Scott Olson/Getty Images News

Amid a surge in tech stocks this year, one major social media company has shown clear resistance: Snap Inc.NYSE: SNAP), maker of the disappearing messaging app of the same name.Company coverage founded by Evan Spiegel The past few quarters have been marked by a series of problems, including slowing user growth, declining advertiser interest and sharply rising infrastructure costs.

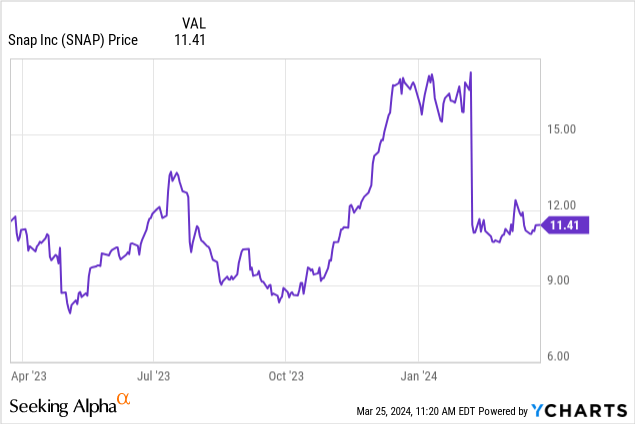

While most other tech companies are up more than 20% so far this year, Snap’s shares are down nearly 30%:

No time to go into details yet

I last wrote a bearish article on Snap in December, when the stock was trading near $17 a share. The company has since reported dismal fourth-quarter results, sending its stock price tumbling. I do think Snap has residual value, but we’re not quite there yet.I’m still determined bearish At least at the current level.

Here’s a reminder of the core risks I see with this company:

- DAU growth slows, especially in the U.S. Snap’s user base continues to grow at a slow pace, and much of that growth is driven outside the United States, where ad revenue is much lower. Meanwhile, in the United States, the user base has become almost flat.

- Social media is fashion driven. What’s more, Snap is always at risk of newer, more immediate platforms like TikTok taking share of eyeballs and stealing users away, perhaps permanently. Snap doesn’t have the messaging/connecting with old friends appeal of Facebook and Instagram, so it’s at risk of becoming obsolete.

- Infrastructure costs are soaring. As we’ll discuss in more detail in the next section, Snap’s investments in machine learning have significantly increased server costs, which has hit gross margins and overall profitability.

At least there’s good news: With its stock price shrinking dramatically this year, Snap isn’t that expensive anymore; in fact, it’s approaching value territory. The stock price is currently close to $11, and Snap has a market capitalization of $18.83 billion.After we subtract the $3.54 billion in cash and $3.75 billion in convertible debt that Snap had on its most recent balance sheet, the company’s net result is Enterprise value is US$19.04 billion.

At the same time, Wall Street analysts predict that the company’s revenue will reach $5.24 billion this fiscal year, an annual increase of 14%. Note that this is a pretty aggressive forecast considering Snap exits the fourth quarter of 2023 with 5% annual growth. It essentially relies on continued DAU growth to deliver stable impressions, but also on Snap’s investments in advertiser improvements to drive a resurgence in advertiser demand.

However, if we take these estimates at face value, Snap is trading at 3.6x EV/FY24 revenue. I’m not a buyer here yet, but if Snap drops to 3x revenue, that would mean a price target of $9.50 This is approximately 17% lower than current levels. This is also roughly where Snap was trading in the middle of last year before rebounding in late 2023 (for no good reason).

All in all, Snap remains a story worth watching. Currently, there are more risks than opportunities, especially at levels around $11. Avoid here for now and invest elsewhere.

Season 4 download

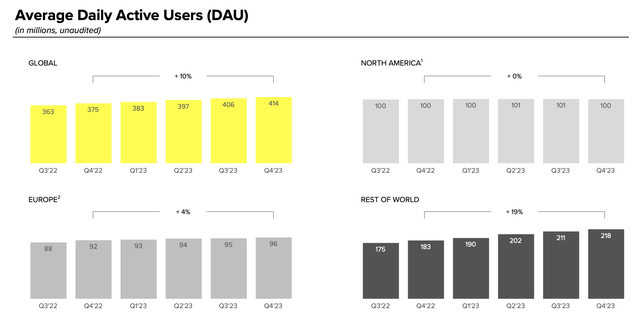

Now let’s take a closer look at Snap’s latest quarterly results. The DAU (Daily Average Users) trend is shown in the chart below:

Snap DAU (Snapshot of fourth-quarter earnings deck)

In the fourth quarter, the total number of DAU increased by 10% year-on-year, with 8 million new users added continuously; however, almost all growth came from the “rest of the world” segment, which increased by 19% year-on-year.Meanwhile, year-over-year trends in North America were flat, and the company actually lost Compared to the user order in Season 3. It’s also worth noting that the company’s DAU target for the first quarter was only 420 million, which means net new users were only 6 million (compared to 8 million in the previous quarter and 8 million in the fourth quarter).

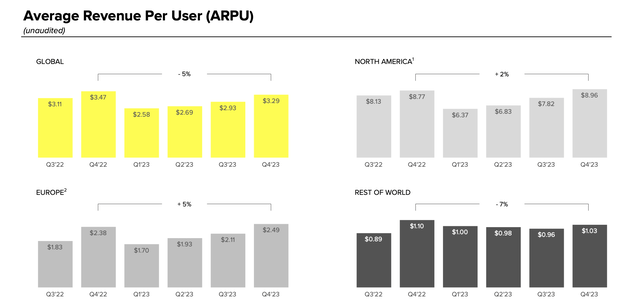

Snap faces a similar problem to many other social companies, from tiny Pinterest (PINS) to large Meta (META) – an oversaturated social media user base in the United States. At the same time, this is a risk because North American ARPU (average revenue per user) is about $9, which is about 9 times that of users in the rest of the world and 3-4 times that of users in Europe:

Fast ARPU (Snapshot of fourth-quarter earnings deck)

Snap’s ARPU decreased -5% year over year to $3.29 due to an unfavorable shift in user mix to the rest of the world and lower advertiser rates in the rest of the world. Snap’s overall revenue was $1.36 billion, up only 5% year-over-year, two percentage points shy of Wall Street’s forecast of $1.38 billion (up 7% year-over-year), leading to weak sentiment on the stock.

The company has a strong focus on improving the advertiser experience to achieve better results. CEO Evan Spiegel stated in his fourth-quarter shareholder letter:

First, we are continuing to develop our machine learning models to improve return on ad spend for our advertising partners. For example, we implemented machine learning ranking and optimization improvements in Q4 for app, web, and Dynamic Product Ads (DPA) optimization goals. Additionally, continued momentum in our 7-0 Pixel purchase optimization model resulted in more than 90% year-over-year growth in purchase-related conversions. We’re excited to see these improvements deliver results for advertisers. For example, James Allen, a fast-growing online retailer specializing in diamonds and bridal jewelry, ran a successful marketing campaign on Snapchat using Snap ads and our performance-driven 7-0 optimization feature. The campaign exceeded the brand’s expectations, reducing CPA by 18%, improving ROI by 67%, and demonstrating efficiency and strong return on investment. Additionally, leading independent advertising agency PMG conducted 7-0 testing on six leading retailers and found that 7-0 optimization improved ROAS by over 85% on average and reduced cost per site visit by 25% compared to baseline performance.” .

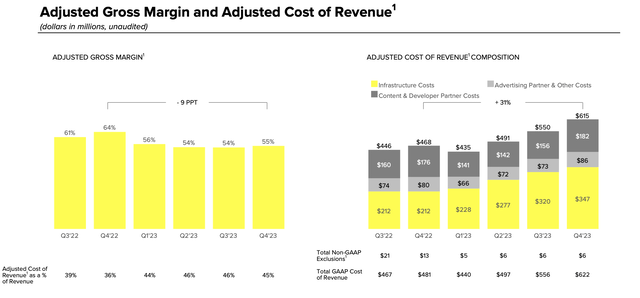

Instead, these investments in machine learning to improve advertiser performance have led to skyrocketing infrastructure costs: As the chart below shows, infrastructure costs continue to grow Increased 64% year-on-year to US$347 million. or 26% of income:

Snapshot cost (Snapshot of fourth-quarter earnings deck)

At the same time, total costs as a percentage of revenue rose 9% to 45% due to a sharp increase in infrastructure costs.

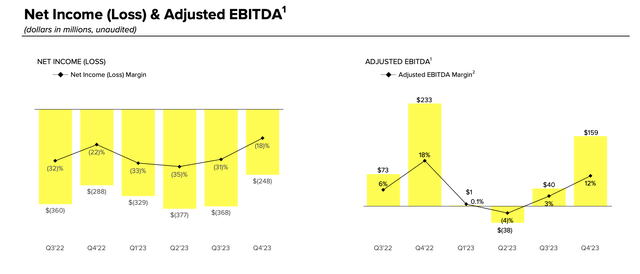

As a result, as shown below, Snap saw Adjusted EBITDA decreased by -29% year-on-year To $159 million, or 12% of revenue, adjusted EBITDA margin fell 6 percentage points.

Quickly adjust EBITDA (Snapshot of fourth-quarter earnings deck)

focus

There’s a good reason why Snap’s stock price is down about 30% this year due to poor user growth, weak advertising performance, and declining profitability. In my opinion, it’s best to wait until Snap drops below $10 before considering buying it.