Monty Rakusen/DigitalVision via Getty Images

I discuss my bullish view on Snowflake (NYSE:SNOW) endorsed their approach to disruptive data analysis and machine learning on siled data in a June 2023 launch article.I still believe snowflakes can continue to expand Their data cloud capabilities provide support for data sharing, analysis, and market launch. I reiterate a “Strong Buy” rating and a one-year price target of $229 per share.

Big customer data cloud growth

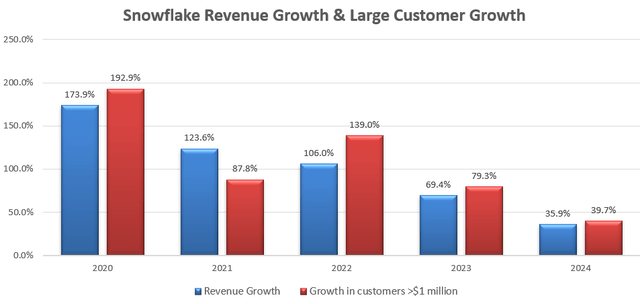

Snowflake provides a single, self-managed and programmable platform to manage data clouds across different cloud services. As shown in the chart below, Snowflake’s revenue has grown by 35.9% in the past 12 months, and the total number of large customers with product revenue of more than $1 million has grown by 39.7%.

Snowflake 10Ks

Growth in the number of large customers is key to Snowflake’s long-term growth prospectus I think the industry is increasingly adopting data cloud and analytics. Enterprises are investing heavily in artificial intelligence workloads, as evidenced by the explosive growth of Nvidia-powered GPUs (NVDA) and AMD (AMD). Science and technology goals It is believed that enterprises are putting machine learning at the center of their business models, and artificial intelligence technology can be used for numerous use cases, including recommendation engines, fraud detection, customer analytics, financial transactions and virtual assistance. All of these use cases require data clouds and data analytics to support the associated AI models. I think the structural growth of artificial intelligence will continue to drive strong business growth for Snowflake in the near future.

I believe large enterprises and hyperscalers are early adopters of AI technology; as a result, Snowflake’s large customer base has been growing strongly. During the fiscal 2024 fourth quarter earnings call, their management stated that starting in the second half of fiscal 2024, they have started to see more large multi-year contracts.

Recent results and conservative growth forecast for fiscal year 2025

Snowflakes released their Fourth quarter fiscal year 2024 Results announced on February 28 showed revenue growth of 31.5% and adjusted operating income growth of 116.5%. The total number of large customers with product revenue exceeding US$1 million in the past 12 months increased to 461, an increase of 39.7% over the same period last year. For the full year, they generated $778 million in free cash flow and repurchased $591 million of their own stock. Overall, they maintained solid revenue and free cash flow growth momentum.

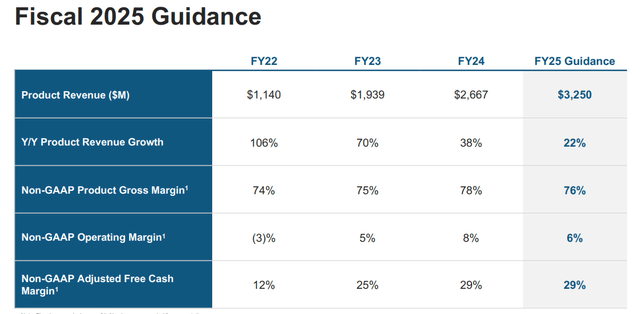

Snowflake expects product revenue to grow 22% in fiscal 2025, see the slideshow below for details.

Snowflake Investor Introduction

Snowflake is on track to achieve 70% product revenue growth in fiscal 2023 and 38% in fiscal 2024; therefore, assuming no major changes in the macro environment in fiscal 2025, the 22% guidance appears quite conservative. I consider the following factors:

As disclosed on the earnings call, Snowflake had $5.2 billion in remaining performance obligations (RPO) at the end of FY24, and they expect 50% of these RPOs to be recognized as revenue within the next 12 months. As a result, Snowflake will generate $2.6 billion in revenue from this remaining debt.

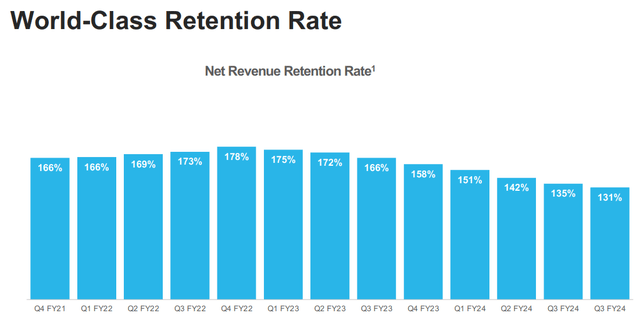

As shown in the chart below, Snowflake’s net revenue retention rate has been above 130% over the past period. The strong retention rate is driven by Snowflake’s efforts to migrate additional customer workloads to Snowflake’s platform and increase customer spending. As I discussed in my launch report , Snowflake has been investing heavily in R&D and rolling out more product features around its data cloud platform. The expansion of the data cloud enables the company to achieve higher consumption and higher retention rates among large enterprise customers. The strong retention rate is attributed to Snowflake’s existing customer growth in fiscal 2025.

Snowflake Investor Introduction

Finally, Snowflake should continue to benefit from sales growth at larger companies. In FY24, the number of large customers increased by 39.7% compared with the same period last year. I think Snowflake could benefit more from workload migration and increased consumption for large enterprise customers.

Therefore, assuming Enterprise Data Cloud spending patterns remain stable, I think their product revenue growth guidance is quite conservative.

Valuation

As discussed, I expect Snowflake to continue its strong growth momentum driven by substantial customer growth, high retention rates, and data cloud expansion. I think they will achieve 30% revenue growth over the next few years.Fortune Business Insights predict The data analytics market is expected to grow at a compound annual growth rate of 27.3% from 2023 to 2030. Therefore, I believe Snowflake will benefit from the growing demand for data clouds.

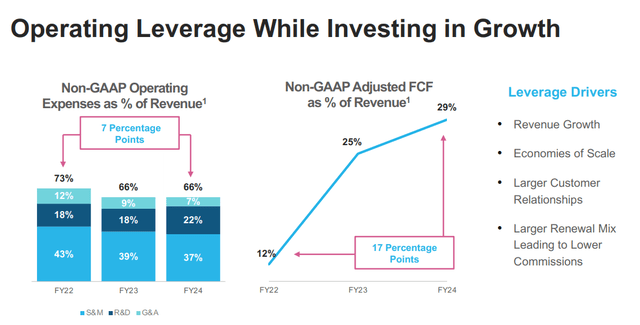

As shown in the slideshow below, Snowflake’s operating leverage comes from sales and marketing and general and administrative expenses. They have achieved a 7% margin improvement over the past two years, driven by revenue growth and a larger renewal mix to lower commissions.

Snowflake Investor Introduction

I think their operating margins will expand through the following changes: gross margin expansion of 250 basis points annually, S&M expansion of 320 basis points, and G&A expansion of 50 basis points. Operating expense assumptions are consistent with their historical averages.

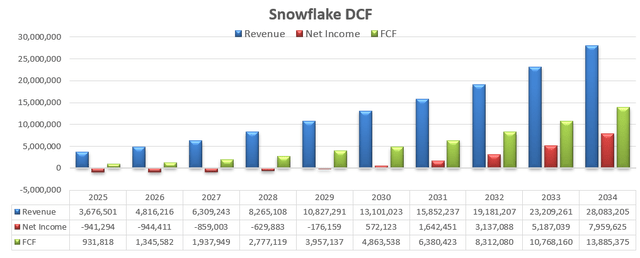

Snowflake DCF – author’s calculations

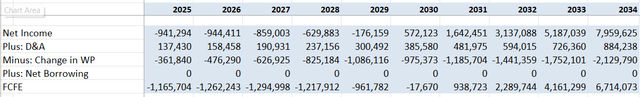

The model uses a 2-stage FCFE model. The calculation of equity free cash flow is shown in the table below:

Snowflake DCF – author’s calculations

The cost of equity is estimated to be 14.6% based on the following assumptions:

-Risk-free interest rate: 4.22%. 10-year government return rate

-Market risk premium: 7%

-Beta: 1.49. SA’s 24-month data

Discounting all future FCFE at a 14.6% discount rate, by my calculations, the one-year price target is $229 per share.

Main risks

snowflake declare Their CEO was changed in February 2024, with Sridhar Ramaswamy becoming the CEO. Since joining Snowflake in 2023, Sridhar has successfully led the launch of Snowflake Cortex. Notably, he brings extensive leadership experience from Google (GOOGL) and Neeva to Snowflake. However, he is still relatively new to Snowflake, and investors need to pay attention to his recent strategic planning and action plans.

Snowflake allocated $1.16 billion in stock-based compensation for fiscal 2024, accounting for 41.6% of total revenue. The SBC ratio is probably one of the highest among software companies. Although SBC’s percentage of total revenue may decline as the business scales, high expenses will impact its GAPP margin expansion in the near future. Additionally, the assumption of margin expansion in my DCF model relies on the rate of decline of SBC as a percentage of total revenue.

On the earnings call, Snowflake’s management said they have been competing with Databricks on some large enterprise deals. While Databricks is still a private company, their Lakehouse platform is competing head-on with Snowflake. I recommend investors pay attention to Snowflake’s large customer transaction growth, consumption growth and net retention rate.

in conclusion

I admire Snowflake’s technology in the data cloud market, and their heavy investment in R&D has been expanding their data analytics offerings in the growing data cloud market. It remains one of the core growth stocks in my portfolio. I believe they will achieve revenue growth of over 30% in the near future. I reiterate a Strong Buy rating and a one-year price target of $229 per share.