Flory/iStock Editorial via Getty Images

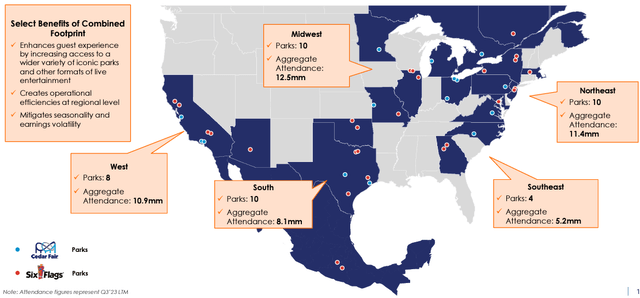

Six Flags (NYSE: Six) operates theme parks and water parks in the United States, Mexico and Canada. The company is seeking a partnership with Cedar Fair (NYSE: FUN), amusement parks, water parks and restaurants operator.In a merger proposed to close in the first half of 2024, Six Flags shareholders hope to have About 48.8% Cedar Fair shareholders own 51.2% of the new company. The new company will be called Six Flags, but will use Cedar Fair’s stock symbol.

Six Flags and Cedar Fair’s stock performance was relatively modest before the coronavirus outbreak completely disrupted the company’s operations. The stocks have been trading at lower levels as the pandemic disrupted earnings. Both companies have historically paid dividends, but as the pandemic spread, they stopped paying dividends to safeguard their financial health.During the Cedar Fair has resumed lower levels of dividend payments, but Six Flags has not yet done so.

Six ten-year stock charts (Seeking Alpha)

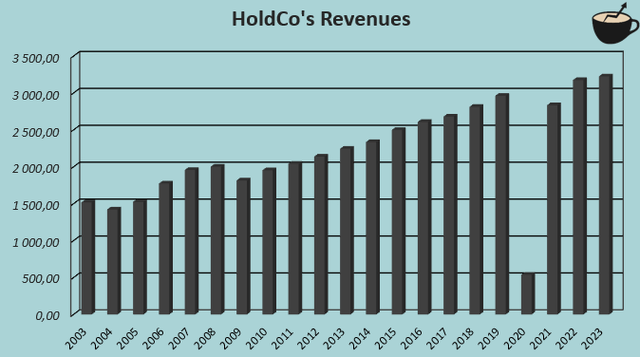

I previously wrote an analysis article about Cedar Fair, published on the 31stYingshi A Hold rating was assigned eight months before the merger announcement. Since then, the stock has posted a total return of 5%, slightly less than the S&P 500’s 15% appreciation over the same period.

My rating history for FUN (Seeking Alpha)

Comprehensive Financial Condition

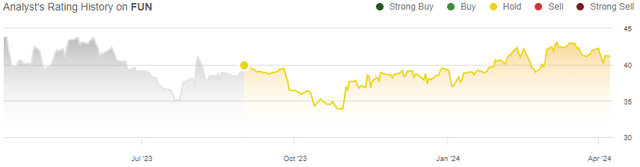

Massive coronavirus lockdowns have disrupted operations at Six Flags and Cedar Fair. As a result, the combined entity HoldCo’s revenue fell by -81.8% in 2020. However, revenue has recovered nicely since then, with HoldCo’s estimated CAGR from 2003 to 2023 reaching a respectable 3.8%. Much of the recent growth comes from Cedar Fair’s 5.9% compound annual growth rate from 2018 to 2023, while Six Flags’ revenue has stagnated during the same period. HoldCo’s total revenue in 2023 is $3.225 billion.

Author’s calculations using TIKR data

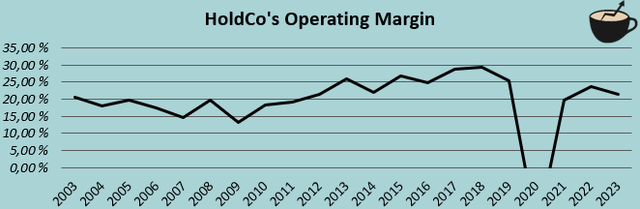

Both companies have strong operating margins, with HoldCo’s combined operating margins at 21.4% in 2023. That margin remains below pre-pandemic levels. However, the two companies expect significant synergies to emerge upon completion of the merger; profit margins are likely to increase as the merger synergies are realized.

Author’s calculations using TIKR data

Targeted synergies

Six Flags and Cedar Fair aim to create significant synergies through the merger. The companies expect that within two years of completion of the merger, they will realize $120 million in operating cost savings from corporate costs, advertising, IT, procurement and other operational efficiencies. In addition, the companies expect the improved product to generate $80 million in incremental EBITDA. Season pass and express lane programs are enhanced through the combined offerings, and the park’s offerings are enhanced through expanded combined intellectual property and improved food and merchandise offerings.

The overall target synergy of $200 million provides shareholders with huge profit potential – in 2023, Six Flags and Cedar Fair’s combined net income was only $164 million. While the synergies aren’t that huge compared to current operating income, the two companies’ hefty interest expenses take full advantage of the synergies’ value to shareholders.

Comprehensive geographical footprint (Cedar Expo and Six Flags amusement park combined display)

A number of complementary theme park locations offer opportunities to enhance combined offerings. Nonetheless, I think some caution about the $200 million total synergies target is warranted – the $80 million in incremental EBITDA from enhanced products appears to be based on a number of assumptions and may prove to provide less benefit than currently expected.

Comprehensive valuation: synergies bring upside potential

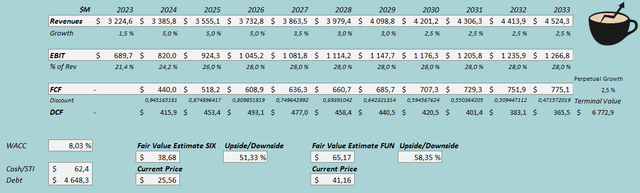

To estimate the fair value of the stock, I built a discounted cash flow model combined with financial information. In the DCF model, I estimate that with the synergy of sales, the growth will be quite good, with revenue growing by 5% from 2024 to 2026. After that, I estimate growth will slow, first to 3.5% and then gradually move into a permanent growth rate of 2.5%. The compound annual growth rate from 2023 to 2033 is 3.4%, which is quite consistent with the company’s long-term growth rate.

I also expect good profit leverage from $120 million in cost synergies – ultimately, as synergies are realized, I expect the combined company’s EBIT margin to increase from 21.4% in 2023 and 21.4% in 2024. 24.2% rose to 28.0%. The company should have pretty good cash flow conversion, although growth should take up some capital investment. Six Flags also paid out minority interests, with $47.5 million due in 2023. In my DCF model, I estimate that minority interests worsen the new firm’s cash flow conversion. Six Flags’ special dividend of $1.00 per share has been added to the stock value and deducted from the combined company’s cash balance.

Based on the above estimates and a cost of capital of 8.03%, the DCF model estimates a fair value of $38.68 for Six Flags stock and $65.17 for Cedar Fair stock. Cedar Fair stock appears to have slightly more room for upside, about 58%, assuming Six Flags holds 48.8% and Cedar Fair holds 51.2%. Both stocks appear to be significantly undervalued due to anticipated synergies, with Cedar Fair trading slightly better at its current share price.

discounted cash flow model (Author’s calculations)

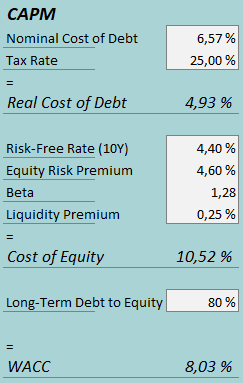

The weighted average cost of capital used is from the capital asset pricing model:

capital asset pricing model (Author’s calculations)

Six Flags Cedar Expo’s consolidated interest expense was $76.4 million in the fourth quarter of 2023. Based on the company’s current amount of interest-bearing debt, Six Flags’ annual interest rate is as high as 6.57%. The company has a heavy debt load; therefore, I estimate the long-term debt-to-equity ratio to be as high as 80%. Both companies plan to deleverage their balance sheets post-merger, but I think deleveraging will take quite some time.

For the risk-free rate in terms of cost of equity, I use the U.S. 10-year Treasury bond yield of 4.40%. The equity risk premium calculated by Professor Aswath Damodaran is 4.60% latest estimate United States, updated on the 5thth January. Six Flags’ five-year beta is currently estimated to be very high, which I believe is largely due to the severe impact Six Flags has suffered from the COVID-19 pandemic.In pre-pandemic markets, company betas were estimated 1.28, which I reckon is a fairer assumption. Cedar Fair is currently in beta is 1.42 That’s pretty close to Six Flags’ pre-pandemic levels, according to Yahoo Finance, but I’m using an estimate of 1.28. Finally, I add a small liquidity premium of 0.25%, yielding a cost of equity of 10.52% and a WACC of 8.03%.

take away

Six Flags and Cedar Fair are looking to complete a merger of the two companies. The combined holding company will have a history of sustained moderate growth and strong profits, and will have room to achieve good growth by expanding profits through enhanced product and cost synergies. While the $200 million total synergy target should be viewed with some criticism at the moment, I believe the synergies offer shareholders significant upside. The DCF model estimates that both stocks currently have good upside potential, although Cedar Fair appears to be the slightly better deal at its current share price. Currently, I have a Buy rating on both stocks.