isayildiz/E+ via Getty Images

investment thesis

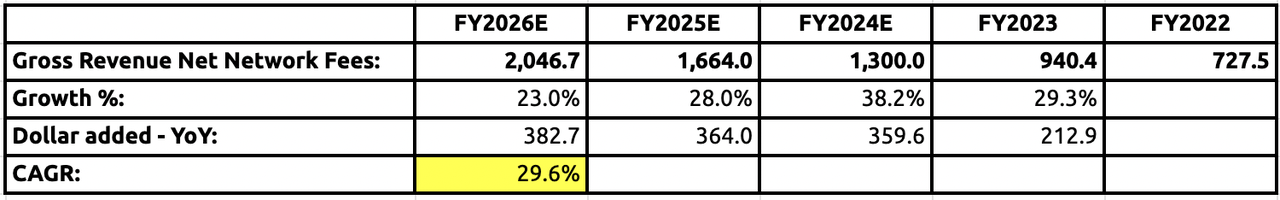

Shift4(NYSE: Four) offers fascinating investment opportunities, supported by its strong financial performance, innovative solutions and strategic acquisitions.With a proven track record of revenue growth, margin expansion and efficient cost management, Shift4 is poised for continued growth The growth rate of the dynamic payment processing field will reach 29.6% in the next three years. I believe Shift4’s premium is for good reason, and as such, I rate it a Buy.

About Shift4

Shift4 is a payments software company that generates revenue in two ways:

-

Offers convenient payment options to merchants in a range of industries, including restaurants, casinos, hotels and sports teams. This makes up the bulk of its revenue.

-

Merchants using the Shift4 POS system are charged a monthly subscription fee

finance

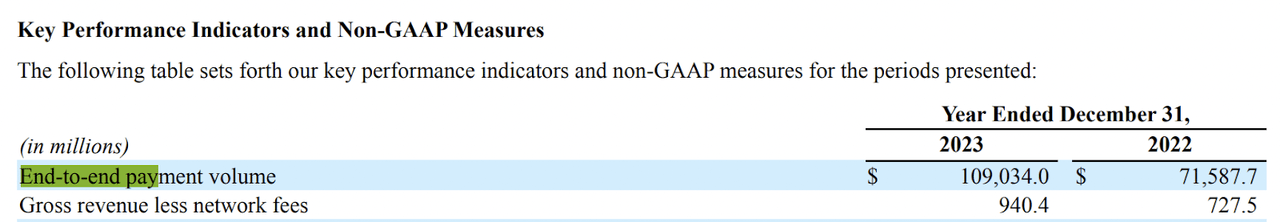

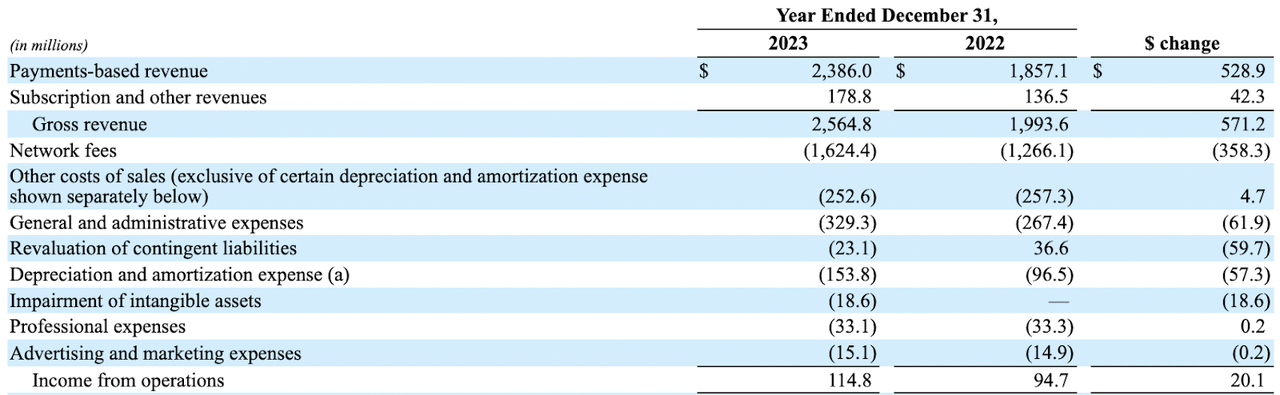

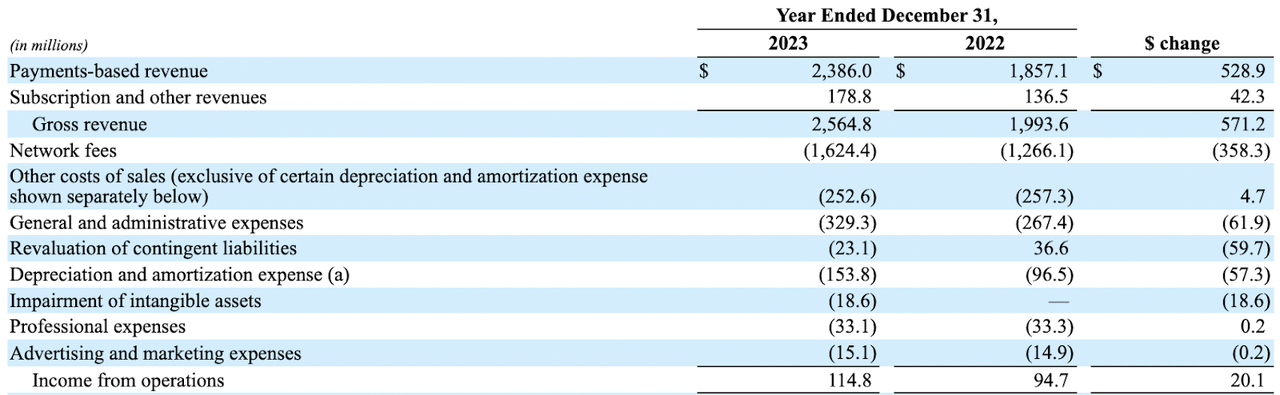

FY23 10-K FY23 10-K

In FY23, Shift4’s end-to-end payment volume increased by 52.3% annually. Reaching $109 billion, highlights the growing adoption of its payment processing solutions by merchants.especially in 4Q23 Earnings Conference Call, management reported corporate wins across multiple sectors, including sports and entertainment, hotels and resorts, and major sports teams and entertainment venues. This helped drive an increase in the volume of payments processed on the Shift platform, with payments-based revenue rising 28.5% year over year to $2.4 billion.

Additionally, Shift4’s recent acquisitions of Appetize and Finaro demonstrate successful integration and the realization of synergies. Appetize was strategically acquired by Shift4 to strengthen its presence in the sports and entertainment industry. Shift4 currently provides mobile commerce, point-of-sale (POS) and loyalty solutions to customers in the industry through its VenueNext technology. The integration of Appetize’s payment software solutions with VenueNext strengthens Shift4’s foothold in the sports and entertainment vertical, supporting a wider range of services and solutions. The purpose of acquiring Finaro is to expand Shift4’s influence in the European market.

On the other hand, subscription revenue increased 30.9% year-over-year to $178 million in fiscal 2023 due to the widespread adoption of the SkyTab POS system, which according to management, they installed more than 25,000 systems in 2023. SkyTab is the next generation POS system launched in November 2022, and by migrating customers from the legacy POS system, they are now reporting higher ARPU. Looking ahead to 2024, management aims to install 30,000 systems in the United States alone and 10,000 systems in Europe and Canada.

Overall, Shift4 experienced strong growth, with total revenue increasing 28.7% year over year to $2.6 billion. Even more impressive is that gross profit increased 46.3% year-on-year to US$687.8 million, exceeding revenue growth, resulting in a significant expansion of gross profit margin from 23.6% in fiscal 2022 to 26.8% in fiscal 2023. This remarkable achievement highlights Shift4’s exceptional efficiency in managing costs and ultimately enhances its profitability.

Profitability

FY23 10-K

Earnings before interest and tax in FY23 grew by 21.7%, which was lower than revenue growth. This resulted in the EBIT margin falling from 4.75% in FY22 to 4.48% in FY23. However, if we exclude $18.6 million in non-recurring intangible asset impairments in the fourth quarter of 2023 due to the discontinuation of certain internal projects, fiscal 2023 EBIT would have been $133 million, an increase of 40% year-over-year. Margin is 5.20%. This suggests that the company is demonstrating operating leverage, leading to margin expansion.

ARPU further expands, and revenue is expected to grow by nearly 30% in the next three years

Looking ahead, the recent acquisition of Appetize not only opens the door to new market segments for Shift4, but also drives ARPU growth through increased upsell and cross-sell opportunities across the combined customer base. The main driver of ARPU improvement is the widespread adoption of Shift4 payment solutions. As customers adopt more of Shift4’s products, ARPU will naturally increase, thereby increasing customer stickiness and improving overall unit economics.

3 years of revenue growth

Based on management’s lower-end guidance of $1.3 billion in total revenue for fiscal 2024, Shift4’s current growth trajectory indicates a high likelihood of achieving its nearly 30% growth target over the next three years, assuming consistent annual revenue increments. Assuming operating expenses remain stable, this growth trajectory suggests margin expansion is likely as we enter fiscal 2026.

balance sheet

As of fiscal 2023, Shift4 had $721.8 million in cash and $1.7 billion in long-term debt on its balance sheet. To measure its ability to manage debt, we have to evaluate its cash flow statement. In fiscal 2023, Shift4 recorded positive cash flow of $388.3 million. Given that it holds a large cash hoard, this underscores Shift4’s ability to pay down debt with ease while driving its growth plans.

Valuation

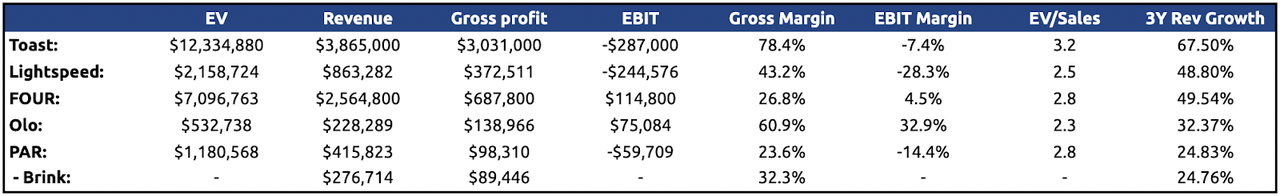

Author comments

When assessing Shift4’s valuation, utilizing the EV/Sales metric may provide a more appropriate comparison, especially considering that many of its peers are currently unprofitable. It’s worth noting that Shift4 is more expensive than similar products other than Toast. However, this valuation may be justified as Shift4 has demonstrated self-sustainability, higher growth rates, and higher profit margins. These factors emphasize the operational efficiency and scalability inherent in Shift4’s business model.

risk

Some risks include:

-

A highly competitive payment processing industry could undermine Shift4’s ability to compete for market share

-

Macroeconomic factors that may affect consumer spending patterns.

-

Corporate, systems and cultural challenges in integrating acquisitions can disrupt operations and impact financial results

in conclusion

Overall, Shift4 demonstrated strong financial performance, driven by its innovative payment processing solutions and strategic acquisitions. With significant growth in end-to-end payment volumes and subscription revenue, the company has solidified its position in multiple sectors including sports and entertainment, hospitality and retail. It is worth noting that Shift4’s efficient cost management is reflected in its significant growth in gross profit and profit margin. Looking ahead, the company’s continued focus on margin improvement, coupled with a strong balance sheet and positive cash flow, positions it for continued growth of 29.6% over the next three years. Finally, for the reasons stated above, I believe Shift4 is fairly valued and, therefore, give it a Buy rating.