Scotiabank branch exterior and parking lot. jewhyte/iStock Editorial via Getty Images

In investing, it is often said that the higher the risk, the higher the potential return. There is some truth to this argument.High-risk asset classes such as stocks Historically, real estate has delivered higher total returns than asset classes generally considered less risky, including bonds and gold.

However, when it comes to equity investment specifically, Research published in 2022 This was found to be inaccurate based on empirical data. In this study, risk is measured through credit ratings assigned by National Information and Credit Rating Corporation or NICE Investor Services, Moody’s affiliate Korea Investors Service and Korea Ratings Corporation.

The authors decided to study South Korea because it provides a more complete data set than the U.S. market.The former data is monthly data since January 2001 As of August 2015, the latter was a few years at best.

The study found that retail investors overall did not give enough consideration to the bankruptcy risk and credit rating of their investments. Therefore, despite the risks, retail investors tend to price the underlying stocks at a premium. This is what drives low risk-adjusted returns.

That’s why one of my top priorities as an investor and analyst is to highlight companies with outstanding balance sheets.

Today I’m taking another look at Canadian banking giant Bank of Nova Scotia or Scotiabank (NYSE:BNS). When I began coverage in January, I liked the company’s position as a leading financial company in North America, its strong financial health, and its attractive valuation.

Since then, shares have gained 5%, while the S&P 500 has gained 10%. In this article, I’ll examine Scotiabank’s fiscal first-quarter results, financial positioning, and valuation to explain why I maintain a Buy rating.

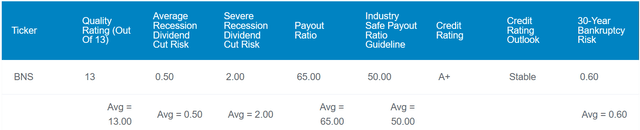

Dividend Wang Zen Research Terminal

According to Seeking Alpha’s quantification system, Scotiabank’s dividend yield of 6.3% is better than the Financials industry median of 3.6%. That’s enough to give the quantitative system an A grade for its dividend yield. However, this dividend is also arguably safe.

The company’s 65% EPS payout ratio is slightly higher than the 50% EPS ratio that rating agencies prefer among financial institutions. However, as I will discuss later in this article, this is not as serious a problem as it initially seems.

As I’ll elaborate on later, Scotiabank’s balance sheet is safe enough that S&P gives the company an A+ credit rating with a stable outlook. This suggests the risk of the Canadian banking giant going to zero over the next 30 years is only 0.6%. In other words, Scotiabank’s credit rating means it can survive 166 of 167 30-year simulations.

All of these factors combined are why Zen Research Terminal predicts a 0.5% chance of the company cutting its dividend in the next average recession. In the event of a severe recession, this risk remains low at 2%. These are the lowest possible dividend cut values for Zen Research Terminal.

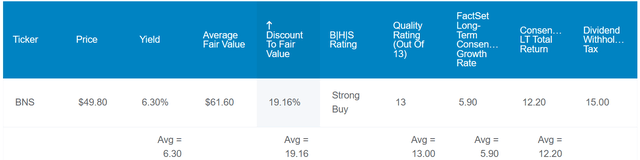

Dividend Wang Zen Research Terminal

Beyond fundamentals, valuation issues could also make Scotiabank stock interesting. Scotiabank’s five-year average dividend yield of 4.9% might suggest its stock is worth $64 per share.

According to the FAST chart, the bank’s 20-year normalized P/E ratio of 11.7 translates to a fair value of approximately $58 per share. Given that Scotiabank’s fundamentals appear to be intact relative to the past, I don’t think it’s unreasonable to expect an eventual return to this valuation multiple.

The following inputs to the Dividend Discount Model show that Scotiabank stock is worth $53 per share: $3.16 annualized dividend per share (calculated in U.S. dollar dividends for the first half of the calendar year), a 10% discount rate, and a 4-year dividend growth rate of % .

Averaging these values, I get a fair value of $58 per share. Relative to a share price of $50 (as of March 19, 2024), suggesting that Scotiabank’s shares could be trading at a 15% discount to fair value.

If the bank grows as expected and returns to fair value, here are the total returns it could generate over the next 10 years:

- 6.3% Yield + 5.9% FactSet Research Annual Growth Consensus + 1.6% Annual Valuation Multiple Expansion = 13.8% Annual Total Return Potential or 264% 10-Year Cumulative Total Return vs. S&P’s 10% Annual Total Return Potential or 159% 10-year cumulative total return

Good first season

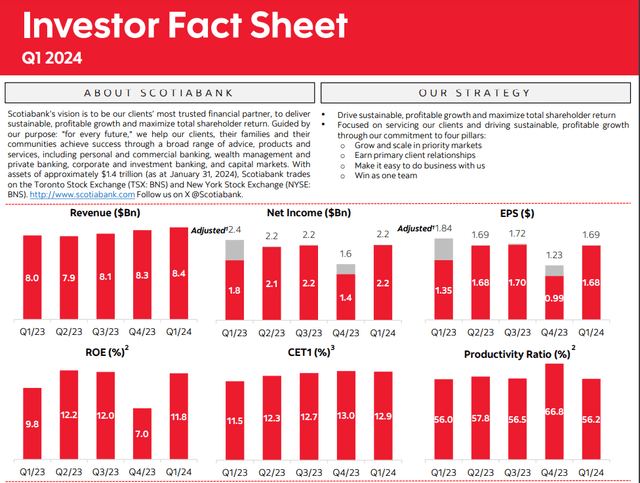

Scotiabank Q1 2024 Investor Fact Sheet

On February 27, Scotiabank announced its financial results for the first quarter ended January 31. The company’s total revenue for the quarter rose 5.9% year-over-year to $8.4 billion (note that this and all subsequent numbers are in Canadian dollars). These results were driven by non-interest income growth, although net interest income also contributed to growth.

In the first fiscal quarter, Scotiabank’s net interest income increased 4.6% year-on-year to $4.8 billion. According to Chief Financial Officer Raj Viswanathan’s opening remarks on the Q4 2023 earnings call, this was due to an 8 basis point expansion in net interest margin. This is another way of saying the investment spread between the interest a financial institution receives and the interest it pays to customers.

Non-interest income increased 7.7% year-over-year to $3.7 billion in the first fiscal quarter. This was driven by strength in Scotiabank’s trading revenue, banking fees and wealth management revenue.

From the income statement, adjusted diluted earnings per share in the first fiscal quarter fell 8.2% from the same period last year to $1.69. The company’s adjusted net income fell as its provision for credit losses increased significantly to $962 million in the fiscal first quarter from $638 million a year earlier.

The good news is that this shows a downward trend in credit loss provisions in the fiscal fourth quarter from just under $1.3 billion. As a Canadian bank, Scotiabank is known for being relatively conservative. Therefore, it may ultimately recover these credit losses. Excluding the $324 million annual increase in these reserves, adjusted diluted earnings per share would have increased.

Scotiabank’s financial strength remained intact in the fiscal first quarter. The company’s common equity tier 1 capital ratio, or CET1, was 12.9%, unchanged from the previous quarter’s 13%. Compared to the same period last year, Scotiabank’s CET1 capital ratio is well above the 11.5% level. This explains why, in addition to an A+ rating from Standard & Poor’s, the company also enjoys prestigious AA and Aa2 (equivalent to AA) ratings from Moody’s, with a stable outlook.

Looking ahead, Chief Risk Officer Phil Thomas expects PCL may peak next quarter or in the third quarter. But after that, things should improve in the second half of the year and he thinks this year will be a tale of two halves.

That’s why analysts agree that adjusted diluted earnings per share will edge up 0.6% to $6.58 this fiscal year, according to FAST Graphs. The macroeconomic outlook improves in 2025 and beyond, with analysts forecasting an additional 8.8% growth to $7.16 in FY2025 and another 6.6% in FY2026 (unless otherwise sourced or hyperlinked, all details are from Scotiabank First Quarter 2024 Earnings Press Release and Scotiabank Q1 2024 Investor Fact Sheet).

Dividend growth will temporarily slow

Scotiabank in Canadian dollars Dividends paid The cumulative compound interest is 27.4%. This is equivalent to a compound annual growth rate of 5%. Over the next few years, I expect dividend growth to slow.

That’s because Scotiabank’s dividend payout ratio this fiscal year will be around 64% to 65%. A few years of limited dividend growth could help push the payout ratio into the company’s more typical range of high 40% to low 50%. By 2027 and beyond, I expect dividend growth to return to mid-single digits annually.

Risks to consider

Scotiabank is a great business, but it still faces risks worth knowing and monitoring.

The financial situation of Canadian consumers is improving, but not yet ideal.The latest data from Toronto-Dominion Bank (TD) finds that household debt to disposable income is 178.7% Ends in 2023. This number remains close to historical highs. If consumers’ conditions do not continue to improve, it could result in a higher PCL. This could harm Scotiabank’s operations and financial performance.

As a global financial institution, the company also has a rich trove of data. Not surprisingly, it has been the target of cyberattacks. Scotiabank is good at managing risk, but there’s no guarantee it will ever avoid a major breach. If the company falls victim to a major breach, there can be many negative consequences. Scotiabank’s affected stakeholders could sue the company for substantial damages. Its reputation may also be damaged, resulting in significant business losses.

Summary: Excellent discount business

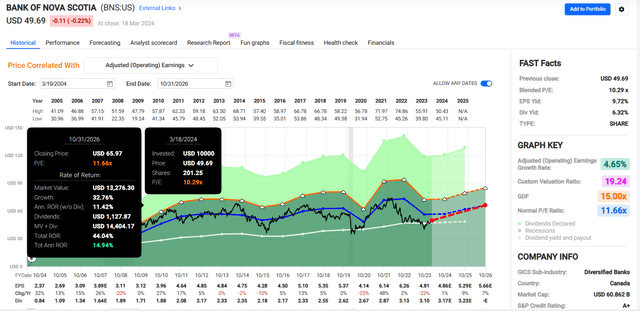

Quick charts, fact sets

In my opinion, Scotiabank is one of the best listed banks in the world. The company’s operating fundamentals are expected to improve. Its balance sheet is a fortress. In nearly 200 years of business, the dividend has never been cut.

On top of that, the stock currently trades at a combined price-to-earnings ratio of 10.3. Relative to the normal 20-year P/E ratio of 11.7, this may be an attractive mean-reversion strategy. If Scotiabank can meet growth consensus and return to a valuation multiple of 11.7, cumulative total returns could reach 44% by October 2026.