SweetBunFactory/iStock via Getty Images

Investing in artificial intelligence ETFs carries certain risks that I personally would rather not take. These mostly relate to speculative valuations across the industry. I believe there are specific ETFs Make good quality picks, but as I’ll outline in this analysis, this particular ETF is too dilutive to achieve long-term alpha.

ETF analysis

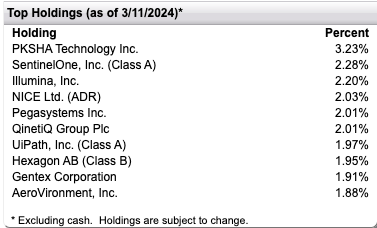

First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ: Robert) is designed to track the performance of artificial intelligence and robotics companies using a combination of value and growth investing styles. Its portfolio consists of 108 stocks, with its top 10 stocks listed below along with its key country exposures:

first trust first trust

Its expense ratio is significantly higher at 0.65%, which is lower than Roundhill’s CHAT ETF (CHAT) but is still much higher than Invesco QQQ’s expense ratio of 0.2% (QQ). However, I believe the automation and artificial intelligence exposure offered by the First Trust Robot ROBT ETF is more nuanced than CHAT, which is more attractive to mass market and retail investors.

For example, all of its top holdings are deeply involved in artificial intelligence, but they’re not limited to that. For example, the exposure is much more concentrated than an investment in Microsoft (MSFT) or IBM (IBM), where artificial intelligence makes up only a small portion of overall operations. SentinelOne (S) and UiPath (PATH) are the closest to pure artificial intelligence in the ROBT portfolio, while Illumina (ILMN) and Gentex (GNTX) integrate artificial intelligence into a wider range of applications.

On its website, the company outlines its intention to make three core investments through ETFs:

- Enablers – Companies that develop building blocks for robotics or artificial intelligence, such as advanced machinery, autonomous systems/autonomous vehicles, semiconductors, and databases for machine learning.

- Actors – Companies that design, create, integrate or deliver robotics and/or artificial intelligence in the form of products, software or systems.

- Augmenters – companies that provide their own value-added services within the AI and robotics ecosystem, but are not core to their product or service. – First Trust

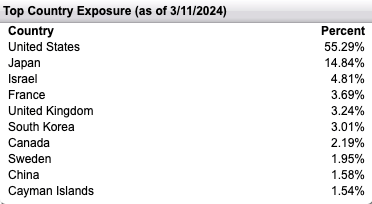

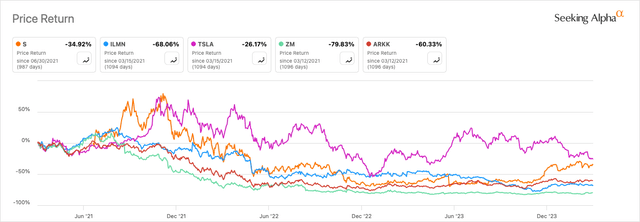

Despite a surge in positive sentiment toward the artificial intelligence and technology industries over the past five years, ROBT has underperformed even the S&P 500 (SP500) and significantly underperformed QQQ.

Author, using Seeking Alpha

Company and market analysis

What ROBT provides is exposure to a niche part of the artificial intelligence and robotics industry that I believe is fundamental to the industry. Take PKSHA (TSE:3993) Technology as an example. The company develops algorithms for natural language processing, image recognition, and machine and deep learning. The company has the highest weighting in the ETF at 3.23%, and according to my analysis it is a financially strong company, but there are significant risks to its valuation. For example, consider the following statistics:

- Equity-to-asset ratio 0.79

- Debt to equity ratio 0.12

- Net interest rate is 7.52%

- Three-year revenue growth rate of 24.2%

- The price-to-earnings ratio is 163

Of these, the last point about its valuation is clearly the most worrisome, and it’s the operational risk I notice when considering investing in a robotics or artificial intelligence ETF. Investors must be careful not to buy a range of stocks that are subject to speculative valuations and associated downside volatility.

Looking at the next two highest weights, the first is SentinelOne:

- Equity-to-asset ratio 0.72

- Debt to equity ratio 0.02

- Net interest rate is -62.89%

- Five-year average revenue growth rate reaches 99.97%

- The forward price-to-sales ratio is 13.54, which is 360.99% different from the industry median of 2.94.

Likewise, valuations are subject to the same risks, a side effect of their high growth and the current strong sentiment around artificial intelligence and automation. Let’s take a look at Illumina, which has the third highest weight:

- Equity-to-asset ratio 0.57

- Debt to equity ratio 0.39

- Net interest rate is -25.76%

- Five-year average revenue growth rate is 8.27%

- The forward price-to-earnings ratio is 137.57

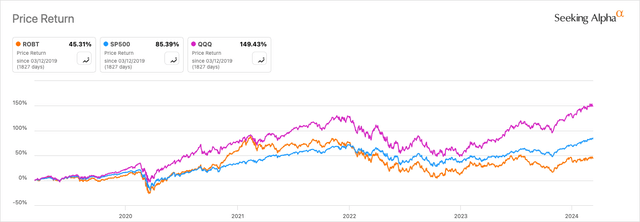

We can look at the aggregate net profit margins of a number of top holdings and see that many of them are not yet profitable. I’m not too worried about this, though, because in the early stages of robotics and artificial intelligence, it’s inevitable to be exposed to pre-profit companies at the forefront of the industry. However, this brings a higher risk to the ETF, and I think investors should keep in mind that some of these companies may fail in the long term.

Author, using Seeking Alpha

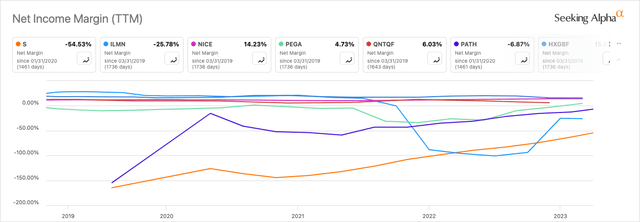

Among the top three, the largest holding company is not listed in the United States. So, to conduct my analysis, I plotted the price returns of two of the largest U.S. public companies:

Author, using Seeking Alpha

This sheds light on the current overall trend among many advanced technology companies, which is that valuations are lower than they were just a few years ago. This can also be seen in companies like Tesla (TSLA), Zoom (ZM), and the ARK Innovation ETF (ARKK):

Author, using Seeking Alpha

According to my analysis, although valuation premiums for many companies listed on the ROBT ETF remain high, investors can be more confident that their current valuations are a better deal than they will be in 2021. I believe that when the time is right, investments in artificial intelligence, currently valued at lower than historical levels in robotics, could yield huge returns. However, as a caveat that I typically associate with ETFs investing in artificial intelligence and advanced technology, I think investors should carefully consider every company they invest in. I think a more powerful way to achieve durable excess returns is to select five core individual and lower-risk corporate AI exposures, as well as two or three of the less risky, higher-reward AI allocations. I believe this significantly reduces the risk of significant downside moves due to “anticipation failures” in advanced technology companies, which experience large price swings due to average contractions reported in financial reports. Many of the smaller companies currently included in the ROBT ETF are also unlikely to last a lifetime, so investing so diversely in a rapidly changing industry could result in performance lagging behind an index like the S&P 500 over the long term.

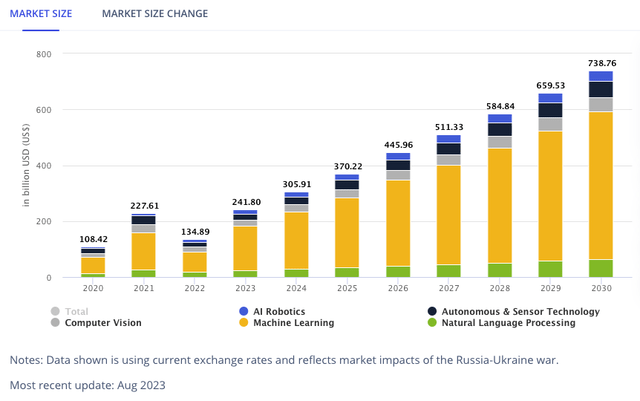

However, I advocate a long-term exposure to artificial intelligence and autonomous technology because I believe it may be the fastest-growing industry in the world over the next decade or more. Consider the following chart from Statista Market Insights:

Statista Market Insights Unit: billion U.S. dollars (Statista Market Insights)

As can be seen from the chart, the market compound annual growth rate from 2024 to 2030 is 15.83%. However, this is an extremely conservative estimate, and other researchers have outlined higher growth rates.One of my favorites comes from Bloomberg, the report outlines a compound annual growth rate of 42% over the next 10 years, with the market size reaching US$1.3 trillion by 2032. Its report will be released in June 2023.

Risk Analysis

I consider investing in high-risk advanced technologies such as artificial intelligence and robotics, so in my current portfolio building efforts I am looking to diversify across a range of industries and geographies. My personal risk tolerance is about 25% of my technology portfolio, with 12.5% allocated to artificial intelligence and autonomous technologies. I believe investors must consider the significant risk associated with being unable to value many technology companies by their future cash flows and earnings in a discounted cash flow analysis. While I agree that high investor sentiment can add intangible value to company valuations, we also need to be cautious about getting overly involved in companies that don’t have concrete evidence of long-term operating quality. Amazon (AMZN) is one of my favorite companies and has proven quality time and time again through impeccable business value and customer service. I’m looking for early-stage companies and founders with similar characteristics, and while it’s nearly impossible to find, some are close enough to be considered worthy of the premium valuations associated with tech stocks. I don’t think the ROBT ETF has enough quality filtering, considering it holds a total of 108 stocks, so I don’t think it will significantly outperform the S&P 500 over the long term. It’s likely to perform relatively well in the short to medium term, but over the longer term I think it’s likely to be challenged due to a host of overvaluation concerns and declining financial performance across a large portion of the portfolio. So in the case of this ETF, it seems prudent for me to rate it a Hold.

ETF Specific Risks and Peer Analysis

Due to the inherently cyclical nature of technology spending, the ETF may experience some volatility, particularly as it relates to more advanced capabilities that may be curtailed during times of economic stress. I believe investors would be wise to remember that there is a certain element of luxury associated with many of the current integrations of artificial intelligence and robotics in the industry. Until these completely replace human labor, the likelihood of periods of stagnant stocks and downward trends is high.

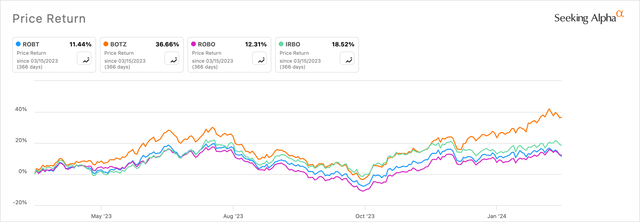

Investors looking for artificial intelligence and robotics ETFs may already be aware of or may want to consider ROBT’s full suite of peers. These include:

- Global X Robotics and Artificial Intelligence Themed ETF (BOTZ): Nvidia (NVDA), ABB (OTCPK:ABBNY) and Intuitive Surgical (ISRG) are heavyweights.

- ROBO Global Robotics and Automation Index ETF (ROBO): Provides investments in 81 assets in 15 countries (including emerging and developed countries). It includes a range of holdings from small-cap to large-cap stocks.

- iShares Robotics & Artificial Intelligence ETF (IRBO): Mainly composed of large companies engaged in a range of technical services and electronic technology businesses.

Among them, BOTZ has been leading the way in terms of momentum over the past year, and given the positive sentiment surrounding it, I believe it is one of the more prudent picks among its peers. It has a larger AUM of about $1.56 billion. However, with 47 holdings, I believe it faces a smaller but similar risk to the ROBT ETF in that it dilutes returns by focusing on too broad a range of companies within an industry. Instead, I’ve picked just a few companies that I think are the best candidates to own for the long term.

Author, using Seeking Alpha

in conclusion

The ROBT ETF gives investors exposure to high-growth industries, focusing primarily on niche markets and lesser-known robotics and artificial intelligence companies. Therefore, it provides an interesting and highly specialized exposure to advanced technologies, which I enjoy. However, I believe that such a diverse range of holdings (108 at the time of writing) carries too much valuation risk due to the speculative nature of the markets in which it currently invests. On the contrary, I think investors would be wiser to choose some core high-quality companies in the field of artificial intelligence and robotics to invest and hold them for the long term. I analyze and post a buy rating on many of these on my analyst page.