titawit.21/iStock via Getty Images

paper

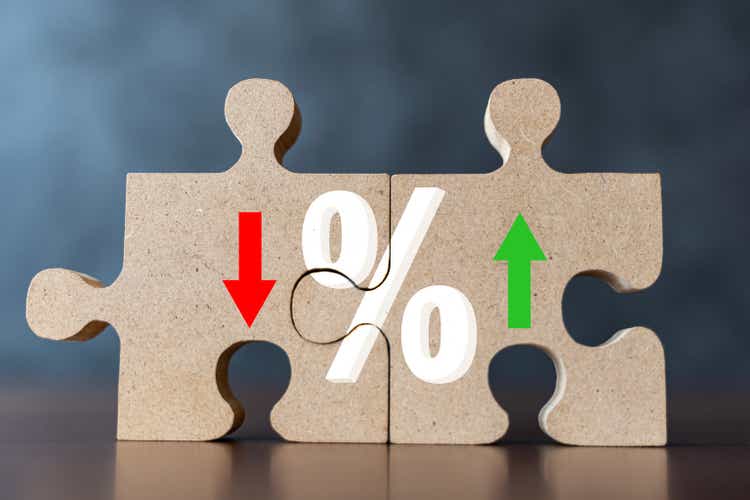

We begin coverage of the Global X SuperIncome Priority ETF (NYSE:SPFF) a year ago, during the regional banking crisis, through an article titled “SPFF: The time has come.”The fund is Total returns have increased nearly 7% since our initial reporting:

score (Seeking Alpha)

In our first article, we described the SPFF as a cyclical fund and warned investors that the fund was not truly a buy and hold, but more of a vehicle for use in times of panic. According to our original article, SPFF’s rankings are quite concentrated, a structure that could introduce additional volatility.

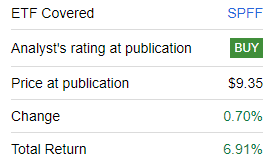

It is interesting to note the current market developments – on one hand, we can see retail investors entering the market due to FOMO (fear of missing out) to profit from the appreciation of the tech giants, while insiders are painstakingly Sell stock. The most interesting and relevant insider pitch to us was Jamie Dimon’s:

J. Dimon insider trading (customized investment)

Dimon has been a buyer of JPMorgan shares over the past decade, and his timing has been perfect. His sell-off coupled with his comments surrounding the soundness of some regional banks should provide a warning sign to many investors. Dimon doesn’t often sell stock, and has never sold shares of this size (more than $150 million worth of stock).

In this article, we’ll take a fresh look at SPFF and shed light on why the current high interest rate environment and the “higher, longer” mantra warrant a downgrade of the name.

blockbuster financial funds

SPFF is a preferred stock fund that focuses on financial stocks:

holding (Fund fact sheet)

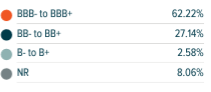

Financial stocks accounted for more than 82% of holdings, followed by communication services and industrial stocks. The fund also assumes significant credit risk through its holdings, which include a large number of BB buckets:

Rating (Fund fact sheet)

The fund is a cyclical fund that is highly concentrated in a few names and invests heavily in BB credits. Currently, the “WFC 7 1/2 Perp” security accounts for 7.3% of the fund, followed closely by “BAC 7 1/4 PERP” at 6.7% of the fund. These are the preferred stocks of Wells Fargo and Bank of America.

The 30-day SEC yield has compressed to a paltry 5.8%, while fund volatility is high

Preferred stocks are purchased for income and sometimes for the potential for capital appreciation following disruptions in capital markets. SPFF’s current 30-day SEC yield has compressed to a paltry 5.8%:

Yield (Fund website)

There are many short-term corporate bond funds or AAA CLO ETFs on the market today that yield over 6%, and we recently covered a few of them:

These companies all have annualized volatility below 3% and very limited pullbacks. Instead, SPFF focuses on very volatile, longer-duration asset classes, with the ETF’s annualized volatility exceeding 14%, according to the Seeking Alpha Risk tab.

Risk/return is a very important metric, especially when investing in a cyclical fund like SPFF. This indicator becomes more relevant when the risk-free rate is above 5%.

Now, with spreads narrowing across the board and stocks hitting new highs, we believe a healthy pullback is only a matter of time. We believe there is no compelling reason to hold SPFF on a risk-adjusted basis from a dividend yield perspective.

Higher long-term interest rates hurt some banks

Although the SPFF primarily contains securities from large, systemically important banks, it is still subject to price dislocations in the context of a risk-off environment. Given the stringent supervisory capital changes following the 2008-09 financial crisis, we do not believe any of the large banks will have any solvency issues, but if more regional banks run into trouble, their spreads will widen.

Long-term higher interest rates have a very interesting way of filtering into the banking system. A high-interest rate environment creates problems with commercial real estate loans that won’t go away anytime soon as owners are unable to refinance at attractive rates.In many cases, they end up lose Their entire equity interest in certain investments:

Late last year, the fund, the Canada Pension Plan Investment Board, sold its 29% stake in 360 Park Avenue South in Manhattan to one of its partners, Boston Properties Inc., for $1. The company also agreed to bear CPPIB’s share of the project. debt.

The impact for banks comes from higher-than-normal provisions for credit losses in the commercial real estate sector, which could undermine net income and capital:

NYCB had not previously disclosed the circumstances of Munson’s departure earlier this year, which shed more light on NYCB’s fourth-quarter results, which showed the company set aside significant funds for potential real estate loan losses and cut its quarterly dividend. 70%.

After the above results were announced, NYCB’s common stock fell by -50%, while its Series A preferred stock (NYCB.PR.A) fell by a staggering -20%. The impact on its capital structure was swift and violent.

A longer-term move higher means there may not be any relief and more borrowers may hand over the keys to banks more frequently at valuations that may be lower than the initial loan. This all translates into loan loss provisions and a loss of profitability for some lenders.

Large and stable institutions such as JPMorgan Chase and Bank of America are able to convert high interest rates into higher net profit margins through extremely low deposit interest rates. For example, JPMorgan Chase currently pays less than 1% for its savings and checking accounts. To be precise, you pay 0.01%.

When you can earn 5.3% interest by depositing cash overnight and pay savers a nominal amount, there is certainly a net income that can be used to offset some of the commercial real estate loan loss reserves. This is not the case for many small and medium-sized banks.

in conclusion

SPFF is a fixed income ETF focused on financial preferred stocks. We first started using this name in the wake of the 2023 regional banking crisis, when we believed investors could use this name to take advantage of systemic financial dislocations. The fund’s total return is up nearly 7% since our rating. With credit spreads tightening and the fund’s 30-day SEC yield reset to a paltry 5.8%, we believe the original trade has now been exhausted.

Higher long-term interest rates will lead to further weakness in commercial real estate, which will occasionally be reflected through large loan loss provisions. We’ve seen NYCB’s story evolve, with significant implications for its common and preferred shares. We expect more stories like NYCB to emerge, which will put pressure on financials’ preferred spreads. Currently, retail investors have ample opportunity to earn over 6% yields with minimal volatility, so it would be best to sell SPFF.