honglouwawa

If you want to explain why the S&P 500 has been rising, you need only look at how investor expectations for the index’s dividends have changed over the past few months.

We introduced it last time We regularly arrange winter snapshot Expectations for future quarterly dividend payments for the S&P 500 (SPX) just less than six weeks ago. Over the six weeks, the outlook for the index’s dividends has continued to improve. With fundamentals supporting it, it’s no surprise that the index hit a series of new record highs.

This development is such that, if it continues, we will have to revise the vertical scale of the chart when we take our regular spring 2024 snapshot of the S&P 500 dividend outlook in about six weeks.

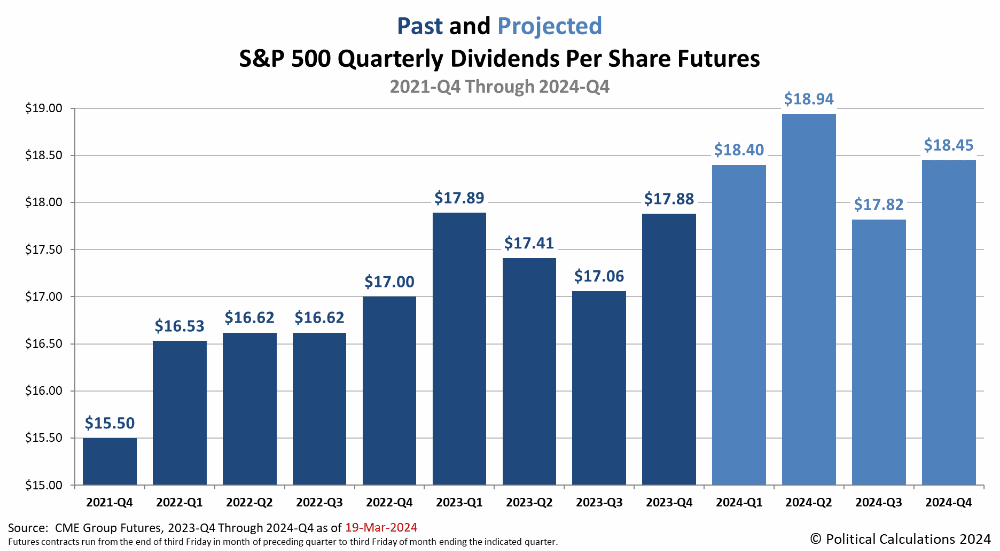

In the animation below chart, we show how much S&P 500 dividend expectations will change for each future quarter through 2024. This chart shows historical (dark blue) and forecast (light blue) S&P 500 Index Dividend Futures Data Data from CME Group for the period Q4 2021 to Q4 2024, based on various snapshots we took between November 14, 2023, and March 19, 2024.

In this animated bar chart, while the data for the fourth quarter of 2023 changes from forecasts (light blue) to historical values (dark blue), most of the actual action occurs in the forecasts for each quarter of 2024.

In particular, if you look at the bar chart for Q2 2024, you’ll see that this quarter (labeled 2024-Q2) has grown so much that it’s starting to “break out” of the top of the chart. This increase is why we soon have to reset the vertical scale of the chart.

You’ll also see the dividend outlook improve each quarter going forward, from mid-November 2023 to mid-March 2024. This improving outlook provides potential support for the S&P 500’s recent series of all-time highs.

Looking ahead to the second quarter of 2024, you’ll see something unusual. Quarterly dividends are expected to decline between the second quarter of 2024 and the third quarter of 2024. This is unusual because we typically expect expected dividends for the third quarter to fall between the forecast values for the second and fourth quarters. With the index’s dividend outlook improving in all quarters, we at least expect to see it narrow the gap between Q2 and Q4 dividend values.

but it is not the truth. If anything, dividends paid out from Q2 2024 to Q3 2024 are expected to continue to fall sharply and widening in all the months we’re looking at. This persistence suggests that investors may have built up expectations for future volatility in dividend stocks.

This market turmoil is likely to occur in the upcoming quarter of Q2 2024 and will subsequently be reflected in dividends paid in the next quarter of Q3 2024. With quarterly dividends expected to rise in the fourth quarter of 2024, this suggests investors expect this turbulence to be relatively short-lived.

At least, that’s the implicit expectation at this moment. The most important thing to remember about the future is that it can change inadvertently.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.