Thomas Barwick

Service Property Trust (NASDAQ: SVC) is a hybrid hotel and triple net real estate investment trust (REIT) that trades at a 4.4x deep value multiple for the Forward Fund of Operations (FFO) consensus. SVC should trade at a discount multiple for two main reasons:

- Managed by RMR Group (RMR)

- Hotels usually deal at cheaper rates.

Hotel REITs trade at a median forward FFO of 9x, while triple net REITs trade at a median of 11.5x. With roughly half the assets in each category, SVC’s natural multiple will be a little over 10x. The remaining discount to 4.4x was primarily due to the market correctly observing the underperformance of RMR-managed REITs.

We are fully aware of the dangers of investing in RMR-managed REITs and have been writing about what we see as errors/disorders for years. However, at a certain point any given issue is priced into the stock, and I think SVC’s extremely cheap P/E is beyond that point.

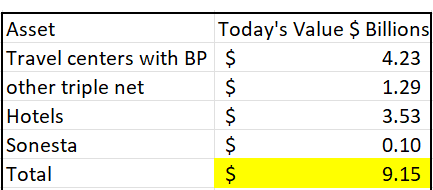

About three quarters ago, we did a total valuation of SVC’s parts.

Article 20 Jul 23

Obviously, we are still early as the SVC market price has been falling. However, asset values have held up reasonably well, with favorable asset sales proving their worth.

With the new information, I want to update two aspects of the valuation:

- As cheap fixed-rate debt matures, interest payments will increase significantly.

- The value of Sonesta International Hotels is far beyond our imagination.

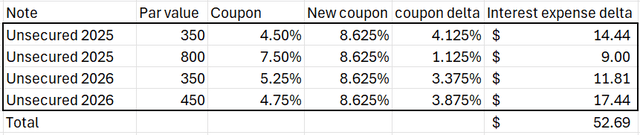

SVC has 4 significant debt maturities over the next 2 years with coupons ranging from 4.5% to 7.5%. Their most recent debt issuance was at 8.625%, so I would expect similar interest rates when these bonds roll over. The table below is the incremental interest expense per note calculated at expected refinancing rates.

2MC uses company filing data

If the interest rate environment remains higher, I expect annual interest expense to increase by $52.69 million. That works out to about $0.32 per share.

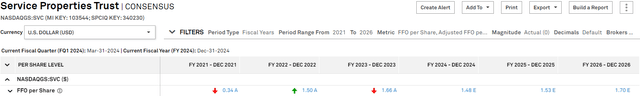

Analysts don’t appear to have fully factored in increased interest expense, as they believe SVC’s FFO/share will grow in 2025.

S&P Global Market Intelligence

The decline in FFO/share in 2024 is related to interest expense, but this is the refinancing that is already in place. Future refinancing does not appear to be in the numbers. Therefore, I think FFO/share in 2025 will be significantly lower than expected.

That said, I think the market is aware of this and as if these estimates are accurate, SVC would be a home run buy. A company that is growing FFO has absolutely no business trading at 4.4x. If SVC’s actual 2026 FFO/share approaches the “consensus” of $1.70, it would be a huge win for shareholders.

I think $1.50 is closer to reality. The $0.32 loss in incremental interest expense will likely be offset by the growth in real estate sales already underway and the continued recovery of the hotel industry.

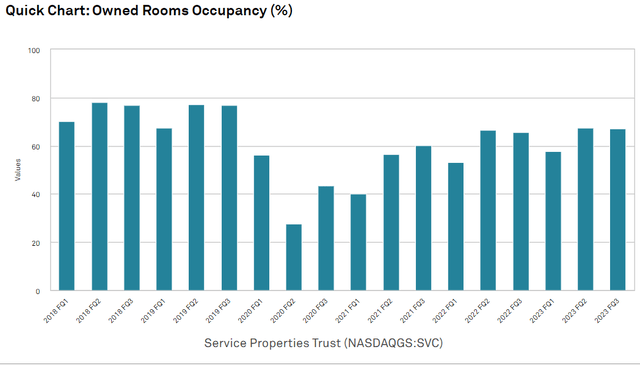

Occupancy rates remain well below pre-pandemic levels but continue to improve year over year.

S&P Global Market Intelligence

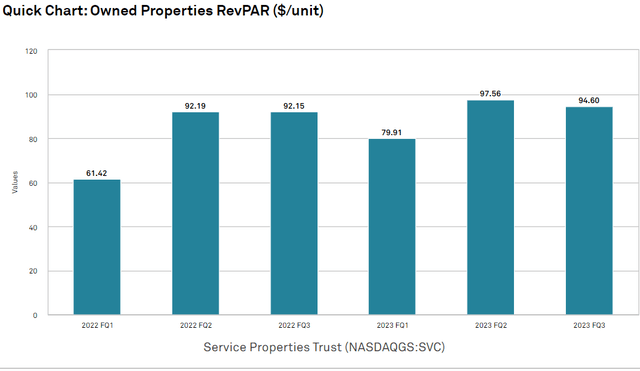

RevPAR is also improving, albeit rather slowly.

S&P Global Market Intelligence

Disposal as a path to added value

SVC plans to sell 22 hotels with a book value of $162 million. These specific hotels are struggling in the current environment, with 2023 EBITDA totaling $4.7 million.

When asked about expected sales pricing on the conference call, Chief Information Officer Todd Hargreaves said:

“My sense is that we probably won’t get all the way to book value. But I don’t think it will be much lower than that.”

For most companies, I think a book value of just under $162 million would imply a gain of about $140 million, but since that statement comes from RMR, I think the proceeds from the sale will be closer to $100 million.

Even at this reduced number, the growth is considerable. In a previous refinancing, RMR borrowed less than it paid back to reduce debt. These property sales will allow them to do something similar for a 2024 refinance.

Therefore, they can borrow $100 million less when they refinance. Using the same 8.625% interest rate as above, there would be savings of $8.625 million in addition to eliminating $4.7 million in negative EBITDA.

The total annual accretion from these dispositions was approximately $13.3 million, or approximately $0.08 per share.

Sonesta is undervalued

Sonesta is a complex asset for SVC because it involves conflicts of interest, as Sonesta is run by RMR affiliate Adam Portnoy. Therefore, contracts for SVC hotels under the Sonesta flag were not fairly negotiated and should be viewed with suspicion.

We examined the contract language and its main features are:

- Long-term extension to 2037

- SVC gets preferred owner returns

- Mandatory capital expenditure

- Sonesta is charged 3%-5% of revenue management (branding) fees.

In my opinion, the fees Sonesta charged SVC were within industry standards and other terms were very similar to SVC’s agreements with Radisson Hotels and Hyatt Hotels for its other hotels.

So the contract itself wasn’t troublesome, but the related parties did mean that SVC would essentially never be able to fire Sonesta if it underperformed. In short, I don’t think there is a financial negative impact on related parties, but there is a consolidation negative impact.

SVC didn’t discuss the Sonesta’s value much in the presentation. Perhaps it was because of the complexity of such fortifications. However, the lack of discussion about Sonesta could cause the market to miss out on a truly large asset.

SVC owns 34% of Sonesta, worth approximately $340 million. Here is the calculation of this value.

Sonesta drain pipe

Hotel branding companies tend to combine direct ownership of hotels with labeling hotels owned by other companies. Therefore, the range of valuations is quite broad relative to the number of properties operating under a particular flag.

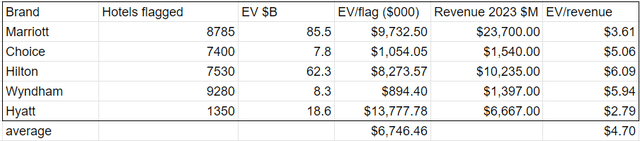

For example, Marriott (MAR) has an enterprise value of $85.5B, despite having only 8,785 hotels operating under MAR or affiliated brands. Each flag has an enterprise value of nearly $10 million. We performed the same calculations for other major players in the space.

2MC

Wyndham Hotels & Resorts (WH) is at the opposite end of the spectrum, with a higher number of flags (9280) relative to its enterprise value. Each flag is worth $894,000.

Sonesta is privately held, so it doesn’t have an enterprise value, but we can use the peer comparison above to restore its value.

Sonesta has 1,100 hotels in its portfolio and, like its peer groups, it owns both its own hotels and branded hotels, such as SVC’s 195 hotels. Most of the remaining hotels come from the 2020 acquisition of the Red Lion Hotel. The acquisition comes at a highly opportunistic time, as pandemic-induced financial pressures have allowed Sonesta to purchase a large hotel portfolio at fire sale prices.

In 2019, Red Lion’s stock price was between $10 and $15 per share, but the pandemic knocked it all the way down to its acquisition price of $3.50 per share.

S&P Global Market Intelligence

According to a press release on file with S&P Global:

“Red Lion’s board of directors unanimously approved the agreement, under the terms of which Sonesta will acquire RLH in an all-cash transaction valued at nearly $90 million. Red Lion shareholders will receive $3.50 per share in cash, a premium of 88% to the closing price on November 4 .”

Since the pandemic, hotel valuations have mostly rebounded to near pre-pandemic valuations, so in hindsight, Red Lion’s acquisition created considerable value.

In 2023, Sonesta’s revenue will be $360 million.EV/revenue multiples for other hotel brands range from Hyatt’s 2.8x to Hilton’s 6x

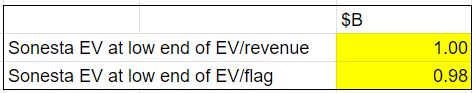

As a company managed by RMR, I suspect Sonesta will trade at the lower end of the valuation spectrum. Therefore, we would value it at 2.8x revenue using the revenue approach, or at the low end of $894k per mark using the markup approach. In each case, Sonesta’s value looks to be around $1B.

2MC

SVC owns 34% of Sonesta, with its stake valued at approximately $340 million.

Note that SVC has a market cap of $1.07B, so as far as I know this is a major value that is completely unrecognized.

Asset valuation

Updating the changes in liabilities and Sonesta to the sum of the parts valuation mentioned earlier, I estimate the asset value to be $9.35B. Subtracting $6.129B of debt, we get an equity value of $3.221B or around $19.40 per share.

That may seem crazy for a company trading at $6.48, but keep in mind that SVC has an asset cost basis of approximately $11B. It’s not unreasonable to think that assets purchased for $11B over the past few decades are now worth $9.35B.

The erosion of value was caused by a combination of difficult times for the hotel and general mismanagement by RMR.

SVC investment prospects

Investing in SVC is quite complex as it’s a mix of big issues and extreme value, with shares trading at around 1/3 of our calculated NAV.

Often, for a distressed company trading at such a discount, the solution is to sell the company. SVC could sell for well above $10 per share, which would provide investors with handsome returns. However, SVC’s management is deeply entrenched and has erected multiple layers of barriers to both hostile and friendly takeovers.

As a result, the normal path to achieving net asset value is blocked, leaving shareholders to rely on cash flow as a means of obtaining returns.

Cash flow is expected to be abundant. Even after adjusting for rising interest expenses due to refinancing cheap fixed-rate debt at over 8%, I expect the FFO/share run rate to still be around $1.50 per share. This FFO should be enough to drive a great dividend yield of 12.25%. Of course, being able to pay a dividend doesn’t guarantee they won’t cut it. My base case is a solid dividend, but I think it should be considered high risk.

Key drivers for the future

SVC is undergoing extensive hotel renovations. As these hotels resume operations, hotel EBITDA is expected to rebound. If a hotel’s EBITDA does not rise after much of the renovation is put back into service, this would be an early warning sign that something is seriously wrong.

Diversification is crucial for this type of investment

Although most of 2ND The Market Capital High Yield Portfolio is comprised of high-quality, well-managed companies, and I do believe that returns can be enhanced by allocating a small portion of assets to carefully selected distressed companies. The following is a basic summary of the selection process.

- Start with a company that is known to be flawed in some way

- Fully understand the extent to which deficiencies impact shareholder value.

- Look for situations where the market price discount is greater than the appropriate discount for a given defect.

I think Service Property Trust is one of those cases where more than 100% of the actual issues are priced in by the market. It’s an opportunity, but it’s riskier than regular equity.