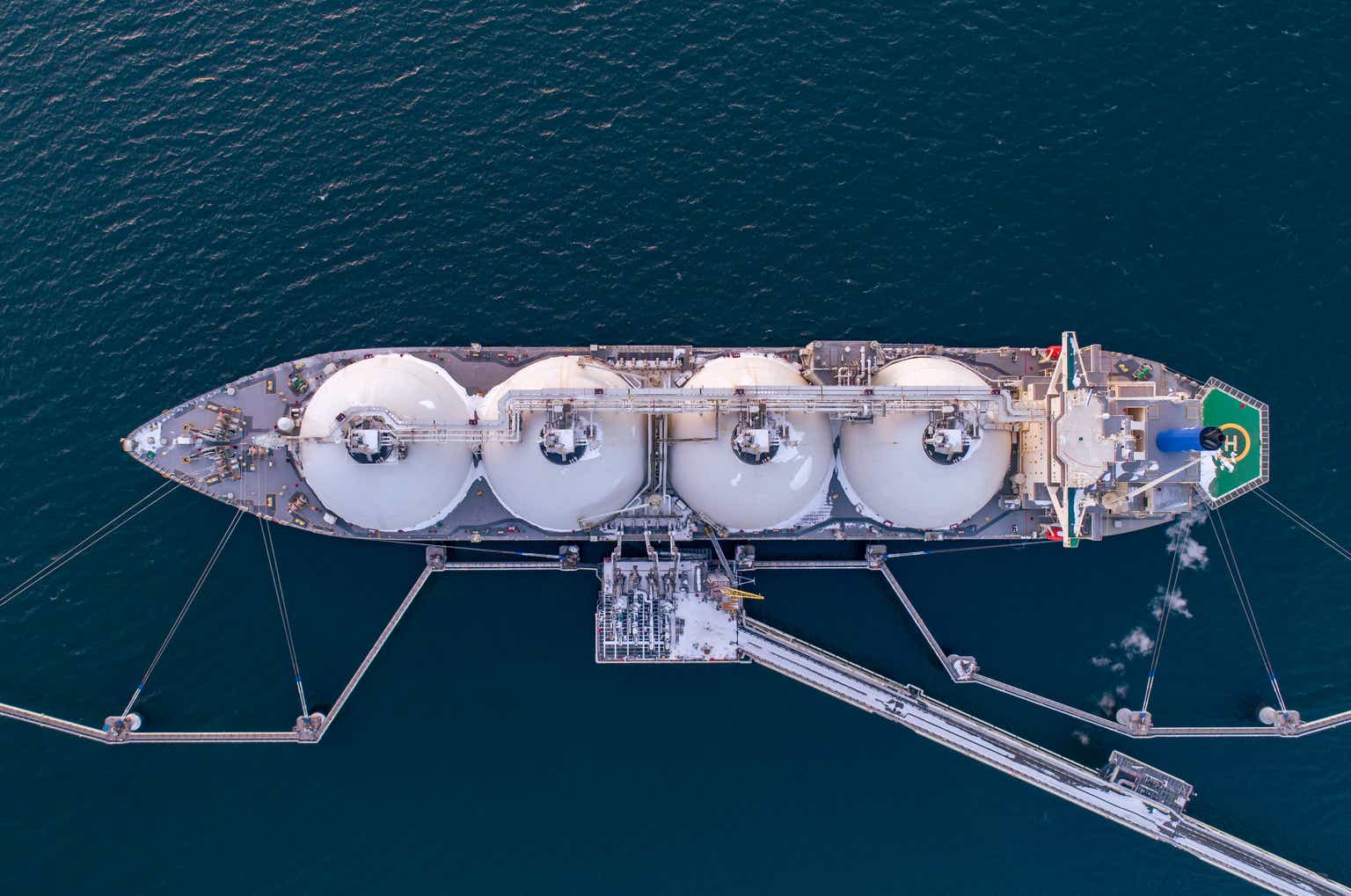

Undefined/iStock via Getty Images

introduce

As of the end of 2023, Seapeak had an “average” of 21 LNG carriers and 21 LNG carriers for the year.I’m mainly interested in LNG ships, that’s the only reason I own long term Jobs at Teekay LNG Partners. I also own preferred shares after Teekay LNG was privatized by Stonepeak and renamed Seapeak. Preferred shares remain outstanding. I still hold long positions on both issues, and the quarterly preferred dividends (without dividend withholding tax) provide a nice boost to my cash flow.For all old articles about Seapeak, please follow this link.

Financial performance remains strong, with excellent preferred stock dividend coverage

With Teekay LNG Partners being taken private and renamed Seapeak, I’m only interested in two things: Can Seapeak succeed? Can preferred stock dividends be easily paid and does the balance sheet provide a margin of safety?

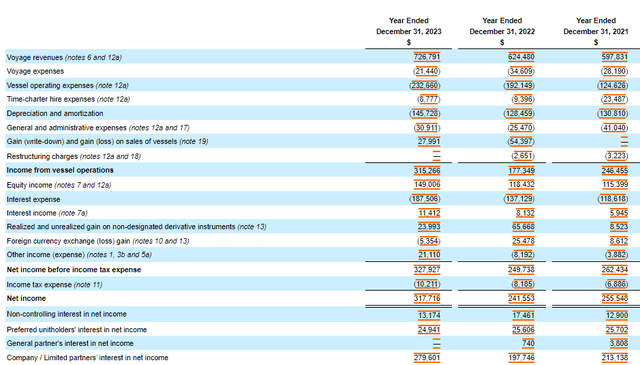

2023 is a great year for Seapeak. The company reported total revenue of nearly $727 million, Ship operating income is approximately US$315 million. This is nearly 80% higher than the $177 million in vessel operating revenue reported in 2022, but much of the improvement can be explained by the difference of more than $80 million in vessel sales gains of $28 million in fiscal 2023 compared to a loss of $54 million in 2022 Means more than half of the higher revenue from ship operations. The other improvement was just organic, thanks to $100 million in additional revenue, offset by only a $27 million increase in operating and voyage expenses.

Haifeng Investor Relations

In addition, Seapeak’s equity investment contribution was higher, and despite the increase in interest expenses, pre-tax income jumped to US$328 million and net profit reached US$318 million. Of this, $13.2 million is non-controlling interest, meaning Seapeak owns more than $304 million. After paying nearly $25 million in preferred stock dividends, net income attributable to Seapeak common shareholders was nearly $280 million.

This means preferred stock dividends are well paid: Seapeak requires less than 9% of attributable net profits to cover preferred stock dividends. Even ignoring the $28 million gain from the sale of ships, the payout ratio is still below 10%.

At the end of 2023, the total equity on Seapeak’s balance sheet increased to 2.58B, of which $278M was classified as preferred shares (representing 11.53M units). Applying the $25 redemption value of the preferred stock, the preferred stock totals just under $290M, which means there is approximately $2.3B of common stock ranked below the preferred stock. This is an improvement from less than $2 billion in common stock at the end of 2022. The strengthened equity position was due in part to an $86 million cash infusion from private equity partners, partially offset by a $50 million dividend.

Terms of A and B preferred shares

As explained in my previous article, Teekay LNG Partners still has two series of outstanding preferred shares after the private equity group chose not to redeem the preferred shares when it acquired them. The terms of the preferred shares remain unchanged from when the last article was published.

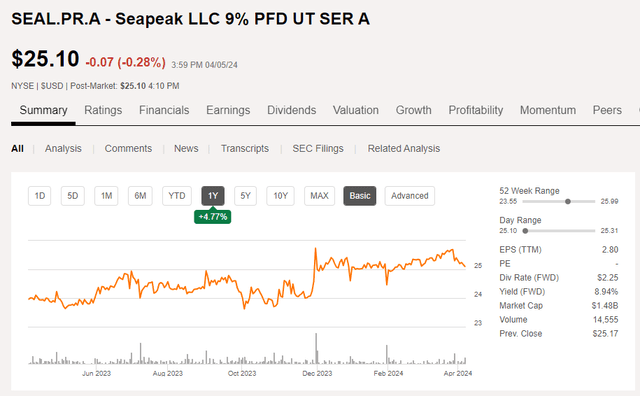

A shares (NYSE: SEAL.PR.A) offers a dividend yield of 9% on the $25 principal value (meaning it pays an annual preferred stock dividend of $2.25 per preferred share, paid in quarterly installments), and can be called at any time. The Series A round is currently trading at $25.10, and the share price slightly above par means the current yield is about 8.95%.

Seeking Alpha

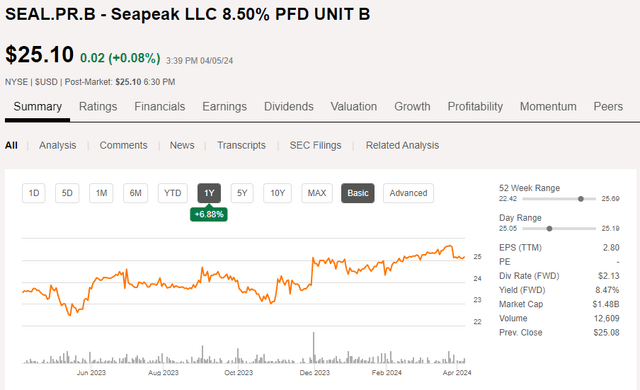

Meanwhile, Seapeak’s B series (NYSE: SEAL.PR.B) preferred shares also remain outstanding. The preferred shares currently pay an 8.5% preferred dividend ($2.125 per year, paid in four quarterly installments), but in approximately 3.5 years (October 2027, to be precise), this will convert to three months of LIBOR interest. The difference plus a 624.1 basis point increase.with a Current 3-month SOFR The interest rate (assuming the company will use SOFR as a replacement for LIBOR) is around 5.28%, which would suggest a jump to just over 11.5%.Prospectus and language in prospectus The annual report makes it very clear:

“If the Calculation Agent for the Series B Senior Units determines that the three-month LIBOR has been terminated, it will determine whether to use as the base distribution rate the alternative or subsequent base rate it determines to be most similar to the three-month LIBOR described in the preceding sentence.”

Since LIBOR is an unsecured rate and SOFR is a secured financing rate, there is a markup of 26 basis points. This means that with the current three-month SOFR of 5.28%, the total preferred stock dividend yield will increase to 5.28% + 0.26% + 6.24% = 11.78% of the $25 principal value, with a preferred stock dividend of 2.945 per preferred share Dollar.

Seeking Alpha

Since the Series B preferred stock is also currently trading at $25.10, I think the small premium relative to the Series A preferred stock is justified. The current yield on Series B preferred stock is just under 8.5%, but the bigger benefit is seeing that Series B won’t be called in 2027. Whenever the three-month SOFR exceeds 3.00%, the preferred shares reset to 9.5% of the primary value.

investment thesis

I own preferred stock in both series, and I have no intention of selling my position. Given the strong financial performance and solid balance sheet, I remain interested in adding to my position, preferably below par. Series A preferred shares can be redeemed at any time, while the company can only redeem Series B preferred shares starting in October 2027. If the three-month SOFR remains at current levels, I believe the likelihood of these stocks being called is quite high.