lemon_tm

Introduction to ETFs

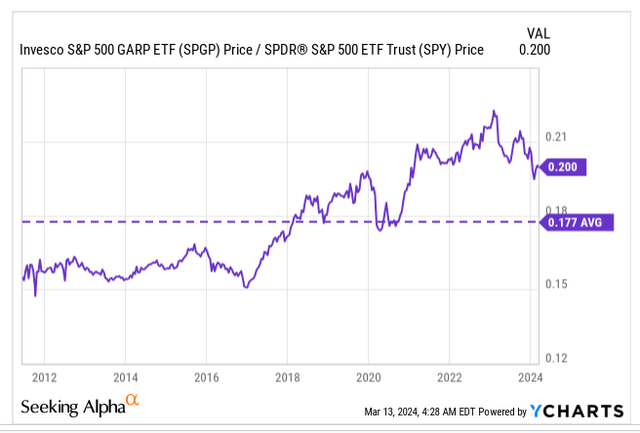

Invesco S&P 500 GARP ETF (NYSE: SPGP) is a $4.7 billion product that has been around for nearly 13 years and covers 75 stocks in the S&P 500 that score high on growth, quality and value thresholds.In other words, the goal The aim here is to uncover large-cap stocks that exhibit admirable characteristics, such as solid fundamental growth, cheap valuations, solid financials, and compelling profitability.

In order to enter the final stage of the SPGP portfolio, these S&P 500 stocks must pass multiple screens. First, note that only stocks with high growth quotients are considered; to determine this, each stock is assigned a growth score, which is essentially the average of its 3-year earnings CAGR and 3-year earnings per share CAGR . The 150 highest-scoring stocks in the S&P 500 will advance to the next stage.

In the next stage, the goal is to assign a certain QV score (quality/value) to these 150 names. The QV score is a function of three other metrics – a) Financial leverage (total debt vs. equity), trailing ROE (return on equity), and trailing yield (12-month EPS relative to CMP).Based on the QV score, the portfolio is further pruned to 75 stocks, and finally these 75 stocks are weighted based on their growth score

Stable alpha, well balanced but risk managed can be improved

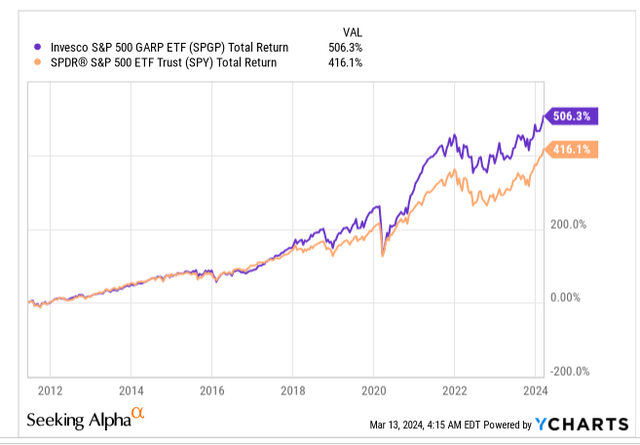

With a multi-pronged screening mechanism that includes a host of useful metrics, you won’t be surprised to see that the SPGP has outperformed its benchmark index, the S&P 500 (1.21x) since its inception in mid-2011.

Y chart

Investors will also be excited to discover that, unlike the S&P 500, it is quite top-heavy and concentrated. SPGP is quite widespread. Despite covering more than 500 stocks, the top 10 stocks in the S&P 500 collectively account for nearly a third of the total portfolio; however, when it comes to SPGP, note that despite covering only a small gain of about 75 names There are many pools (which makes it more concentrated), but the top 10 only account for 20% of the total portfolio.

SPGP has also made a point of ensuring that no single holding weighs more than 5%, and as it stands, its largest holding, Diamondback Energy (FANG), has a weight of just 2.3%. Please note that the most recent rebalancing occurred only in the third week of December (rebalancing occurs twice a year). Given that SPGP seeks to maintain these strict portfolio caps, it’s not surprising to find that its annual portfolio turnover rate is slightly higher (49%); for context, the median annual turnover rate across all ETFs is just 29 % about.

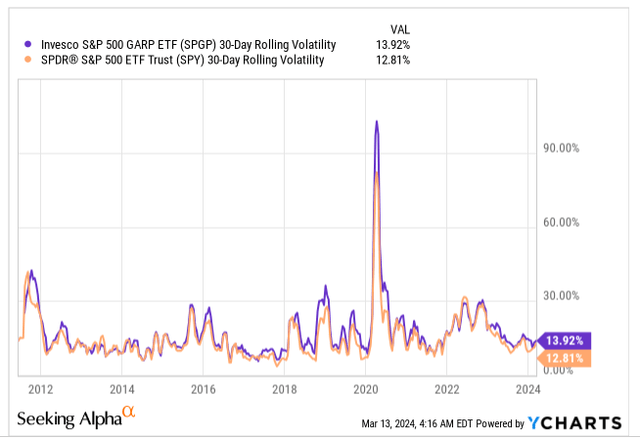

Perhaps one area of concern for us is the risk profile of the SPGP and its inability to thrive when the tide turns. Note that its rolling volatility is about 100 basis points higher than the S&P 500.

Y chart

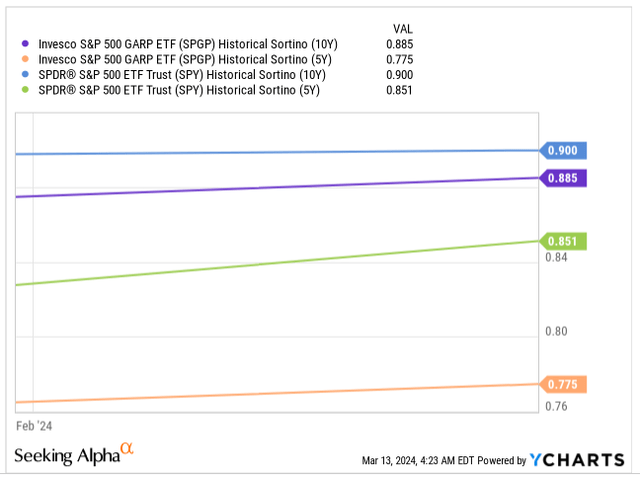

Crucially, it does not do a very good job of generating excess returns over the risk-free rate in the face of harmful volatility. This is exemplified by the lower long-term (10-year) and short-term (3-year) Sortino readings (relative to the S&P 500).

Y chart

Should you buy SPGP now?

It is difficult for us to make a firm decision on investment in SPGP at this time because we see many conflicting themes.

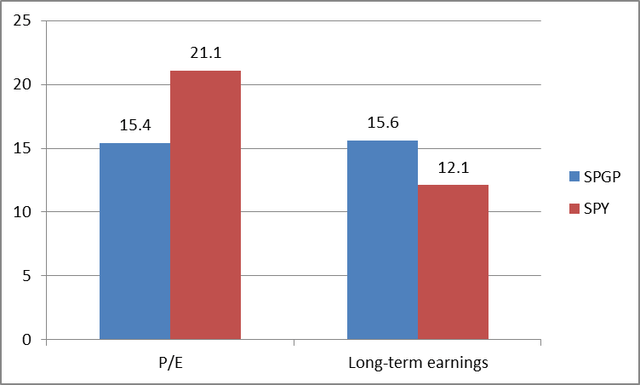

First of all, we know that this product takes into account the valuation quotient of the stock, and it is definitely achieved on a weighted average basis. What’s more, when you consider the long-term profit potential on offer, it feels like a pretty good deal, especially compared to the S&P 500.

SPGP is priced at just 15.4x P/E, which is 27% lower than the corresponding multiple for the S&P 500, but note that SPGP gives you long-term earnings growth on par with the P/E ratio (meaning a useful PEG of only 1x), which is comparable to the benchmark In sharp contrast, the benchmark index is only expected to generate long-term gains in the early double digits.

Morningstar Corporation

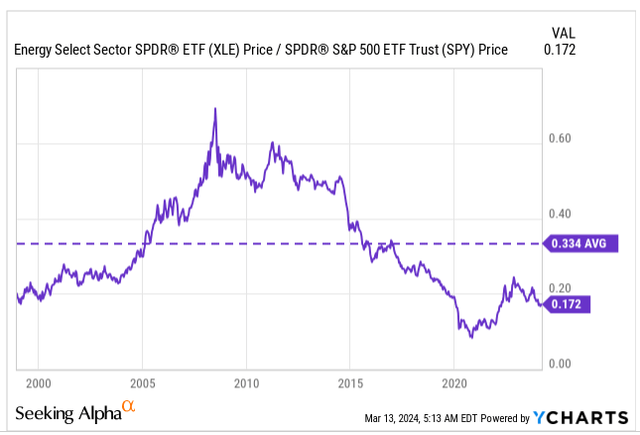

SPGP’s low valuation is due in large part to its strong exposure to the energy sector (which is the cheapest of the 11 sectors in the S&P 500 from a P/E perspective), which accounts for 50% of the total market capitalization. Nearly a quarter holds shares. When it comes to energy, we again have mixed feelings about this exposure.

Y chart

If we look at the positioning of energy stocks in the S&P 500 relative to the broader market, the chart above suggests that this is a beat down space (the current relative strength ratio is almost half its long-term average) that is likely to benefit going forward. mean reversion over time.

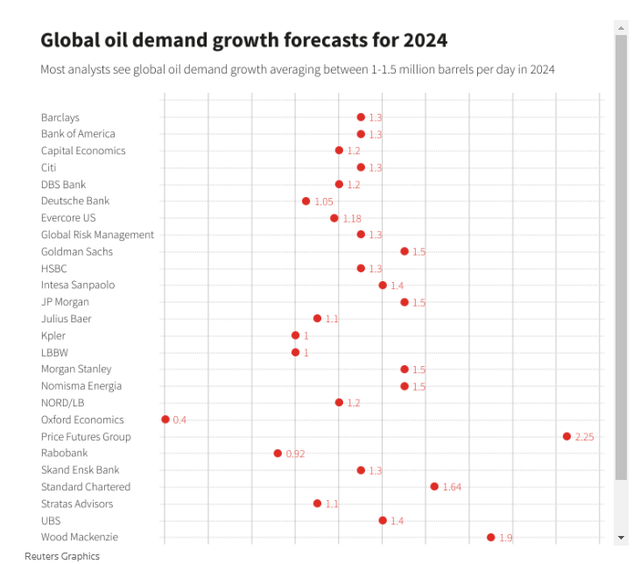

However, energy market fundamentals suggest that vague future.We can applaud OPEC+S’ recent decision to extend voluntary production reduce This will put further pressure on oil inventories going into the second quarter; however, there is still reason to believe that OPEC may have overestimated demand levels this year. Separate forecasts from the IEA and 26 major observers indicate that oil demand this year may only approach 1.25 million barrels per day, a far cry from OPEC’s forecast of 2.25 million barrels per day.

Reuters

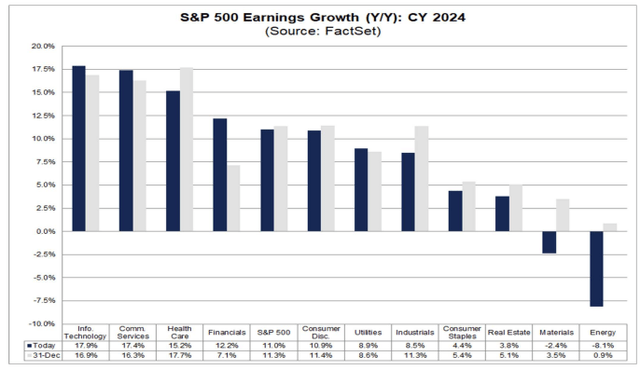

Investors should also consider that many energy stocks in the S&P 500 are poised to deliver meaningful returns. benefit The contraction will not only occur in Q1 2024, but also throughout FY24.

In fact, looking at the full year, the energy industry is only one of two industries that has seen a decline in profits, and is expected to have the largest decline (-8%).

fact set

Then, if we look at the standalone weekly chart for SPGP, we can’t say we’re happy with the risk-reward profile it’s currently offering. From the chart below, we can see that in the past two years, SPGP has been showing an upward trend in the form of an ascending channel, rebounding from the upper and lower boundaries from time to time. Judging from the current situation, ETFs are not far away from hitting the upper limit. Also consider that the RSI indicator hit overbought levels for the first time in two years.

invest Y chart

Finally, also consider that investors looking for rotation opportunities within the S&P 500 may not necessarily favor SPGP’s holdings, as its current relative strength ratio (relative to the S&P 500) is higher than the midpoint of its long-term range Out about 13%.