Philomia Indawangpan

paper

I recommend a “Hold” rating on Sametime (NYSE: SMWB) due to its slower growth, lower revenue retention, and modest valuation.

Company Profile

Sameweb is a software company that provides digital intelligence solutions to its customers.Their products allow customers Research online traffic trends, prospects for new leads, research stocks, and more. Their core clients include agencies, consultancies, publishers and investment firms (hedge funds, quant funds, venture capital).

Sameweb is part of the 2021 IPO boom. They went public in May of that year. They started trading at around $20 a share. Their stock price was once close to $25, but fell to less than $5 per share in November 2022.

Sameweb was founded in 2009 and is headquartered in Israel. The company’s CEO and CPO are the original founders of the company.It is worth noting that individuals and Insiders have a vested interest in investors as they own 26.6% of shares outstanding. This equates to a market value of US$188.7 million.

finance

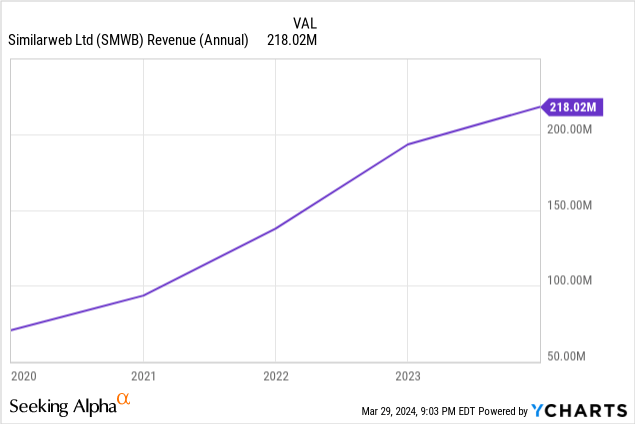

At the end of 2023, Similarweb’s revenue was US$218 million, an increase of 12.8% over the previous year. However, this growth is many times lower than the 40.4% annual growth from 2021 to 2022. This slowdown in growth sums up much of Similarweb’s current narrative. They have taken their foot off the gas pedal and are entering the next stage of their life cycle. Instead of focusing on growth at all costs, they focus on profitability and cash generation at all costs.

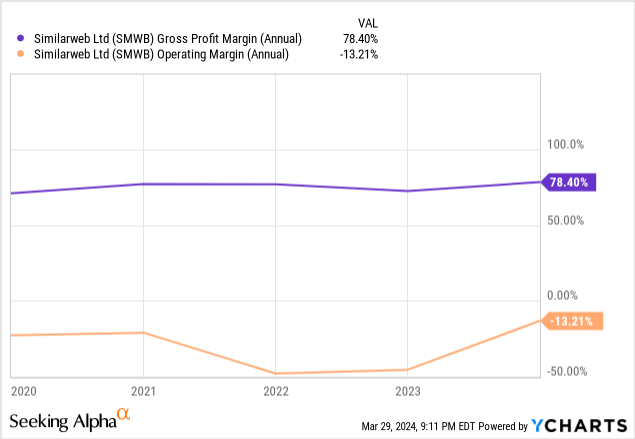

Sameweb’s gross margin remained at a healthy 78.4% in 2023, more than 600 basis points higher than the previous year. But despite considerable gross margins, Similarweb is still not profitable on a GAAP basis. Their operating income in 2023 is -$28.8 million and net profit is -$29.4 million.

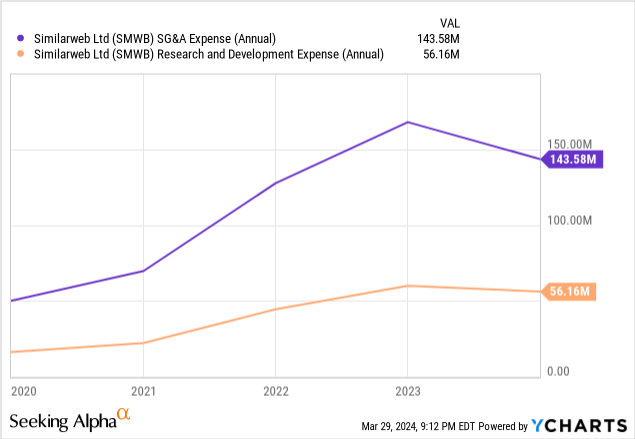

It should be noted that Similarweb has begun cutting operating costs as part of optimizing cash generation. The company’s SG&A expenses in 2023 will be $143.6 million. That’s down nearly 15% from 2022’s total of $168.7 million. The same trend exists for R&D spending. Research and development expenses in 2023 will be $56.2 million, while research and development expenses in 2022 will total $59.9 million.

Part of these cost reductions can be attributed to layoffs Sametimeweb enacted the bill in May 2023, when they laid off 6% of their employees. The layoffs follow a 10% reduction in headcount in November 2022.

By cutting expenses, Similarweb can get closer to profitability. In GAAP terms, the fourth quarter of 2023 is Sametime’s closest quarter to profitability. They ended the quarter with a net profit of $4.8 million.

Similarweb achieved positive free cash flow in the first quarter of 2023 despite not being profitable. Leveraged free cash flow in the fourth quarter of 2023 amounted to $3.7 million. While the total is meager, it’s a positive step forward for the company.

Sameweb’s balance sheet is quite healthy and there’s nothing concerning about it. The company currently holds $71.7 million in cash and equivalents. This is consistent with their total debt of $67.4 million. While its current ratio of 0.79 may seem less than ideal, it’s worth noting that $100 million of its $184 million in current liabilities is deferred revenue that will be recognized next year.

Overall, Similarweb’s financials are in good shape. However, the story they tell of slower growth and cost-cutting marks the beginning of a new chapter for the company. Growth will still be important, but profitability and cash generation will be paramount. Sameweb’s ability to execute into this new phase of its lifecycle is critical to their future.

Valuation

At first glance, Similarweb’s 3.2x EV/revenue multiple might lead you to believe that this is a cheap SaaS opportunity. While that may be true, it’s cheap for a reason.

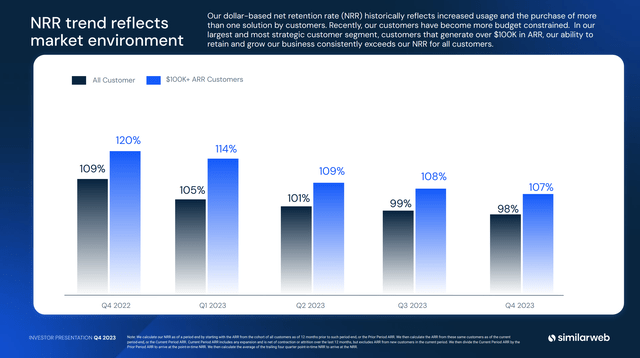

For the most part, Similarweb’s products are nice-to-haves rather than must-haves. Their revenue retention metrics illustrate this reality. In its investor presentation, they were quick to highlight some of the positive aspects of its revenue retention, such as a 107% net revenue retention rate for customers with more than $100,000 in annual recurring revenue. But a deeper look reveals a worrying trend. Similarweb retained 98% of net revenue for all customers in the fourth quarter of 2023. This is down from the 99% level in the third quarter and a significant decrease from the 109% level in the fourth quarter of 2022. Sametimeweb’s current revenue retention level is similar to SMB software, not enterprise software.

Sameweb Q4 2023 Investor Presentation

Now, we can blame this downward trend in revenue retention on the macroeconomic environment. In fact, during an investor presentation, Similarweb titled its revenue retention slide: “NRR trends reflect market conditions.” While that may be true, it’s still not a great admission for Sametime’s business . The decline in retention during the economic contraction suggests that Similarweb’s business is subject to a cyclical nature – a reality that is not true for the world’s most powerful enterprise software company. These dynamics once again show that Similarweb’s products are nice to have, not must-haves.

This revenue retention claim is important because one of the key factors in the valuation of enterprise software companies is their retention. Companies with earnings that remain strong are valued at multiples of those that have trouble maintaining earnings.

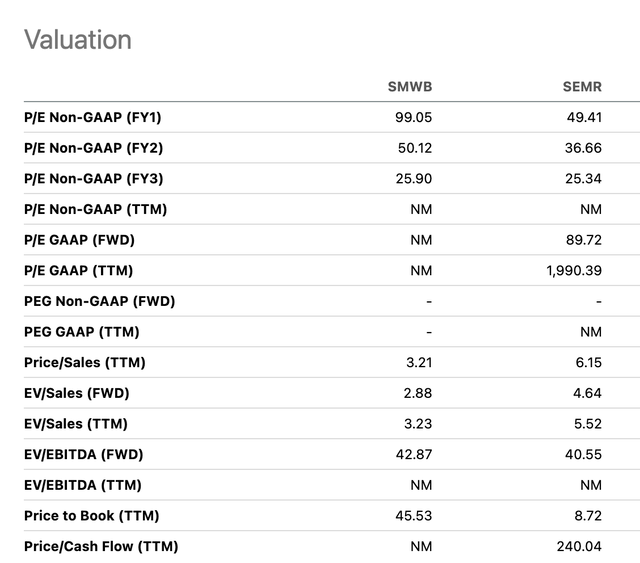

One of Sameweb’s closest comparisons is Semrush (NYSE:SEMR). Semrush offers many similar features to Sametime and caters to many of the same customers. Semrush’s EV/revenue multiple is 4.6x, while Comparisonweb’s multiple is 3.2x. However, there are several factors that make Semlash worthy of the higher multiple of the two.

Seeking Alpha

For one, Semrush is larger than Similarweb. Semrush’s 2023 revenue is nearly $100 million higher than Similarweb’s. Second, Semrush’s profitability metrics are better than both. Semrush’s gross profit margin is 83%, basically breaking even on net profit. Additionally, Semrush’s net revenue retention rate for the fourth quarter of 2023 was as high as 107%. Add in the fact that Semrush will grow revenue by nearly 20% this year and has a perfect balance sheet, and it’s easy to think that Semrush deserves a higher multiple.

Unless the competitive dynamics between the two change meaningfully, it looks like Sametime’s valuation will always be capped by Semrush’s. For these reasons, Similarweb’s current valuation appears appropriate.

catalyst

Since Similarweb’s revenue retention trends follow cost-cutting trends into 2023, their metrics could see a jump as the Fed begins cutting interest rates in 2024. Lower interest rates could bring new growth to the market and make it more likely that companies will spend money on products and services that are worth having, rather than just those that they need to have. If these market dynamics occur, Similarweb could exceed its 2024 revenue guidance.

Another possible catalyst for the stock could be its shift toward profitability on a generally accepted accounting principles (GAAP) basis. To some extent, as the company moves toward meaningful profitability, it provides the market with another opportunity to assess its value. Investors are no longer limited to valuations based solely on revenue metrics and potential. Conversely, when profitable, investors can value the company based on actual cash generation.

This phenomenon could lead Similarweb to reprice its shares in line with the market. Of course, this assumes they can achieve meaningful profits in the near future. But if that does happen, it could be a catalyst for the stock.

risk

As mentioned earlier, one of Similarweb’s key risks is declining revenue retention. Their retention trends over the past few quarters are concerning and should be watched closely by investors going forward. It will be interesting to see if their retention rates rebound in the coming year. If not, Similarweb’s valuation could drop significantly.

in conclusion

Overall, Similarweb has built a strong business. They experienced rapid growth in the years leading up to their IPO and the year after. But now growth has slowed, and management is forced to transition the business to the next stage of its life cycle. Going forward, cash generation will be the focus. At the same time, management faces revenue retention issues. It remains to be seen whether the decline in revenue retention is simply due to macroeconomic trends or if there is a deeper catalyst. Regardless, this trend should keep investors on their toes. For these reasons, I recommend a “hold” rating on Sametime.