seitz

Introduction and thesis

Rockwell Automation (New York Stock Exchange: Year) is a leading global provider of industrial automation and digital transformation solutions. Headquartered in Milwaukee, Wisconsin, the company serves a variety of industries including automotive, food and beverage, pharmaceutical, and oil and gas.

With a history dating back to 1903, Rockwell Automation has become a major player in industrial automation, using advanced technology to optimize manufacturing processes and improve operational efficiency for customers around the world.

From a business perspective, South Korea is a great business. This is a pure business with extensive expertise and market reputation, arguably representing the industry leader. This foundation has been progressively supported by innovation and M&A, limiting any concerns about its competitive position despite considerable technological disruption.

We support management’s current strategy and believe it should deliver value to shareholders Over the next five years, early evidence suggests a shift toward higher quality income is occurring.

Still, further progress is needed, and that’s not fully factored into South Korea’s valuations. We think investors would be wise to monitor the stock for margin improvement, and if that happens, the stock could become a winner soon, but if not, the share price could react. Therefore, we assign a Hold rating to Korean stocks.

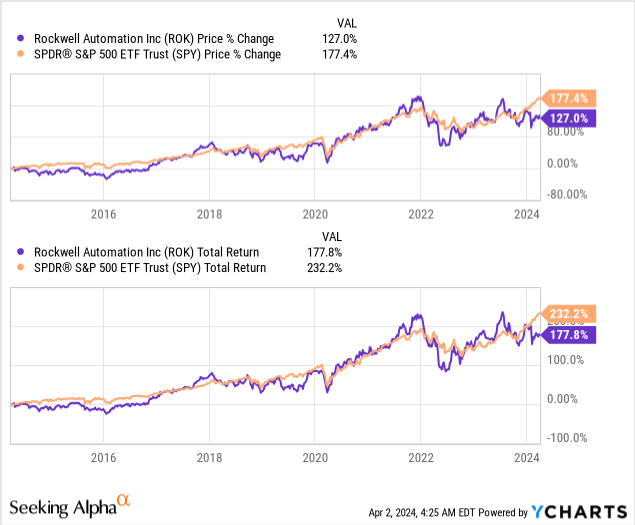

share price

South Korea’s stock price performance over the past decade has been considerable, basically tracking the S&P 500 Index, with limited volatility. This reflects its modest but sustained financial developments during this period.

business analysis

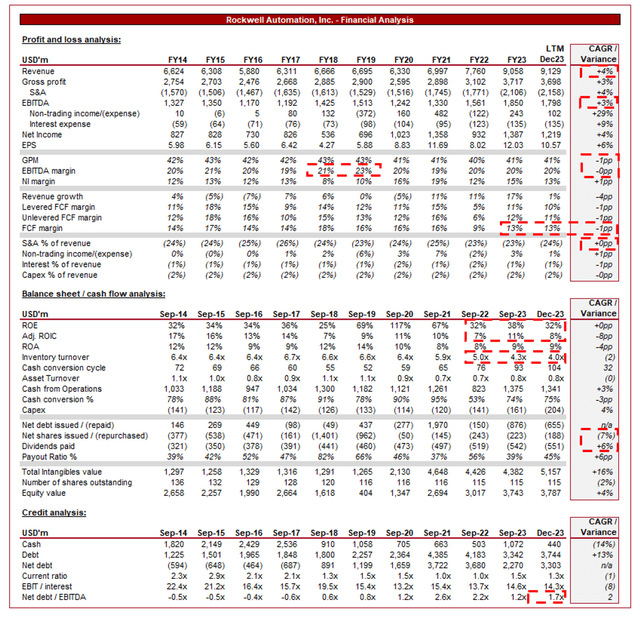

Capital IQ

The above describes South Korea’s financial performance.

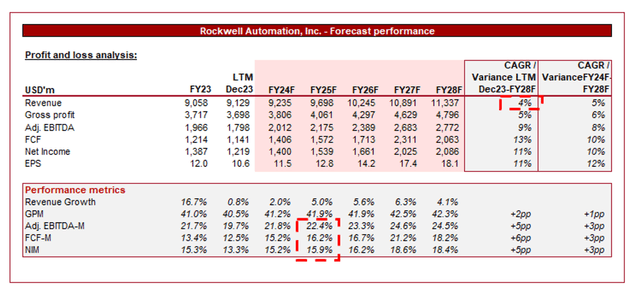

At its current scale, South Korea’s revenue has grown well over the past decade, with LTM23 growing at a CAGR of +4%. Otherwise, the company’s profit margins were flat.

business model

Year

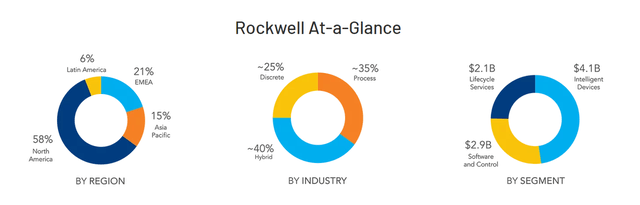

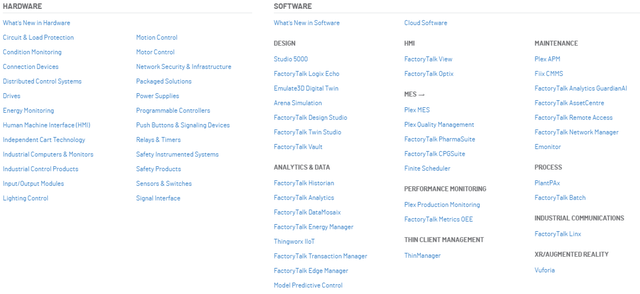

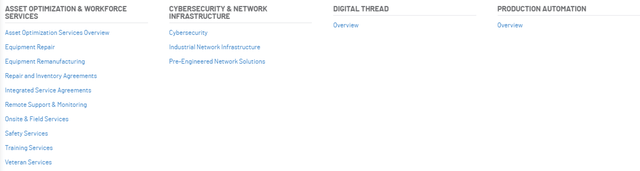

ROK provides industrial automation and information solutions to global manufacturing industries. Its solutions include control systems, software, sensors and services that help improve operational efficiency, productivity and safety in manufacturing processes.

The industries targeted by South Korea have historically experienced considerable inefficiencies, particularly a lack of technology integration, creating significant opportunities for external suppliers to support operational enhancements and productivity.

Unlike many of its peers, the company offers a comprehensive range of products and services. Importantly, ROK allows for the seamless integration of control, information and analytics across the entire manufacturing enterprise through the interconnection of products and services. ROK essentially supports both components of the interaction, maximizing efficiency and streamlining the process.

Year

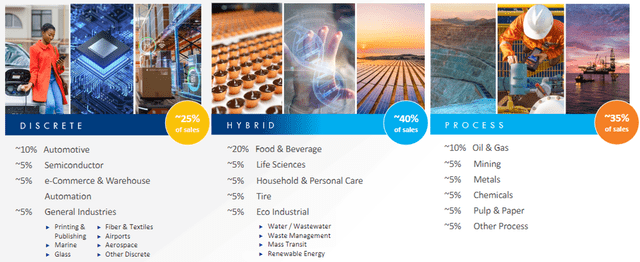

These solutions are tailored for a variety of industries, including automotive, food and beverage, pharmaceutical, and oil and gas. South Korea is able to achieve this on a global scale, allowing it to serve the largest multinational corporations. This service positions ROK as a leading service provider in the industry while maximizing its total addressable market.

Year

Underpinning its core transformation solutions is a suite of lifecycle services including consulting, design, implementation, maintenance and training services. These services assist customers in maximizing the value of their automation investments throughout the lifecycle of their manufacturing assets. This is an underappreciated component of most business models because its cyclical nature creates greater certainty in revenue generation and limits the volatility that comes with project wins.

Strategy

Management’s current focus is on providing integrated solutions and software rather than standalone products. This results in a closer relationship with customers, in the form of ongoing support and fewer point-in-time transactions. This allows ROK to continue billing at a lower marginal cost (in terms of software), creating greater lifetime value for customers, while also having greater certainty in generating revenue. To illustrate, S&C’s OP% in 1Q24 was 25%, compared to 16.2% for smart devices and 10.4% for lifecycle services. Overall, its S&C and lifecycle services have grown organically beyond its smart devices division, reflecting the success of this approach. The problem for ROK is that while lifecycle services support its organic growth, it dilutes S&C’s bottom line.

Through its Connected Enterprise vision, South Korea is at the forefront of driving digital transformation in manufacturing. By leveraging advanced technologies such as the Industrial Internet of Things (IIoT), cloud computing and artificial intelligence, the company is seeking to support customers in optimizing operations and driving innovation. Current technological developments continue to sophisticate in terms of complexity and value provided, which represents a significant opportunity to capture growth. While there’s always a risk of falling behind and disrupting the status quo in technological development, there’s comfort in South Korea’s scale relative to other countries. As discussed earlier, the company has a lot of expertise that it can leverage to make incremental improvements. In the worst-case scenario, South Korea could find its own way to acquire the expertise it needs.

When it comes to M&A, South Korea expands its product portfolio, enhances its technological capabilities and enters new markets through strategic acquisitions of complementary businesses.The company has spent about $4 billion in cash on deals over the past decade, the largest of which was Plex Systems, a Leading Pure Software as a Service, a cloud-native smart manufacturing platform that operates at scale. These acquisitions have fueled the company’s growth by diversifying its products and expanding its reach into adjacent industries.

Industrial automation industry

The industrial automation and control systems industry is expected to grow at a compound annual growth rate +10.5% The next decade will be driven primarily by technological developments and increased infrastructure spending. As investment and attention in basic industries increases, so will the need for efficiency and innovation.

We believe that global infrastructure modernization, clean energy transition, and Industry 4.0 (and related digitalization trends) led by IIJA in the United States will become the cornerstone of growth in the next few years. All factors require significant financial investment and are well advanced in development, limiting risks.

Although South Korea is one of the largest pure-play players, it still competes with other industrial automation companies such as Siemens (OTCPK:SIEGY) , ABB (OTCPK:ABBNY) , Schneider Electric (OTCPK:SBGSF) and Emerson Electric (EMR) , as well as Professional provider of software and digital transformation services.

finance

South Korea has been strong recently, with revenue growth of +25.8%, +13.7%, +20.5% and +3.6% over the past four quarters. Meanwhile, South Korea’s profit margins remained stable as expected.

South Korea’s performance was divided into two parts. Its S&C business unit grew an impressive 5.3%, while its lifecycle services unit surpassed that growth with 10.5%. Drivers for both include management’s increasing focus on market segments, up/cross-selling benefits, and potential need for ongoing support. This has brought ARR (“Annual Recurring Revenue”) growth to +20%, further enabling the company to transition into a software model. However, conversely, its largest smart devices segment declined -1%, dragging down revenue growth. The sector is being affected by economic conditions, with sales coming under pressure as projects and investments are delayed or canceled.

Looking ahead, analysts expect modest growth (+4%) in fiscal 2028, with margins improving from last quarter. We believe this perfectly reflects management’s current strategic direction. With the increasing focus on software and services, the company’s growth rate will naturally slow due to the billing cycle of these solutions compared to point-in-time sales, and lower marginal cost of delivery will help margin appreciation. Achieving this outcome depends on management’s ability to execute software growth beyond lifecycle services, which appears to be the case (+24.9% S&C growth vs +11.6% S&C growth in fiscal 2023).

Capital IQ

Industry analysis

Seeking Alpha

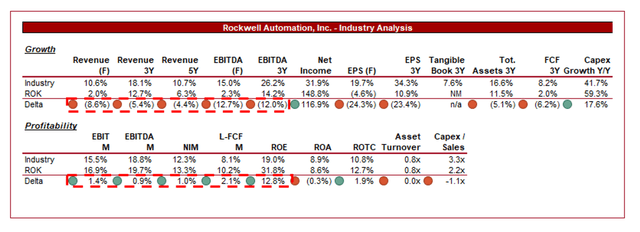

Above is how South Korea’s growth and profitability compare to industry averages as defined by Seeking Alpha (31 companies).

South Korea is performing well compared to its peers, with higher margins and better ROTC. While its incremental gains aren’t huge, the company has shown impressive consistency, and as we’ve already discussed, there’s room for further gains.

Growth is currently a weakness, which is not surprising given the company’s size (ranked seventh out of 31 companies), as this limits the scope of its absolute earnings. Additionally, unlike most of its Korean peers, the company is not entirely direct-to-end-user, which will limit its growth risks during a period of rapid growth.

With this in mind, as South Korea’s forecast growth rate will drop below 5%, if South Korea continues to achieve its 5-year average of about 11%, its growth rate may fall by half, limiting its margin advantage. For illustration purposes, $100 of revenue in FY24 will generate total revenue of $556 and EBITDA of $130 in FY28, according to analyst estimates. If we take the same approach, with a growth rate of 10.7% (5-year industry average) and an EBITDA-M of 18.8%, total revenue will be $619 and EBITDA will be $116. This is a small buffer, which means there is risk associated with achieving margin improvement because existing levels are not sufficient.

Valuation

Capital IQ

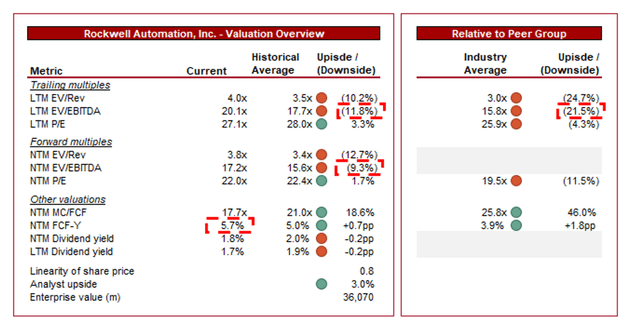

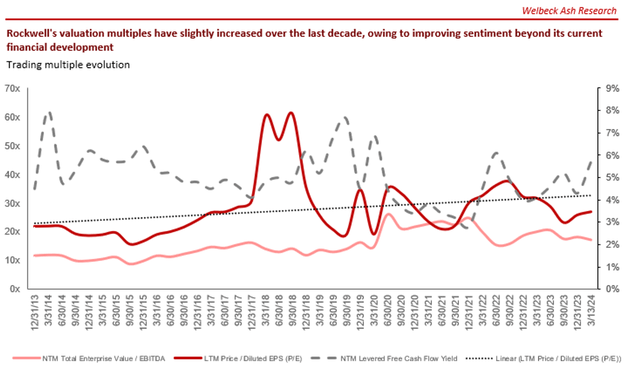

ROK currently trades at 20x LTM EBITDA and 17x NTM EBITDA. This is above its historical average.

We believe a small premium to its historical average is justified due to a successful, albeit incomplete, transition to higher-quality revenues (which are recurring in nature). While it hasn’t delivered so far, we do believe it will help improve margins and reduce revenue volatility.

Additionally, Korea trades at a modest premium of around 10-20% to peers (LTM EBITDA/NTM P/E), which we believe is justified only if margin improvement is achievable. Given the risks associated with this, this means we believe South Korea is slightly overvalued.

Overall, we do not believe South Korea’s valuations imply upside. While its historical averages suggest it’s at fair value, its valuation relative to its peers suggests it’s slightly overvalued. If that wasn’t inconsistent enough, its free cash flow yield has risen to around 6%, below its historical average. Given that its share price is broadly in line with the market, the discount here suggests it’s undervalued.

As long-term investors, we tend to consider a business’s profit potential and therefore its free cash flow. However, we don’t think the upside potential will exceed 10%.

Capital IQ

Key Risks of Our Paper

The risks of our current paper are:

- Margin improves execution.

- Execute transformational M&A, if proposed.

- Manufacturing/infrastructure spending shows a cyclical downward trend.

final thoughts

South Korea is a strong enterprise that represents pure industrial development. The company has a strong track record of creating value and is deeply entrenched in the operations of its peers.

Based on management’s current strategic direction, we see room for margin improvement, resulting in accretive returns for shareholders. Underpinning this will be opportunistic M&A and continued attractive allocations. This should drive alpha over the next few years, although execution risks will be apparent given that management needs to find EBITDA margins of around 4.5 percentage points.

Unfortunately, we don’t think its valuation’s margin of error is large enough to make it a good risk-adjusted investment. We recommend investors focus on progress and look for early signs that are in line with forecasts, when valuations will quickly move into attractive territory.