400tmax/iStock Not published via Getty Images

Rivian Automotive Company (NASDAQ: RIVN)’s share price has taken a beating over the past few years.I remember when I saw this stock trading as high as $170 or so, I wondered what people were thinking, paying this The price of the stock is very high. However, now I wonder what people are thinking and doing selling this stock at around $10. It seems that the previous highs and current lows represent extremes. Obviously this stock was a sell when it was trading extremely high, but I think it looks like a speculative buy around $10.

The entire electric vehicle industry has experienced varying degrees of collapse. A few months ago, Tesla (TSLA) stock was trading at around $260, and now it’s at $172. Lucid shares fell to around $3 a share, Fisker (OTC: FSRN) stocks can be purchased for a dime, and May be delisted From the New York Stock Exchange. Seeing this kind of price action doesn’t help sentiment across the industry. However, the industry is undergoing a shakeout and we may be at a moment of capitulation. Through this elimination process, high-quality EV companies will eventually go on to become industry leaders, while some may ultimately go bankrupt or sell their assets. Obviously, Tesla will remain at the top, but I also think the market is big enough for Rivian to succeed. Let’s take a closer look below:

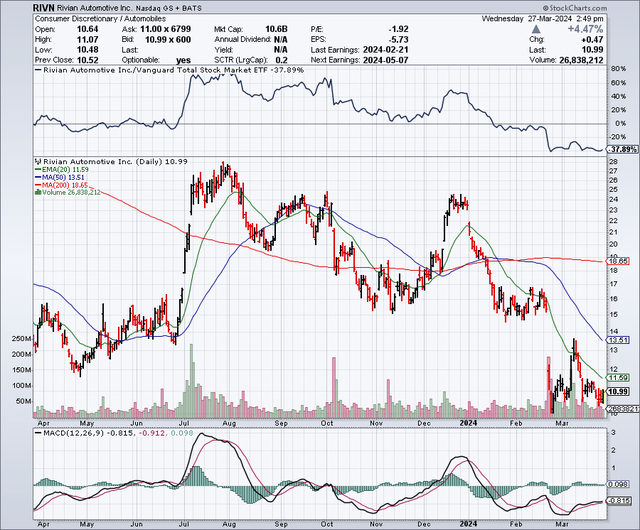

chart

As you can see in the chart below, Rivian stock has had a number of ups and downs over the past few months. The stock was trading at $20 at the start of the year, but has now fallen by half. The stock is currently trading well below its 50-day moving average ($13.65) and 200-day moving average ($18.67). Rivian stock is oversold and could rebound. It’s also worth noting that the stock plummeted to around $10 in late February, jumped to around $14 in early March, and is now back in the $10 range. If levels around $10 hold, this could set the stock up for a potential very bullish double bottom.

StockCharts.com

Why Rivian stands out as a leader

The electric vehicle industry appears to be undergoing a shakeout that could cause many stocks in the sector to fall. Clearly, Tesla will do very well in the long run, and I believe Rivian will survive this shock and become one of the leading EV companies. Some other companies in the space appear to be facing too many challenges. I think one of the reasons Rivian stands out in this industry is the successful collaborations and agreements it has signed in the past with other big companies like Ford (F) and Amazon (AMZN). I think this speaks to the quality of this company and I believe there can be more collaborations in the future.

There are reports that Apple (AAPL) recently shelved plans Make electric cars. Still, I wouldn’t be surprised if Apple decides to partner with Rivian in some way. There is even speculation that Apple might acquire Rivian, which I believe would make more sense than starting from scratch. Whether or not that happens, I do think Rivian will likely announce more significant deals with other big companies. I also see huge potential for Rivian in commercial vehicles, such as the vans Amazon uses for deliveries. A recent Forbes article pointed to a number of reasons for Apple’s acquisition of Rivian, including the belief that Tim Cook and Rivian CEO Robert Scaringer would be compatible and therefore Apple would work with Rivian.this The article points out:

“Whatever price Scaringe proposes for Rivian will be trivial to Cook, who will likely only engage in stock swap transactions and remain fairly hands-off on Rivian’s development, which It seems to be going well.

Putting Rivian under Apple’s umbrella would bring huge, Broad He now needs financial and R&D resources to compete with Tesla and everyone else.For Cook and Apple, they will finally have vehicles that are compatible with their technology and market expansion goals. Already on the market, and more to come. “

Profit Forecasts and Balance Sheets

Analysts expect Rivian to lose about $4 per share in 2024 on revenue of $4.87 billion. By 2025, losses are expected to fall to $2.62 per share, while revenue jumps to about $7.8 billion. By 2026, losses are expected to narrow to $2.09 per share, and sales are expected to surge again to about $12.2 billion. Obviously, no one wants to see continued losses, but if these estimates hold true, the revenue growth will be staggering. When investors see this type of growth, it’s easy to overlook losses, which are often part of the deal when a company grows at an astonishing rate. We’ve seen this happen in the past with many companies, including Amazon.

As for the balance sheet, Rivian has about $4.92 billion in debt and $9.37 billion in cash. That’s a strong balance sheet, although it will weaken in the coming years unless the company tightens spending and shows signs it is cutting costs.

recent downgrade

Some analysts have recently downgraded Rivian’s stock, which has apparently led to more recent selling as some shareholders appear to be backing down on the EV front. The latest downgrade I’ve seen was on March 25, 2024, when an analyst at Mizuho Securities lowered the price target on Rivian to $12. For many of us, downgrades from Wall Street analysts lack credibility when a stock is already trading at or near a 52-week low. Especially when the stock’s value is down nearly 90% from its all-time high. Where would the $12 price target be when Rivian stock was trading at $100, $150, or $170 per share, because then it would be prescient and helpful. I bring all this up because I think these recent downgrades are extremely late and ill-timed, and are a sign of a potential capitulation bottom for the stock.

New products and other upside catalysts

In early March 2024, Rivian launched a number of new models, including the R2 (midsize SUV), R3 (midsize crossover), and R3X (a sporty version of the R3). A recent Seeking Alpha article noted that the R2 model received 68,000 orders in the first 24 hours. The article also noted that Rivian is implementing cost cuts, which may help investor sentiment. Improved financial results from these cost-cutting measures could serve as an upside catalyst in the coming quarters. R2 Pricing is expected to start at $45,000, with deliveries expected in 2026.

(C) 2024 Hurst Motor Company.all rights reserved

In late March, Rivian announced a deal that would allow Rivian owners to charge their vehicles through Tesla’s Supercharger network. This again shows how Rivian can work with other big companies, even competitors like Tesla. I believe more deals with other companies are coming, which could be a major upside catalyst for Rivian stock. Those deals could involve large orders for some of its commercial vans, or they could be orders with companies like Apple.

Potential downside risks

The fact that the company doesn’t have a long track record is a potential downside risk. As a relative newcomer to the auto industry, it may not have extensive experience dealing with certain challenges, such as a severe recession. My biggest concern is the losses, especially since they are expected to occur for at least the next few years. So I’m pleased to hear Rivian’s recent decision to delay and reduce capital expenditures.

In short

I think there are several reasons to buy Rivian stock right now, although I’m not looking to buy heavily either as I view the stock as speculative. One of my favorite things is that $10 a share is much less speculative and risky than $179 a share. The chart shows that the stock is oversold and has the potential to form a bullish double bottom. I think the sentiment towards the EV industry is too negative right now, which is something contrarians can appreciate. If Rivian succeeds in cutting costs and launching some new models like the R2 in 2026, it could be a great buy now.

No warranties or representations are made. Hawkinvest is not a registered investment adviser and does not provide specific investment advice. This information is for reference only. You should always consult a financial advisor.