BeritK/iStock via Getty Images

In a short time and on a much smaller budget, Rumble Inc. (NASDAQ: Rum) claims to have built a mini-Google in its latest version Fourth Quarter 2023 Earnings Conference Call. it expanded its Its portfolio focuses on uncensored content, including video, live streaming and ad hubs, and since Q1 2024 it has provided Independent cloud service Open to the public on a subscription-based business model. The stock is considered a high-growth stock and has seen some strong momentum recently, rising 42.25% since listing. My last article January 2024. Most of its popular content creators focus on politics. Therefore, political events have a great impact on user activities, and there will be a lot of user activities this year in the US election year. As a result, this makes the stock highly volatile and difficult to predict, as market sentiment has less impact on its financial performance. Fiscal Year 2023, Total revenue more than doubled, but was still only $81 million, and there was a significant slowdown in the second half of fiscal 2023. Additionally, the company lacks adequate advertising revenue streams, we have yet to see monetization results from its cloud products, its losses are deepening, and the company is increasing its cash burn. Briefly comparing the stock to its industry peers, it’s difficult to justify the current valuation with relatively disappointing results and lack of growth guidance. Therefore, I do not recommend it to long-term investors and maintain a Hold rating.

One-year stock trend (SeekingAlpha.com)

Rumble – Recent Updates

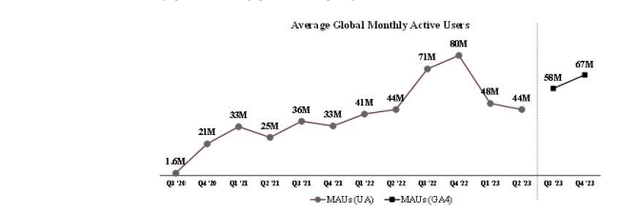

Recently, I provided a Company Overview. I think it’s important to remember that Rumble attracts viewers through its anti-censorship, nuanced political stance, and pays several large, polarizing content creators to post content on the site. It quickly built a base of more than 40 million monthly recurring users, achieving rapid growth amid an increasingly polarized U.S. political environment since 2020.

Average global monthly viewers per quarter (Sec.gov)

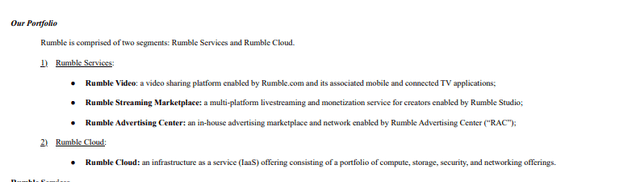

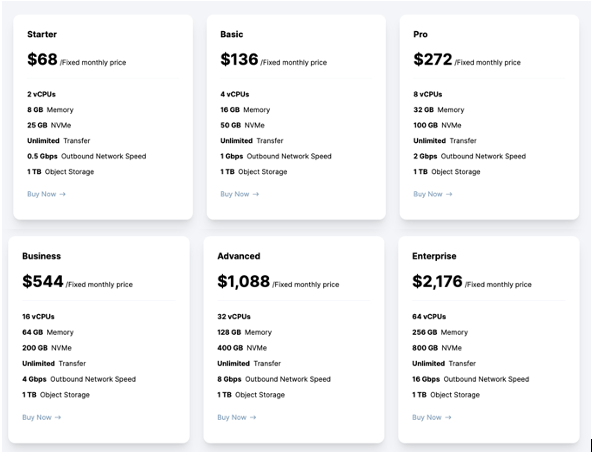

It is trying to diversify content and increase advertising opportunities through partnerships, such as bar stool exercise. Recently, it has expanded its product portfolio by promoting its standalone cloud products.Newest Cloud products Adopting a subscription-based model will allow the company to diversify its revenue, which is primarily advertising-based.

Rumble Investment Portfolio (Sec.gov) Rumble’s cloud products (Company website)

Rumble stock – challenges and future growth

Amid all these efforts, however, there are potential challenges in attracting advertisers and driving content engagement in a space dominated by tech giants with larger budgets, more advanced infrastructure, larger global reach influence and a greater willingness to adjust policies to meet advertising needs. Rumble’s loyal (non-paying) users are willing to accept feature flaws and a less flashy, slower user interface experience for the sake of free speech. The company’s monetary efforts are mainly focused on promotion.Take a quick look at Rumble’s Popular videos Data from the past month shows that the most popular videos are primarily produced by individuals who paid to be posted on Rumble and were previously banned from YouTube (Google).

rumble trend (Rumble.com)

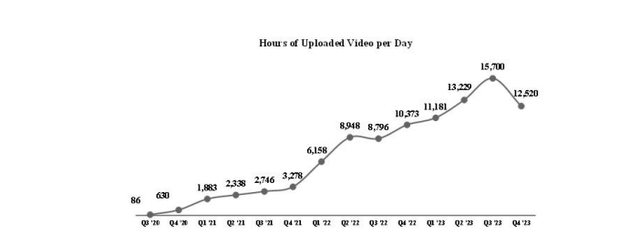

To get more users to stick around, I believe a lot of investment in infrastructure is needed to gain long-term active user traction. The importance of functionality was shown when YouTube Prevent it from syncing automatically with rumble. This has a direct impact on the number of hours of content uploaded to the site.

Hours of video uploaded per day per quarter (Sec.gov)

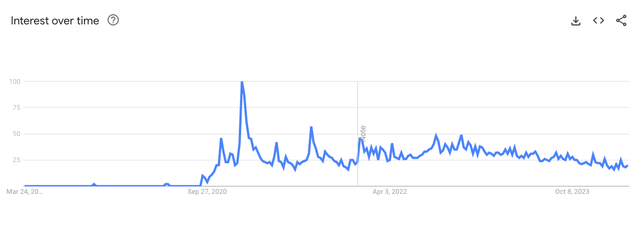

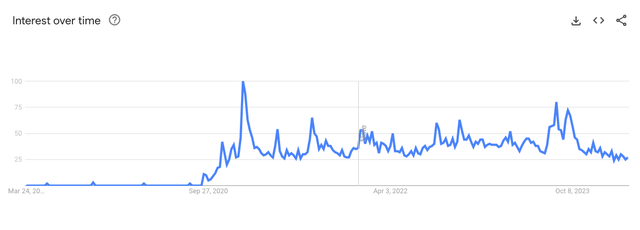

If we look at Google Trends, we can see that the company received most of the attention during the previous US elections in 2020. However, aside from political intensity and polarizing events, the company hasn’t particularly shown an upward trend in search interest. United States or Global.

longlong.com More than five years in the United States (Trends.google.com) longlong.com Global trends over the past five years (Google Trends)

For fiscal 2024, it will be critical to see whether the company can monetize its growing services. Ad monetization is crucial, allowing the company to spend less on content creators and increase its revenue. Additionally, we may see a spike in monthly active user trends due to the US election. These would be considered outliers from normal growth. Rumble has not yet issued guidance; however, the company said results will improve starting in the second quarter of 2024 and expects to break even by 2025.

Rumble Q4 2023 Earnings Overview

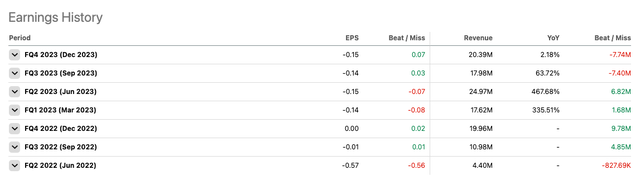

Over the past two quarters, we’ve seen the company’s revenue slow down significantly, missing revenue estimates for two consecutive quarters. This is concerning for growth-stage businesses and reflects a key challenge in attracting and retaining advertisers on a platform focused on non-censorship. The company has built an advertising hub to boost this revenue and additional services revenue and diversified its revenue into cloud products, but we haven’t seen the impact of these measures yet. In the fourth quarter of 2023, Rumble beat earnings estimates by $0.08 per share, with GAAP EPS coming in at negative $0.14. However, we can see losses deepening as revenue fails to cover operating costs.

Quarterly EPS and Revenue Performance (SeekingAlpha.com)

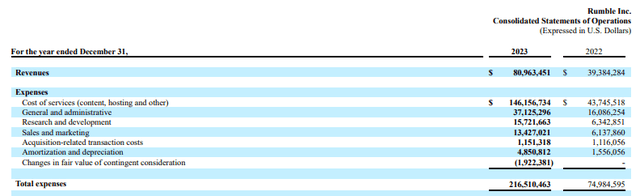

We can see that costs and fees have increased, but at the same time, this is also due to the expansion of the business, resulting in additional content creation costs, hosting fees and other service charges.

Fiscal Year 2023 Expenses vs. Fiscal Year 2022 Expenses (Sec.gov)

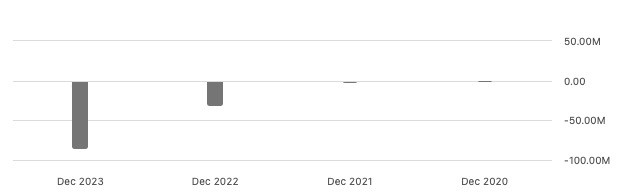

We can see heavy cash burn, with leveraged free cash flow of negative $84.4 million. A large portion of the cash flow goes to content creators. Rumble aims to significantly reduce this by the end of 2024; however, this will remain a problem for Rumble as long as these content creators don’t make huge amounts of money from advertising.

Annual Leveraged Free Cash Flow (SeekingAlpha.com)

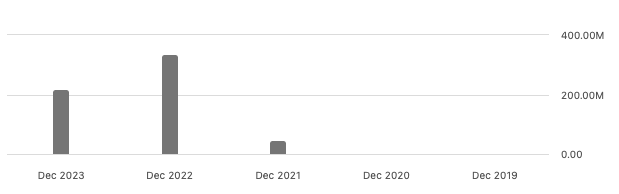

If we look at the balance sheet, we can see that cash totaled $218.3 million in fiscal 2023. Management believes it has sufficient cash to meet its capital requirements. Additionally, as it scales, it will save costs by automating business processes and reducing costs.

Total cash and short-term investments (SeekingAlpha.com)

Rum Stock Valuation

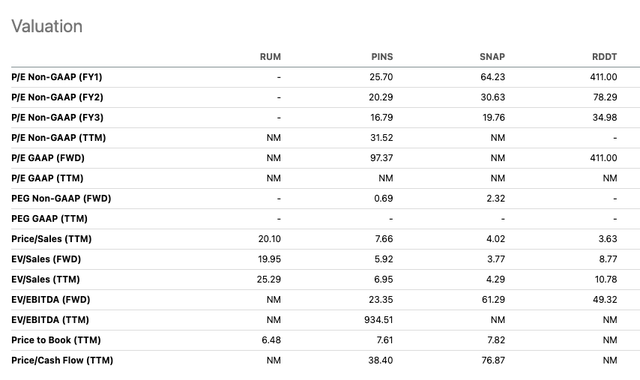

Rumble’s stock momentum is driven more by hype and speculation than financial progress, which makes the stock inherently risky. It has a market capitalization of $2.26 billion, while annual revenue has yet to hit $100 million, with annual earnings per share falling to $0.58 in fiscal 2023. Additionally, while the company has added services, there is growing uncertainty over whether those services will be monetized under its non-censorship stance. If we compare the stock to three peers that leverage users’ online time and generate revenue through advertising, namely Pinterest (password), break(break), and most recently on Reddit (RDDT), we can see that its price-to-sales ratio of 20.10 is very high compared to its peers. At this stage, the risk of investing outweighs the reward, and comparisons with peers magnify this risk.

Valuation compared to peers (SeekingAlpha.com)

risk

Rumble brought attention to the public by focusing on non-censorship. However, it is working hard to find a monetization strategy consistent with this information. In addition, the management team had limited experience managing public companies, and the company was expanding its business very quickly. Increased complexity in stakeholder and company operations may require skills that the executive team does not currently possess, which may have a negative impact on the business. The company has also grown through heavy promotion and investment in sensational content creators, but less in infrastructure. When I briefly click on some of the videos on the site, I often experience laggy content. In the long run, this may put off potential users and impact overall business performance.

final thoughts

Rumble’s stock price has seen significant upward momentum over the past three quarters. However, revenue momentum fell sharply in the first two quarters, the company’s losses increased year-on-year, and its cash consumption continued to increase. While management believes it has enough cash to invest in the business and to offer some exciting new services, the pressing question remains whether a business built on non-censorship can compete in the fiercely competitive online world. space to successfully monetize its efforts. Additionally, the stock is highly volatile and influenced by news rather than financials. Therefore, I believe that the rewards for long-term investors of taking and maintaining a position are not aligned with the risks.