chunumunu

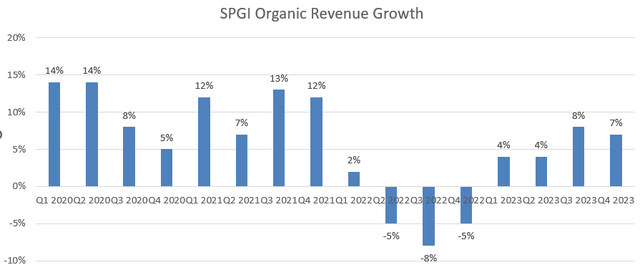

In the launch report released in September 2023, I highlighted S&P Global’s (NYSE: SPGI) portfolio diversification, global debt issuance is expected to begin to stabilize. S&P Global achieved organic revenue growth of 6% in fiscal 2023, and its ratings business increased by 9% annually. They guided for fiscal 2024 organic revenue growth of 7-9% and margin expansion of 100 basis points. I expect the ratings business to grow above its guidance in fiscal 2024. I upgraded it to Strong Buy with a fair value of $480 per share.

Strong recovery in ratings business

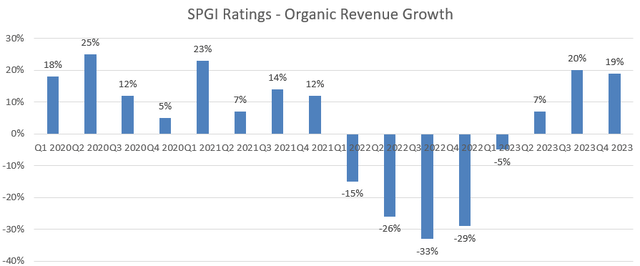

As shown in the chart below, S&P Global’s ratings business revenue declined significantly in fiscal 2022, when companies began to reduce bond issuance due to high interest rates.from Q2 FY2023business began to recover, with organic revenue growing 7% and accelerating to 19% growth Fourth quarter fiscal year 2023.

S&P Global Quarterly Results

The company expected note issuance to grow 3%-7% in fiscal 2024 during its fiscal 2023 fourth-quarter earnings call on February 8. I think the guidance is more likely to be conservative, and I expect their ratings to deliver strong results in the first quarter of fiscal 2024, and the company may increase full-year guidance.

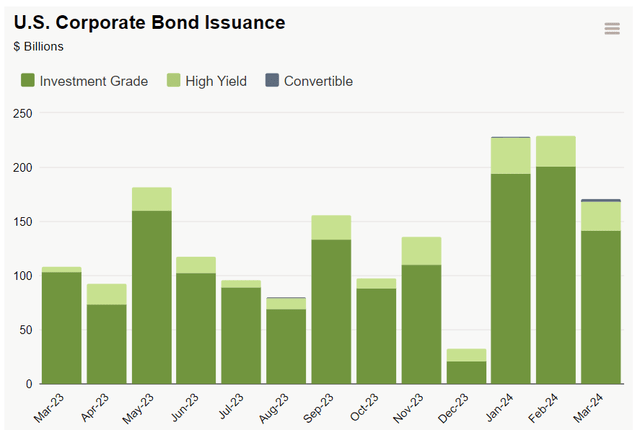

An important source of information on bond issuances is SIFMA research.based on their recent Report Data released on April 2 showed that U.S. corporate bond issuance increased by 81% year-on-year in the first quarter of 2024. As the chart below shows, growth has been driven primarily by high-yield and investment-grade bond issuance.

SIFMA research

I think the strong growth in debt issuance may be driven by two main factors:

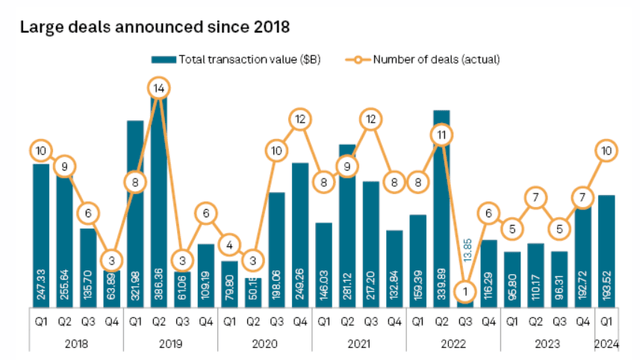

Data from S&P Global shows that M&A activity was quite active in the first quarter of 2024, with the total value of transactions more than doubling compared with the same period last year. Several Big Deals Announced in Season 1: Home Depot (HD) acquired SRS allocation of $18.25 billion; EQT (EQT) acquired Equitrans Midstream $14.3 billion; Honeywell (Hon) acquired Carrier Global Access Solutions (CARR) is valued at $4.95 billion. Strong M&A activity will drive growth in corporate debt issuance.

S&P Global Insights

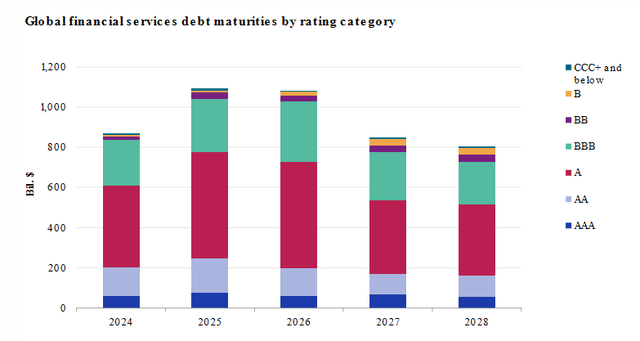

Another driver is strong demand for debt refinancing. Compared with debt issuance related to mergers and acquisitions and share repurchases, debt refinancing is less elastic. As shown in the chart below, approximately $1.96 trillion in debt is expected to mature over the next two years. I think large refinancing needs will be positive for S&P Global’s ratings.

S&P Global Insights

Recent Results and FY2024 Outlook

S&P Global announced its fourth-quarter fiscal 2023 results on February 8, with organic revenue growing 7% and adjusted revenue growing 15%. Operating profit increased. The results they deliver are at the high end of their guidance range. For fiscal 2024, they guided for organic revenue growth of 7-9% and margin expansion of 100 basis points.

S&P Global Quarterly Results

As mentioned in my launch report, S&P Global has a portfolio of great businesses. To estimate their growth throughout the year, I break it into its different components:

– Rating: As mentioned, I expect strong growth in the first quarter and full year of fiscal 2024. Year-to-date bond issuance supports double-digit volume growth, exceeding fiscal 2024 guidance of 3%-7%. Conservatively, I think S&P Global Ratings will grow 20% in fiscal 2024.

– Market Intelligence: S&P Global provides multi-asset class data and analytical solutions. I expect this business to continue HSD’s growth momentum in the near future. The business is highly recurring in nature, as more than 80% of revenue comes from the subscription model.

– Commodity Insights: They provide essential price data, analysis, insights and software and services for commodities and energy markets. 88% of revenue comes from subscriptions, a highly repetitive business model. Again, I expect them to be able to maintain growth momentum in the mid-to-high single digits.

– Indexes: They generate revenue from asset-linked fees that are tied to the AUM size of ETFs and passive mutual funds.PricewaterhouseCoopers predict By June 2028, global ETFs will exceed US$19.2 trillion, with a five-year compound annual growth rate of 13.5%. This growth was primarily driven by flows from active mutual funds to passive ETF/index funds.

Valuation adjustment

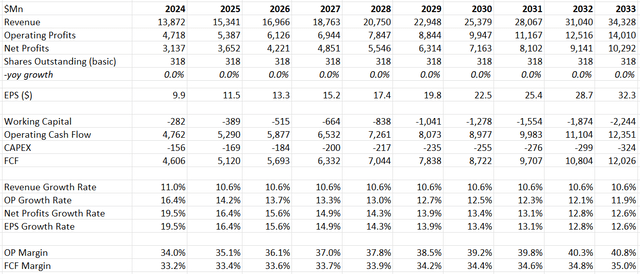

As mentioned above, here’s a summary of my revenue estimates: Ratings up 20%, Market Intelligence up 9%; Commodity Insights up 7%; Indexes up 13%. According to my calculations, consolidated revenue growth in fiscal 2024 is expected to be 11%.

Margin expansion is mainly driven by the following factors:

– February 2022, they completed merge Partner with IHS Markit. Under the original plan, they expected to achieve $600 million in cost synergies by fiscal 2023 and approximately $350 million in annual revenue synergies by 2026. For now, S&P Global has been reaping cost and revenue synergies from the merger.

– New Products: As revealed in the earnings call, they launched 7 new products in fiscal 2023 and plan to launch another 14 products in fiscal 2024. It is worth noting that these new products have higher gross profit margins; therefore, the launch of new products will increase its gross profit margins.

All in all, I predict their operating expenses will increase 8.4% year over year, with operating leverage coming from cost of sales and intangible asset amortization.

S&P Global DCF – Author’s calculations

The WACC is calculated to be 10.8% based on the following assumptions:

– Risk-free interest rate: 4.25% (US 10-year Treasury bond yield)

– Beta: 1.2 (SA’s data)

– Equity risk premium: 7%; Debt cost: 7%

– Debt balance: US$11.4 billion; Equity balance: US$34.2 billion

– Tax rate: 23%

After discounting all future free cash flows at a discount rate of 10.8%, the total enterprise value is calculated to be $160 billion. My estimate, after adjusting for total debt and cash balances, is that the fair value is $480 per share.

Main risks

Energy Transition: S&P Global provides commodity insights to clients in industries experiencing the challenges of the energy transition. It’s fair to say that the energy transition presents both risks and opportunities for traditional energy companies. I think if these energy/commodities companies can navigate the transition and successfully transition their operations to new energy markets, they will be successful in the future. That said, the energy transition may create some growth uncertainty for S&P Global Commodities Insights.

Ratings Business: As noted in my launch note, global bond issuance is cyclical and to some extent tied to global GDP growth. Therefore, for S&P Global shareholders, they should prepare for weak ratings growth in the coming years.

judgment

In short, I expect S&P Global to report stronger-than-expected first-quarter results and raise full-year guidance. The current strong debt issuance is driven by strong M&A activity and demand for debt refinancing. I still view S&P Global as a collection of high-quality businesses. I upgraded it to Strong Buy with a fair value of $480 per share.