Fairwater/Getty Images News

Rocket Lab (NASDAQ: RKLB) announced its 2023 financial results last week, which have already shown high volatility after suffering a sell-off of more than 6% in the trading day immediately following the earnings release. At first glance, profit result That’s not bad, but it still worries some investors. While we believe the company will be under significant pressure through the end of 2024 due to different factors that we will examine in depth, we remain confident in the company based on its fundamentals and the fact that it is the second-largest launcher in the United States. , as we analyzed previous reports.

Earnings in 2023: Some hiccups, but growth remains strong

- Electron and HASTE sign record 25 publishing deals in one year

- Launch contract backlog exceeds $1 billion, double last year

- won $515 million contract from Space Development Agency

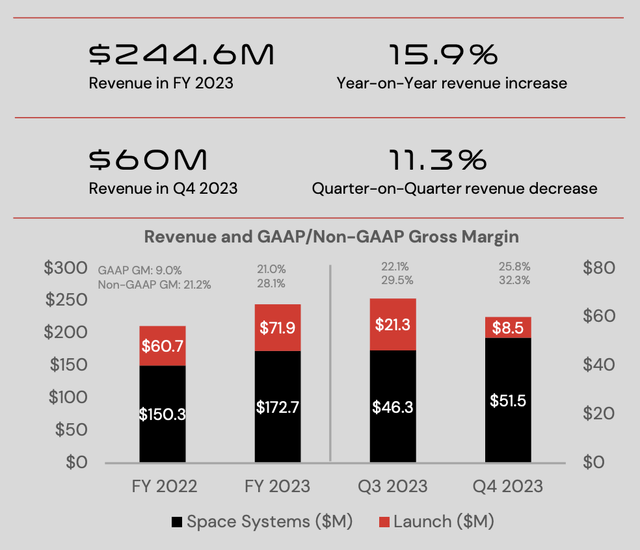

- Even with nearly three months of shutdown, fourth-quarter revenue still increased 16% compared with the same period last year.

- Full-year loss widened from last year to $182.6 million due to increased investment in Neutron

- Total cash and marketable securities are down more than 48% from last year, primarily due to continued investments in Neutron; however, the company’s financial position remains healthy, with a current ratio of 2.13

- Operating cash flow was flat compared to last year, with the company securing additional loans to prepare for intensive Neutron development in the coming year, offsetting total cash outflows in fiscal 2023

Rocket Lab 10K

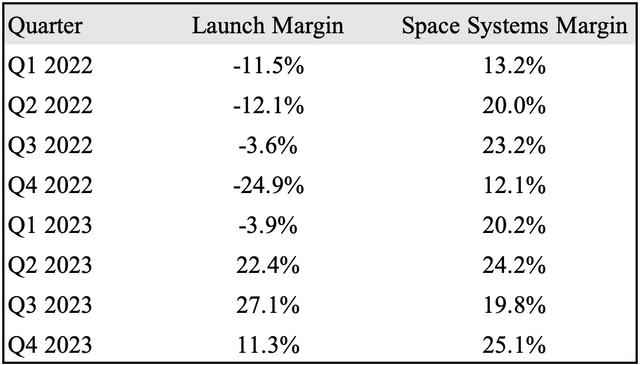

When I published my first analysis of the company, Rocket Lab’s launch business gross margins were still in negative single digits. However, the company has turned things around and the segment’s gross margins are in the low twenties, The target for next year is 50%. This year, we saw the benefits of product diversification as the company successfully hedged losses in its launch services business, which accounted for 85% of revenue in the quarter, with its high-margin systems business. This is a very positive image of management’s highly successful strategy.

rocket lab

Despite the good news, are there any questions?

As an investor in Rocket Lab, I’m excited to see where the company is today. But why did it fall immediately after the earnings report was released? In my opinion, there are several factors that people are still worried about.

First, is Electron still a safe industry?

Safety can refer to the launch success rate, if fail In September 2023, the root cause will happen again. My answer is no.To use risk management terminology, Rocket Lab encountered an unlikely event, e.g. swiss cheese model. This means that every step in a launch mission has its own unique weakness, like the hole in every slice of cheese. Going through one hole doesn’t mean it will go through another hole in another piece – and the chance of mission failure happening like “overlapping holes” is very low. This briefly describes Rocket Lab’s problems with ripple voltage, helium and nitrogen concentrations, and the subsequent “arcing” that is very, very unlikely.

But as shared in a previous earnings call, in the seven weeks since the incident, Rocket Lab’s team has drilled down into more than 12,000 data channels and conducted extensive analysis of the mission’s manufacturing, test and flight data. analysis. Chief executive Peter Baker said rest assured the company would not stop at “finding the cause” but “fixing the problem”.

But launch safety doesn’t mean Rocket Lab’s business as a company is safe to rely on, because profit margins in this business segment are still low and only larger, more efficient launch vehicles can compete with competitors. New entrants include Relativity and Firefly Space, and eventually SpaceX. This brings us to the second question.

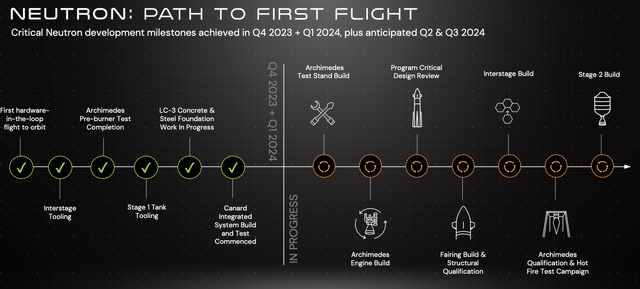

Secondly, when will Neutron be ready?

rocket lab

…so many engineers are now sleeping under their desks trying to get vehicles on the road – Peter Beck, CEO

Who doesn’t think that the sooner Neutron is launched, the better for Rocket Lab?But the reality is that the company has a deadline Go catch it. Under the Space Force’s National Space Security (“NSSL”) Phase 3 launch requirements, new rocket companies like Rocket Lab can compete with traditional launch providers such as SpaceX and Lockheed. One of the most important criteria to qualify for a contract is that a company needs to have “trusted path“Be able to launch by December 15, 2024 – this is a strict deadline that Rocket Lab needs to meet.

Management said it would be an incredible achievement if the launch vehicle could “make it to the launch pad.” Whatever “on the pad” means here, whether it means “launch on the pad,” “display on the pad,” or “test on the pad,” the company is under tremendous pressure. But on the other hand, the wait for Neutron’s more profitable and larger business is over — and when investors realize this, the company’s valuation will be at a premium. But is it easy?

Third, as a competitor, there are other pressures

The day before Rocket Lab released its financial results, “Defense One” report Internal members of Congress were quoted as saying the company was not ready to launch.Days after the earnings release, TechCrunch further leakage Congressional memo about internal discussions about Rocket Lab’s possible failure to deliver. Where do these pressures come from?I’m not going to talk about the rumors here, but here they are a guess.

A reasonable assumption is that as a new and competitive competitor in the market, you face significant pressure from existing providers. This is not any free market, this is a market where many of the existing players have been doing business with the Space Force or the Air Force for years. Therefore, Rocket Lab investors please prepare for the impact.

Without further ado, tell me how much Rocket Lab is worth.

First, I like to compare SpaceX and Rocket Lab. SpaceX is currently valued at $180 billion and has total revenue of $9 billion, nearly half of which comes from 96 launches and the other half from Starlink.

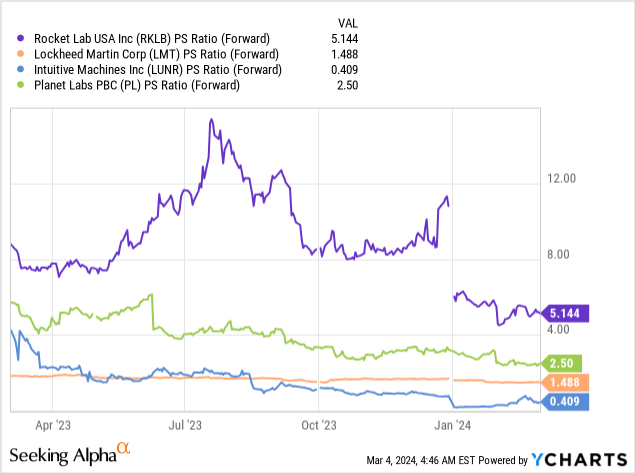

We expect Rocket Lab to conduct nearly 30 Electron launches by 2026 (a slight increase from the 22 currently planned for 2024 from two launch sites), 3 Neutron launches (the company compares Neutron to the Falcon 9, and SpaceX has Launching three Falcon 9s in the third year of successful launches) and the space systems business, the company will bring business revenue of US$80-900 million to the company. Using the same valuation multiple as SpaceX, the company is valued at about $18. This is a bull case because SpaceX is a company valued at a premium, similar to Elon Musk’s other companies.

Second, using the same revenue (i.e. sales) forecast, the base case is an industry average P/E of 3x and a price target of about $6. This is the base case, as the peers being compared are either established companies with very stable businesses and moderate growth (e.g. Lockheed Martin), companies without clear revenue forecasts (e.g. Intuitive Machines), or satellites in the software business company.

investment risk

Like all space businesses, I view Rocket Lab as a high-risk, high-reward business. Therefore, investors need to be aware of certain risks: 1) Electron could fail and have an adverse valuation impact like its last failure, while Neutron could fail several times even on the launch pad, just like SpaceX did Starship and what it did in its early stages; 2) The aerospace business is highly dependent on government contracts, and Rocket Lab may not only compete on technological superiority, but also lobbying and influence within the government; 3) The impact of financing risks on the company compared with other technology companies As big as that is, a funding round will result in a significant decline.

in conclusion

I’m a big believer in Rocket Lab with a Strong Buy rating because the company has strong technology and fundamentals — and as Neutron grows, the company will be able to increase its profitability and market share. However, it is almost certain that from a short-term trading perspective, the company will face a lot of volatility, more scrutiny and potential rumors about the company’s progress.