near green studio

investment action

I recommend giving Sealed Air Corp. a Hold rating (NYSE:SEE) Last time I wrote this, I saw clear weakness in the business in the second half of 2023.based on My current outlook and analysis on SEE, I recommend a Hold rating. I still think the prospects of SEE are not very good. Despite some positive early indicators, the overall demand outlook remains uncertain and weak. Additionally, I find management’s fiscal 2024 guidance to be overly aggressive, adding more risk to the stock as the stock is heavily dependent on a recovery in fiscal 2024 (which depends on where the macro economy goes, in other words, a wildcard) .

review

SEE’s overall results for the fourth quarter of 2023 were sales of approximately $1.38 billion (adjusted). EBITDA was $274 million (margin 19.9%) and earnings per share were $0.88. In the food segment, sales were $893 million (up 2.1%) and adjusted EBITDA was $194.9 million (margin 21.8%).As for Protection segment sales were $485 million (-8.9% growth), resulting in Adjusted EBITDA performance growth of -11.6%, resulting in Adjusted EBITDA of $91 million (18.7% margin).

As I expected, 2H23 won’t be great. I think the outlook remains mixed right now, as the business continues to face headwinds and challenges that need to be addressed before investors turn bullish on the stock. Starting with the food segment, operating performance in the fourth quarter of 2023 was not ideal. Sales/mix deteriorated to -3.3% from -0.8% in Q3 2023 and -3.2% in Q4 2022, and pricing was similarly weak, contributing only 0.7% compared with 0.9% in Q3 2023, p. It was 7.4% in the fourth quarter. Based on the current macro picture, I expect this weakness to persist through at least the first half of the year (until an actual rate cut improves the overall health of the economy). In short, I believe customers will continue to cut capital expenditures in a weak demand environment, which will impact SEE’s 2024 equipment sales outlook. I also think the pricing impact will start to turn negative as SEE experiences the benefits of higher raw material prices, putting more pressure on top-line growth.

As for the protective sector, while I think it may benefit from cyclical stabilization, I note that there are also structural issues. The upside of the near-term cycle is that SEE’s destocking campaign should be nearing its end, with soft industrial demand having a significant impact on the segment’s sales performance (volume/mix down 14% in 2023). This -14% volume/mix performance was up from -11.1% in fiscal 2022, and cumulatively was approximately -25% volume. Judging from SEE’s historical performance, there has never been such a huge loss. Therefore, I believe a turnaround may be coming.On the other hand, this segment faces more competition from the e-commerce market, where online stores Switch to paper packaging Instead of plastic.This is a very negative narrative and I think it will take some time for SEE to address this as it has Late launch Its paper packaging products. Due to market fragmentation, plastic packaging is also facing price pressure. Therefore, pricing pressure + lower plastic sales may dampen near-term results until SEE increases adoption of its paper packaging products.

Pricing pressure has intensified as competitors step up to combat weak market demand. On the bright side, the destocking of downstream inventories has been basically completed. 23rd Season 4 Phone

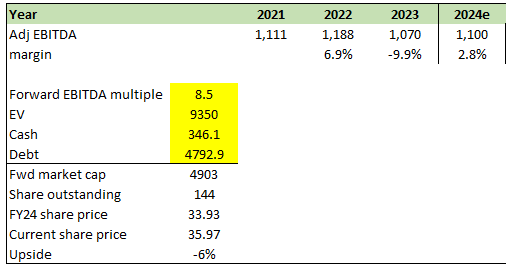

I think another near-term risk to the stock is that management’s guidance is quite optimistic about a strong recovery in the second half of 2024. Management expects EBITDA to be $240 million in the first quarter of 2024, which represents an annual decrease of approximately 10%. They expect EBITDA to grow sequentially every quarter and achieve annual growth in the second half of 2024. This does put a lot of pressure on 2H24, and it only adds to expectations and risks at a time when the macro outlook is quite uncertain. For the full year, management guided for an EBITDA range of $1.05 to $1.15 billion, and if we factor in the poor near-term demand outlook, we assume Q2 2024 EBITDA trends similar to Q1 2024, which means 2024 Second-quarter EBITDA grew 11% to reach the midpoint of fiscal 2024 EBITAD guidance. Given that SEE’s total EBITDA has never grown by 10% (on an annual basis), this seems like a very difficult hurdle to overcome. Additionally, the macro environment in FY24 is arguably tougher than in past years.

Therefore, my updated view remains a Hold rating as there are still no obvious catalysts that could drive the stock higher. There are some early indicators to be happy about – the end of destocking campaigns – but overall, demand remains uncertain.

Valuation

author’s works

Even if I believe management can meet guidance and achieve $1.1 billion in EBITDA in fiscal 2024, I still think the market is unlikely to upgrade the stock due to all the headwinds I mentioned above. Therefore, I expect the stock to continue trading at a depressed P/E ratio in the near term. Frankly, I think this guideline has a very negative impact on SEE.With this guide, they can expected Hitting that target (because they guided on it), but that doesn’t help address the larger issues (plastic product demand headwinds, catch-up pricing, macro conditions impacting food equipment sales). If they don’t meet the guidance, it can be a significant blow to management’s credibility.

All in all, I think the risk of investing in SEE is still relatively high, and investors should continue to wait and see for now.

final thoughts

My recommendation is a hold rating. The overall demand outlook remains uncertain, and management’s fiscal 2024 guidance appears overly optimistic, relying heavily on a second-half recovery tied to an unstable macro environment. While the protective gear sector may soon see cyclical benefits, structural challenges such as e-commerce competition and pressure on plastic packaging remain. Additionally, the food segment faces weak sales and price headwinds. Until these concerns are resolved and a clear growth catalyst emerges, staying on the sidelines on SEE seems like the more prudent move.