Tumor 3123

By Behnood Noei, CFA

In 2023, the dominant market theme will be fixed income returns.Fast forward to 2024, and despite a sharp rise in spreads and falling yields in Q4, we believe the theme is Still alive and well. In fact, U.S. high-yield and investment-grade corporate yields are still in the highest quintiles and deciles of the past decade.

However, emerging market debt, especially emerging market corporate debt, has been one of the market areas that has received much attention. In this article, we look at this area and examine the case for incorporating emerging market corporate debt into investor portfolios relative to U.S. corporate bonds and dollar-denominated debt of emerging market sovereigns.

Attractive production potential

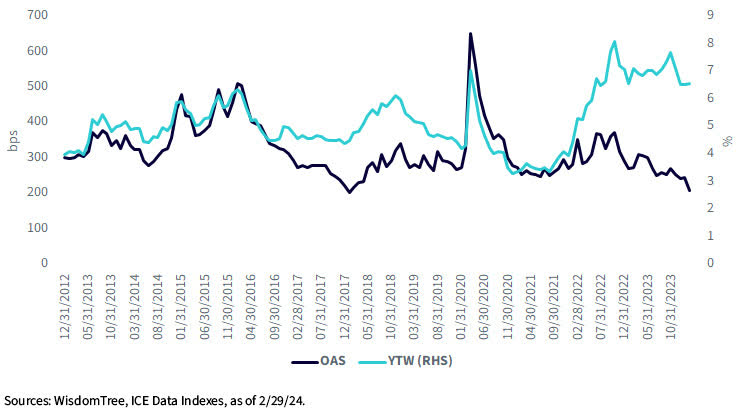

Even after a sharp rebound Emerging market corporate spreads continued to offer attractive total yields at 444 basis points (bps) compared with the highs during COVID-19 (653 bps in March 2020). In fact, the total return at the end of February was 6.58%, ranking in the top 10% of the industry’s returns over the past 10 years.

emerging market companies

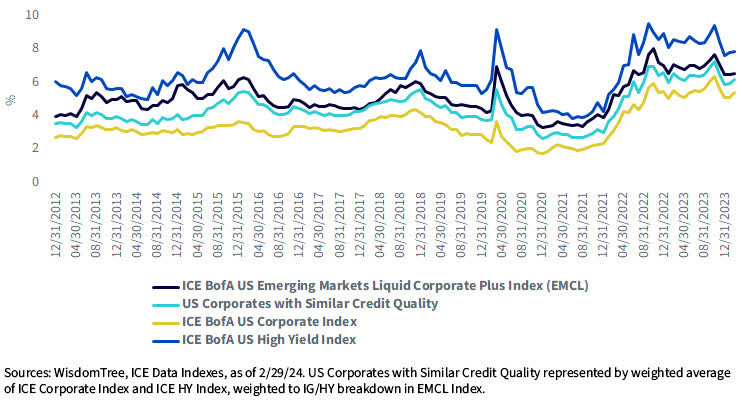

Not only do emerging market companies offer higher yields than in the past, but they also compare favorably with portfolios of U.S. peers with similar credit ratings (expressed as a weighted average of the ICE Corporate Index and the ICE HY Index, weighted as per EMCL The investment grade/high yield segment within the index (69% investment grade and 31% high yield as of February 29, 2024), they have consistently provided investors with higher incomes.

However

solid foundation

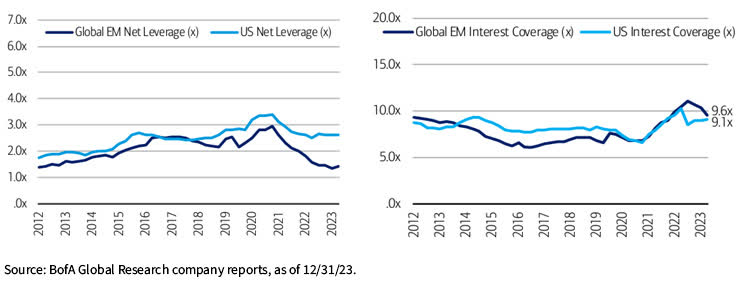

One of the biggest concerns about emerging market securities, especially corporates, is their fundamentals, which is the main reason they continue to provide higher income than a portfolio of U.S. businesses with a similar credit rating mix. However, looking deeper, we can see improving fundamentals for emerging market companies. Gross and net leverage for emerging market companies are at their lowest levels in the past decade and are also lower relative to U.S. companies. The same goes for their interest coverage. Although their IC has declined recently, they are still outperforming U.S. companies.

Compared with emerging market US dollar sovereign countries, the credit quality is better and the interest rate risk is lower.

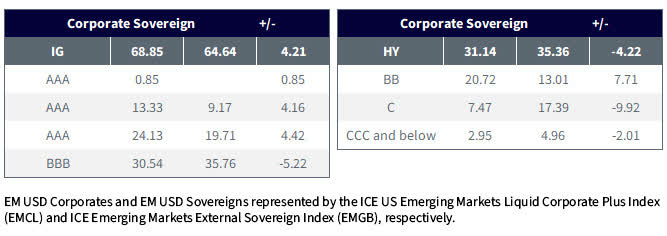

Another argument often used to ridicule emerging market companies is that if investors want to invest in emerging markets, they can invest in “higher quality and lower risk” sovereign countries. However, this is another misnomer for emerging market companies issuing in U.S. dollars. The U.S. dollar-denominated Emerging Markets Corporate Index has a higher allocation to investment-grade issuers than to U.S. dollar-denominated emerging market sovereigns.

Credit Quality of the ICE Emerging Markets Debt Index – USD Corporates vs. USD Sovereigns

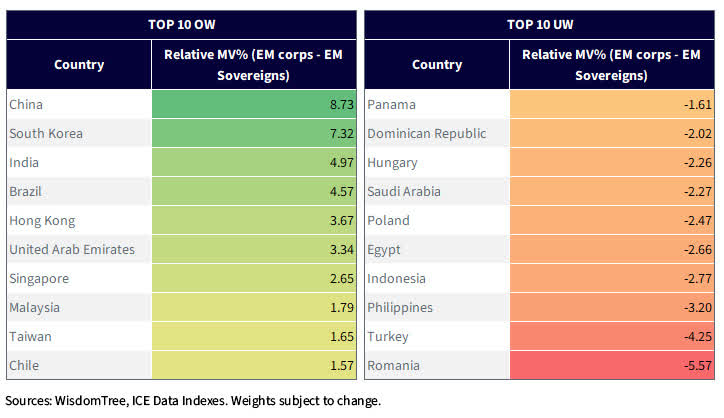

Looking at the risk countries of issuers in both indexes, the Emerging Markets Corporate Index has a much higher allocation to countries with better fundamentals and a much lower allocation to countries with poor economic conditions. In many cases, more advanced emerging market governments secure much of their financing through debt denominated in their own currencies.

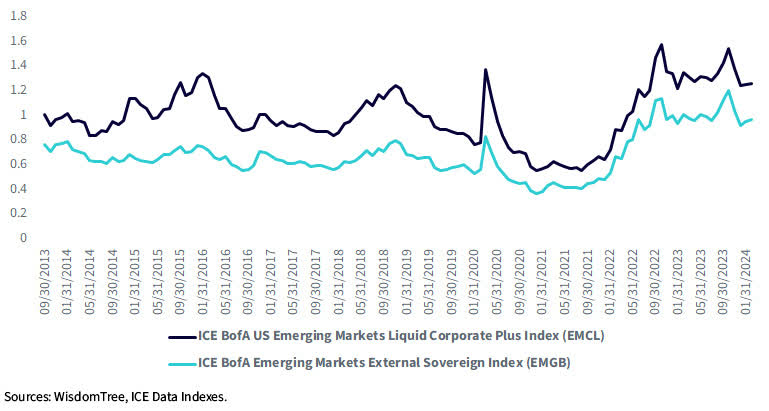

Finally, many emerging market corporates issue primarily medium-term debt, while emerging market sovereigns issue longer-dated debt, resulting in persistent large duration differences between the two sectors. (Currently, the average duration of EM corporates is 5.21, while the average duration of EM USD sovereign bonds is 6.98.) Despite the duration difference, the total yield sacrifice offered by EM corporates to emerging markets is relatively small, The average is about 27 basis points higher than in 2019. past 10 years. Therefore, taking into account interest rate risk or unit term yield, the potential yield on emerging market corporate portfolios is significantly higher than on emerging market U.S. dollar sovereign bonds (as defined by their broad benchmarks).

Yield per unit period

Choice is key

As mentioned earlier, emerging market corporate fundamentals remain resilient and financial policies remain prudent. As a result, default rates are also expected to be lower. However, as with any other part of the market, investors need to be selective and choose issuers/regions with better fundamentals.This is how the company manages its team WisdomTree Emerging Markets Corporate Bond Fund (EMCB) taken. EMCB has an overweight rating on Latin America (relative to the J.P. Morgan CEMBI Diversified Index) and an underweight rating on Africa and some Asian countries (notably China). China’s stepped-up policy response appears to have stabilized economic activity; however, growth is likely to slow further this year as housing and private sector confidence remain negative.

Important risks associated with this article

Investing involves risks, including possible loss of principal. Foreign investments involve special risks, such as the risk of loss due to currency fluctuations or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and efficient than investments in developed markets and are subject to additional risks, such as the risk of adverse government regulation and intervention or political developments. Investments in derivatives may be volatile, and these investments may be less liquid than other securities and be more sensitive to the effects of different economic conditions.

Fixed income investments are subject to interest rate risk; their value generally decreases as interest rates rise. Additionally, when interest rates fall, revenue may decline. Fixed income investments are also subject to credit risk, which is the risk that a bond issuer will be unable to make timely interest and principal payments, or that a negative perception of the issuer’s ability to make such payments will cause the bond’s price to decline. Unlike a typical exchange-traded fund, there is no index that the fund attempts to track or replicate. Therefore, the Fund’s ability to achieve its objectives will depend on the effectiveness of its portfolio managers. Please read the fund prospectus for specific details regarding the fund’s risk profile.

Behnood Noei, CFA, Director of Fixed Income

Behnood Noei serves as Director of Fixed Income at WisdomTree Asset Management, where he is responsible for developing the firm’s suite of fixed income and currency exchange-traded funds and enhancing existing investment processes. Behnood has 11 years of investment experience in portfolio management and quantitative research. Prior to joining WisdomTree in 2022, Behnood served as a portfolio manager and developer of select fixed income ETFs at J.P. Morgan Asset Management, where he was directly responsible for the management of more than seven fixed income ETFs and multiple SMAs with over $13 billion in assets. He graduated from The Ohio State University with a Master of Science in Finance and holds a CFA charter.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.