ceramic graphics

It’s been two weeks since my last post and there have been some significant developments. On the macro front, “long-term higher” interest rate expectations are back again, with the first interest rate cut expected in September, not June or July.superior On the technical front, the S&P 500 (spy) eventually broke out of the trend channel and stabilized below the 20-day moving average. This signals that the trend from the January lows may have ended and a new phase has begun.

However, this does not mean that the S&P 500 has peaked. Every major trend is made up of smaller trends and correction phases. When a trend sequence ends and corrects, it sets up another trend sequence. This repeats until the major trend on the higher time frame completes and peaks, or a major correction and another major trend is established.This may sound complicated – when you consider your current major The trend originated in 2009, or better still, 1932 – but we can continue to look for inflection points and technical signals to simplify things.

This weekend’s article will briefly explore whether the current correction is a buying or selling opportunity and outline the best positions to enter the trade. Various techniques will be applied across multiple timeframes in a top-down process, while also taking into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

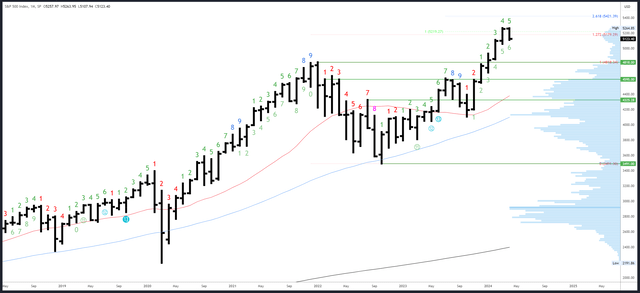

S&P 500 Monthly Index

The bullish bias remains on the higher time frame charts and a top is unlikely.

First, the Q1 and March bars closed at highs with no clear signs of rejection; conversely, the April bar disappeared from the March range, leaving a “weak” high.

Second, when January, February and March all closed higher as they did this year, the rest of the year closed higher 19 out of 20 times.

Having said that, there is a lot of room for correction in the first place. I distinctly remember pointing out that the July 23 monthly high was weak and fully expecting it to be breached. However, it took until December to finally break through to a new high.

In short, the monthly chart suggests that at some point a decline will be a buy point at 5,300. The exact time and place is best figured out within a shorter time frame.

SPX Monthly (Trading View)

The high of 5264.85 is the only resistance.

Support at the February high of 5111 was tested on Friday and remained there until the weekly close. The March low of 5056 is the next level. Below, the next support level is 4853 points.

April will be the 5th bar (possibly the 9th bar) in the Danish upside exhaustion count.

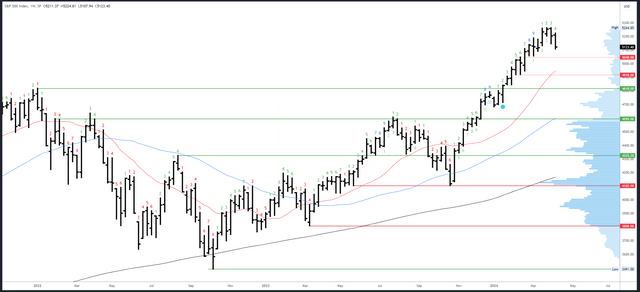

S&P 500 Index Weekly

Looking at the bigger picture, the weekly chart once again supports the view that weak highs have been formed. Strong highs are formed when price is rejected quickly and volume is light. Instead, it is testing the 5261-64 area for three consecutive weeks with ample volume near the highs.

Looking at the near term, this week’s bar closed very close to the low, which is the second time since the rebound began in October of ’23. This suggests the move should continue to the downside.

S&P X Weekly (Trading View)

Resistance levels are at 5224 and 5264.85.

The gap at 5117 has been filled and could lead to a rebound. However, 5048-5056 is a more important area that may be tested this month. A breakout of this area could signal a test of 4818 at some point.

The upward Danish exhaustion signal appears to be producing a similar delayed effect as the July ’23 signal. A new upside count is underway and will take place on next week’s bar 5, but it looks unlikely to continue as next week’s bar needs to close above 5234.

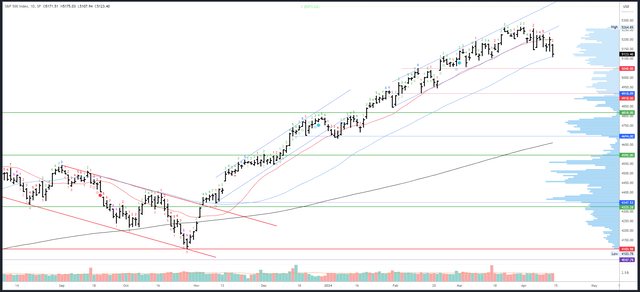

S&P 500 Daily Index

Two clear channels can be traced on the daily chart from the October 23 lows – the first channel peaked after the sharp rise in December. A small correction then establishes the next uptrend and the channel formed in the first quarter. This has different characteristics and less bullish action.

As mentioned in the introduction, the channel and the 20-day EMA have now been convincingly broken and acted as resistance during last week’s rally, signaling the entry into a new correction phase. The big question now is whether this will be another small correction to set up another trending sequence higher, or whether the decline will be bigger this time and fall to 4818 (at least). 5048-5056 is where this question is answered.

S&P X Daily (Trading View)

Secondary resistance is 5138-46. A close above this level could result in the gap filling between the 20-day moving average and 5199, with 5256 being the next resistance level above this level.

Support is found at Friday’s low at 5107, just above the 50-day EMA and intersecting the February high at 5111 and the gap fill. This area may take several attempts to break. The volume distribution on the right side of the chart emphasizes the importance of 5048-5056 – this is an area where price is rejected and there is very little volume. 5042 is also the 38% Fib retracement level of the first quarter rebound and the “normal” retracement level of this stage of correction.

The downside Danish exhaustion signal will appear on bar 3 on Monday, but will not be completed next week.

Driver/race

CPI rose 0.4% for the third consecutive month. While the hot non-farm payrolls data may not get the Fed to budge, the inflation data definitely will. The market is now expecting a first rate cut in September, but is it overreaction? Fed members will be busy speaking for most of next week, so pay close attention to their messages.

Retail sales and the Empire State manufacturing index are due out on Monday, with much quieter data this week. Earnings season gets more intense after the bell on Thursday as banks and Netflix ( NFLX ) report.

Middle East geopolitics is heating up again as Iran warns of attacking Israel. While the uptrend continues, the market may quickly shake off this effect, but a more pronounced reaction is likely to occur during this new phase.

Possible changes next week

Looking at the bigger picture, the higher time frames have a weak high and a breakout of 5264.85 is still possible this year.

That said, the near-term path may be lower and 5048-5056 may be tested in the second quarter. This area is the inflection point of the sharp decline to 4818 and a retest of the breakout point.

Next week could see a battle between the 50-day EMA and 5100 on the downside, and a gap filling between the 20-day EMA and 5199 on the upside. This may drop to 5048-5056.

While I think 4818 will be reached, I would still buy 5048-5056 if there is a solid foundation in the area. There could be a 50 pip bounce, it could go straight to a new high, or there could be no bounce at all; I can’t predict what will happen, but I can prepare a trade if the odds are favorable and the risk/reward is attractive.