Yuichiro Chino/Moment via Getty Images

The S&P 500 Index (SPY) hit an all-time high this week, in line with the predictions outlined in this weekend’s article.Not only did the index “take a step back when trading reopened on Tuesday, but The decline tested the 4950-60 area” before rebounding to the target area of the “5107-112 area Fibonacci measurement cluster” and reversing at 5111 on Friday.

Granted, I think the rebound will be much slower, but I doubt anyone will be disappointed when profits come faster than expected.

This weekend’s article will focus on what happens now that the goal has been reached. Various techniques will be applied across multiple timeframes in a top-down process, while also taking into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

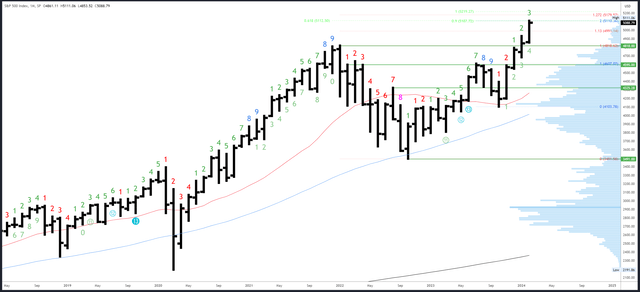

S&P 500 Monthly Index

With only four trading days left in February, a bearish bar closing below the opening price of 4861 seems unlikely to form. Even a close back below the January range of 4931 looks like a tall order.

That’s not to say the turnaround can’t begin next week. The October bottom came from the neutral bar, while the July top came from the bullish bar. This just means that we are less likely to get reliable reversal signals from the monthly chart.

The weak seasonality in the second half of February has not yet materialized, but now that the Fibonacci target has been reached, changes are likely to occur in the last four trading days.

SPX Monthly (Trading View)

Friday’s rally stopped at 5111, right in the 5107-5112 range, where three measured moves/Fibonacci targets converge (the 2022-2024 rally is equal to 0.618* of the 2020-2021 rally of 5112, which is 5112 200% extension). The July-October correction is at 5110, while another cautious bounce off the 2022 lows is at 5107.

5179 is the next Fibonacci extension (127% extension of the 2021-2022 decline).

4931 is an important downside level. 4818 is the next major level from the previous all-time high.

The wait for the next monthly Danish signal will be long. February is the 3rd bar (out of 9 possible bars) in the new upside exhaustion count.

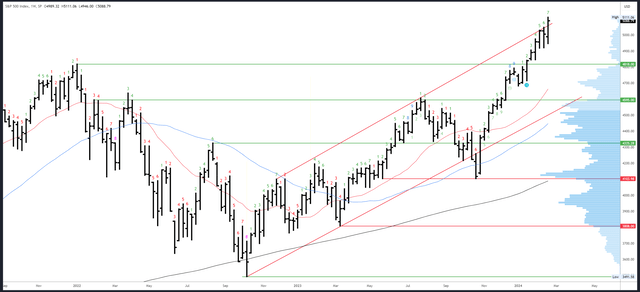

S&P 500 Index Weekly

This week has formed a bullish weekly pattern with higher lows, higher highs and higher closes. Six of the seven bars that bounced off the January lows have the same characteristics.

Now that the Fibonacci targets have been reached and weekly weakness is emerging, I will be looking for something different next week to indicate a reversal. The key is Thursday/Friday setting new lows for the week.

It’s worth noting that the current rally has broken out of the weekly channel – is this a breakout or has the rally exceeded expectations? I suspect it’s the latter, but we’ll need to see at least one other bar to know which is the case.

S&P X Weekly (Trading View)

Now that the channel has been broken, there is no resistance. The same applies to the Fibonacci target of 5179 in the monthly chart.

The previous week’s high of 5030-48 is the key to momentum. Below, this week’s low of 4946 is the initial support, of which the double bottom of 4918-20 is more important. A small weekly gap at 4842-44 is also potential support, but 4818 is the main level from the previous all-time high.

The upward Danish exhaustion count will occur on bar 8 (of 9) next week. Reactions usually occur by week 8 or 9, so we may end up experiencing changes in personality.

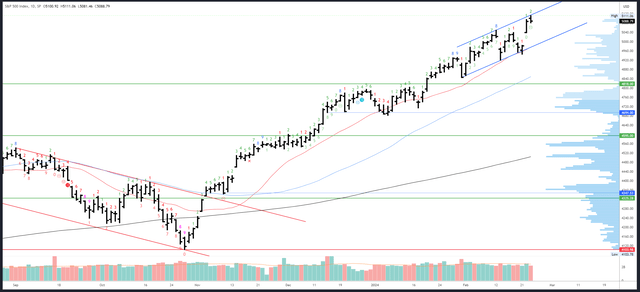

S&P 500 Daily Index

This week’s decline broke out of the channel but held the 20-day EMA, as expected last week. It is now possible to draw different channels that are more relevant to the latest fluctuations.

Friday’s modest decline looks more like profit-taking than a bearish reversal. No strong bias early next week.

S&P X Daily (Trading View)

The only resistance comes from Monday’s new channel high near 5122.

The first level of support is Thursday’s low of 5038, which is key territory given the previous weekly high. Channel support on Monday is near 4980, converging with the 20-day moving average.

Denmark’s daily consumption cannot be completed next week.

Driver/race

Clearly, Nvidia’s (NVDA) earnings report is a hot topic this week. I did see some of the mainstream media headlines about this rally (US, Germany, and Japan hitting all-time highs for the first time since the 1980s) as a warning sign that sentiment was becoming frothy. It’s worth noting that Thursday’s decline showed some weak internal factors, with only about 54% of NYSE stocks advancing.

This week’s data is balanced – the manufacturing PMI is better than expected, and the service PMI is lower than expected, but both are in the expansion range. Overall, the economy remains stable despite the Federal Reserve’s restrictive policies. This suggests the Fed may have less influence than originally thought, at least during this part of the cycle. That’s all well and good now, but if the economy does turn around, spending cuts are unlikely to be the quick fix that markets expect.

Next week is on the quiet side for scheduled releases. The preliminary GDP value will be released on Wednesday, with growth expected to be 3.3%. The monthly core personal consumption expenditures index will be released on Thursday along with jobless claims.

Possible changes next week

This week’s strong action also brought some red flags. Weak participation in Thursday’s rally came amid exciting headlines. Furthermore, Friday’s rally stalled right in the expected target zone. With the weekly exhaustion signal taking effect next week, a compelling reversal window has emerged.

That being said, the market is yet to show any real signs of weakness. In order to set up a reversal, I expect a higher test early next week, but it will eventually be rejected and lead to a drop to new weekly lows on Thursday and Friday. In short, the opposite of what happened this week. 5030-5038 is the first support area, and a weekly close below 5030-5038 could signal the beginning of a sharp retracement. A daily close below the channel and the 20-day EMA would further confirm improvement.