ceramic graphics

The S&P 500 Index (SPY) hit another all-time high of 5189 this week, just above the Fibonacci target of 5179 I outlined in my previous article.To be honest, I almost turned off the screen a long time ago The stock moved sharply higher on Friday – after all, it has closed higher in 16 of the past 18 weeks, and Friday’s performance was particularly strong. But then something different happened – a 66-point reversal that resulted in the S&P 500 closing the week lower. Perhaps more importantly, “Magnificent 7” has lost its general, Nvidia (NVDA).

Given the weekly signs of weakness, Friday’s reversal could be severe, or it could just be a short-lived dip like other corrections since late January (two of the last three lasted just one session). This weekend’s article will look at how to differentiate between the two situations.Different kinds Technology will be applied across multiple time frames in a top-down process that also takes into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

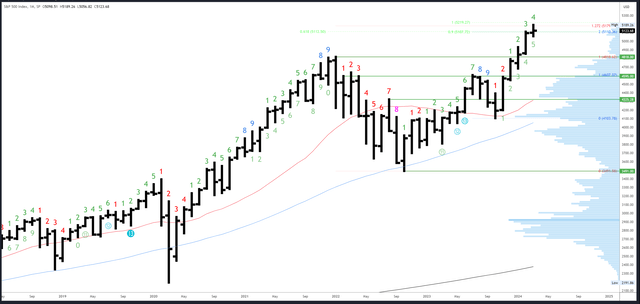

S&P 500 Monthly Index

The March bar has now touched the 5179 level, which is the 127% Fibonacci extension of the 2021-2022 decline. Now that new highs have been made this month, a bearish bar could easily form and fall back to the February range below 5111. However, it would need to close below that level, ideally much lower, to solidify the reversal pattern.

SPX Monthly (Trading View)

Above the Fibonacci extension line of 5179, there is a cautious move to 5219, and the current rebound from the October 23 low will be equal to the rebound from October 22 to July 23.

5096-5111 is the first support area that could set the bullish/bearish tone for the remainder of March. 4818 is the first major level from the previous all-time high.

The wait for the next monthly Danish signal will be long. March is the 4th bar (possibly the 9th bar) in the new upside exhaustion count.

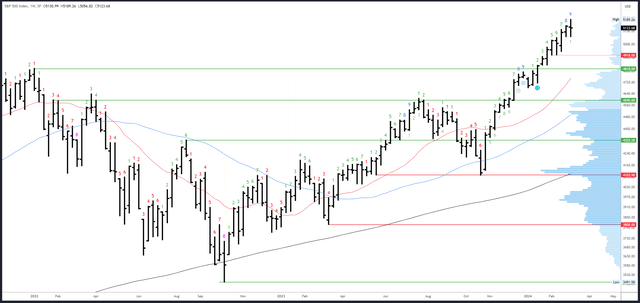

S&P 500 Index Weekly

Not only did this week’s bar close lower, but it also made a brief low. Both are on the edge, but this is the first weekly with lower lows and lower closes since the first week of the year. This marks a change of character, but is not overly pessimistic. In fact, the weekly pattern formed a “Doji” which is a signal of indecision. If the following bar continues to make lower highs and then closes below the 5056 low, this could develop into a reversal.

SPX Weekly (Trading View)

The 5189 high is the only real resistance.

5048-5056 is the key support area. Below, we quickly see the 4918-20.

This week the upward Danish exhaustion count was completed on bar 9 of 9. This usually results in a pause/down for several bars (weeks).

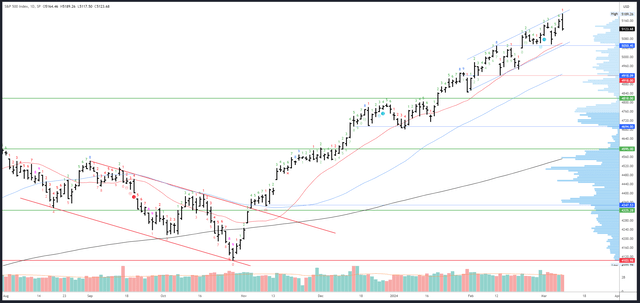

S&P 500 Daily Index

Friday’s reversal came from the top of the daily channel and a Fibonacci extension. A “devouring” column is formed, which is a reliable reversal pattern. Additionally, closing prices near the low of the daily range is expected to continue early next week.

SPX Daily (Trading View)

The channel high is a potential resistance level, which will be near 5200 on Monday.

Secondary support is 5105-111. Channel support is very close to the 20-day EMA near 5060 (and rising).

There will be no daily exhaustion signal in Denmark next week.

Driver/race

Fed Chairman Powell’s testimony will certainly be fantastic for bulls, as he said the Fed expects a “Goldilocks” scenario to play out.

“We expect that inflation will fall and the economy will continue to grow… If that is the case, a significant reduction in interest rates over the next few years will be appropriate,” he said.

Powell’s dovish testimony gave the green light to strong data, while another hot jobs report will be another bullish factor for the S&P 500. However, signs of cooling, revisions and weakness in household surveys were negative.

Next week, focus on Tuesday’s CPI, which is expected to rise 0.4% month-on-month. In terms of market reaction, inflation readings should be fairly straightforward – good news (lower inflation) should benefit the S&P 500 and vice versa.

There will be two bond auctions next week on Tuesday and Wednesday. Thursday is busy with Producer Price Index (PPI), retail sales and unemployment claims.

Possible changes next week

Friday’s bearish bar predicts some downside movement early next week. The 5105-5111 area is secondary support that could lead to a rebound, but as long as a lower high forms at 5189 to maintain the weekly “Doji” reversal pattern, then we should see a more significant daily channel/20dma Test, critical 5048-5056 area.

Given that this area has been the low for the past two weeks, there is a good chance of a breakout of this area on the next test and towards 4918-4920 points in the coming weeks. However, I suspect price may hang around 5000 for a while to create a balance (volume) between the 4818 breakout and the 5189 high.