Yorocks

One of the easiest ways to lose money over time is to take advantage of your bets on beta-positive assets—that is, investments tend to increase in value over time for fundamental reasons.That’s exactly what ProShares UltraPro Short does S&P 500 ETF (NYSE: SPXU) is intended to do this.

In some cases (though not many), a huge short position in the S&P 500 Index (SPY) might make sense. I’ll discuss when to consider holding SPXU and for how long. Generally speaking, however, this is the ETF that most, if not all, should avoid.

What is SPXU?

ProShares UltraPro Short S&P500 is a triple-leveraged inverse strategy designed to generate three times the negative daily returns of the S&P 500 Index. In other words: when the US stock index rose 1% for the day, SPXU fell -3%. when. . .when The S&P 500 is down -1%, while the ETF is expected to rise 3%.

SPXU achieves its objective by shorting the S&P 500 swaps contract (and to a lesser extent the S&P 500 E-mini futures contract). Beyond that, the majority of an ETF’s assets are held in cash and equivalents. It’s worth emphasizing that the goal is to triple the inverse of the S&P 500’s daily return, meaning the ETF resets its position every day.

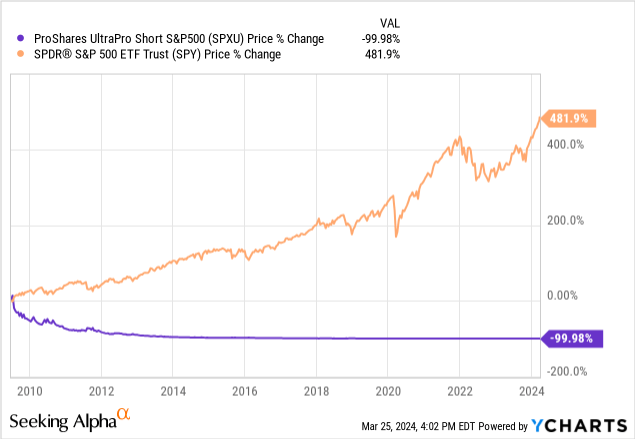

One of the key characteristics of SPXU is shown below (purple line): ETFs tend to lose quite a bit of value over time. There are two main reasons why this happens:

- ETFs are bets that the underlying asset will rise over the long term, even if its value fluctuates almost unpredictably from day to day;

- Due to its aggressive leverage, SPXU is heavily affected by what is known as volatility drag. Simply put, this is a phenomenon where high volatility causes losses to compound over a period of more than a day. Therefore, even if the S&P 500 rises only slightly during a given period, SPXU will most likely incur sizable losses.

How often does SPXU generate revenue?

The ProShares UltraPro Short S&P500 has been around since July 2009. However, it is possible to estimate how the ETF would have performed if it had been around for a longer period of time.

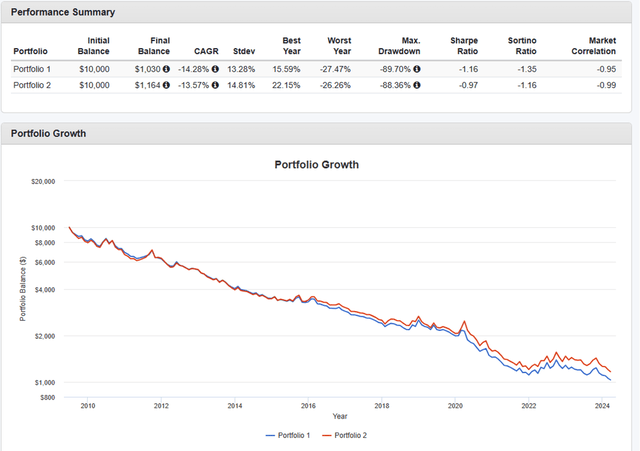

The chart below shows the performance of the 33/67 portfolio allocated to SPXU and cash respectively since 2009 (blue line). The red line is -100% invested in the S&P 500, with the remaining 200% of the portfolio held in cash. The conclusion is that one can come very close to replicating SPXU’s performance by simply shorting the S&P 500 with considerable leverage and rebalancing daily.

Portfolio Visualization Tools

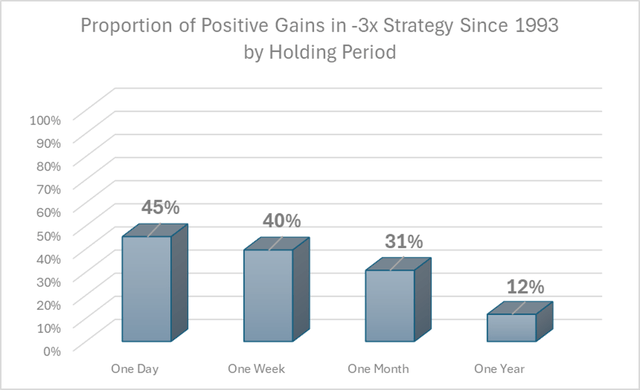

I used the S&P 500 Index to model SPXU’s performance since 1993. Over the past 30-plus years, the market has witnessed a variety of bearish developments, including recessions, bubble bursts, flash crashes, and more. However, contrary to what may seem obvious, SPXU won’t gain much in the long term, absent from very specific and short-term periods.

At a high level, SPXU has produced positive daily returns 45% of the time since 1993, or 9 out of every 20 trading days. That’s not bad. But the longer you hold the ETF, the lower the chance that SPXU will be a winner, as shown in the chart below. According to my calculations, in the extreme case, holding a leveraged inverse ETF for a full year would only generate a positive return of 12%.

DM Martins Research, data from Yahoo Finance

The first conclusion, using historical data as evidence and a proxy for what may happen in the future, is that one should only consider holding SPXU for a day or at most a week. Even in these situations, the odds are stacked against ETF holders. Want to continue holding SPXU? I strongly encourage readers to reconsider.

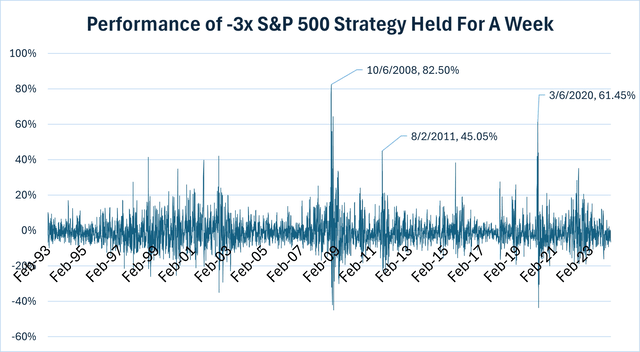

But under what circumstances will SPXU be beneficial? As the chart below shows, the best weekly returns occurred in October 2008 (at the height of the Great Recession), March 2020 (at the end of the massive COVID-19 bear market), and August 2011 (when the European debt crisis was deep and distressing). A shocking downgrade of the U.S. government’s credit rating). The common theme is periods of market dislocation and sharp declines.

DM Martins Research, data from Yahoo Finance

SPXU: Right timing and luck

Therefore, holding SPXU makes the most sense when an investor or trader firmly believes that the S&P 500 is overvalued or that the economy is about to deteriorate. Instead, history shows that bets are only likely to succeed when the market is already in deep trouble, allowing SPXU to benefit from general bearish and downward momentum.

But even so, notice in the chart above that the worst one-week pay period occurs at about the same time as the best one-week pay period. In other words: SPXU holders not only have to be patient and wait for the right moment to start trading, but they also have to determine the timing of the day.

Since SPXU needs to line up so perfectly to generate meaningful gains, I choose to ignore this ETF as a viable trading (let alone investing) vehicle.