bjdlz

Spartan Delta ( OTCPK:DALXF ) is a Canadian company that reports in Canadian dollars. Last year, the company paid out a large dividend and effectively ended major projects.Now, management is touting the achievement while launching another growth project to pursue Another huge gain. This makes this atypical company unsuitable for income investors. But for those who like “starts and finishes,” this type of company may be right for you. To others, the company is actually a new growth company, starting over, and has a history of successful management in the recent past.

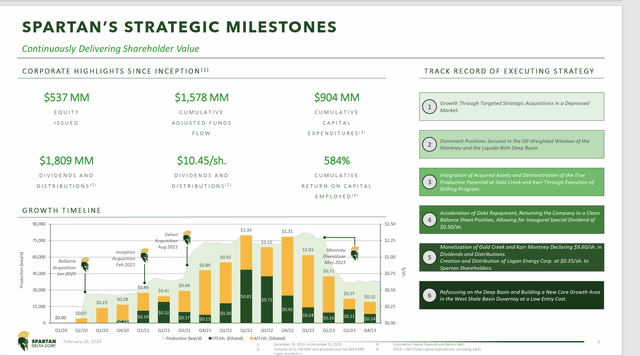

Spartan Delta Corporation Historical Shareholder Returns and Results (Spartan Delta February 2024 presentation)

Please note that the last time During this period, management effectively allocated another company (Logan Energy (LGN:CA) ) while also returning roughly three times the cash raised.For most investors, this signals Successful conclusion of proposed profit-making project.

Investors now have a variety of options. The cash distribution was made possible through the sale of these properties to Crescent Point Energy (CPG). If investors are interested in this scenario, they do have the option of investing in Crescent Point. Logan Energy is much smaller and therefore, at least for now, unlikely to be discussed here.

This article will discuss the future development of the Spartan Delta project, since management and the board of directors “overcame the difficulties” last time with considerable success.

natural gas operator

The focus this time appears to be primarily on natural gas in Canada’s deepwater basins.

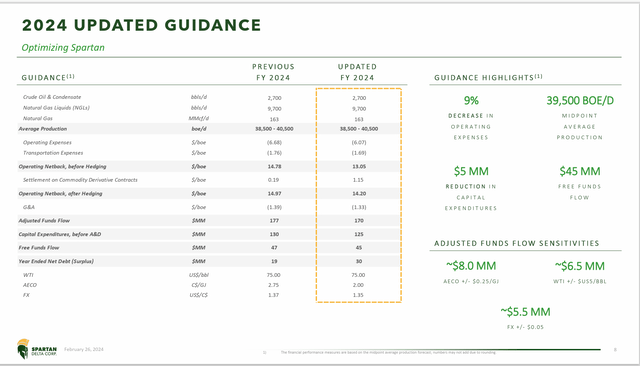

Spartan Delta 2024 Remaining Operations Guidance (Spartan Delta February 2024 Company Presentation)

Anyone who follows Cenovus Energy (CVE) knows that the Deep Basin is known for its natural gas production. Apparently, this time around, management is also including some liquid production. This could add considerable value to natural gas production while maintaining North America’s ability to join a stronger world natural gas market as natural gas export capabilities increase.

If successful, this appears to be a very lucrative proposition.

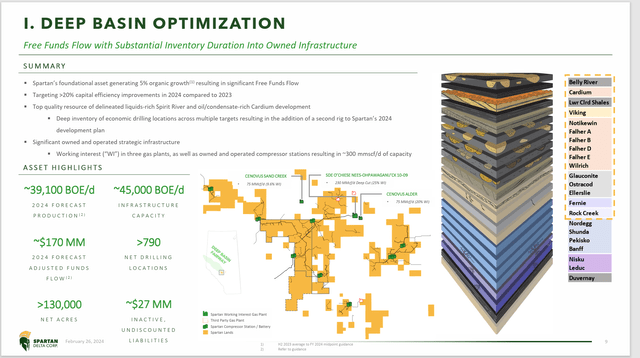

Spartan Delta begins operations of deep basin assets (Spartan Delta Company Briefing, February 2024)

Spartan Delta proposes to grow the fledgling organization through a combination of acquisitions and organic growth as before. Balance sheet strength and company growth will be top considerations. Dividends will have a much lower priority.

The company is now much smaller than before. This makes the company’s ideas more speculative than before. As is typical in Canada, the company has a sizable midstream presence on land it owns, but will be liaising with other operators to bring product to market.

expansion room

One of the big differences between the United States and Canada is that Canadian industries can easily acquire more acreage without having to acquire other competitors.

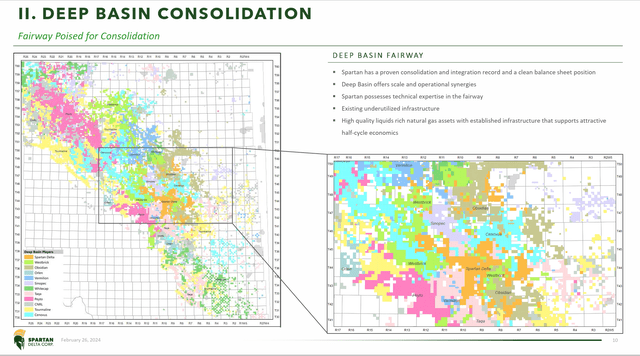

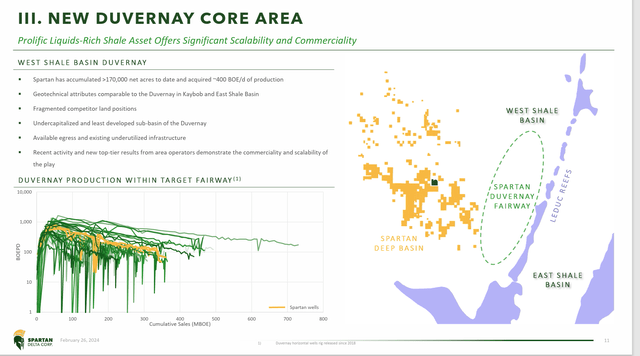

Map of Spartan Delta Operations and Competitor Holdings (Spartan Delta Company Briefing, February 2024)

As you can easily see from the above, there is a lot of space that is not rented out. This usually reduces the acquisition price, as there is always the option of leasing other land.

Furthermore, this means there is considerable room for expansion in the industry. Currently, Canadian production is somewhat supply-constrained because Canada’s reserves far exceed its needs. But that could easily change as more export capacity comes online in the near future.

From this perspective, the company’s prospects are very good, whether growing organically or through consolidation. In this part of North America, the “big boys” generally don’t have all the good land occupied. Therefore, if a startup enters early enough, it can often achieve a lucrative position comparable to that of the “big companies.” In the United States, this is often not the case.

The upshot of all this is that the cost of land in basins like this where land is to be acquired is often minimal compared to the United States.

Map of Spartan Delta Operations and Competitor Holdings (Spartan Delta Company Briefing, February 2024)

Management has a focus area that promotes company growth. As a concrete long-term goal, this is more important than “we want to start a company.” Perhaps the most important idea about the entire region is its long-standing reputation for natural gas production.

However, technological advances have allowed for other intervals. Many of these intervals have fluid in them. Of these liquids, condensate is very important to the industry because Canada produces large amounts of heavy oil and thermal oil (as well as tar sands). Condensate is needed to move these heavier products through pipelines to the refinery.

In Canada, condensate generally costs more than light oil because Canada must frequently import the condensate it needs. Depending on how development goes, this could certainly become a great profit opportunity.

risk

This is actually a new, much smaller company as most of the business has been sold. Any new venture must be viewed as a proposition with a higher risk of failure. Management and boards have had past success in mitigating this problem. However, this does not eliminate risks for new companies.

An emphasis on finances will significantly reduce the financial risks of a new company. Companies with strong financial positions tend to have the best chance of success.

Profits from these lands may be less than planned. Management may then need to develop a new plan or liquidate the company.

There is always a risk of losing key personnel. Even the best-laid plans for massive profits can be derailed.

generalize

Spartan Delta is now effectively a new company with enough assets and cash flow to “live within its means.” Management clearly has some knowledge of the operating basin.

The upstream segment of the business is highly volatile and highly dependent on suitable commodity prices. Small players have limited competitive growth prospects. Management noted fragmentation of operations in the region. This bodes well for the proposed integration strategy. However, in a rapidly evolving industry like this, things can change overnight.

For investors who can handle the risks of Canada’s relatively new companies, the management team has the experience and track record of mitigating risks for many smaller company operators. To me, this makes this a speculative strong buy, as having the success of previously public companies is important when considering smaller companies in this industry. There are so many ways to fail.

Now let’s see what the future holds for this idea.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.