Shahrir Maulana

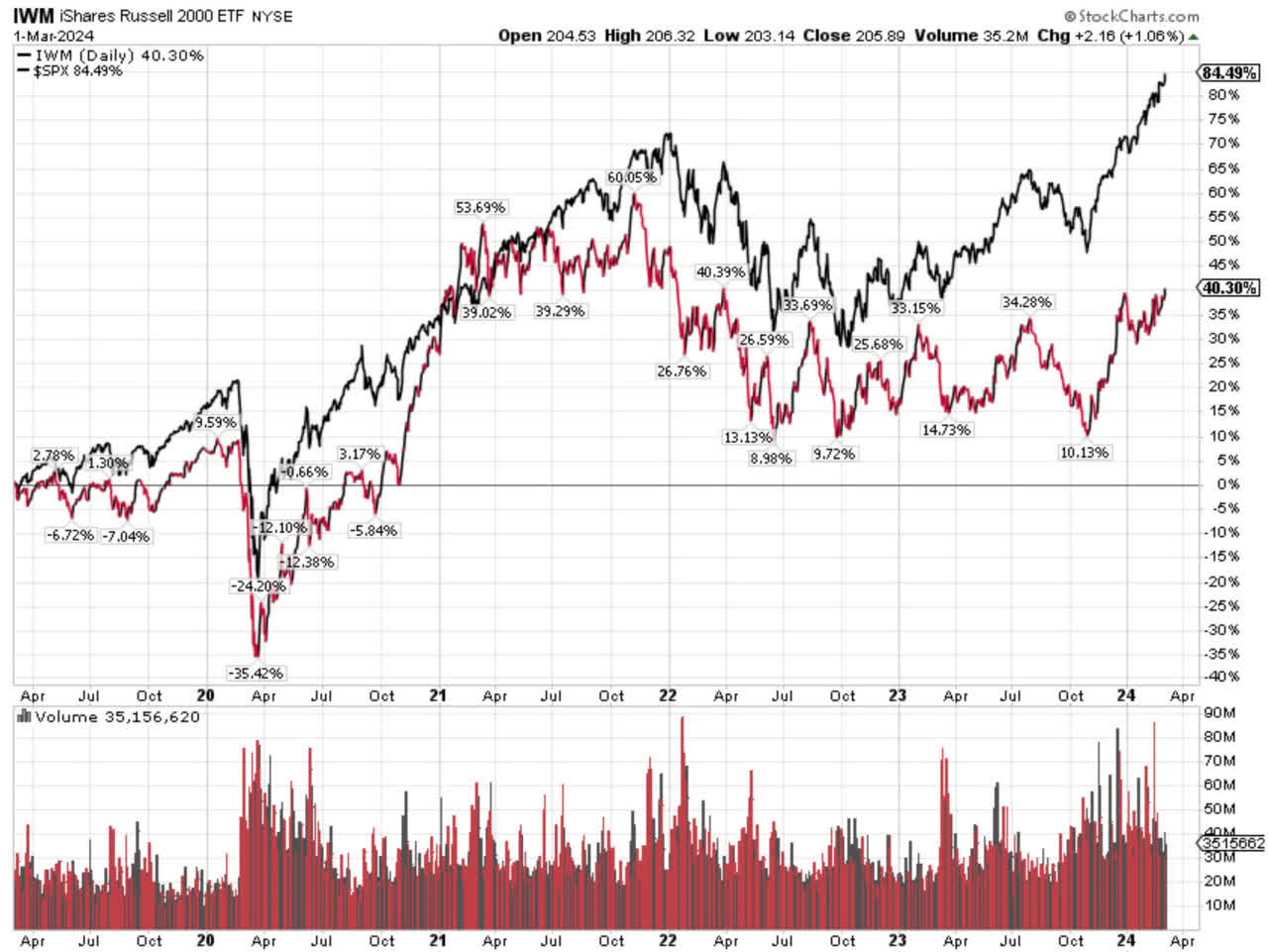

Why did I say “violence”? Because that’s what the Russell 2000 Index is doing. Small-cap indexes dance to their own drummer. It may rise when other indices fall and vice versa.

Recently, it has Already lagging far behind, if we avoid a recession – which is a very big “if” in 2024 – the index could rebound strongly.

Small-cap stocks are hit hardest during recessions and tend to rebound the most during recoveries. If we don’t have a recession and the small-cap index gets hammered (as it did in 2022 and 2023), then the recovery that the index saw in the second half of 2023 should continue into 2024, or so the theory goes.

Charts are provided for illustration and discussion purposes only.Read the big reveal at the end of this review.

The stock market is doing well beneath the surface. We continue to see some overheating in the tech sector, so investors are turning to large-cap and small-cap stocks.

The index traded sideways before starting to move higher. I know what a bubble looks like because I lived through it in 1999 and 2000.

The action we are seeing today can only be characterized as retrenchment and is far from a bubble. No, the valuation isn’t cheap, but it doesn’t reflect an economy emerging from recession, either.

Charts are provided for illustration and discussion purposes only. Read the important reveal at the end of this review.

Since we haven’t seen a recession during this cycle, these indexes have never been in the doldrums, but they certainly have room to move higher if the economy holds steady in 2024 and the Fed cuts interest rates.

Economic data have continued to be weak in recent years, and it is unclear whether the largest monetary tightening in 40 years will cause greater damage to the U.S. economy.

The Fed’s monetary policy is now restrictive, so all you have to do is subtract inflation from the federal funds rate and you’ll see that we’ve entered positive return territory. The same is true for many market-driven interest rates.

I don’t think the upside surprise in January’s inflation will stick, nor will the upside surprise in the jobs report in the same month.

Companies tend to raise prices in January, and they also hire heavily at the beginning of the year, making forecasting inflation and employment based on January data more difficult than usual. That puts additional burden on Friday’s February jobs report, which needs to provide a clear picture of the employment situation.

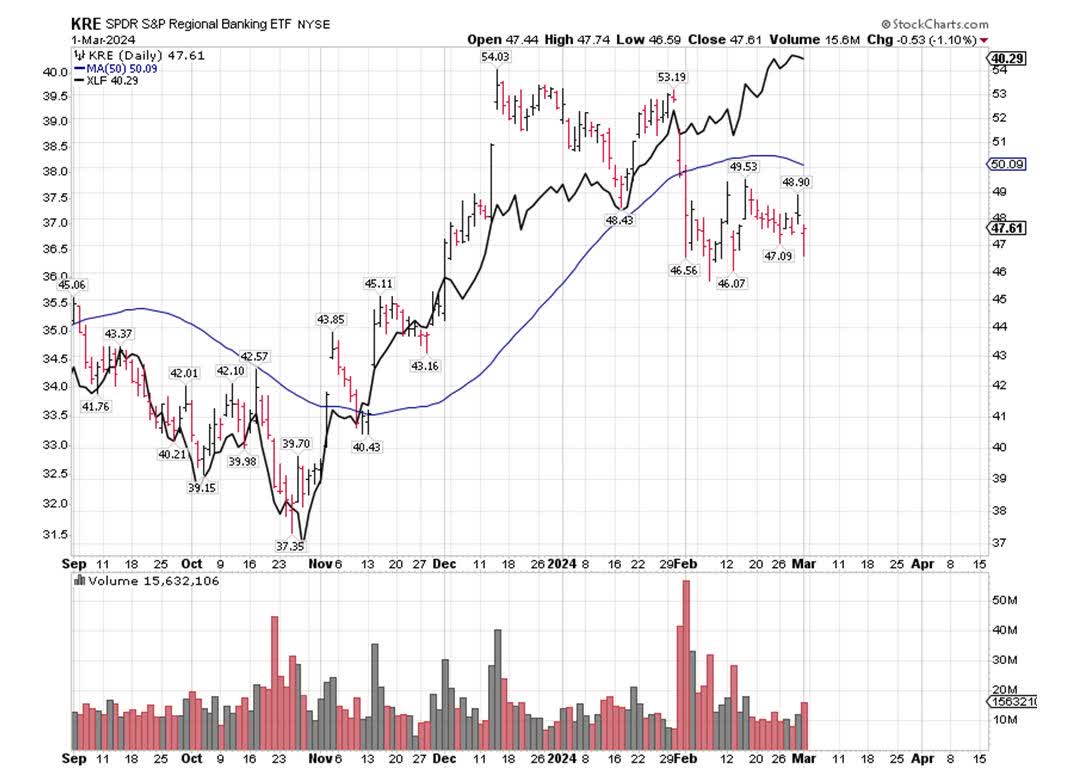

There will certainly be a correction in the stock market, but it’s not yet clear why. The trigger last year was the collapse of Silicon Valley banks around this time of year. A 3-5% selloff could happen at any time, but could also come from higher levels.

Charts are provided for illustration and discussion purposes only. Read the important reveal at the end of this review.

New York Community Bank (NYCB) has left investors with a bad feeling this year, as has the entire regional banking industry as investors are unsure whether more opportunities are out there, especially given the problems with commercial real estate, which is headed by Regional banks provide funding.

As the big banks’ share prices continue to rise, regional banking has declined this year. It’s clear to me that investors sell regional banks first and ask questions later, insisting on the safer major banks.

All opinions expressed above represent the opinions of Ivan Marchev of Navellier & Associates, Inc.

Disclaimer: please click here For important disclosures, please see the “About” section of the Navellier & Associates profile accompanying this article.

Reveal: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s note: Highlights of this article’s summary were selected by Seeking Alpha editors.