Designer 491

I introduced it last time SPDR Bloomberg Short-Term High Yield Bond ETF (NYSE:SJNK), a short-term high-yield bond ETF launching in late 2022. In that article, I argued that SJNK’s good and growing yield and low interest rate risk made the fund a buy. SJNK Since then, the index has significantly outperformed broad bond indexes and slightly better than those focused on high-yield bonds. Dividend growth was also strong, with the yield rising to 7.3%. SJNK’s fundamentals remain strong, so the fund remains a buy.

SJNK – Basics

- Investment Manager: State Street Bank

- Related indices: Bloomberg U.S. High Yield 350 Million Cash Payouts 0-5 Years 2% Capped Index

- Dividend yield: 7.32%

- Expense ratio: 0.40%

- 10-year compound annual growth rate: 3.59%

SJNK – Overview and Analysis

Indexes and Portfolios

SJNK is a simple short-term high yield bond index ETF that tracks Bloomberg US High Yield 350 Million Cash Payment 0-5 Years 2% cap index. It’s a simple, if somewhat wordy, index that includes all short-term U.S. dollar-denominated high-yield corporate bonds that meet basic inclusion criteria. It is a market capitalization weighted fund with an issuer cap of 2% to ensure diversification. To me, the index doesn’t mean anything else.

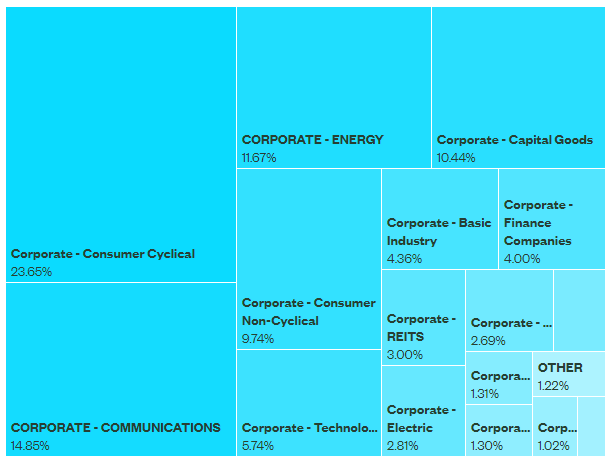

SJNK is a fairly diversified fund, investing in nearly 2,000 bonds from all relevant industry sectors. Concentration is also quite low, with the issuer accounting for only 2.0% of the portfolio, while the top ten issuers account for approximately 9.3% of the portfolio.

SJNK

SJNK appears to be as well diversified as most high-yield bond ETFs. For example, the largest high-yield bond ETF and industry benchmark, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), invests in only 1,200 bonds, significantly fewer than SJNK. Industry risks are comparable. HYG Do Long-term bonds are held, which provides its own diversification. Industry risks are comparable.

SJNK is much less diversified than most broad-based bond index ETFs, including the largest of them, Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ: BND ). BND invests in more than 10,000 bonds, more than 5 times that of SJNK, and invests in multiple bond sub-asset classes, including Treasury bonds, corporate bonds and municipal bonds. SJNK only holds high-yield bonds.

Overall, SJNK appears to be diverse enoughbut lower than broader bond ETFs.

Credit risk analysis

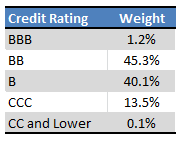

SJNK focuses on the short term high yield Bonds, mostly issued by weaker companies with lower credit ratings. details as follows:

SJNK – Author table

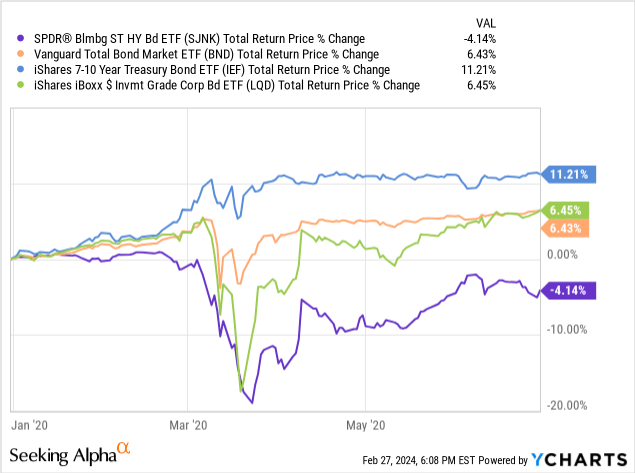

The underlying assets held by SJNK have higher-than-average default rates, which depend in part on underlying economic conditions. During downturns and recessions, default rates should spike, leading to higher-than-average losses. For example, SJNK lost nearly 20% in the first quarter of 2020 during the outbreak of the coronavirus pandemic.The loss is a lot of Higher than investment grade bonds and Treasuries. The losses were also short-lived, with the fund recovering from most of its losses in the second quarter of 2020.

Data comes from YCharts

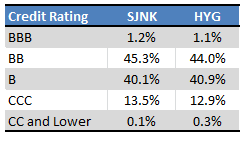

SJNK’s credit quality appears to be comparable to HYG and most other high-yield corporate bond ETFs.The credit quality is weaker Riskier issuers are generally forced to issue short-term debt/investors are unwilling to extend longer-term credit to riskier issuers than in previous years. It’s unclear what prompted the change, but credit quality does appear to have improved.

Fund Filing – Form by Author

Overall, SJNK’s credit quality is poor, which is detrimental to the fund and its shareholders.Credit quality seems to be poor overly Pretty weak, so that’s not a deal breaker for me. More risk-averse investors may disagree.

Interest rate risk analysis

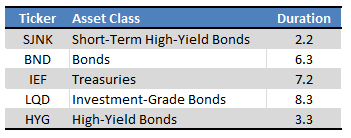

SJNK focuses on short term High-yield bonds have short maturity and short duration. The fund itself has a duration of just 2.2 years, which is significantly lower than the average bond and slightly lower than the average high-yield corporate bond.

Fund Filing – Form by Author

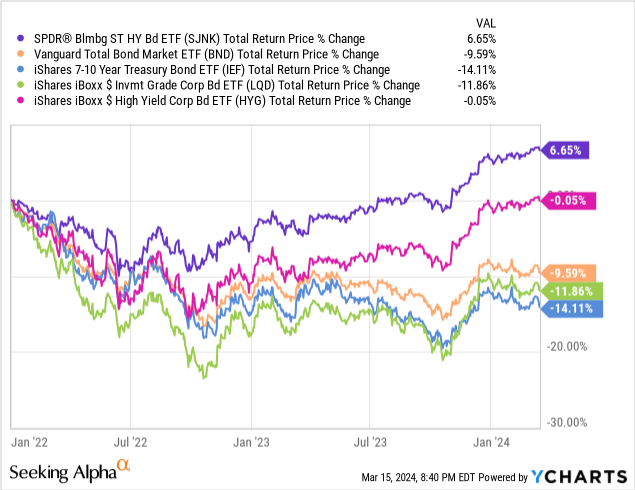

For the reasons stated above, the fund should perform significantly better than most bonds and slightly better than high-yield bonds when interest rates rise, as has been the case since early 2022.

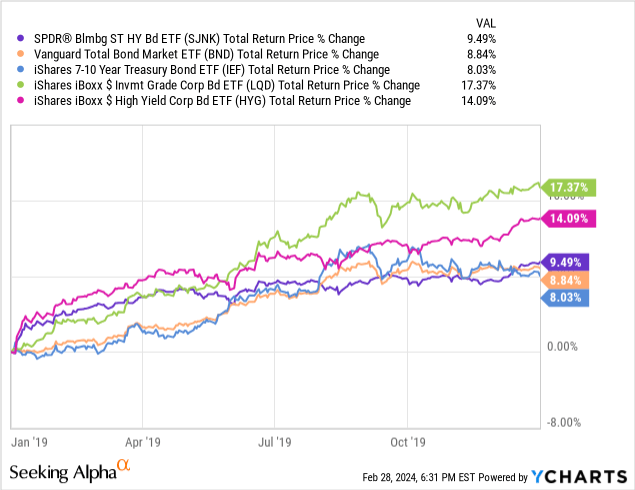

SJNK should It underperforms when interest rates fall, but much depends on the exact magnitude and timing of any potential rate cuts. Other issues, including dividends and default rates, also play a role. Excluding the impact of the epidemic, the last time rates fell was in 2019, during which SJNK’s performance was about average. Broader corporate bond indexes and ETFs outperformed the SJNK, including those focused on investment-grade and high-yield corporate bonds.

Data comes from YCharts

Considering the above, SJNK is no Once the Fed starts cutting interest rates, it is bound to perform poorly. A large rate cut will almost certainly lead to underperformance, while a small rate cut may not.

Dividend analysis

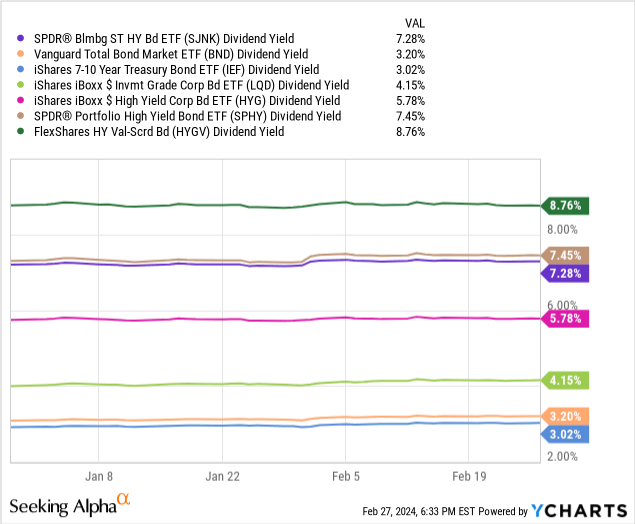

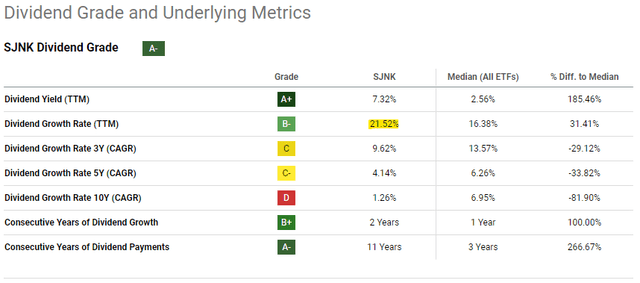

Riskier bonds tend to have higher yields, and SJNK’s underlying bonds are no exception. SJNK itself yields 7.3%, a strong number in absolute terms and significantly higher than most bonds and bond sub-asset classes.

SJNK produces more than most High-yield corporate bond ETFs, including benchmark HYG, but there are many exceptions, including the SPDR Portfolio High Yield Bond ETF (SPHY) and the FlexShares High Yield Value Score Bond Index Fund ETF (HYGV).

Data comes from YCharts

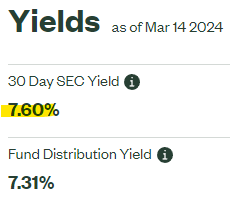

SJNK’s dividends are fully covered by underlying income, as evidenced by the fund’s 7.6% SEC yield.

SJNK

SJNK’s dividend depends on a variety of factors, but Fed policy and default rates are key.

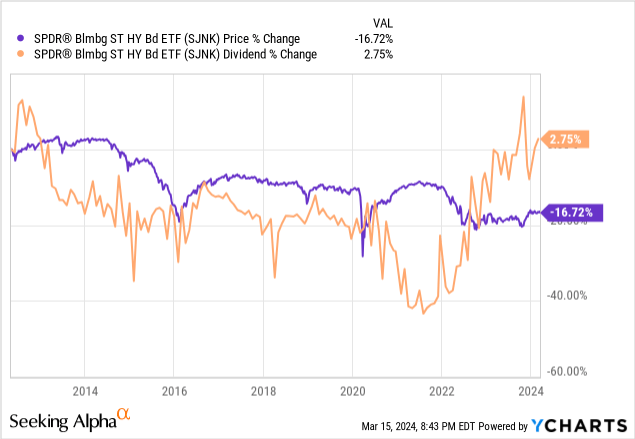

Default means a reduction in the fund’s income and assets, and the higher the default rate, the greater the impact on both.High-yield corporate bonds have higher-than-average default rates, so these should This resulted in a steady decline in the fund’s share price and revenue.Most bonds do pay off in full without issuance, even the riskier high yield bonds, so I wouldn’t expect important However, decline. SJNK shares have fallen 16.7% since its inception more than a decade ago, largely in line with expectations. Dividends have been flat but have been trending downward for most of the fund’s life.

Raising interest rates by the Federal Reserve typically causes interest rates on most bonds to rise, including the high-yield corporate bonds SJNK invests in. Dividend growth has been very strong over the past few years, thanks to the recent series of rate hikes. The above increases actually offset previous dividend cuts/defaults. Long-term growth is even more subdued because interest rates have been falling for much of the past decade.

Seeking Alpha

On a more negative note, SJNK’s dividend should decline in the coming years as the Federal Reserve cuts interest rates. It should take months for the Fed’s rate cuts to materialize, months for dividends to start declining, and several years for the final process to materialize.

In my opinion, SJNK’s dividend is high enough to withstand several rate cuts, especially considering that these will affect most other bonds as well. For example, even if the Federal Reserve cuts interest rates by 1.0% – 2.0%, the yield of 7.6% will still remain at a fairly high level. Higher cuts will obviously have a bigger impact, but so should other bond funds.

Performance Analysis

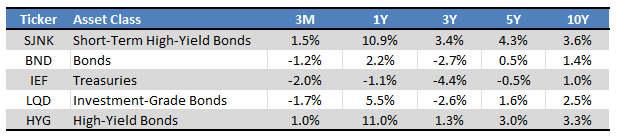

SJNK’s track record is pretty good, but there are some caveats.

Long-term returns have been low because interest rates have been low for much of the past decade.

Returns have increased significantly in recent years as interest rates have largely stabilized at higher levels.

Except during economic downturns and recessions, returns tend to be above average.

The return result is as follows:

Seeking Alpha – Author Form

Going forward, SJNK’s returns will depend on Fed policy and underlying economic conditions. I expect returns to be higher than the 3.6% CAGR of the past decade, as interest rates are much higher now than they have been in the past, and it seems unlikely that ZIRP will return, at least in the short term. However, during downturns and recessions, or when the ZIPR returns, returns will be significantly lower.

SJNK – Alternative

Finally, wanted to quickly take a look at some alternatives to SJNK.

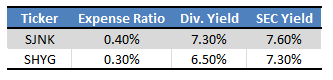

The iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is broadly similar to SJNK. The fee is lower at 0.30%. The dividend yield is also lower at 6.5%. The SEC yield is only slightly lower at 7.3%. Performance has been very similar since its inception. SHYG and SJNK seem to be roughly similar choices, at least to me.

Fund Filing – Form by Author

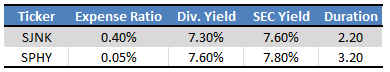

SPHY is a high-yield corporate bond ETF. The fees are much lower at 0.05%, the lowest in the industry. The dividend and SEC yield are higher at 7.6% and 7.8% respectively. The duration is longer at 3.2 years. SPHY tends to outperform SJNK, except during periods of rising interest rates. Looking at the internet, I think SPHY is a slightly stronger investment than SJNK, mainly because of the lower fees.

Fund Filing – Form by Author

in conclusion

SJNK’s strong 7.3% dividend yield and solid fundamentals make this fund a buy.