RapidEye/E+ via Getty Images

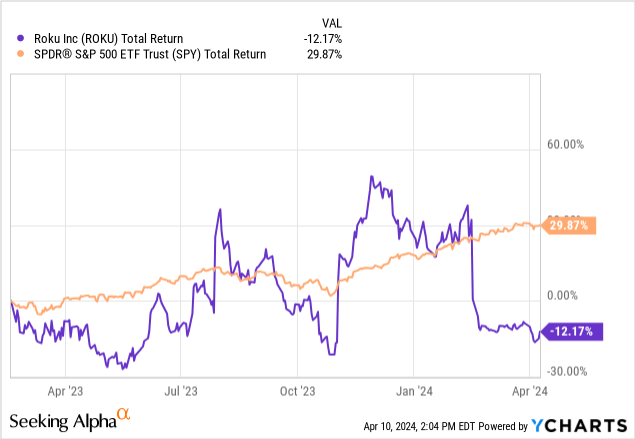

I covered Roku (NASDAQ: ROKU) over a year ago, with a strong sales rating. Some stocks do have passionate followings in the market, and I know Roku is one of them.but i am Still surprised to see the reaction in the comments. I was told that I didn’t understand the grand vision of the business. Actual financial numbers mean little because it’s all about growth (growth in user numbers, not actual growth). But my thesis is simple.

1. Popular products don’t always lead to great business

2. Margins are taking a hit and all marketing spend is not translating into meaningful revenue or real revenue growth

3. The company focuses on adjusted metrics, but that doesn’t work well in a high-rate world

4. The company strays from its core business and jump on the AI bandwagon (I believe AI is the magic word that companies can rely on when their underlying business struggles, and there is clear evidence that Roku is capitalizing on this trend)

5. The company relies heavily on financing growth from retail investors (excessive dilution)

The bottom line is, in the short term, my conclusion is that your money has better uses than Roku, and it’s important to separate the hype from the investment. It seems I was right.

The number of users is rising, and revenue is rising, but ARPU and profit margins need to be improved.

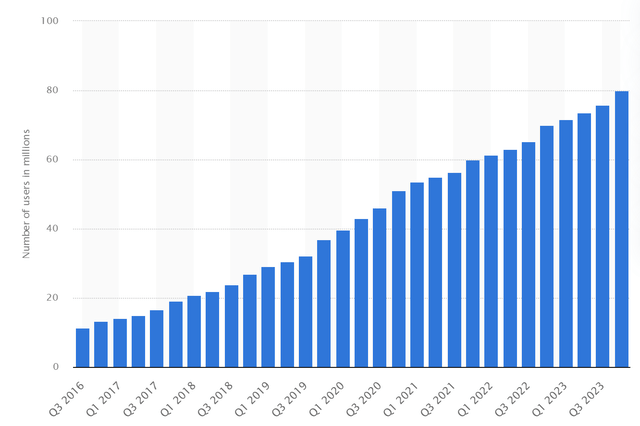

One key difference between a year ago and now is that subscriber numbers actually translate into increased revenue.

Number of users over time (politician)

The number of active accounts is 80 million, an increase of more than 14% from 2022, and the streaming time has increased to 106B, an annual growth of more than 20% (the global streaming time on the Roku platform has increased by 21% year-on-year, and the streaming time on Roku has Channels increased by 63% year-on-year).

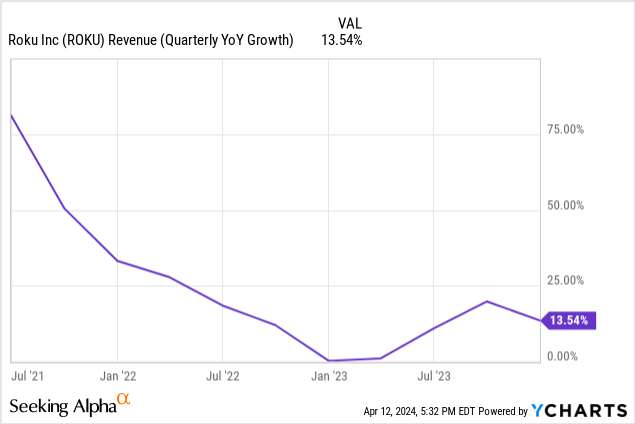

The good news is that, unlike a year ago, this has translated into revenue growth. Total net revenue reached $3.5B, growing 11% year over year (YoY). Platform revenue increased 10% year over year to $3B. The results reflected significant contributions from streaming service distribution activities and film advertising. While all this is good news, beneath the surface, things are less certain.

1. Average revenue per user (ARPU) is US$39.9, an annual decrease of 4%

2. Gross profit margin will decrease slightly compared with 2022

3. Operating margins are trending in the right direction, but still impacted

Specifically, a year ago, I saw a lot of progress in sales and marketing (with revenue growth declining during that time, I couldn’t understand where their marketing dollars were going). Fortunately, this time around I can see S&M getting the quarter under control (-11% year-over-year), but still up 14% in revenue. But for the full year, S&M’s revenue percentage remains high.

|

Total revenue (USD million) |

Marketing expenses (millions of dollars) |

S&M/Income | |

| 2023 |

3480 |

1030 |

30% |

| 2022 | 3130 | 838.42 | 27% |

| 2021 | 2760 | 455.6 | 17% |

| 2020 | 1780 | 299.46 | 17% |

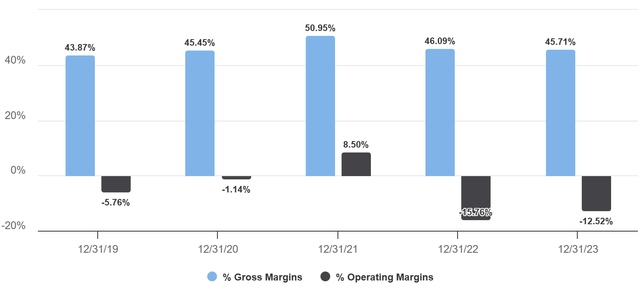

margin (Really)

In a welcome change compared to last year, the company’s net loss not only widened, but its adjusted profit metric was negative and widening! This time, they achieved positive adjusted EBITDA and free cash flow in 2023. Their outlook did not mention when profits would actually materialize, but promised “over time.” They primarily attribute this to near-term challenges in the macro environment and an uneven recovery in the advertising market.The company still faces Online TV competition is becoming increasingly fierce Walmart’s deal with Vizio isn’t likely to make things any easier, either.

As of now, investors only have to contend with positive adjusted EBITDA in 2024.

controlled dilution

From what I understand, stock-based compensation is a feature of young tech stocks and provides companies with a smart way to encourage growth. One of my big gripes last year was that in addition to slower growth and wider losses, the return on equity-based income also increased, topping out at 12% compared to previous years. For 2023, this number is relatively low, which is a welcome sign.

| date | stock-based income compensation |

| 2023-12-31 | 10.6% |

| 2022-12-31 | 12% |

| 2021-12-31 | 7% |

| 2020-12-31 | 8% |

| 2019-12-31 | 8% |

| 2018-12-31 | 5% |

| 2017-12-31 | 2% |

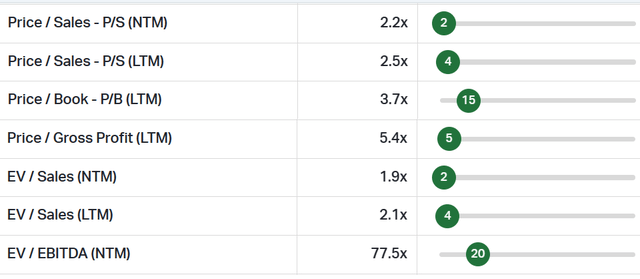

Valuations tough, EV/sales bring hope

For a nonprofit company that only adjusts earnings metrics, many valuation ratios become ineffective. One metric you can rely on is the price-to-sales ratio. From an industry perspective alone, this number looks overvalued by 2.4x, compared with the communications services industry’s median of 1.2x. One thing that works in Roku’s favor is that it’s completely debt-free. This means its EV/sales multiple is starting to look good at 2x, compared with the industry median of 1.85x.

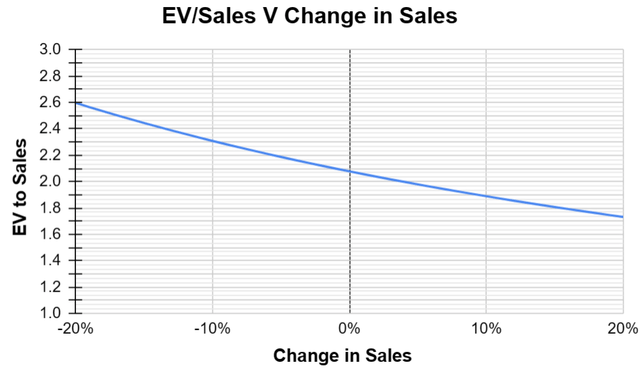

We can extrapolate this number and find that if growth continues or rises, the metric becomes increasingly attractive. The figure below shows the situation at different growth rates.

The author calculates

I like forward-looking ratios based on scenarios because they account for uncertainty (which is more important in Roku’s case). If we see 11% growth continue this year, then the EV/sales ratio will start to drop to 1.9, and if it rises further, we may also see it below the industry median. From a pessimistic perspective, if revenue growth declines (which is entirely possible given economic uncertainty and competition in the advertising market, etc.), we could see the ratio drop to 2.6x, with revenue falling -20%.

From a historical perspective, I have observed the company trading near its rock bottom. EV/Sales (NTM) estimates show that 98% of the time, the company was trading at a much higher price than it is now.

Valuation percentile (Coyfin)

Upcoming Earnings and Expectations

Roku is scheduled to report its upcoming earnings on April 25, and activity is starting to pick up. Wells Fargo lowers price target From $51 to $45, that’s not encouraging. We saw a 30% price drop in the last earnings report, and we may see more examples of analysts trying to get ahead of the curve.

last call

I upgraded my rating to Sell from Strong Sell. To summarize, the reasons for upgrading are as follows:

1. The company continues to expand its market and adoption of its products continues to increase, which also correlates with the revenue numbers

2. Although ARPU has declined, today’s users can contribute to tomorrow’s revenue (this is the nature of the advertising business). Just looking at the revenue multiple, this looks attractive at current growth rates and will continue to become even more attractive if growth rates remain the same.

But this is still a sell, and it is still a reason to sell. To sum up, there are the following points:

1. Profit margins still need to be improved. No timetable was mentioned for when actual profits are expected. In my opinion, this is not a good sign and is not conducive to the current market environment.

2. There are many better names that offer a better risk-reward ratio. Investors buying here may have to contend with more sideways moves until the company figures out how to achieve full profitability. Unless growth rates far exceed market expectations, performance will likely continue to lag the market (which is what we saw last year).