ceramic graphics

The S&P 500 Index (SPY) hit lower highs this week, only the second time since the rally began in October 2023 and the first since the week of January 2.This is another change in behavior What to add to the final overview weekend articles There is growing evidence that bulls are tired. That said, the trend channel maintains Friday’s decline and a decisive breakout has yet to emerge to confirm a bearish turn.

This weekend’s article explores how to make this transition. Various techniques will be applied across multiple timeframes in a top-down process, while also taking into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

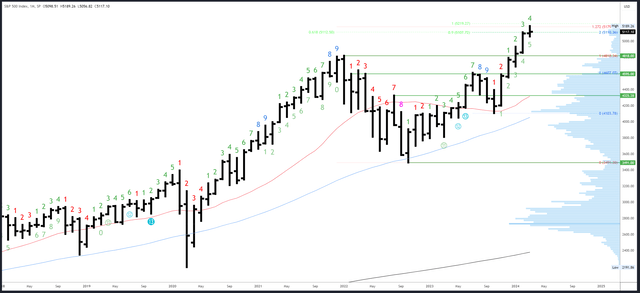

S&P 500 Monthly Index

Friday’s close 5117 keeps the March bar above the February high of 5111. With two weeks left in the month, a lot can still happen, but momentum seems to be stalling. A fall back into the February range and a close below 5111 could set up a reversal pattern on the higher time frames.

SPX Monthly (Trading View)

The 127% Fibonacci extension of the 2021-2022 decline has been tested at 5179. The next level of interest is 5219, where the current bounce from the Oct’23 low will equal the Oct’22 to Jul’23 rally.

5096-5111 is the first support area that could set the bullish/bearish tone for the remainder of March. 4818 points is the first major support level of the previous historical high.

The wait for the next monthly Danish signal will be long. March is the 4th bar (possibly the 9th bar) in the new upside exhaustion count.

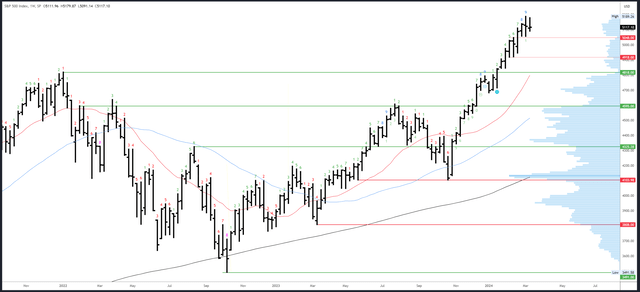

S&P 500 Index Weekly

This week’s opening and closing prices were very close, forming a “Doji” for the second consecutive week. This is a sign of indecision. In addition, all of this week’s movements occurred within last week’s range, forming an “inside line.” This is another sign of indecision.

SPX Weekly (Trading View)

These weekly signals ultimately reflect the weaker price action we saw throughout February and March. In November and December, price action was extremely bullish, with very small declines. Recently, however, there have been sharper declines that are getting deeper and deeper. New highs are also beginning to fall.

The 5189 high is the only real resistance.

5048-5056 is the key support area. Below this, 4918-20 is potential support, but may just be a rebound area towards 4818.

Last week, Denmark completed its upward exhaustion count on bar 9 (out of 9). This usually results in a pause/down for several bars (weeks).

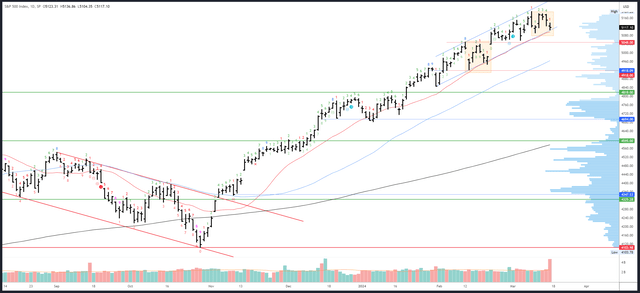

S&P 500 Daily Index

The high for the week was on Tuesday, which is not bullish. That said, this week’s low occurred on Monday, which is not bearish (shorts hope for next week’s new low on Friday). It all plays into the theme of mixed signals and indecision. Neither side has really taken action yet.

Friday’s decline tested and held the channel. This area is key now and should decide the bull/bear battle.

SPX Daily (Trading View)

I highlighted a similar pattern in mid-February in the chart above. This shows how bulls can take the initiative and continue rising. Bears need a weak close below 5091.

5179-89 is an obvious resistance level.

Friday’s low of 5104 is right above this channel and marks support. However, the 20-day moving average is slightly below this week’s low of 5,091. Therefore, the 5091-5104 area is the key area. 5048-5056 is the next important support.

The volatile situation does not allow Denmark to issue an exhaustion signal, nor will it be able to issue a daily signal next week.

Driver/race

This week’s CPI reaction is a bit confusing and may well just be the result of the previous decline and entry into the triple curse. However, the producer price index (PPI) was too hot to ignore, and weakness in retail sales and the Empire State manufacturing index also weighed. Stocks want to see strong data – in fact, the hotter the better, since the Fed is not attaching any strings to its dovish stance.

Next week will remain quiet until Wednesday’s Federal Open Market Committee (FOMC) meeting. No change in policy is expected, and any change in dovish tone so soon after Powell’s testimony would be surprising. This makes the expected reaction slightly bullish, but also means we could see a very bearish reaction if the Fed makes any hawkish shift.

On the other hand, the probability of a rate cut in June has now dropped to just 55%, and the 10-year Treasury yield is about to exceed 4.327%, a key turning point for long-term yields.

The Purchasing Managers Index will be released on Thursday and will be important reading on the economy.

Possible changes next week

Either way, the chart shows indecision rather than a strong signal. Given the strength of the bullish trend and the hold of support on Friday, the odds remain slightly in favor of the bulls. However, danger signals are mounting and the rally is at a critical turning point. Bearish odds are the highest since January, with a close below 5091 breaking the recent trend. A move below 5048 could be decisive and should lead to an eventual (temporary) move below 4818.