smile studio ap

Rubrik is transforming into a SaaS company

Rubrick Corporation According to SEC S-1 news, RBRK has applied to raise US$100 million through an IPO of Class A common stock. Registration Statement.

Rubrik helps organizations protect their data by: The company’s cloud platform and software.

While RBRK has made significant progress toward becoming a SaaS subscription company, that transition may take time, and the company’s revenue growth has been lackluster and operating losses have been high.

I will provide an update as we learn more details about the IPO.

What does Rubrik do?

Rubrik, Inc., based in Palo Alto, California, was founded to provide a range of data security technologies to companies around the world.

Management is led by Co-Founder, Chairman and CEO Mr. Bipul Sinha, who has joined the company since January 2014 and previously served as a Partner and Board Member of Lightspeed Venture Partners Nutanix member.

The company’s main products include:

-

Data protection

-

Data threat analysis

-

Data security posture

-

Network recovery

As of January 31, 2024, Rubrik has received $980 million in fair market value investments from investors including Lightspeed, Greylock Partners and various individuals.

The company promotes its cloud platform capabilities to large and medium-sized enterprises through direct sales and marketing forces in the United States, and adopts a “land and expand” strategy to develop each customer’s business.

As of January 31, 2024, the company had more than 6,100 customers from around the world.

Selling and marketing expenses as a percentage of total revenue increase as revenue increases, as shown in the chart below:

|

Sales and Marketing |

expenses and income |

|

period |

percentage |

|

Fiscal year January 31, 2024 |

76.8% |

|

Fiscal year January 31, 2023 |

69.6% |

(Source – SEC)

The sales and marketing efficiency multiple (defined as how many dollars of additional new revenue is generated per dollar of sales and marketing expenses) was just 0.1x in the most recent reporting period. (Source – SEC)

The Rule of 40 is a rule of thumb in the software industry that states that as long as the sum of revenue growth and EBITDA percentage equals or exceeds 40%, a company is on an acceptable growth/EBITDA trajectory.

The most recent calculation for RBRK was negative (44%) as of January 31, 2024, so the company is underperforming here, as shown in the table below:

|

Rule of 40 |

calculate |

|

Recent revenue growth % |

5% |

|

Operating profit margin |

-49% |

|

all |

-44% |

(Source – SEC)

The company’s net revenue retention rate in dollar terms for subscription customers was 133%, which is a good result, but that’s only based on its subscription customer base and does not include its traditional perpetual license base, which the company is looking to convert. Subscribe to this foundation.

What is Rubrik Market?

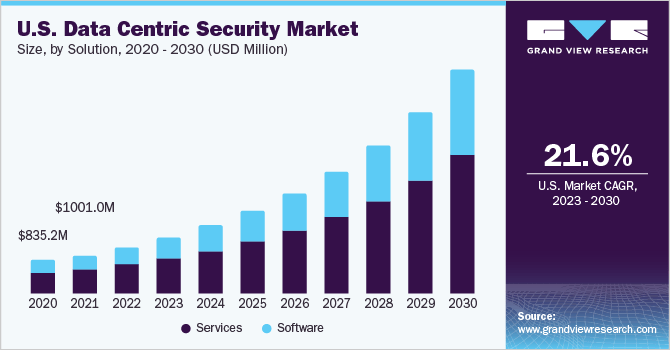

According to 2023 market research report According to Grand View Research, the global data-centric security market is estimated at $4.3 billion in 2022 and is expected to reach $24 billion by 2030.

This means that the compound annual growth rate (CAGR) from 2023 to 2030 is expected to be 24.2%, which is a very strong expected growth rate.

The main drivers of this expected growth are the continued migration of on-premises computing technology to the cloud and the increase in cyber threats targeting cloud systems.

Additionally, the chart below shows the historical and expected future growth trajectory of the U.S. data center security market from 2020 to 2030:

Macroview Research

Major competitors or other industry participants include:

-

com vault

-

Dell EMC

-

International Business Machines Corporation

-

Wim

-

cohesion

-

others

Rubrik’s recent financial results

The company’s recent financial performance can be summarized as follows:

-

Total revenue grows slowly

-

Improve gross profit and gross profit margin

-

High operating losses

-

Shift to cash use in operations

Here are the relevant financial results from the company’s registration statement:

|

Total revenue |

||

|

period |

Total revenue |

% variation compared to before |

|

Fiscal year January 31, 2024 |

$627,892,000 |

4.7% |

|

Fiscal year January 31, 2023 |

$599,819,000 |

|

|

Gross profit (loss) |

||

|

period |

Gross profit (loss) |

% variation compared to before |

|

Fiscal year January 31, 2024 |

$482,930,000 |

15.6% |

|

Fiscal year January 31, 2023 |

$417,805,000 |

|

|

Gross profit margin |

||

|

period |

Gross profit margin |

% variation compared to before |

|

Fiscal year January 31, 2024 |

76.91% |

10.4% |

|

Fiscal year January 31, 2023 |

69.66% |

|

|

Operating profit (loss) |

||

|

period |

Operating profit (loss) |

Operating profit margin |

|

Fiscal year January 31, 2024 |

$ (306,506,000) |

-48.8% |

|

Fiscal year January 31, 2023 |

$ (261,548,000) |

-43.6% |

|

Comprehensive income (loss) |

||

|

period |

Comprehensive income (loss) |

Net profit rate |

|

Fiscal year January 31, 2024 |

$ (355,096,000) |

-56.6% |

|

Fiscal year January 31, 2023 |

$ (278,959,000) |

-46.5% |

|

operating cash flow |

||

|

period |

operating cash flow |

|

|

Fiscal year January 31, 2024 |

$ (4,518,000) |

|

|

Fiscal year January 31, 2023 |

$19,287,000 |

|

(Source – SEC)

As of January 31, 2024, Rubrik had $279 million in cash and $1.6 billion in total liabilities.

Free cash flow was negative ($16.9 million) for the twelve months ended January 31, 2024.

Rubrik’s IPO news

Rubrik plans to raise $100 million in gross proceeds from the IPO of Class A common stock, although the final figure could be higher.

No shareholders have expressed interest in purchasing shares at the IPO price.

Class A shareholders (public investors) are entitled to one vote per share, and Class B shareholders are entitled to 20 votes per share.

Management stated that the net proceeds from the IPO will be used as follows:

We intend to use the net proceeds from this offering, together with existing cash, cash equivalents and short-term investments, as necessary, to satisfy all of our anticipated withholding tax and remittance obligations related to the settlement of certain outstanding RSUs. RSU Netting and Additional RSU Netting.

We intend to use any remaining net proceeds from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. We are unable to identify all specific uses for the remaining net proceeds from this offering. We may also use a portion of our remaining net proceeds to acquire or strategically invest in complementary businesses, products, services or technologies. However, we currently do not have any agreements or commitments to make any significant acquisitions or investments.

(Source – SEC)

As of press time, no introduction from the company’s roadshow leadership was available.

Regarding pending legal proceedings, management stated that the Company is not involved in any legal proceedings that it believes would have a material adverse effect on its operations or financial condition.

Listed bookrunners for the IPO include Goldman Sachs, Barclays, Citigroup, Wells Fargo Securities, Guggenheim Securities, Mizuho, Truist Securities, BMO Capital Markets, Deutsche Bank Securities, KeyBanc Capital Markets, Cantor, CIBC Capital Markets, Capital One Securities, Wedbush Securities and SMBC Nikko.

Rubrik’s IPO Summary and Commentary

RBRK is seeking investment from the U.S. public capital markets to fund its growth plans and working capital needs.

The company’s financials were such that total revenue (overall) increased slightly, gross profit and gross margin improved, operating losses were very high and increasing, and cash used in operations increased.

Free cash flow was negative ($16.9 million) for the twelve months ended January 31, 2024.

As revenue increased slightly, so did sales and marketing expenses as a percentage of total revenue; its sales and marketing efficiency multiple was just 0.1x in the most recent fiscal year.

The company currently plans to pay no dividends and retain any future earnings to reinvest in the company’s growth and working capital needs.

RBRK’s recent capex results show that the company continues to make capex despite negative operating cash flow.

The company’s Rule of 40 results were poor, with slow revenue growth and large operating losses driving the metric into negative territory.

The market opportunity for providing data security cloud services is huge and is expected to grow rapidly in the next few years.

Risks to Rubrik’s prospects as a public company include the time it will take to significantly complete the migration of traditional permanent customers to the cloud platform, which management predicts won’t be completed until at least fiscal 2026.

Other such companies have attempted this transition, but their growth trajectories have been hampered by the process.

The company’s subscription business contribution margin was recently negative (12%) for the fiscal year ending January 31, 2024, and was negative (117%) in fiscal 2022, which is a significant improvement and indicates that in the future Substantial progress was made in generating operating leverage in the subscription segment during the year.

Valuation at IPO will be critical, and management will likely seek a “narrative” case showing that the company is successfully transforming into a fully cloud SaaS company.

I will provide final comments when we understand Rubrik’s pricing and valuation assumptions.

Estimated initial public offering pricing date: To be announced.