Pictures of Jet City

investment thesis

Since we are currently seeing several military conflicts taking place in different parts of the world, I think an analysis of RTX Technologies (NYSE:RTX), with nearly 40% of its sales coming from military contracts, for My readers. I was surprised to see that RTX’s revenue hasn’t actually grown (CAGR is in line with inflation) and profitability metrics have worsened significantly over the past decade. My valuation analysis shows that the stock is roughly fairly valued, and with only so little upside potential, I don’t think it’s worth the risk. All in all, I give RTX a “Hold” rating.

company information

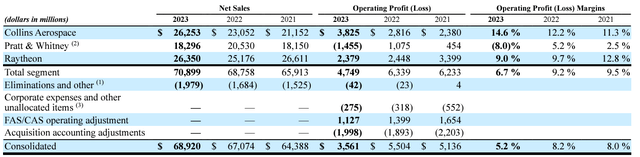

RTX is an aerospace and defense group operating through three segments: Collins Aerospace (aerospace products and services), Pratt & Whitney (aircraft engines) and Raytheon (military equipment and weapons).

RTX’s latest 10-K report

According to the latest 10-K report, sales to the U.S. government accounted for 46% of total sales in fiscal 2023. The company’s fiscal year ends on December 31.

finance

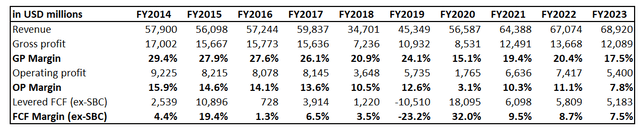

RTX’s financial performance has been stagnant over the past decade. Revenue grew at a CAGR of 2%, in line with historical long-term inflation averages. Gross profit margins dropped significantly, from nearly 30% in fiscal 2014 to less than 20% by the end of the decade. Operating margins have shrunk about twice over the past decade. That said, I think the company’s financial performance suggests the business may be in long-term decline.

Author’s calculations

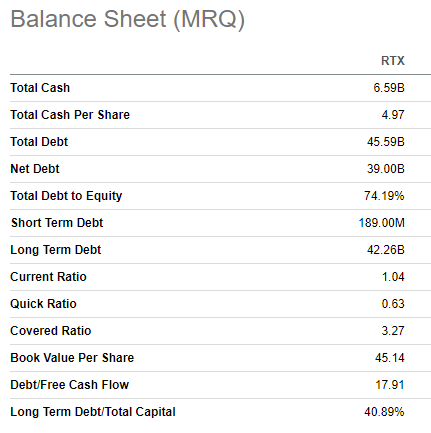

In my opinion, the company’s financials are average. It would probably be stronger without $45 billion in total debt. On the other hand, most of the debt is long-term and the leverage ratio is still significantly below 1. The company pays dividends and engages in stock buybacks. The forward yield rate provided by RTX cannot be called high, because the 2.4% yield rate is still lower than the current inflation level.

Seeking Alpha

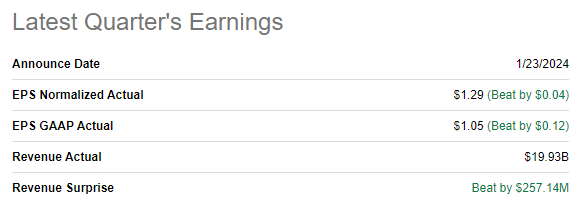

The company’s latest quarterly earnings were released on January 23, when the company beat consensus estimates. After a sharp 20% revenue decline in the third quarter of 2023, RTX resumed revenue growth in the fourth quarter, with an annual increase of 10%. Adjusted earnings per share increased from US$1.27 to US$1.29, and net profit growth was significantly slower than revenue growth. The good thing is that the EPS expansion was aided by operating leverage, with operating margin expanding by about 70 basis points.

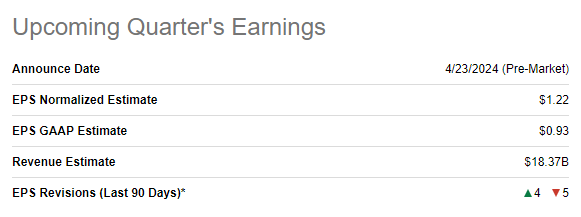

Seeking Alpha

Next-quarter earnings are scheduled to be released on April 23. Market consensus forecasts first-quarter revenue of $18.4 billion, an annual increase of 69%. Adjusted earnings per share are expected to be flat at $1.22. Overall, the long-term consensus forecast projects revenue to grow at a CAGR of 3.73% from 2024 to 2027, and adjusted earnings per share to outpace revenue at a CAGR of 5.4%.

Seeking Alpha

I tend to believe that RTX revenue will likely continue to grow roughly in line with inflation, which is currently significantly above the long-term average of 2%. I’m skeptical that RTX can grow EPS faster than revenue. The inflation factor is obvious to me, and even with 2% inflation, the projected revenue CAGR of 3.73% is not enough to achieve a net income CAGR of 5.4%. Competition for talent is becoming increasingly fierce, leading to rising wages. For manufacturing companies such as aerospace equipment, aircraft engines, and cutting-edge missiles, I believe that access to top talent is a crucial factor. Therefore, I don’t see how RTX can achieve significant savings in personnel costs without losing quality.

Given the nature of the company’s business, it’s difficult to expect any surprises in revenue growth. As I highlighted above, almost half of the company’s sales come from contracts with the U.S. government. This means there is a lot of uncertainty depending on the political priorities of the administration or presidential administration. Furthermore, government spending cannot increase significantly because of constraints such as budgets, approvals, potential debt ceiling issues, and many other factors designed to control government spending.

Last but not least, RTX serves and supplies markets where mistakes are expensive.Last year the company achieved $3 billion in fees Technical issues with Pratt & Whitney’s engine, a huge sum even for a company with a market capitalization of over $100 billion. In addition to hefty penalties and fines, such headlines can also cause reputational damage, as aircraft engine failure can actually lead to disaster.

Overall, becoming an RTX bull is difficult given all the risks and limitations the company faces. With limited growth potential due to the nature of its major customers, and inflationary pressures likely to be at least in line with overall inflation, when your business sells aircraft and aerospace weapons and equipment, the cost of even small mistakes can seem huge. The stock also can’t be called a high-yield stock because its forward dividend yield lags the current rate of inflation.

Valuation

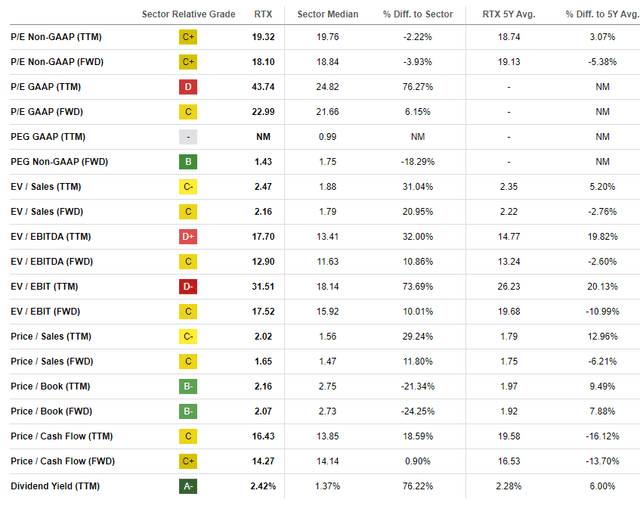

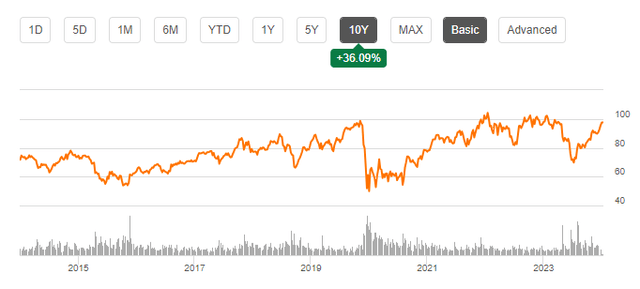

RTX is currently trading at almost exactly the same price as a year ago, but has fluctuated widely over the past 52 weeks, from $68.6 to $104.9. RTX has outperformed U.S. stocks in 2024, rising 18% year-to-date. The current valuation ratio is roughly in line with RTX’s historical average, which likely means the stock is fairly valued.

Seeking Alpha

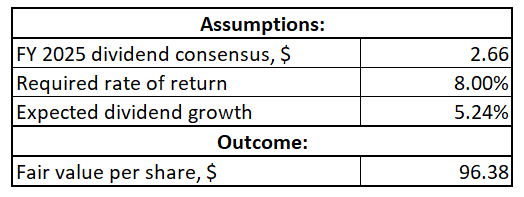

Since RTX is a stock with excellent dividend consistency, I thought the simulated dividend discount model (DDM) would be a reasonable choice to continue my valuation analysis.I use a required rate of return of 8%, which is consistent with the recommended range valueinvest.io. For the base dividend, I use the consensus forecast for fiscal 2025, which is $2.66. For the long-term growth rate, I use a compound annual growth rate of 5.24% over the past decade.

Author’s calculations

According to my DDM simulations, a fair share price for RTX is around $96.4. This is very close to the current market price, which means RTX is fairly valued. However, RTX’s upside potential is too low to make its valuation attractive. Furthermore, if we look at the RTX share price chart over the past decade, we can see that $100 is a strong resistance level for the stock.

Seeking Alpha

Risks to my cautious thesis

The company’s Raytheon unit provides military equipment and weapons and accounts for about 37% of the company’s total revenue. That said, RTX’s financial success depends heavily on government military spending. Although I have mentioned that the US military budget is not expected to increase significantly in 2024, a major war in central Europe continues. Despite various Western sanctions against Russia and military aid to Ukraine, Russia still looks like it has enough fuel to continue the war for years to come. So I’m not surprised by what European countries are doing. Increase military spendingthis may be a tailwind for RTX.

In addition to potential unexpected tailwinds for the company, I think the stock price could move higher if there’s positive news on shareholder returns. This could include increasing dividends or expanding buyback programs. So it’s possible that RTX stock could surge on some bullish news, but I don’t expect this rally to last.

bottom line

All in all, RTX is a “hold”. I’m not interested in investing in companies with stagnant revenues and declining profitability. There are a number of factors that could limit RTX’s ability to drive significant revenue growth and profitability expansion. The stock also doesn’t offer any benefit of a high dividend yield, nor is it heavily discounted.