ceramic graphics

The S&P 500 Index (SPY) closed the first quarter and March at 5,254 points. It’s up 28% in less than six months and now has a price-to-earnings ratio of 24.6. How could anyone buy it at such a high price? !

Actually that’s not the case Difficult; the key is to rule out the extent to which you think it might be overvalued, or the extent to which it might fall, and define (minimize) your risk based on the point at which you know your trading idea is wrong. In each article, I provide guidance on when the trend is changing from bullish to bearish, which is the best entry point. If you’re wrong, you won’t be wrong for long, and you shouldn’t lose too much money.

For example, last weekend’s article concluded: “Modern losses in the first half of the week should hold 5179-89 and make new highs.” Tuesday’s drop to Therefore, 5203 is an opportunity to buy against the highlighted level. Granted, the gains may be limited, but there’s about 30 pips of risk in potential 60, 90 (who knows how many in this crazy trend) returns.

This weekend’s update will look at second quarter expectations and once again emphasize the important levels of staying on trend. Various techniques will be applied across multiple timeframes in a top-down process, while also taking into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

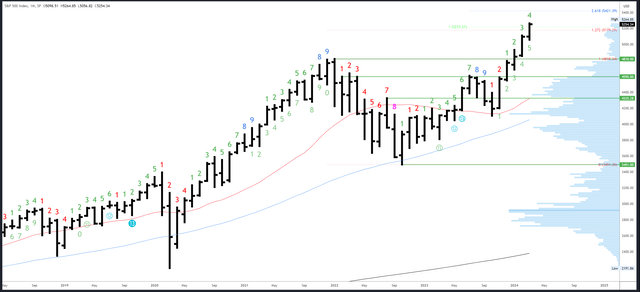

S&P 500 Monthly Index

March and Q1 closed at 5254 points, just 10 points below the all-time high. Therefore, the likelihood of continuation in April and the second quarter is high. Additionally, the seasonality is quite strong and there is no real resistance.

Looking even further, when January, February and March all closed higher as they did this year, the remainder of the year ended higher 19 out of 20 times.

While this is an interesting statistic, there will still be slippage along the way. Once new highs are established, a higher time frame reversal may occur and a pullback back to the March/Q1 range. We’ll need to see how April ends before making any inferences, but it’s something to keep in mind.

SPX Monthly (Trading View)

So far, there has been little reaction to the previous Fibonacci target. There is a cautious move at 5371, with the bounce from the January lows equaling the Oct-Dec ’23 rally.

The March high of 5264 and the February high of 5111 are potentially important downside levels.

April will be the 5th bar (possibly the 9th bar) in the Danish upside exhaustion count.

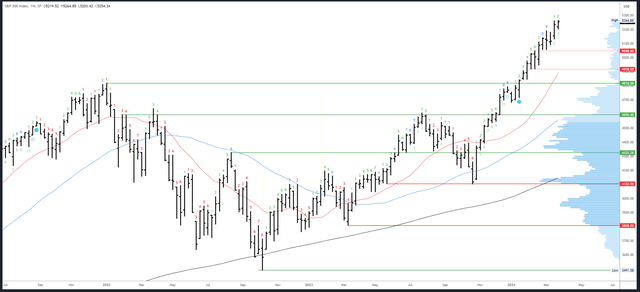

S&P 500 Index Weekly

The weekly chart is back to the usual 2024 pattern of higher highs, higher lows, and higher closes. This consolidates the previous breakout above 5189 and is expected to continue next week.

S&P X Weekly (Trading View)

The 5179-5189 breakout level is key. If broken, the gap of 5117-5131 is the rebound area, but 5048-5056 may be the destination of the rebound.

Upside weakness signals are active in Denmark, but perhaps the two-week pause in the first half of March was its only response. The new signal is at least 7 weeks away.

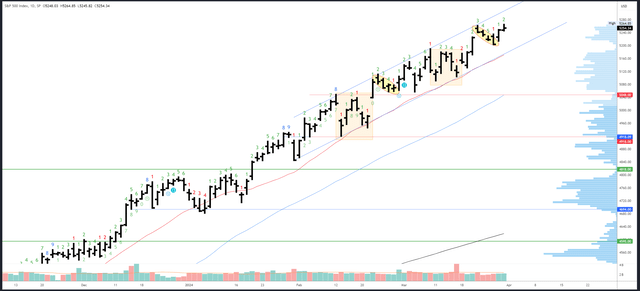

S&P 500 Daily Index

The daily chart continues to hold the trend channel and the 20-day moving average. It also continues to follow a repeating pattern from February that I first highlighted two weeks ago. This now suggests that the move to new highs will be back to 5203 with a sharp drop similar to that seen on March 5th. Obviously, neither a repeat nor a trend channel can continue indefinitely, but a sharp pullback to 5203 and perhaps 5190 could be a low-risk breakout trading opportunity.

S&P X Daily (Trading View)

The top of the channel will be at 5310, rising around 10 points per day.

5203 is a weak low/close that could be hit again and weakened. 5179-89 is more important and may align with channel support and the 20-day EMA.

Last week’s depletion signal in Denmark was not completed due to volatile conditions. The new count will take place on Monday in Section 3 and will not be completed next week.

Driver/race

The core PCE price index released on Friday showed a reading of 0.3%, after a revised reading of 0.5% last month. It has moved significantly higher in recent months, with the three-month annualized figure rising from below 2% to 3.5%. Given the Fed’s recent dovish communications, I suspect they will remain silent and hope the issue goes away. That said, Powell will speak on Wednesday, so keep an eye out.

Earnings season has begun, but it doesn’t really get interesting until mid-April when the big banks release their results. The numbers should be solid enough as the economy heats up in the first quarter, but there’s still a lot to achieve — earnings are expected to grow 30.6% by the end of 2025, according to S&P.

With so much growth expected and priced in, strong data is a must, and a final GDP figure of 3.4% (3.2% expected) this week is what bulls will want to see, especially since the Fed hinted that no number is too hot or too high. So much so that they can’t reconsider the cuts. As long as next week’s jobs report is strong or in line with expectations, there should be a bullish reaction. If a major mistake were made, the situation would be different, with perhaps interesting consequences – would the market be worried about the economy, or would it be happy that a rate cut is more certain? It’s likely to be the latter initially, but the recent rally does suggest that the market is more concerned about the economy/earnings than cuts, so I’m assuming that weak data will equal a weak market.

Possible changes next week

The strength approaching March and the first quarter is expected to continue to new highs in April and the second quarter. 5300 and 5371 are the next upside targets.

Be wary of failed new highs and a quick reversal, as this suggests a repeating pattern on the daily chart that could continue with a sharp decline that weakens the weak low of 5203. This will test the channel and the 20-day EMA, which is key next week indeed for the rest of April.

With many eyes now on this apparent passage, spikes and “chaotic” action may unfold. 5179 is a clearer inflection point – a break above this level would confirm that the near-term trend is compromised and weekly support levels of 5117-5131 and 5048-5056 would come into play.