big country

I published an article on SentinelOne, Inc. (NYSE:S) about 9 months ago. To summarize my thoughts at the time, I thought the company was clearly promising, but I was concerned that profitability was looking increasingly distant.exist Instead, management’s goal at the time was actually to become profitable on a cash flow basis by the end of fiscal 2024. With the financial year behind us, now seems like the perfect time to take another look at the stock, considering at the time I found it hard to believe management could pull it off, given how far away they were from achieving profitability. Any views.

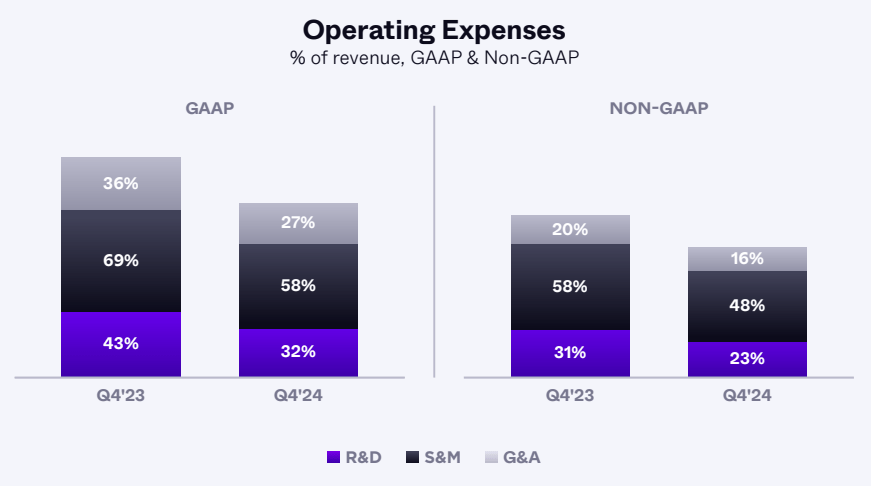

Although it is indeed some distance from the expected goal, it turns out that this is not empty talk: SentinelOne has clearly turned to profitability. Compared with revenue growth, the growth rate of operating expenses has dropped significantly. Reducing sales and marketing expenses obviously has an impact on revenue growth, but I think a business growing at around 30% but cash flow positive is more attractive than a business growing at twice the rate but cash flow positive.

In fact, SentinelOne isn’t cash flow positive yet, but is clearly working towards that goal, and I wouldn’t be surprised at all if it turns out to be free cash flow positive in the first quarter starting this year (FY2025). Considering the company is still growing at over 30%, has a lot of cash and zero debt, and is signing new customers at a very healthy rate, I have to say that, in my opinion, an investment in SentinelOne is better now than it was 9 months ago Easier to swallow, even though the stock is up about 67% since my last article.

New ways to make money

Revenue slows, but GAAP margins improving (Y chart)

Last year, revenue growth slowed significantly from the extremely high growth rates (triple digits) the company has maintained since its July 2021 IPO. Revenue slowed further in the most recent quarter, with revenue of $174 million, up about 38% from the same period last year. However, total operating expenses only increased by 9.5% during the same period, and operating efficiency improved significantly. In particular, SG&A expenses fell significantly, accounting for 84% of revenue in the quarter. Don’t get me wrong, this is still a shocking portion of revenue going to overhead, but in the past, SentinelOne used to spend 120%-130% of its revenue on SG&A, which helps put the latest numbers Put it in the background.

SentinelOne Fourth Quarter 2024 Letter to Shareholders

To be honest, SentinelOne hasn’t been trending in the right direction for a while, as they’ve had nine consecutive quarters in which revenue grew faster than total operating expenses; however, the gap between the two numbers has been fairly small in the past. , it was only in the past year or so that the company significantly changed its strategy and pursued profitability more seriously. Although SentinelOne is not there yet, the path is very clear to me and I have no doubt that management will continue to rein in expenses so that it can reach profitability soon.

The market didn’t like the latest quarter

The cybersecurity provider released its fourth-quarter 2024 results on March 13, and the market reaction was very negative. The stock sold off aggressively and is still down about 18% since the quarterly release. The main culprit is guidance, as management targeted fiscal 2025 revenue in a range of $81.2 to $818 million, compared with Wall Street’s expectations of $817.5. The market reaction seems pretty aggressive given that the guidance deviation is so small, but considering SentinelOne has had six consecutive quarters of lower year-over-year revenue growth, in my opinion, it suggests Wall Street is worried about an overall sales slowdown. The pessimistic guidance could spook investors as there appears to be no end in sight to the sales slowdown.

I personally think there’s more to this story. The data clearly shows that management is willing to accept lower revenue growth by slashing marketing expenses. I believe these two numbers are directly related, it’s just a matter of executing the strategy. SentinelOne could push its growth toward higher revenue growth rates, but that would come at the expense of its cash reserves as it moves further and further away from profitability.

Sales and marketing expenses related to revenue growth (Y chart)

Despite lower sales and marketing expenses, the company continued to record good customer growth numbers. In the most recent quarter, customers contributing at least $100,000 in annual recurring revenue grew 30% to 1,133, while customers with at least $1 million in annual recurring revenue also grew at “record numbers,” according to management commentary. growth, although no clear figures were provided.

SentinelOne Fourth Quarter 2024 Letter to Shareholders

While SentinelOne doesn’t have a cash problem (~$926b in cash or investments, and no debt), management is currently willing to sacrifice short-term growth in order to preserve cash on the balance sheet. This is likely in response to the challenging macro environment, with many corporate customers still rationalizing their spending to this day. I personally applaud this strategy because interest rates are no longer zero, money now has a cost, and companies should be more cautious in the way they manage liquidity. Investors should also expect businesses (growth businesses too!) to behave differently in this regard compared to the 13 years of expansionary monetary policy we recently abandoned.

An interesting phenomenon I’ve been seeing more and more lately: Growth stocks that IPOed when money was cheap and raised a lot of cash in the process are now actually making more money from the cash than from the business. The benefits gained are even greater. While SentinelOne has never had a quarter of positive operating cash flow, in its most recent quarter they earned $12 million in interest profit on invested cash. In the past 12 months, this figure reached $44.7 million. Not bad for a company that had negative operating cash flow of $68.4 million during the same period.

Cybersecurity remains an area of concern

The bull thesis surrounding SentinelOne remains intact. Cybersecurity is increasingly considered a must-have for enterprises and mid-sized businesses. A new generation of cybersecurity vendors like Crowdstrike and SentinelOne are growing like weeds, quickly replacing existing vendors because they often offer better quality and value. As cybersecurity threats continue to evolve, they become increasingly difficult to detect, and they begin to deploy their own artificial intelligence technology to bypass current security systems. From the latest earnings call:

For too long, disjointed platforms and legacy vendors have been playing whack-a-mole with point solutions, trying to plug security gaps, only to see new ones emerge. We think this is a failed approach. It drains resources and gives a false sense of protection. The frequency and intensity of modern attacks make it abundantly clear that legacy solutions, siled products and disjointed platforms are failing. SentinelOne offers the best protection on the market. Our Singularity platform is data-driven, adaptive and delivers AI-based security, all through a unified platform and a single agent.

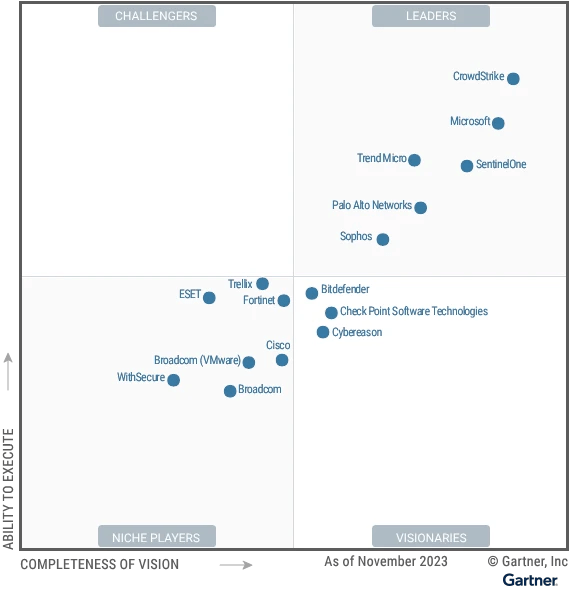

SentinelOne was recently named a Leader in the 2023 Magic Quadrant for Endpoint Protection Platforms by Gartner.

Gartner Magic Quadrant for Endpoint Protection Platforms. (Gartner (December 2023))

The cybersecurity market SentinelOne targets is large and continues to grow. Management identifies a total addressable market of at least $100 billion, while also acknowledging that the market is so large and has so many nuances that it will always naturally accommodate many successful providers.

There are obviously risks. One of the most immediate concerns when investing in a cybersecurity vendor is the potential for huge reputational damage if a company suffers a breach. Additionally, as we’ve talked about before, SentinelOne doesn’t yet enjoy effective scale as a smaller company, which in itself is riskier as an investment, but the company does enjoy a very positive cash position as well as an operating position This risk is effectively mitigated. Cost reduction measures. The current fiscal year (2025) will be a critical time for the company, as I believe they will be profitable for the first time, and next year will be crucial in understanding how profitable the company can actually be on a recurring basis.

Valuation and Key Points

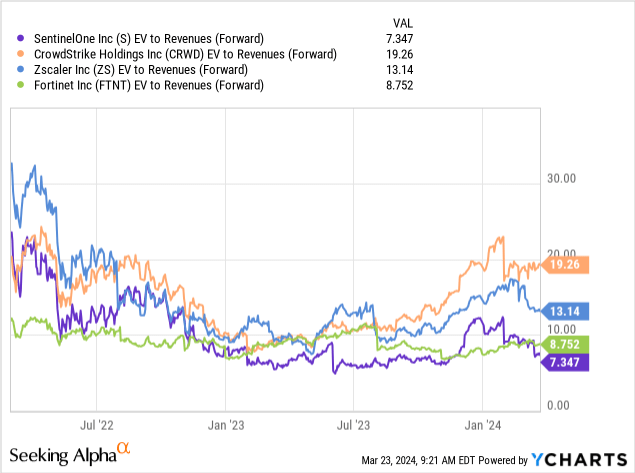

As noted above, SentinelOne’s stock price is down approximately 18% since the earnings release. Despite the drop, the stock is not cheap considering it trades at a price-to-sales ratio of 10.82 times. If we strip out cash and only consider enterprise value, the stock’s EV/Sales is still a whopping 9.50. However, even though revenue growth is declining, the company is still a growth stock, so the forward value is probably better reflected in the valuation here (8.32x vs. 7.22x, respectively). As of now, SentinelOne isn’t profitable, so more traditional indicators like P/E or P/FCF are effectively useless.

While these ratios are quite expensive in absolute terms, its valuation is starting to look more attractive compared to some of SentinelOne’s peers in the cybersecurity space.

Y chart

CrowdStrike (CRWD) is considered by most to be the leader in its space, and its insane valuation does represent a massive premium over its competitors. Considering how well SentinelOne has performed, and considering that they are turning around profitability, this seems like an excellent time to start accumulating some shares. Growth stocks are highly affected by overall market behavior, so investors should know that all of the above stocks will absolutely crash if the economy slows down or enters a recession. High valuations always mean a large portion of them are traded purely on market sentiment. It is always recommended to reduce this risk by appropriately sizing a diversified portfolio. However, if SentinelOne continues to grow as a company, then at today’s prices, the next 5 to 10 years will likely be profitable for buyers.