Andrew

investment thesis

Company Profile

Apex Global Corporation (NYSE: SPIR) Founded in 2012 (renamed “Spire Global” in 2014) and headquartered in Vienna, Virginia, it is a provider of satellite aircraft tracking and ship monitoring data, providing insights and predictive analysis for optimal decision-making and economics Efficient app.

Strengths and weaknesses

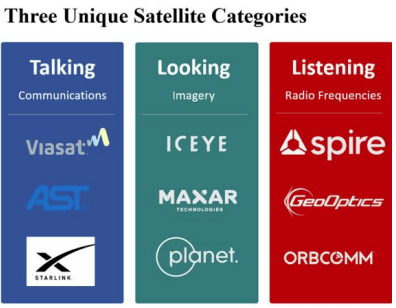

Although the satellite data industry is in its infancy, it can be divided into three detailed categories based on its application and specialization. One is for communications, such as StarlinkX, one is for imaging, such as ICEYE, and Spire belongs to the category focused on radio frequency surveillance or listening.

Spire Global: three unique satellite categories (Company 10K)

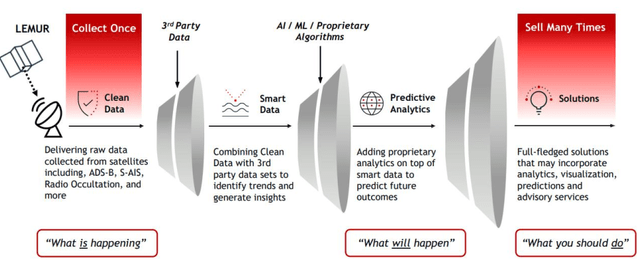

Spire Global’s biggest asset is clearly its constellation of low-orbit satellites, called “LEMUR nanosatellites.” But how the company builds them into one of the largest multi-functional “listening” networks relies heavily on ground station network infrastructure.it is Multiple receiving satellites utilize the Global Navigation Satellite System (“GNSS”) to acquire Automatic Identification System (“AIS”) data from ships, Automatic Dependent Surveillance-Broadcast (“ADS-B”) data from aircraft and Radio Occultation (“RO”) ) data) satellite. This space-to-ground communication covers the Earth more than 200 times a day on average, making its data effectively instant or near-instant. The value of a unified view with robustness and versatile access points has been integrated with SaaS platforms and cloud-based data analytics, essentially making its extensive data scalable multiple times, marketed as a clean predictive data solution, to solve specific problem business problems.

Spire Global: Business Operations Summary (Company 10K)

The largest industries to which Spire sells are maritime, aviation and government as directly applicable customers. But it has also developed a range of existing and target industries such as agriculture, logistics, financial services, insurance, aerospace, energy, fisheries, academia and real estate.

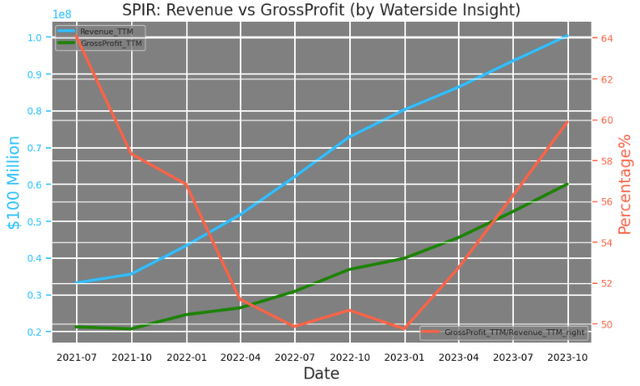

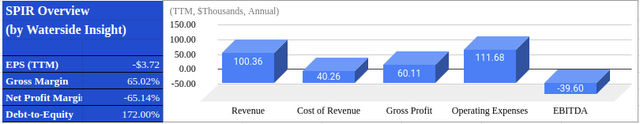

Since its IPO, the company’s quarterly revenue has grown from $35 million to $100 million today, more than three times what it was three and a half years ago.

Spire Global: Revenue and Gross Margin (Calculated and charted by Waterside Insight based on company data)

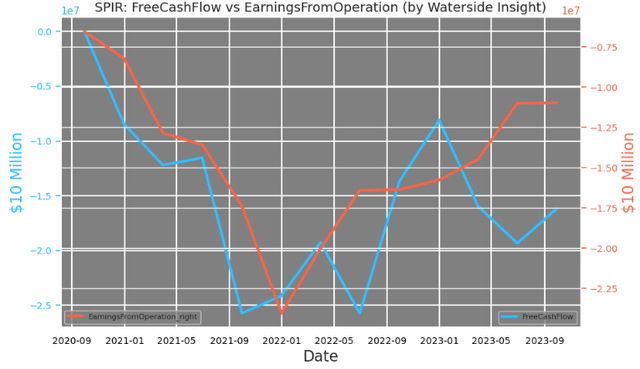

But its free cash flow and operating profit were both negative. They have now recovered from their lows in Q3’21, but are still lagging behind the near-zero levels they started with.

Spire Global: Free Cash Flow vs. Operating Income (Calculated and charted by Waterside Insight based on company data)

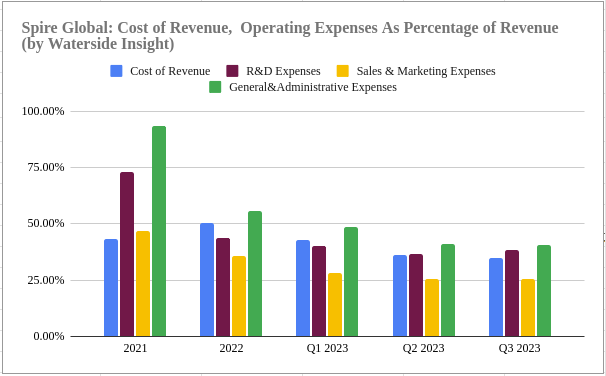

Spire Global expects 2024 to be the year it finally becomes profitable, including positive operating cash flow, free cash flow and positive adjusted EBITDA. This will be an exciting prospect for investors, and we want to examine these expectations. The biggest factor it needs to overcome to become profitable is the costs and expenses associated with revenue. It has a fixed cost structure that needs to be spent, such as satellite launches and ground station expansion and maintenance. The most significant decrease in revenue growth was in general and administrative expenses. It rose from more than 90% in 2021 to 40% in the third quarter of 2023. S&A expenses fell from 47% to 25%, while R&D expenses fell from 73% to 38%. All reduced by half. Meanwhile, cost of revenue only rose from 43% in ’21 to 35% recently.This does exactly what it says 10,000 in 2022 Cost of revenue and operating expenses will both rise in absolute terms, but op. Spending is expected to decline as a share of revenue. Simple extrapolation can show that as revenue grows by almost 40% per year, operating expenses gradually decrease on that basis, resulting in the percentage being reduced by half each year. Its net profit margin is currently about negative 60% and may drop to negative 30%. It needs to either grow revenue by at least 80% in a year or more aggressively cut spending further. We think it will be difficult to achieve positive earnings and profitability.

Spire Global: Cost of Revenue, Operating Expenses (Calculated and charted by Waterside Insight based on company data)

We believe focusing on the scalability of its revenue growth is a better way to achieve positive profits. Spire’s proprietary radio occultation data can predict hurricane otisIts strength is better than other models, but other models miss its rapid strengthening, catching those affected off guard. Such data added through emerging microwave detectors is part of its global weather forecast model. Weather data is crucial for ships, cargo and cruise ships in the aerospace industry or shipping to choose the safest and most fuel-efficient routes. It also has a $2.8 million, 12-month contract with NOAA to integrate its wind speed data into the study. With its ability to predict weather events such as polar vortex changes and/or sudden stratospheric warming up to two weeks in advance, commodity traders are keen to take advantage of the trading advantages it offers. There are also insurance companies, academics, and government entities interested in mining not just immediate data, but historical data as well. Cloud data platforms and artificial intelligence integrated recommendation analysis can resell data at scale without significantly increasing marginal costs. After building critical infrastructure and modeling capabilities with revenue costs, scaling can scale down expenses to improve profits. Since it is global data, scaling on an international basis is also part of the equation.

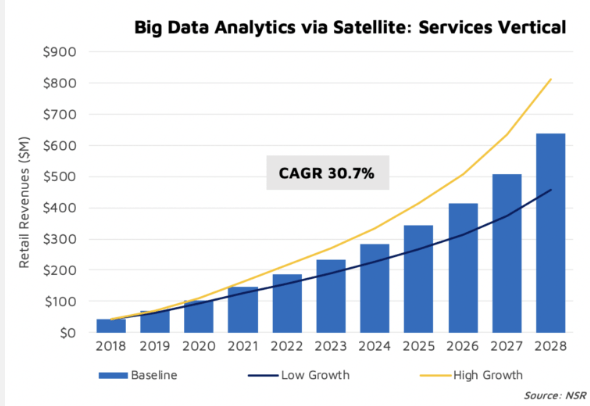

NSR, a satellite and space market consulting service provider owned by Analysys Mason, said that by 2028, the compound annual growth rate of big data analysis through satellites will be as high as 30%. The need for better, more accurate data across many industries is how customers determine usage and how Spire Global can scale to meet corresponding needs.

Big data analysis via satellite (NSR.com)

Financial Overview and Valuation

Spire Global: Financial Overview (Calculated and charted by Waterside Insight based on company data)

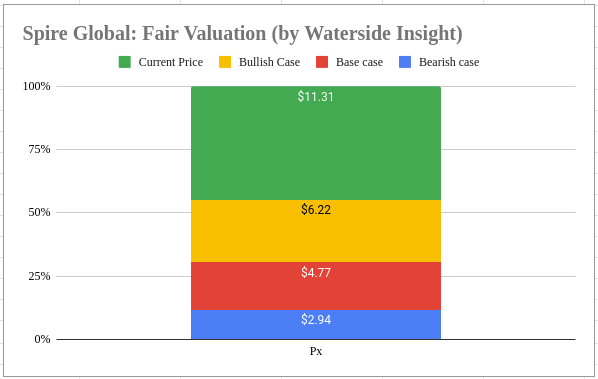

We estimate Spire Global’s fair value using our proprietary model. We assume that the cost of equity is 9.12% and the WACC is 12.89%. In our most optimistic case, the company barely turns a profit this year and is free cash flow positive, but will expand faster over the next 5 to 7 years due to its size; it’s valued at $6.22. However, in our base case, which falls short of being profitable and cash flow positive and subsequently grows faster despite a significant narrowing of the gap, it’s valued at $4.77. On a bearish note, its rapid growth came later than expected due to macro conditions and customer adaptation, pricing at $2.94.

Spire Global: Fair valuation (Calculated and charted by Waterside Insight based on company data)

The stock’s current market cap is overly optimistic about its future cash flows and growth. Spire Global needs to grow revenue by more than 50% annually over the next decade to have a chance of matching this valuation. We think this premium is too generous.

for Upcoming Earnings Report, we expect its EPS to be -$0.50, better than the market average estimate of -$0.57. Revenue also beat expectations by $30.02 million, topping estimates of $29.19 million.

in conclusion

Spire Global produces a unique and critically important proprietary data system. But leveraging satellite data remains an emerging application that many industries are learning to adopt, albeit at an ever-increasing rate. Based on industry trends and our own profit growth strategy, we are optimistic about the company’s growth. But market pricing expectations are too high. We recommend pausing at this time.