Andrei Zhuravlev

SLV’s breakthrough

The goal of this article is to A) analyze the iShares Silver Trust ETF (NYSE: SLV) finally broke out of the multiple consolidation pattern, and B) analyzed the fundamental forces that could support higher prices.

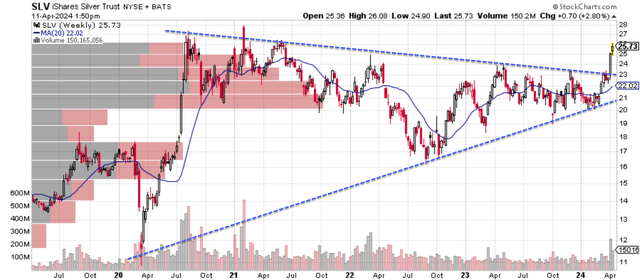

I Start with the technical signs first. The chart below shows SLV’s weekly price action over the past five years. As shown, the fund has been trapped within a consolidation window, or more specifically, within the narrow wedge shown by the two dotted blue lines. Over time, as shown in the chart, the range becomes narrower, suggesting a breakout is more likely as the balance of buying and selling pressure becomes increasingly more delicate.

To me, the price action over the past few weeks clearly indicates that SLV has finally broken out Upward wedge. The fund is currently well above the upper limit of the wedge, and more importantly, as can be seen from the horizontal volume price bar, the maximum volume over the past five years has been between $20 and $21. The current price is definitely higher than this range.

In addition, my experience is that the longer the consolidation period drags on, the greater the room for upside once a breakthrough occurs. In the case of SLV, the consolidation lasted at least five years, which is quite long in my opinion.

Next, I will move on to discuss the fundamental forces that could support further price gains. These fundamental forces include silver’s supply and demand dynamics and mintage rates.

Source: StockCharts.com

SLV ETF: A quick introduction

Before we dive in, a quick introduction to the ETFs themselves, in case readers are unfamiliar. SLV is the largest physically-backed silver ETF that I know of. As the chart below shows, its assets under management (“AUM”) are $12.3 billion, far more than similar products such as the Aberdeen Physical Silver Equity ETF (SIVR) and the Sprott Physical Silver Trust (PSLV). Please note that PSLV is a CEF (closed-end fund). Its expense ratio is 0.50%, which is higher than SIVR (0.30%) but lower than PSLV (0.60%).

Therefore, my suggestion is that SLV is best suited for frequent trading. For those who trade frequently, better liquidity and tighter trading spreads can justify its higher expensive ratio. However, for buy-and-hold investors (such as myself), SIVR is a better option because of its lower fees.

Seeking Alpha

Silver: Demand Outlook and Production Costs

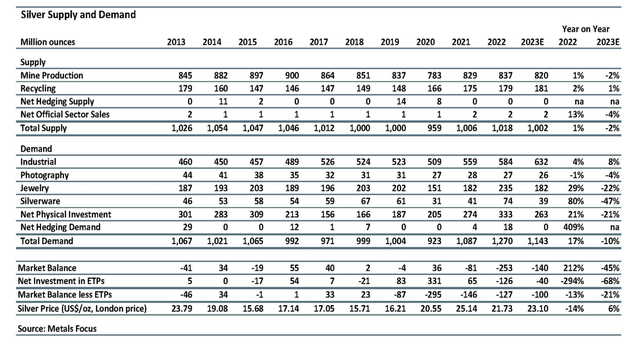

Silver has been the currency and store of value for much of our civilization. In modern times it has retained this role. As the chart below shows, a significant portion of global silver demand remains earmarked for jewelry (a form of store of value) and net investment.

However, significant use of silver is now in the industrial sector, as shown in the chart below. Among its industrial uses, According to forecasts, the main driving forces are expected to come from the following areas Silver Research Institute Report:

…The main driver of this growth is a strong green economy, including investment in photovoltaics (“PV”), grids and 5G networks, as well as increased use of automotive electronics and supporting infrastructure. Improvements in photovoltaics are particularly notable as battery production growth outpaces silver savings, helping to drive rising electronics and electricity demand.

With the rapid expansion of technologies such as photovoltaics, 5G and electric vehicles, I expect silver demand to surge rapidly.

At the same time, I think supply has been struggling to keep up, and current silver prices are quite low compared to production costs. As shown in the chart below, aggregate demand has been exceeding aggregate demand since 2021, and the gap is getting wider. Silver’s production costs are difficult to determine and vary from miner to miner.I’ll quote some people’s figures miner Just to provide a reference point:

Production costs may vary Much depends on many factors such as mine location and efficiency, ore grade, by-products versus primary metals, etc. Taking these changes into account, Endeavor Silver’s all-in sustaining costs (“AISC”) are expected to be in the range of $22-$23 by 2024 (based on an ounce of silver).

As of this writing, the current price of silver is around $28, which I don’t think is much higher than the cost of production given surging demand, supply shortages, uncertainty about production (worker strikes, geopolitical conflicts, etc.), and the cost of production. Ongoing inflation tends to drive up production costs.

Source: Metal Focus

mental proportions

Finally, another catalyst that could support SLV price growth involves mintage, suggesting that now is indeed a good time to trade silver and gold. My previous article covers this concept in detail, focusing on:

The trade simply involves selling a certain amount of gold to buy silver when the price of silver becomes more attractive relative to the price of gold, or vice versa. A key indicator for assessing which metal is more attractively priced is the so-called Mintage Rate (“MR”) or the Gold-Silver Price Ratio (“GSPR”).

The current MR is about 90 times, as shown in the figure below. To put the situation into perspective, over the long term, the average MR is only around 64.9, well below the current level of 90x, indicating that silver prices are very favorable relative to gold.

Seeking alpha data.

Risks and final thoughts

Investing in SLV carries risks common to all commodity funds. The SLV ETF does not generate any cash flow or dividends. The fact that it costs money to store and insure physical silver bars and thus generate negative cash flows is reflected in SLV’s relatively high fees (especially compared to index stocks in bond ETF funds). In addition, the IRS considers ETFs backed by physical precious metals such as SLV (and SIVR) to be tax collections. Therefore, capital gains on SLV (even long-term gains) may be taxed at a higher rate than other investments, such as stocks or bonds.

All in all, I think the upside potential under current conditions could easily overcome the above issues and deliver healthy returns. Looking back, I see strong technical signs of a price breakout for SLV and fundamental catalysts supporting a significant price increase. The fundamental catalysts are a potential surge in demand for silver from industrial uses, a supply/demand imbalance, and a very favorable mintage ratio.