Iryna Drozd/iStock via Getty Images

In a vibrant investor community like Seeking Alpha, if your theme is a “high yield” ETF, such as the Invesco S&P 500 High Dividend Low Volatility ETF (NYSE: SPHD) is showing strong signs that it may soon Reversing its underperformance compared to favored dividend ETFs like the Schwab U.S. Dividend Stocks ETF (severe heart disease) You better have some evidence. As the saying goes, “He who reigns supreme will never fail.”

I’ll leave it to the comments section and let readers tell me how much they agree with this analysis. But for me, as a dividend investor, I want the dividend yield. SPHD does this, SCHD does this, but always to a lesser extent. During periods of potential rising stock market prices, the desire for yield as a component of total return is reduced.It’s been like this for years Now. But the clock is ticking on dividend strategies that are really more like growth strategies with above-average yields.

While SCHD has performed very well over the past few years, I think its style will likely not perform well in the environment we are transitioning into. In this case, dividend investing is more about yields that are high enough with low price volatility. I think SCHD remains a solid dividend ETF, but going forward, I prefer the precision and focus that SPHD offers. I think they can be used together as well. But my bottom line is that over the next 2-3 years, which is as far into the future as I’m willing to look, I prefer SPHD to SCHD. Frankly, the fact that their ticker symbols are only slightly different understates how different they are.

SPHD: An index ETF that acts more like an active manager – relatively low ER

Since 1960, reinvested dividends have made up Accounted for 84% of the S&P 500’s total return. At first glance, investing in an established company with predictable revenue may seem like a less than attractive option, especially in the growth-obsessed market we’ve seen in recent years. But capital appreciation combined with stable dividends has proven to be a solid long-term investment strategy.

The “recency effect” is psychologically detrimental to dividend ETFs, except for those that are actually more of a hybrid dividend/growth style. SPHD is a dividend-focused, dividend-preferred ETF that combines a search for yield with a preference for historically less volatile companies. Because when I prioritize dividend yield, the last thing I want is a significant reduction in a key part of my portfolio. This is one of the key tenets of the Yield at Reasonable Price (YARP) dividend approach that I described in a recent article . I also apply YARP to dividend ETFs. I like what SPHD is seeing here.

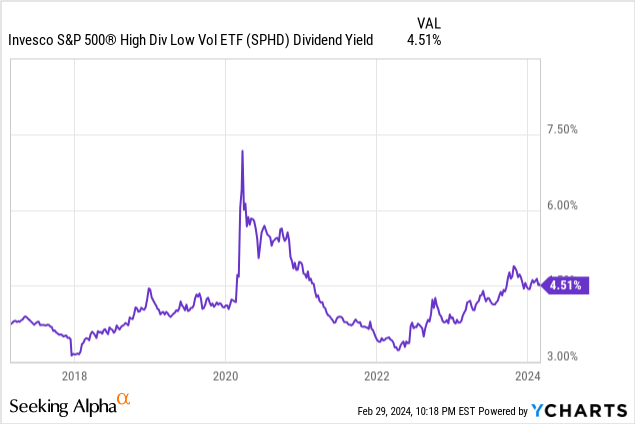

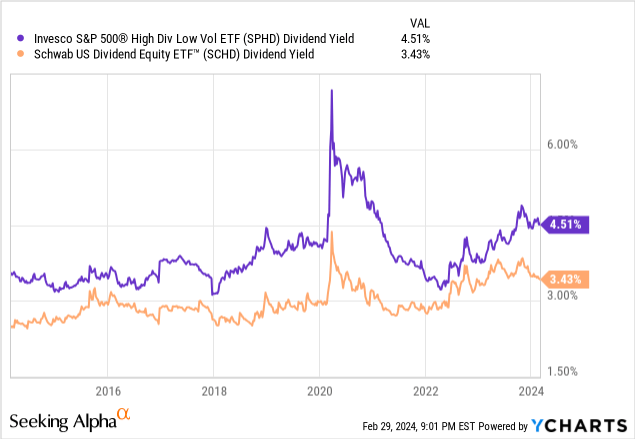

This is the key starting point for my YARP system. SPHD’s yield is near the top of its seven-year range. It started to fall, in line with the price trend (not shown), which had the potential to break out of a fairly long downtrend. I’ve found that YARP is ideal for stocks, and while not as sharp for ETFs, it’s still quite effective. For SPHD, I look out several years, so my accuracy in “calling breakouts” in this ETF is not a priority here.

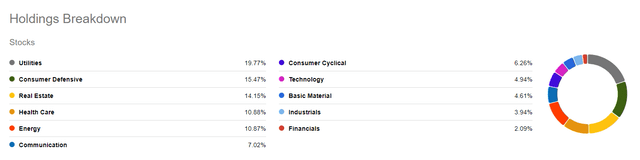

SPHD’s philosophy is to invest in high-yielding, low-volatility investments, so it’s no surprise that it is overweight defensive stocks and underweight volatile technology and consumer cyclical companies.

SPHD Top 10 Holdings (Seeking Alpha)

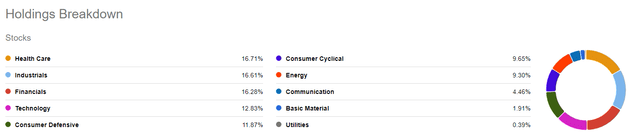

SCHD is weighted more than twice as much as SPHD in these two areas, and is weighted significantly less in many traditional defense areas. This has contributed to its recent success, but I think it’s also contributed to a sense of overconfidence among the shareholder base. To be clear, I think SCHD is a good ETF, but with assets currently at $53 billion, it may lose the flexibility of holding some stocks that may save returns. My concern is that from an investment perspective, its success with AUM is partly past performance and partly fanatical behavior. Neither approach is likely to be successful in the coming years, as inflation is likely to remain high and the market may rediscover true dividend ETFs like SPHD.

SCHD Top 10 Holdings (Seeking Alpha)

Higher interest rates may finally come into play in 2024-2025

Generally speaking, higher interest rates hurt stock market performance because it costs more to borrow money for companies to grow or fund acquisitions, thereby eroding corporate profits. Due to high interest rates and inflation, 600 businesses will file for bankruptcy in 2023 alone, the highest number in the past decade. And, with inflation still above 3%, I don’t think the Fed will cut interest rates before June this year, which means more companies and consumers will have to borrow at higher rates. This will increase the debt burden of companies, especially by 2025, when many companies will fall into the “refinancing cliff”. This seems like a good recipe for moving away from what worked in the dividend world and toward what was done before the Fed. It saved the U.S. economy in 2016 and embarked on the path of “unlimited QE” before 2022.

Since I am somewhat pessimistic about the market’s outlook, I would like to de-emphasize growth sectors and reconsider defensive and industrial sectors.

Focus: The key to what I love about SPHD

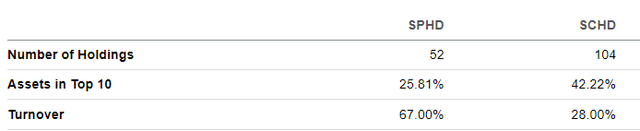

When I can access ETFs this way, I like to pool them. SPHD holds half as many shares as SCHD (52 vs. a little over 100). While I prefer a more active rotation in a stock portfolio, the turnover provided by SPHD looks more like an actively managed fund, but that’s not the case.

Seeking Alpha

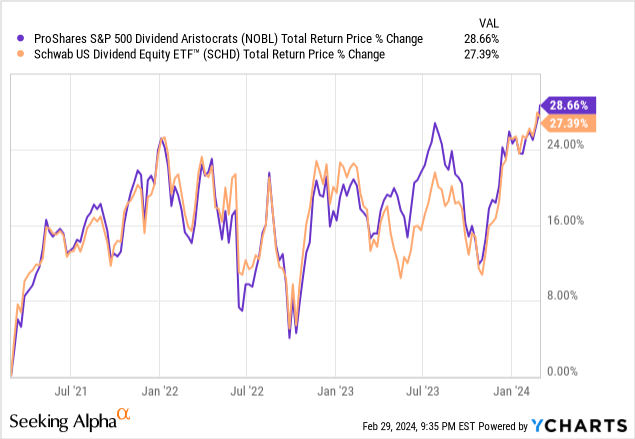

As for SCHD, I can use a chart to reveal its success over the past 3 years, and that’s this chart. The way I see it is this: its total return is very close to that of an ETF, which cares more about how many years a stock dividend has been raised than the amount it will pay me now and in the foreseeable future (which accounts for my percentage of investment). In other words, SCHD is aided by the relative strength of the “Dividend Aristocrats” and I think the era is transitioning to higher yielders.

This is another reason why I favor the SPHD Dividend ETF, which has historically had a yield advantage. This yield advantage shrunk in the immediate aftermath of the pandemic, but as shown below, it has expanded nicely. When Treasury yields are 5%, 4.5% looks much better to me than 3.4%.

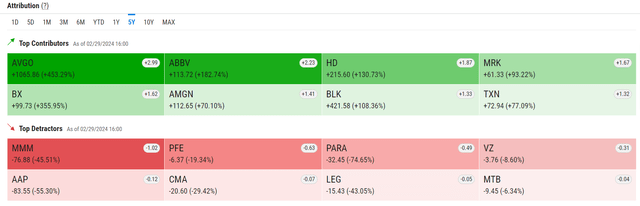

Here’s another way to analyze the differences between two ETFs, using YCharts’ “attribution” analysis. Below are the main contributors and critics of SCHD over the past five years. I see some stocks here that have decent tailwinds, but are unlikely to generate enough yield to qualify for my dividend ETF “bucket.”

SCHD4 (Y Chart)

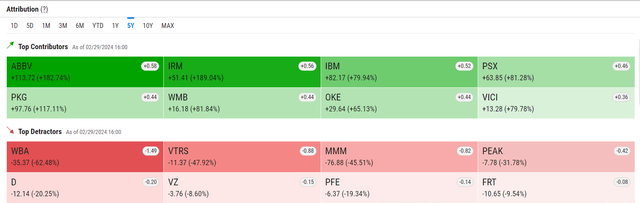

Now, here’s the same analysis from SPHD over the past 5 years. Of course, there is a bit of overlap. But these are more of what I consider classic dividend stocks.

SPHD (YCharts)

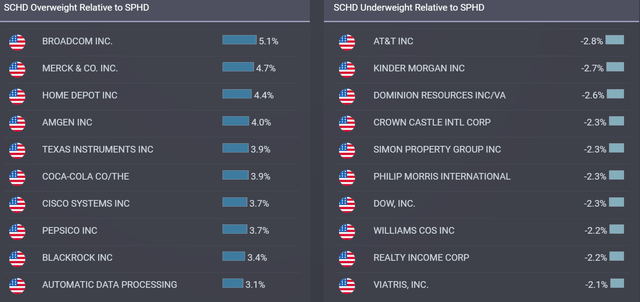

Finally, the holdings chart looks like this: on the left, SCHD owns significantly more shares than SPHD, and on the right, the reverse is true. Yes, there are some “ugly” stocks on the right side at the moment, but the next phase of the market is likely to see renewed interest in those beaten-down yield stocks, which is a huge drag on the performance of many income portfolios .

ETFRC.com

SPHD: Buy for me, outlook 2-3 years

I’ve owned it before and I like the idea of building a position here and looking out 2-3 years. In my personal portfolio, I would probably take a much smaller position in the ETF itself and choose to overweight some stocks, but I just mention this in parentheses to explain how I use both dividend ETFs and YARP Dividend Stock.

While I continue to think this is a buy, there are some downsides to this ETF. The bottom line is, as some pundits like to say, “this is 1995.” That was a period after seven consecutive rate hikes in 1994, which, far from crushing the stock market, opened the proverbial floodgates and created the dot-com bubble. Perhaps artificial intelligence is a repeat of that era, rather than the factor that drove the broader market into trouble as it did after the bubble burst in 2000.

I won’t get too hung up on the timing and will simply conclude that SPHD is a solid core dividend ETF for someone like me who cares about dividend ETFs and thinks “dividends” are not “decent dividends,” but make sure I When markets get irrational, there are some hot growth stocks that can boost performance. ” I would rather keep the two concepts separate. Therefore, SPHD considers a 2-3 year time frame when getting a Buy rating.