mikkelwilliam/E+ via Getty Images

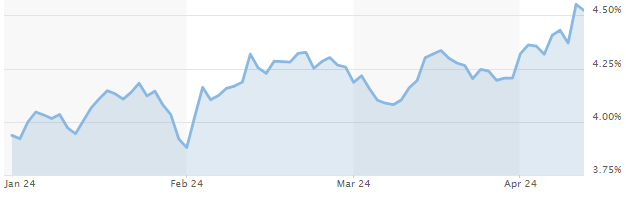

Wednesday was a real turning point for markets and investors, or at least it should have been. The latest set of disappointing inflation data showed that the Consumer Price Index (CPI) in March Report Come in Wednesday was slightly warmer than expected. This triggered a sell-off in Treasury and 10-year note yields (10 years USD), the closing price of the day was 4.55%. Investors did breathe a sigh of relief on Thursday morning when the March PPI was released. read Slightly better than expected.

All major stock indexes closed down about 1% on Wednesday, but that doesn’t quite sum up the losses in the more interest-rate-sensitive areas of the market.Real estate was the worst performer among the S&P’s 11 sectors on the day, ending Wednesday’s session only down. More than four percent. Small-cap stocks were also hit hard, falling more than 2.6%.

Seeking Alpha

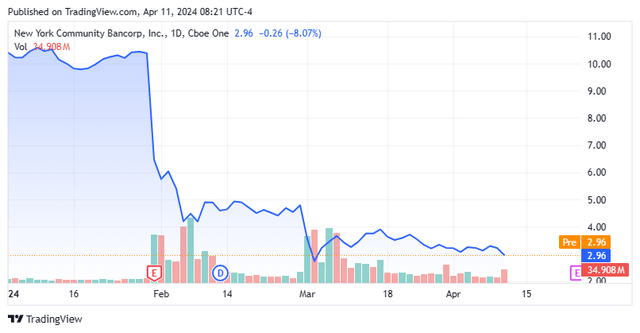

Particularly troubling are the actions of Regions Bank.this SPDR® S&P Regional Bank ETF (KRE) The stock price plummeted nearly 5% that day. A poster child for regional banking system problems in 2024, New York Community Bank (NYCB) It fell 8% on the day and closed below $3 on Wednesday.All the good vibes that come with the bank’s $1 billion stake bit Almost completely dissipated a month ago.The bank’s compensation is also the highest online rate Deposit money in the country, which could be interpreted as a sign of desperation.

Higher interest rates will only make deteriorating conditions in most credit markets more dire.According to a just-released Report Credit card delinquency rates reached their highest level this cycle in the fourth quarter of 2023, according to data from the Federal Reserve Bank of Philadelphia. At the end of the quarter, nearly 3.5% of credit card balances were at least 30 days past due. With credit card balances exceeding $1.1 trillion and credit card interest rates at record highs, this situation is sure to get worse before it gets better. For reference, credit card delinquency rates peaked at 6.7% in the second quarter of 2009. The lowest point in this cycle was in the third quarter of 2021, at just under 1.6%.Car loan default Rate It has also reached the highest level this century.

The backdrop for commercial real estate (CRE) debt has also worsened significantly.This is a topic I return to again in this post article. CRED iQ, a real estate data compiler founded in 2020, is reporting on its CRE NPL ratio All commercial real estate types rose 28 basis points to 7.61% in March from the previous month. This is an all-time high since this report was written. The retail industry led the way, growing by 108 basis points, while the hotel industry’s non-performing rate jumped 80 basis points to 7.7%. Offices continue to have the highest distress rates among industries. About 37% of the distressed loan pool has exceeded its debt maturity date and has stopped making monthly payments.

The latest rise in yields above 4.5% could further freeze the housing market and become a driver of overall construction spending.Earlier this week, the average 30-year fixed mortgage speed Just over 7.4%, compared with just over 3% at the beginning of 2022.I recently wrote an article article exist United Rentals (URI) and a piece exist BuilderFirstSource, Inc. (BLDR). Both companies have customers in the single-family, multifamily and commercial construction sectors, and both stocks expect fiscal 2024 free cash flow yields to be significantly lower than “No risk” Short-term Treasury yields. United Rentals shares fell more than 2% in Wednesday trading, and Builders FirstSource shares fell more than 6%.These stocks, along with most stocks related to the construction sector, are likely to face more downside in the coming months as “HTaller and longer” Interest rate scenario.

Seeking Alpha

At the beginning of the year, futures-based expectations were that the federal funds rate would be cut six times, with the first cut occurring at the March FOMC meeting. Before early April, the new forecast was for three rate cuts in 2024, with the first action coming at the Federal Open Market Committee (FOMC) meeting in June. After Wednesday’s CPI report, the likelihood of a rate cut in June plummeted to just under 20%. this”newTwo interest rate cuts are expected in 2024, but the market is somewhat divided on whether the first rate cut will be in July or September.

10-Year Treasury Bond Yield (Market Watch)

One of the main backdrops for the sharp rise in the overall market since the late October lows is that interest rates will fall sharply in 2024 as inflation continues to fall. So far, neither optimistic scenario has materialized. The 10-year Treasury yield has risen to over 4.5% from just below 4% at the beginning of the year. Despite this and continued deterioration in several core credit markets, stocks staged an impressive rebound in 2024, with the S&P starting the year with its best quarterly performance since 2019.

With that in mind, it feels like “Reality check” For investors, the near-term difficulties have become increasingly clear as the Federal Reserve will not take rescue action as expected at the beginning of the year and credit conditions deteriorate further. With the three-month Treasury note (US3M) yielding a whopping 5.4%, caution appears to be an important component of courage. Investors should act accordingly as the likelihood of an imminent lower entry appears high.