JHVE photos

One of the best things about investing is the passive income it can generate. You initially need to work to make money to invest, but once you invest in dividend-paying company stocks or funds, you’ll generate a stream of unearned income. Income will start flowing. With enough money invested over a long enough period of time, this stream can become a raging river of passive income. Having a relatively equal injection of income each month from a stock or fund that pays monthly is great for planning ahead.

When considering ETFs that provide a monthly low-volatility passive income stream, the Invesco S&P 500 High Dividend Low Volatility ETF (NYSE: SPHD) seems suitable for investors. However, there are other options that can provide a stable income stream and higher historical returns.So there may be better options For your money.

SPHD Overview

Invesco set up SPHD to track the S&P 500 Low Volatility High Dividend Index, and the fund does a good job tracking the index. The fund’s home page commits to investing at least 90% of its assets in stocks related to the index. In this respect, it has served its purpose.

The fund holds 51 different stocks. As of April 10, 2024, the fund allocated approximately 20% to utility stocks, nearly 16% to consumer staples, and 14% to real estate. Companies in the top 10 include tobacco giant Altria (MO), telecom giants AT&T (T) and Verizon (VZ), and industrial conglomerate 3M (MMM). These are stodgy old companies known for the revenue they deliver rather than growth. Information technology, the fastest-growing industry in recent years, accounts for only 4.83% of the fund’s holdings.

The fund’s management fee is 0.30%, which is significantly higher than the 0.06% charged by Vanguard’s High Dividend Yield Index Fund ETF (VYM). The latter holds 454 companies compared to SPHD’s 51, and it makes no attempt to limit volatility. However, a 0.30% management fee is not terrible because there are many funds that exceed 1%.

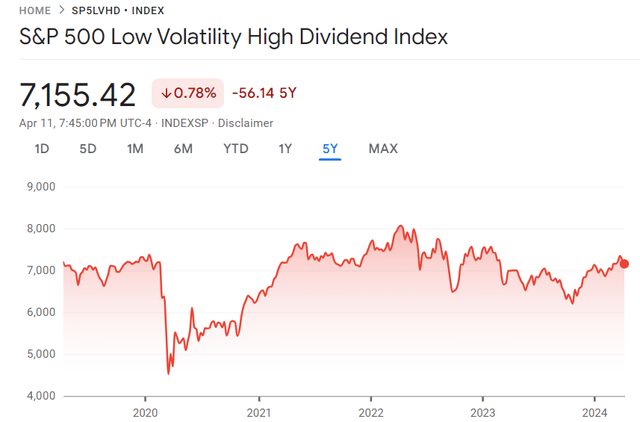

When it comes to limiting volatility, SPHD has done a great job over the past decade. Its stock price rose by 45.17% this time, with an annualized rate of return of 3.76%. EFT has been essentially flat over the past five years, appreciating a total of 0.39% (non-average) over that period. Despite the lower dividend, the S&P 500 Index (VOO) has returned nearly 80% over the same period. Investors in SPHD have actually seen little to no share price appreciation, but its price has actually declined over the past five years compared to the index it’s supposed to track.

S&P 500 Low Volatility High Dividend Index 5-Year Return (Google Finance)

SPHD’s tracking error exceeds the tracking error of all ETFs over the past one, three, and five-year periods, with its error being 13.25% higher than the median ETF over the past five years.

income

SPHD does provide substantial dividend income. Its current yield is 4.37%, which is truly a high dividend segment. The fund also makes monthly payments. This yield is comparable to VYM’s, which currently yields 2.89%. It also beats the S&P 500’s weak yield of 1.36%, which is more than three times the amount of passive income per dollar invested. Add the 4.37% yield to returns over the past five years, and the total return is about 5%; over the past 10 years, that number has risen to just over 8%. Not bad, but not great either.

However, what it provides in current dividend income, it gives up in dividend growth. Investing in the companies mentioned above does not result in rapid growth in earnings and revenue numbers, so companies like T and VZ have had very low dividend growth numbers in recent years. Overall, SPHD’s dividend has grown by just 2.56% over the past five years, although that number has risen to 6.34% over the past decade. Over the past five years, average dividend growth has failed to keep pace with inflation. Those who rely on the fund for significant income will actually see their purchasing power decline with little price appreciation for their efforts.

Compare

For investors who want substantial income, there may be better options. There is likely to be more volatility, but if past performance is any indicator, further price gains are likely. One such fund is the Charles Schwab U.S. Dividend Stock ETF (SCHD), a popular fund among income investors. The fund’s management fee is 0.06%, and its current yield is 3.42%. While that’s a little more than 1% lower than SPHD’s yield, it’s still well above the overall market’s yield.

Additionally, SCHD has achieved higher returns over the past decade. Not only did SCHD’s stock price not rise by 45.17% in the past 10 years, but it rose by 110% during the same period, with a compound annual growth rate of 7.65%. Add this number to the 3.42% yield, and the total return is just over 11%. Additionally, SCHD’s annualized dividend growth over the past five years was 11.80%, although the most recent year’s increase was only 1.22%.

Even the Global X NASDAQ 100 Covered Call ETF (QYLD), a controversial hold for many, has had better overall returns than SPHD. The fund’s share price has declined an average of 3.11% per year, but combined with the current yield of 11.54%, the total return is expected to be closer to 8.5%, which is higher than SPHD. Like SPHD, QYLD is a monthly dividend payer, so it’s an option for those looking for a monthly infusion of cash.

Ironically, both SCHD and QYLD have lower annualized volatility figures than SPHD, which is supposed to be a low-volatility fund.

in conclusion

SPHD achieves its stated goals. Its share price volatility is relatively low. In fact, the price per share has barely changed over the past five years, with the overall return (not CAGR) over that time being less than 1%. SPHD also provides stable dividend income, with the current dividend yield exceeding 4%. However, when it comes to total returns, there are other options that perform better, even in the high-yield space.