023. But the real bright spot was the 43.3% drop in net profit in the first half of 2023. In the first half of 2023, it fell by 42.8%.

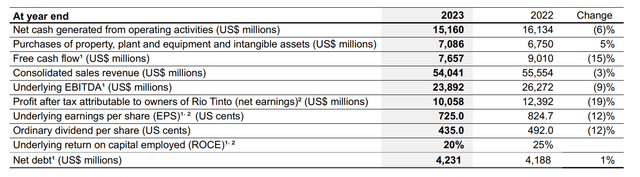

While the full-year figure is still affected by a challenging first half of 2023, the decline narrowed significantly. Net sales revenue fell to 3%, and net profit fell 19%.

Key financial data (Source: Rio Tinto)

Dividend yield looks good

The company also cut its dividend for the year by about 12% to $4.35 due to weak profits. But here too, the cut is down from 34% in the first half of 2023. This results in a TTM dividend yield of 6.94%. Furthermore, despite consecutive dividend cuts over the past two years, investors who have owned the stock over the past five years have enjoyed a strong yield on cost of nearly 10%. In other words, it’s still a good dividend stock to consider buying.

Source: Seeking Alpha

Rio Tinto iron ore price forecast optimistic

But disappointingly, rising iron ore prices have reversed year-to-date trends, causing prices to fall 17% since the start of 2024. However, this may still work in Rio Tinto’s favor. Here’s why.

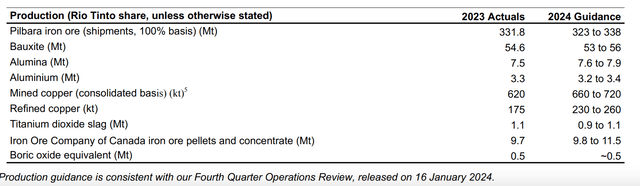

Last year, its iron ore realized price increased by 2% year-on-year to US$108.4 per dry ton. While the exact realized price may vary depending on the iron price category to which it is most relevant, overall the current iron ore price of $118 per ton remains above that level.Additionally, ING forecasts that prices will remain around these levels throughout the year, with prices in 2024 averaging US$120 per ton. This could positively strengthen the company’s financial profile, as iron ore production is expected to be broadly similar to last year (see table below).

Source: Rio Tinto

While there remains a degree of uncertainty about China’s demand potential in the year ahead, given the government’s slightly lowered growth forecast for this year and a weakening economy, The same goes for other big markets (See discussion of “Macros show they’re not out of the woods yet” in the link) It remains to be seen how much the price will be affected.

Moderate market multiples

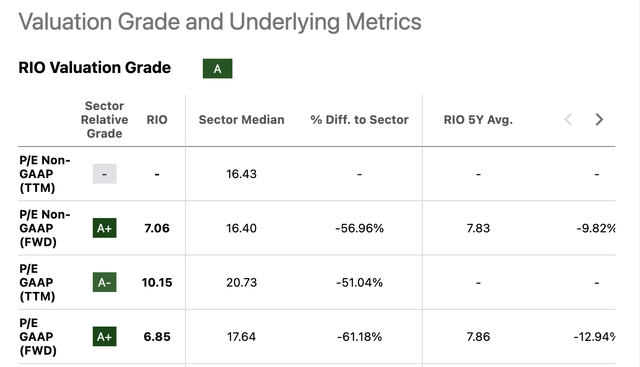

The stock’s market multiples have also slowed significantly since my last check. The GAAP TTM price-to-earnings ratio currently stands at 10.15x, which is lower than the ratio over the past decade 11 times Much lower than the 13.5x the last time I checked. Additionally, the forward GAAP price-to-earnings ratio of 6.85 times is below the five-year average of 7.86 times and below the past ten-year average of 8.53 times. These ratios are also significantly lower than the materials industry median (see table below).

Source: Seeking Alpha

What’s next?

The key takeaway from the discussion is that Rio Tinto is in a much better position now than it was a quarter ago. Not only did its earnings improve significantly in the second half of 2023, but the company’s dividend yield also looks good despite dividend cuts over the past two years. Iron ore price forecasts are also optimistic and could boost the company’s revenue and profits in the year ahead. At the same time, price corrections have resulted in more attractive market multiples.

There are still risks in the global macro situation, especially in China. While no alarm bells are sounding yet, a closer look will be needed to assess their impact on Rio Tinto. However, based on current conditions, the company’s 2024 results look better than 2023. I’m upgrading the stock to Buy again, but for investors looking for capital gains, the rating could change if the macro picture changes. Things didn’t go well. For mid- to long-term income investors, developments this year are likely to have a smaller impact on returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.