Vertigo 3d

Disclaimer: These instructions apply only to US recipients and are not specifically directed to any UK recipients and are not intended to be relied upon by any UK recipients.Any information or analysis in this note is not an offer or solicitation for sale Offer to purchase any security. Nothing in this note constitutes investment advice and should not be used as the basis for investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note or persons associated with it, may have a position in any stock, security or financial instrument mentioned in this note. Any opinions, analyses, or possibilities expressed in this note are those of the author as of the date of this note and are subject to change without notice. The companies mentioned in this note, or their employees or affiliates, may be clients of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values its independence and transparency, and does not believe this poses a significant potential conflict of interest or affects the content of its research or publications.

Still too much wet stuff and stuff

correct. sales team(NYSE: CRM). start.

Your author is old and still remembers 2004 Salesforce IPO. It’s also a very exciting thing. Veterans of pre-IPO Salesforce.com (then called Salesforce.com because the addition of .com made the stock worth just a few dollars at one point!) will tell you that explaining deferred revenue accounting was a major headache. matter. B SEC believes that recruiting sales executives from perpetual license driven competitors is very difficult as those fat old license sales fees pay for some happy boys outings to Maui etc and when you start talking to the average person how much Tenant Database Security The model’s eyes glazed over before she discovered something more interesting in the next room. In short, it required hard work as the new kid on the block, a product approach that no one liked, a commission plan that no one liked, and familiarity with the accounting principles of GAAP before SOP97-2.

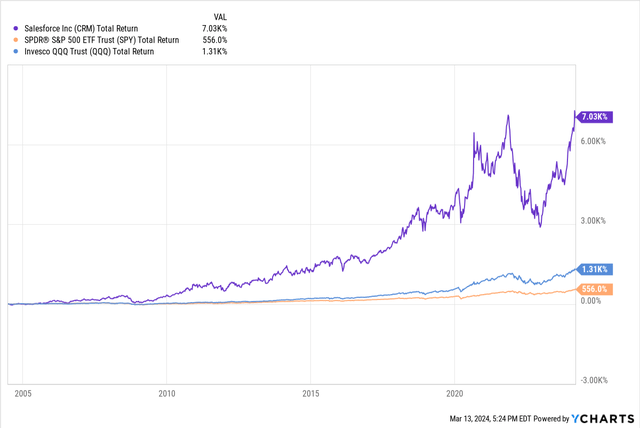

Still, that thing is on the moon.

CRM vs SPY vs QQQ, total returns since CRM IPO (Ycharts.com)

But Salesforce is no longer terrible child Enterprise Software; Now, it’s cuter on the outside, but there’s still a gleam of old steel beneath the cardigan.The company at least has some reason to start Promote its artificial intelligence credentials (But remember, even AT&T (T) is an AI stock these days because, you know, AI means more data communications and so on). But the question is, has the name aged, or is it still light on its feet and twinkling in its eyes?

Toutiao Finance

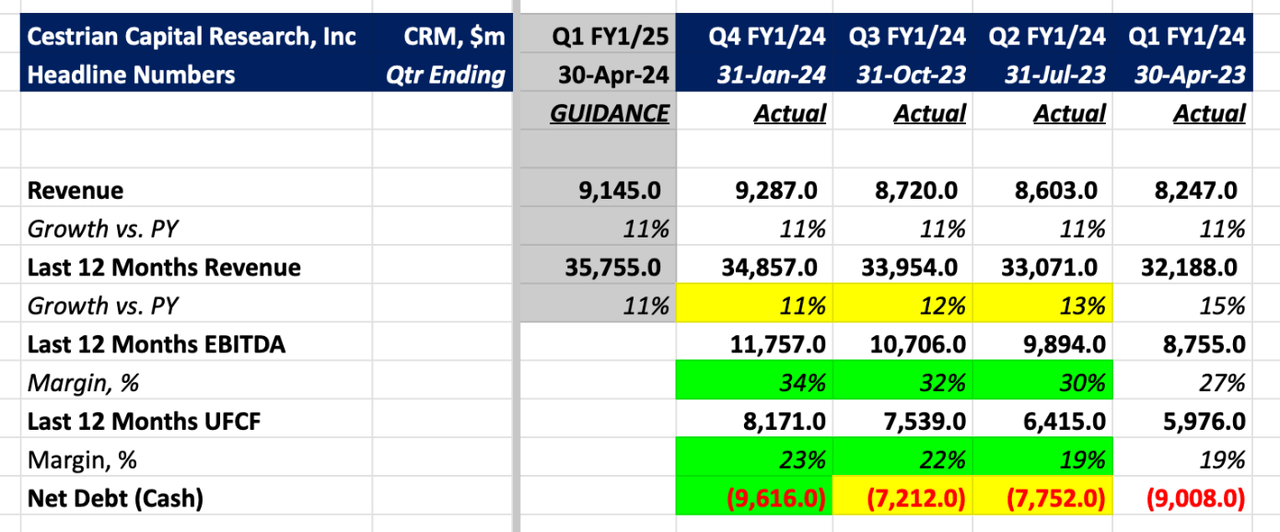

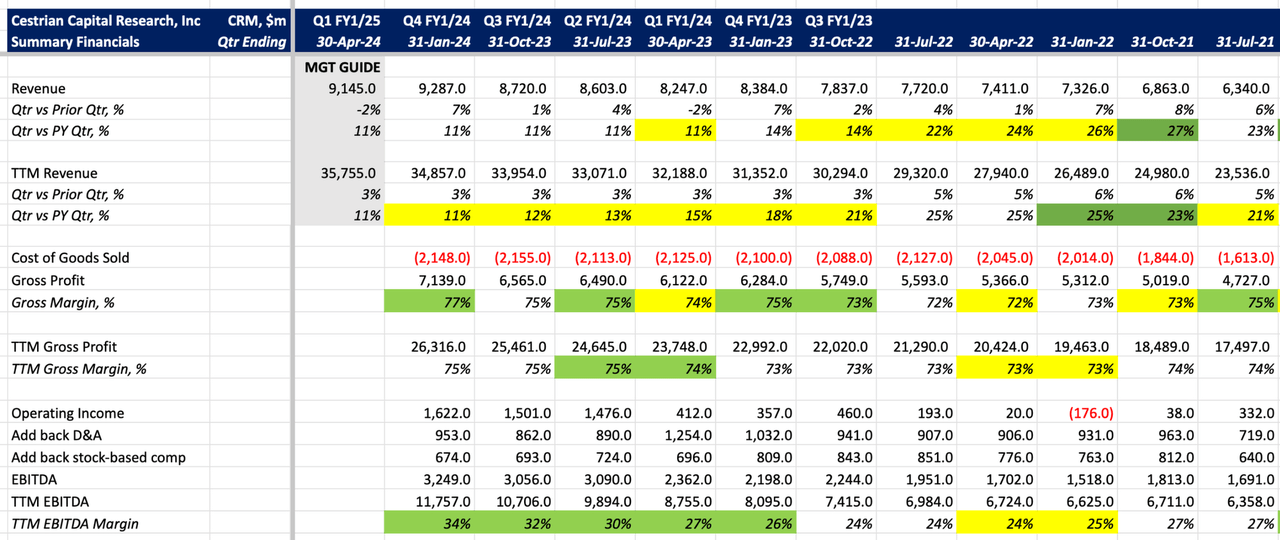

The most recently reported quarter was January 31, 2024, which was the fourth quarter of fiscal 2024. This is the headline news.

CRM Financial Highlights (Company SEC Filings, YCharts.com, Cestrian Analysis)

in short:

- Revenue growth for the quarter compared to the same period last year was held at 11%…the same rate as the past three quarters…and guidance for next quarter is…you guessed it…11%. This is an unusual consistency.

- EBITDA and cash flow margins are climbing significantly, but note the significant gap between them. To me, this means I tend to ignore EBITDA and focus on cash flow, and those cash flow margins are quite low relative to growth levels.

- The balance sheet is as safe as a house, now with nearly $10 billion in net cash (if you discount the value of its long-term equity investments, which is a more cautious measure, you can say net cash is about $6 billion).

My own view on fundamentals is, well.The company is undergoing further restructuring – see recent coverage in the Wall Street Journal here – But that’s not really what matters, and if you sat down, you’d probably conclude that 11% growth and 23% cash flow margins are nothing special.

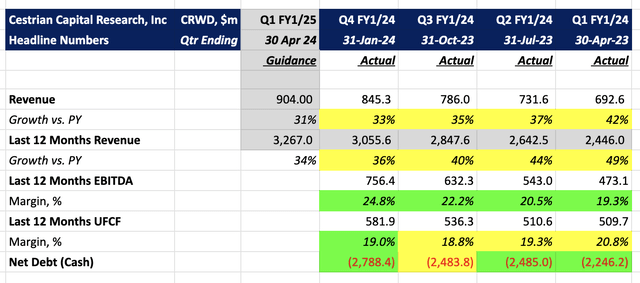

You might look at a young company like CrowdStrike (CRWD), which has a TTM growth rate of +36%, coupled with a TTM UFCF margin of +19%, and conclude that this is a better balance.

CRWD Financial Highlights (Company SEC Filings, YCharts.com, Cestrian Analysis)

But as we all know, fundamentals are only one input to stock prices, not even the most important input. So let’s turn to the analysis of inventories (output materials) rather than companies (inputs).

technical analysis

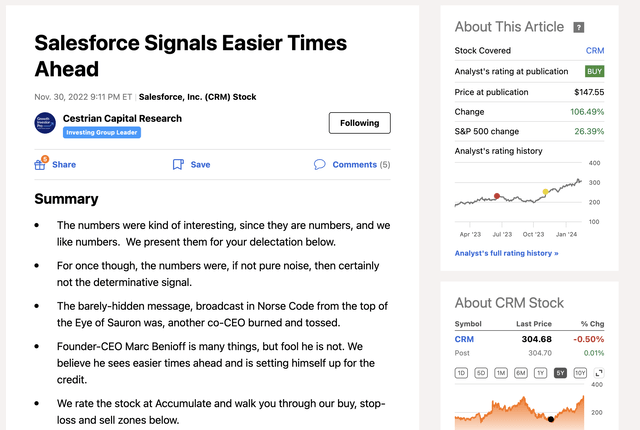

CRM stock really took a brutal beating in 2022, and in my opinion, it went too far. The stock bottomed in December 2022, just a few dollars above its late 2018 lows. The recovery was equally rapid. Our rating on CRM ranges from $138 to $166 per share, reflecting the concentration of institutional buying at the time; the stock currently trades at around $305, having recovered from a minor earnings selloff. So, in a stable software business with a solid balance sheet, you have the opportunity to double your money in less than a year. Not too shabby. Here are our notes for November 2022.

CRM explained, November 2022 (Seeking Alpha, Cestrian Capital Research)

Now?

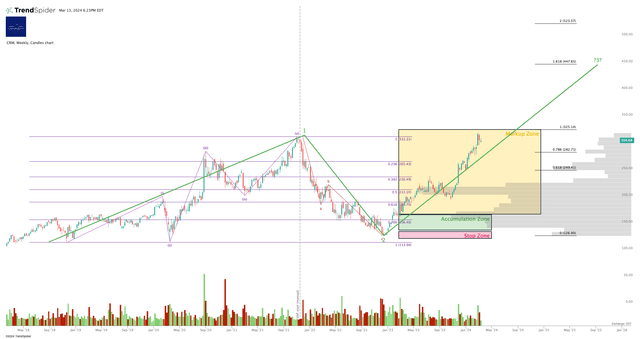

Well, here’s our long-term view on the stock. You can open a full-page version of this chart. here.

CRM Stock Chart (TrendSpider.com, Cestrian Analytics)

The stock should easily reach $325; we are in a bull market and this is just a 100% extension of the previous wave’s second wave low. Currently, we only extend the marked area to this level.

However, with the stock rising – we think we are in a bull market and there is still a lot of wind in the sails – $447 is not a stupid target – it is an extension of the 1.618 wave 3, where the previous wave 1 placed the wave 2 lower. This is a fairly normal third wave high. CRM may be boring for software, but its beta is high compared to the index, as you can see as soon as you look at the chart above, so its potential to scale to 1.618 isn’t really real to us The problem. Of course, potential isn’t a sure thing. That’s not my point – my point is that such a volatile stock can surprise up in a bull market just as it can surprise down in a bear market.

In the short term, the stock has hit resistance and is in a consolidation pattern near the 100% extension of the previous wave. Again, this is a mild extension of the sell-off in the bull market, so more upward movement may be expected. I would be surprised if the stock climbs back up to around $374 (an extension of the previous wave of 1.618) before a sharp retracement, but most surprises right now are on the upside, so as always, one should let the price dictate what the price is, not Prices try to second guess.

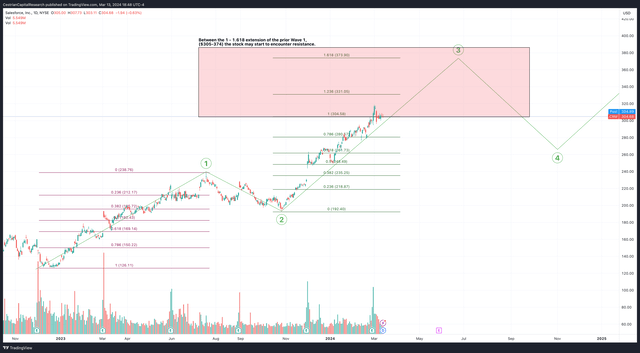

You can open a full-page version of our short-term charts, here.

CRM Short Term Charts (TradingView.com, Cestrian Analysis)

Fundamental analysis

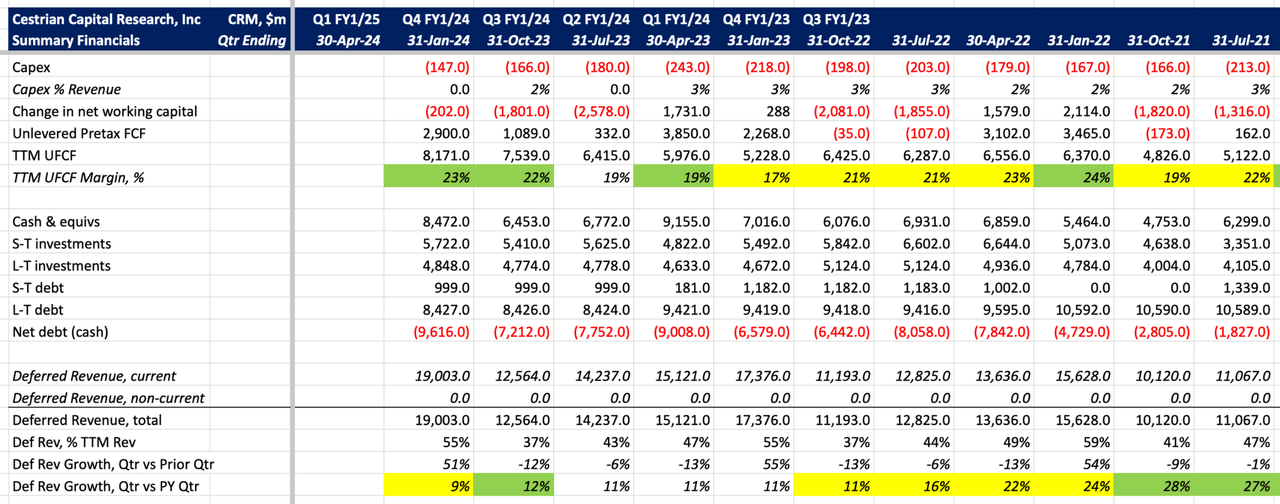

Before we get into the valuation analysis, let’s take a look at the detailed numbers.

CRM Basics I (Company SEC Filing, YCharts.com, Cestrian Analysis) CRM Basics II (Company SEC Filing, YCharts.com, Cestrian Analysis)

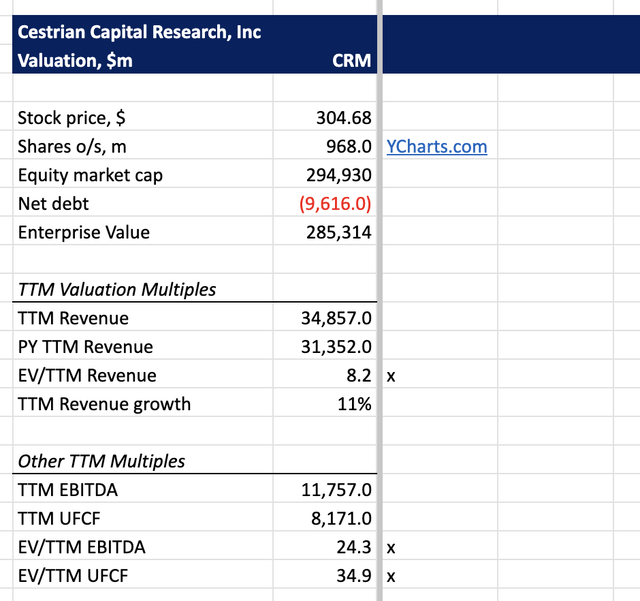

Valuation analysis

In my opinion, the stock is a bit expensive – nothing stupid, but if I were paying 35x cash flow for this thing, I’d like to see a more aggressive restructuring plan in place so that cash flow growth will be higher than it currently is situation faster. But in my opinion, the current valuation isn’t a reason to buy or sell – it’s not close to extreme lows or highs yet.

CRM Valuation Analysis (Company SEC Filings, YCharts.com, Cestrian Analysis)

stock rating

Formally, we rate it a Hold because if the market continues to rise (which we think it will, see our long-term view on the market), then based on our chart above, CRM is likely to follow.

Personally, though, I don’t hold any positions in this name because I can think of other places I’d rather put my capital to work. From a fundamental perspective, the company is neither fish nor fowl; growth isn’t great and margins aren’t great. As growth rates fall below 10%, which is likely to happen in due course, well-managed mature software companies should achieve unlevered pre-tax free cash flow margins of 35-50%. CRM achieved only 23% TTM UFCF, indicating that there is still a lot of wasteful spend in the business. If spending increases growth, that’s great, but if growth doesn’t respond to spending, then at this stage of the company’s life cycle, I think spending should be cut.have something Salesforce is in the midst of a restructuring plan, but as far as I know it won’t lead to Microsoft-style cash flow margins, and the AI purge won’t lead to higher growth in my opinion. Therefore, as a high beta stock in a bull market, hold.

If you have any questions or comments, please leave them in the comments box below. We read everything and try to respond promptly.