Andres

Overview

My recommendation for the Bean Sprouts Farmers Market (NASDAQ: SFM) is a Buy rating because I now believe the business can sustain growth and profits due to its differentiated business offerings.Furthermore, with its growth profile, margins and business model, I believe It should be valued relative to its peers in the supermarket industry.Please note that I have previously reviewed Hold rating Because I’m worried that if a price war breaks out, sales will fall, and coupled with the acceleration of store expansion, the increase in fixed costs could really hurt its profits. My fears did not materialize. Instead of declining, SFM’s trading volume continued to produce strong results, pushing the stock price up from about $40 when I covered my position to about $64 currently.

Recent results and updates

Sustainability FM Report earnings About a month ago, so I’ll briefly touch on the results before continuing. Earnings per share in 4Q23 were $0.49, beating the consensus estimate of $0.45. Driving this growth was same-store sales growth (SSSG) of 3.3%, driven by positive foot traffic and stability in average unit revenue (AUR) and units per transaction. Same-store sales improved, and gross profit margin expanded 20 basis points to 36.5%. Nonetheless, this expansion was offset by a 25 basis point increase in SG&A costs as a percentage of sales due to higher wages and benefits. The performance of SFM Season 4 in 2023 made me change my view on the business. Previously, I believed that the increase in SFM’s gross profit margin was due to non-structural reasons. Once a price war breaks out, there is room for collapse. However, I now believe this is due to the unique business model offered by SFM, which provides differentiated products to a different target customer group than typical supermarkets.In fact, supported by inflation, SFM was able to report consistent same-store sales growth (SSSG) in the range of approximately 3% andImportantly, there is positive foot traffic both online and in store and The stable sales volume does show that SFM’s differentiation strategy is working. Also, if there is a price war, it has already happened in the previous months when inflation was high and consumer budgets were tight – industry players should be competing for traffic on the field, which should hurt SFM, if my previous The point is right.

So SFM has really proven that their differentiated assortment continues to resonate with core customers, with management specifically highlighting category strength in grocery, dairy, frozen and meat, as well as private label’s 13% growth (note that they’ve Success will increase this penetration to 21% of sales in Q4 2023). I believe this should continue to support margins as SFM targets consumers who prioritize health and wellness over price, which is actually a key reason for SFM’s margin resilience, especially with traditional food retail competing for budget business Business comparison – the conscious consumer. Management guidance for FY2024 gross margin expansion of 20-25 basis points, which is an improvement from the previous guidance of flat, which I think is possible as they appear to be exiting promotions and SFM covering distribution centers (DC) 2024 Fiscal year expansion headwinds.

Management has also done a good job of improving efficiency, reducing supply chain costs by expanding distribution centers and ensuring that its stores are close to those distribution centers.The problem is, all these cost savings are not reflected in the income statement However Due to ongoing store expansion. A typical SFM store takes about 4 years to mature, and SFM has accelerated store openings in the past 3 years: 12 stores opened in FY21, 16 stores opened in FY22, and 30 stores opened in FY23. At the same time, current labor inflation in the United States is further depressing profit margins. My view is that as these stores mature and labor inflation cools, coupled with improving margins, SFM should have no issues with attractive incremental margins.

So at the beginning of the year, we opened more stores in new markets, which, as you know, take three or four years to mature, and our existing markets are off to a pretty good start.Excerpted from: 2016 Third Quarter Earnings Conference Call

Valuation and risk

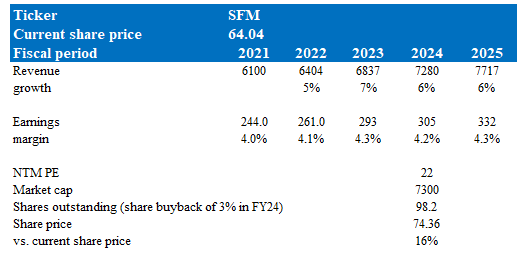

Author’s valuation model

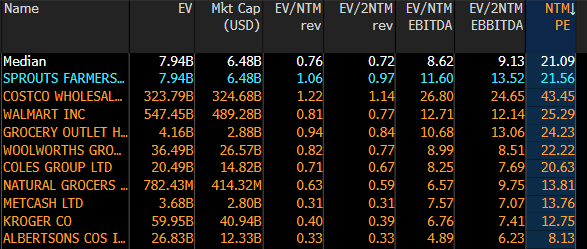

According to my model, SFM is valued at $74.36, up 16%. This was a big step up from my previous model as I gained a fresh perspective on the business, acknowledging its ability to sustain growth and profits. Based on its recent performance, I believe it should be able to continue growing in the mid-teens (6%) for the foreseeable future. Management guided for a small margin decline in FY24, which I think is reasonable since they opened 30 stores last year and labor inflation remains high, so being conservative makes sense. However, as stores expand and the labor market cools, margins should rebound to 4.3% in FY25. Finally, the biggest reason I’m raising my price target is that I think SFM can continue to trade at 22 times forward earnings, in line with typical supermarket peers in developed markets such as Woolworths Group, Coles Group and Grocery Outlet. While I don’t predict an upward trend further, I note that Walmart trades at a P/E ratio of 25x but with lower gross margins (24%) and similar growth, so an upgrade from SFM is possible.

Burundi

risk

SFM’s main growth point is to expand its stores nationwide, and the performance of new stores may not be as good as that of its traditional counterparts. If so, the runway for growth will be much more limited than I expected. Additionally, the fixed cost leverage argument may not come into play, limiting the potential for net profit expansion.

generalize

To conclude this article, the recommendation for SFM is to upgrade to Buy. My view on SFM’s business has changed and I now believe its differentiated offerings resonate with health-conscious customers, which should continue to drive consistent same-store sales growth and margin resilience. Therefore, I also think SFM should trade within the trading range of supermarket players (typically 20+ forward P/E). While there are risks to new store performance, execution so far has been excellent (386 stores now).